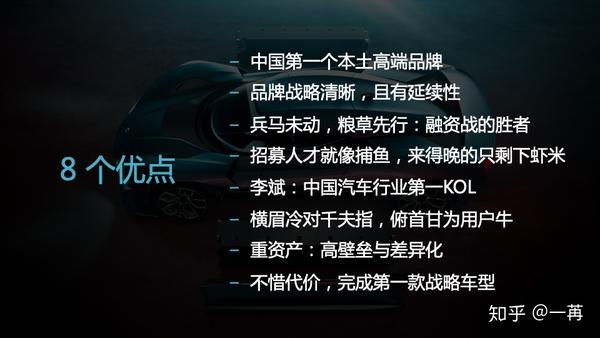

Going back to 2018, let’s take a look at NIO’s 8 major advantages

In mid-September 2019, as a guest speaker at Dongfeng Nissan, I had the opportunity to return to the first stop of my career and share some observations on the electric vehicle industry.

That day, I mainly focused on Musk and Tesla, and incidentally talked about the Chinese new car movement represented by NIO. However, the feedback from the audience during the QA section after the speech was unexpected. They were more concerned about NIO than the superstar Musk. They believed that this new start-up company founded by Chinese people, with a Chinese team as its core and mainly targeting the Chinese market, was the most worthy industry sample to observe. At that moment, I realized that although I had already taken NIO the company seriously, I still underestimated its influence.

It was a closed-door sharing session that day, so my PPT on site was bigger in scale than on Zhihu and WeChat.

I politely predicted: There will be no more than 5 Chinese new car companies that can survive.

Compared NIO and Tesla, Tesla is extremely innovative, but NIO has made many unique localization strategies while learning from Tesla.

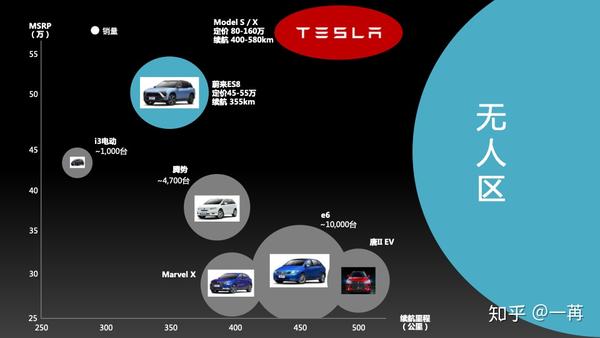

At that time, NIO’s brand and product positioning was extremely smart, occupying a vacuum. Tesla on top was too expensive, while at the bottom, there were too many people and complexities. And I have always believed that only by cutting into the mid-to-high price range of the private electric vehicle market, can we take the right path.

The sales charts of the US electric vehicle market in recent years and China’s electric vehicle market this year have both shown this point. The electric vehicles below are not bad products, but the user group corresponding to the products at this price point are simply not ready to buy an electric vehicle. For a period of time, buying a gasoline car is still a wiser choice for ordinary people.

Looking at the state of the two companies at the IPO, the pace was very different. Tesla started early, but ran steadily. NIO started 9 years later, but chased very quickly, so the pressure on human and financial resources was extremely high.

At that time, NIO was a controversial phenomenon in the industry. As a newly IPO’d company, its prospectus leaked everything. Due to delivery delays, the pricing of its first car model ES8 significantly exceeded the historical limit of Chinese brands, product quality issues, significant financial losses, and a controversial marketing strategy. If you asked industry friends or professional media people from Dongfeng Nissan, SAIC or Geely about NIO at that time, most of them would not have anything good to say.

At that time, NIO was a controversial phenomenon in the industry. As a newly IPO’d company, its prospectus leaked everything. Due to delivery delays, the pricing of its first car model ES8 significantly exceeded the historical limit of Chinese brands, product quality issues, significant financial losses, and a controversial marketing strategy. If you asked industry friends or professional media people from Dongfeng Nissan, SAIC or Geely about NIO at that time, most of them would not have anything good to say.

I summarized the eight unique advantages that NIO displayed at the time. For the Chinese auto industry, almost every one of them was revolutionary and very scarce.

I also saw the five shortcomings of NIO at the time, such as product planning, cost control, and R&D pace clearly having certain problems. But objectively speaking, it is impossible for a startup to have no problems, and no one can be like an old hand when they are still a child.

Anyone who travels back to 2008 would know how many problems Tesla had at the time. The brilliant achievements today have only covered up the embarrassing historical details. For the startup companies that ultimately survive, it is never because they have no shortcomings, but because their strengths are prominent enough. Shortcomings can often be slowly improved. Without excellent DNA at the beginning, a company is unlikely to gradually become excellent in the future.

Unexpectedly, the next day after sharing ended, I received an invitation to join NIO from their side.

In just one day, I made a decision:

To quit operating the highway flying, suspend my own writing, end the consulting and marketing projects I was doing at the time, and join this unique company.

I hoped to see what kind of company NIO is with the likes of Li Bin and I also hoped to contribute to such a brave and innovative enterprise.

As for the results, all three of the initial goals were achieved. The only regret was that I stayed for a rather short time.

7 Realistic Slices of the Big Automakers Making Electric Cars

Over the past few years, before Tesla had completely established itself, and before NIO had positive gross margins, there has always been a voice in the wind: once powerful BBA, Volkswagen, Geely, etc. start making electric cars, Tesla and new Chinese carmakers will be wiped out.

This hypothetical judgment seemed to have enough logical support: in terms of sales, personnel, funding, and brand, these old aristocrats are always stronger than young upstarts by at least an order of magnitude.

From today’s reality, the traditional automakers have not yet proven that they can do electric cars well, but rather, startup companies like Tesla and NIO without so-called automotive industry accumulation have successively completed the dual proof of capital market and user market.### The Battle between Electric and Gasoline Cars

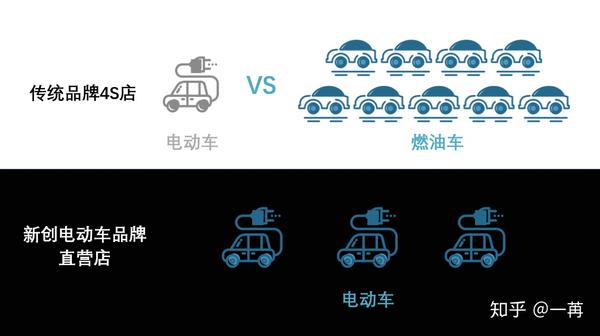

In a 4S store of a joint venture mainstream car manufacturer, a new and cost-effective pure electric car is added, selling for about 150,000 yuan after subsidies, with a range of more than 300 km.

However, potential customers visiting the store soon notice that there is also a gasoline car next to the electric car, almost identical in appearance, with a range of more than 600 km on a full tank, and 20,000 yuan cheaper.

Under these circumstances, unless plate restrictions force them to, who would be crazy enough to buy an electric car? About 25 million cars are sold in China each year, and the market for private electric car licenses is only just over 200,000.

The industry always says that electric cars are the trend, but the general manager of the 4S store must be responsible for the interests of the investors, and he cares about making money. When he finds out that this EV cannot compete with his own brand’s gasoline cars and cannot bring sustained profits to the store, he quickly orders the team to focus on selling gasoline cars, and the only reason this electric car is still displayed in the showroom is to cope with manufacturer inspections.

Similarly, a few days ago, I visited a local high-end brand’s 4S store in Beijing. The star gasoline car in the store was highly valued, being displayed prominently in the center of the showroom, even though the official price had not been released yet, and there were already many customers visiting to see the car. However, the only pure electric car in the store was placed in a poorly lit and dim corner, with its parameter label askew, and nobody was interested.

An Electric Car Subsidiary of a German High-end Brand

A German high-end brand with innovative ambition launched an electric car subsidiary very early on, offering both pure electric and hybrid models, as well as exploring the application of lightweight new materials.

However, the first two products of this subsidiary, although highly praised, did not sell well, obviously causing the Group to bear some losses. Later, we discovered that this subsidiary was frozen in time and has yet to launch any new cars.

We all know that Tesla has been losing money for more than 15 years since 2003, and it has just become profitable recently. If Musk pushed back or cancelled plans for Model X and Model 3 due to poor sales and losses on Roadster and Model S, Tesla would clearly not be Tesla today.The core professional management team responsible for this electric car brand belongs to one of the few elites who first mastered the secrets of electric cars in this industry. This gives them a rare value. There are too many industry talents who develop and market fuel cars, but few who have worked on electric cars. After the subsequent research and development was shelved, most of them jumped ship. Many of them chose to join Chinese new car manufacturers who are rich and daring to pursue their dreams. Here, they will have room for development that Germans cannot provide, as well as stock options and tolerance for losses.

Of course, this brand is still worth respecting, after all, the other two brands that are often placed parallel to its name have not yet made a true original electric car.

Electric car planned to be launched next year

The performance of this model is quite good, the endurance is quite long, and the price is reasonable, of course, this statement is based on a comparison with the existing Tesla, Nio, and XPeng this year. What will happen when it really goes on the market next year is hard to say.

There is a bigger problem, which is about 200% higher than the average market sales price. This means a terrible assumption: the vast majority of users who walk into the brand’s 4S stores across the country cannot afford this new car.

Before the iPhone was introduced, the mainstream models of international brands were priced at around 2,000 yuan, and models above 4,000 yuan were high-end and had a low sales proportion. However, the hot sales of the iPhone actually raised the average price of the entire mobile phone category. Similarly, the recent Ten-Year Speech by Lei Jun that swept the Internet reviewed a fact that when Xiaomi 1 was released, the price of 1,999 yuan was about three times the average price of the domestic Lenovo mobile phone, which was the market leader at that time.

In fact, when a feature phone upgraded to a personal smart terminal, it is a normal scientific phenomenon for the price to increase. But the problem is that users’ willingness to pay is closely related to brand recognition, and they cannot be completely rational. Ten years ago, users would not pay 1,999 yuan for a Lenovo-branded phone, but they were willing to be “monkeyed” by Xiaomi and ran to snap up online every day.

It can be foreseen that a mature car brand with decades or even hundreds of years of history has already been shaped by public recognition. It will be very challenging for the brand’s marketing and channel system to convince potential users to pay a price that is beyond their imagination for the same logo.Everyone understands that using old methods will not solve new problems, so innovation is necessary. The marketers of this electric vehicle project are trying their best to solve the problems, but they don’t have much time and limited authorization to make changes. Making systematic changes is unrealistic, so they have to find things that can be quickly implemented within a year without excessively impacting the existing marketing system, while demonstrating innovative elements. Even a devout and professional manager can only innovate for the sake of innovation in this situation.

High Research and Development Standards Are Habitual

More than one international car manufacturer has experienced similar stories.

Their engineers are very cautious about new, expensive components like batteries in the automotive industry, and have established a rigorous set of standards to ensure the safety and stability of the battery. These companies impose their own independent standards in addition to those of the battery suppliers, making the battery development process more complex, lengthy, and expensive. Three years later, when users see the product parameters on the market, they will think that this brand’s electric vehicle technology is mediocre: the battery capacity is not low, but the range is not high, the car is heavy, and the acceleration is not strong.

Engineers’ rigorous attitudes and businesses’ insistence on high standards are respectable, however, they can also be lavish and insensitive during special circumstances.

Automotive power battery technology is rapidly evolving, with a yearly cost reduction of about 8% and constantly emerging new formulas and processes. Its pace of evolution is far faster than that of engines and gearboxes, making it unsuitable for the classical research and development system of the automotive industry. Until smarter new methods are found, it is a necessary choice for the classic high-standard system of century-old car manufacturers to be preserved.

If we use the first-generation iPhone from Apple as an example, we can also laugh at Steve Jobs and his team of engineers: you Silicon Valley elites thought you were so smart, yet the durability test for the screen clearly didn’t match the rigor of the Finns.

Being rigorous is valuable and politically correct.

But is rigor all that consumers need?

The real key issue is: for large-scale car manufacturers, especially international car manufacturers, their lifeline does not lie in their choice of rigor, but in their inability to temporarily forget rigor and turn themselves into barbarians. The standardized research and development system based on rigor is better suited to solving stable large-scale manufacturing businesses. However, when the industry needs to change its approach, and various new technologies and uncertain environments need to be integrated, it is more reasonable to return to the flexible startup company model: finding small breakthroughs, trying them out quickly, and iterating based on the results.During this special period, being rigorous may just be a habit and a scapegoat for refusing to take risks. When a company grows larger, many people become “risk averse”, placing greater importance on avoiding mistakes over achieving success. This attitude is understandable, as making accomplishments may result in no more than a promotion or pay raise, while encountering setbacks could lead to being forcibly transferred to a different position.

When traditional car companies were just starting out, they were once young, passionate, and nimble. But now they can’t go back, having become accustomed to suits and dress shoes, unable to don peasant clothes and straw sandals any longer.

For a long time, the internet and automotive industries were two separate circles, one working in the digital world of bits and the other running in the atomic world.

However, the electric vehicle and intelligent car era, by coincidence, has allowed the internet circle to begin infiltrating the car circle.

When a NIO ES8, in the vicinity of Chang’an Street, came to a standstill and took an hour to update due to an OTA caused by user operating errors during a test drive, this was supposed to be a microcosm of a huge revolutionary change in the automotive industry, but was instead satirized by public opinion as the clumsiness of a new player after being embellished by netizens.

Setting out on a journey into the unknown always carries risks of falling. Comprehensive OTA capabilities require completely overturning past architectural and software development designs. In this process, numerous embarrassing situations are unavoidable.

However, that past helplessness and embarrassment now seem to serve as battlements.

A certain mainstream German brand has always been known for being skilled at designing car platform architectures, but has repeatedly encountered setbacks in their latest attempts: delivery delays, frequent software bugs, inability to update OTA and only being able to upgrade through physical connectivity… If the brand name were covered up, one might even think it was reporting on the most unreliable new Chinese car manufactured in 2018.

This company has a huge workforce of automotive mechanical engineers, but in terms of software, they are in the early stages. Any exploration implies changes in the distribution of power and benefits, which, in a large corporation, will clearly encounter great resistance. In order to build consensus and unite the team, the CEO of the company has to transform into a cheerleader, publicly praising Musk and Tesla every other week. Obviously, these remarks are not meant for external audiences but for the conservative groups within the company.

However, he seems to have been stripped of part of his power recently in his official role. It seems that his cheerleading strategy was not effective. There must be many within the company who either truly dislike Tesla-style innovation or are worried about being marginalized despite holding great power, thus opposing radical reforms.

The former view is understandable, as many international car executives are already grandfathers in age and do not reside in Silicon Valley or Shenzhen, where mobile internet and chips are not integral parts of their bloodstream.

The latter is even more understandable. Such is human nature.

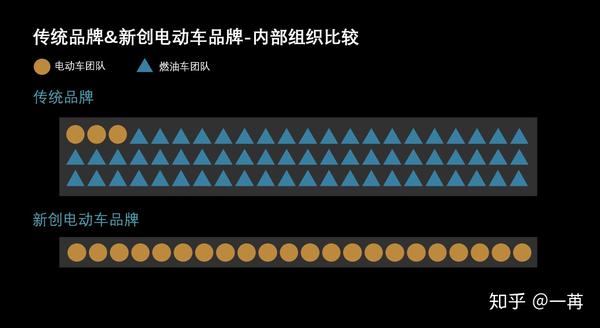

The Difference Between Swimming in Deep Water and Shallow Water## Many automakers are developing or have already deployed electric cars. Their basic approach to these products is as follows: research and develop them in the same way as past conventions, manufacture them in the same way as past conventions, sell them in the same way as past conventions, and provide after-sales services in the same way as past conventions.

Users say charging is difficult? Shrug.

Users say the price of the car is too high? Shrug.

Users say the car’s infotainment system and app are not smart enough? Shrug.

Users say the purchasing experience is not good? Shrug.

In every corner of this big company, there are extremely intelligent and passionate talents. Can’t they see the problem? Not really. However, these people’s job authorities only allow them to solve “technical” problems, and do not give them the space to think about the “philosophy”. To reform the system, break the rules, at least high-level executives above VP are needed. But the executives are responsible for the company’s operating performance, responsible for the chairman and shareholders, and responsible for their own contracts. In this situation, which executive will work desperately to worry about electric cars and break past habits for this narrow business with only 1% income share stability?

This way of playing with electric cars is like swimming in shallow water. It is swimming, but the limited experience of learning.

Some start-up companies, because they have fewer tasks in their hands and their family background is not strong, often focus on building 1-2 car models and focus on developing and serving the same type of user. They redesigned the entire business operation model, from manufacturing to supply chain, from retail channels to service experience, and from charging to the app community.

The entire process, due to many reforms and too little experience inherited from predecessors, is full of risks, like a novice who just started swimming and rushed into the deep water area, even the tumultuous sea. But the advantage of doing so is that once he does not drown, he really understands the water.

Today, both types of people stand in front of users and tell users that they can swim. How will users choose?

Don’t say those who have learned to swim in shallow water, as long as they are determined, they can quickly take care of deep water.

Tesla’s supercharging stations are spread all over the world, and no traditional automaker has seen them seriously follow up. Initially, they could use this model to comfort themselves with too much burning money, Tesla’s annual loss. But today, Tesla is building new charging piles at an unprecedented speed, selling cars at an unprecedented speed, and continuously making unprecedented profits.

Why can’t traditional car companies do well in the seemingly simple brand app?

Tesla is a leader in the global electric vehicle market. But in the local battlefield of brand apps, NIO, XPeng, and Ideal are probably more innovative practitioners.

NIO, which leads this wave of innovation, has built this app into a super app integrating brand self-media, user socializing, e-commerce, and car management tools. Its complexity is comparable to that of a medium-sized internet company.NIO’s App started out with a simple function, limited content, and low traffic. Despite facing frequent negative crises and suffering a significant decline in traffic after its point reward system was adjusted, the company eventually established a new path in the industry.

While at least 10 traditional car companies have copied NIO’s App, which established a user community through Chairman Li Bin’s active participation in the comment section and daily distribution of credit rewards to car owners in their chat groups, how many large car companies can replicate this approach? Who can resist the urge to delete user-generated content and fully embrace a new brand language system as well as initiate genuine interactions with users using conversational communication? Who can effectively leverage the entire supply chain, from products to services to communication, to make products that truly add “user value” instead of being driven by the “manufacturer’s expressions”? Without the willingness to be a model citizen in the community and solely relying on the appearance of an App, it is impossible to establish stable social relationships.

In general, traditional car companies’ approach to App development is for the App to be a new tool led by the marketing or IT department, adhering to established organizational structures in content and operation. The communication area is assigned to PR and communication departments, aftersales services to aftersales and CRM departments, and sale pages to the sales team.

This results in an App that more closely resembles a “copycat” official website, lacking a product design that derives from mobile internet logic, and is not a user community.

In fact, many people are unwilling to build a community, as once you grant users the freedom to publish (post) and gather (chat in groups), the possibility of negative outcomes multiplies, which opposes traditional car companies’ experience in dividing and ruling users.

In summary, traditional car companies are not lacking in funds or development systems or capable people who want to succeed in electric vehicles. However, these production factors are challenging to mobilize and organize within a mechanism that is skilled in producing gasoline cars.

Professional managers and staff members are doing their best to move forward at a short-term operational level. However, no one can affect the culture of the organization or the structure of the entire business. Even hiring former Tesla and NIO employees may not be effective in resolving the issue. The purpose of introducing new blood is to seek change, but these people won’t push for change on their first day at the company; instead, they must first adapt to the new environment and focus on survival before development.During this once-in-a-century transformation period in the automotive industry, it takes determination from the CEO to make critical decisions. However, in the PowerPoint presentation shown to the CEO, it’s clear that the revenue contribution of electric cars is significantly low, and the market capacity of electric cars in the entire industry is only 4%. It is risky to invest heavily in electric cars, which may not bring about significant results in the short term, while causing great damage to profits. How can this be justified to shareholders? CEOs and shareholders seem to be waiting for the day when Tesla and NIO will be even more successful. Only then will they be able to see clearly, reduce risks, and have sufficient reasons for change.

But when that day comes…

There Is Nothing New Under the Sun

Recently, the speech and authorized book of Lei Jun’s tenth anniversary at Xiaomi have been trending on social media, reviving many of the company’s past moments.

Professional experts generally believe that a start-up company cannot survive under the pressure of giants such as Nokia, Apple, and Lenovo.

In the early stages of hiring and building a supply chain, they encountered obstacles everywhere;

The cost of the first product far exceeded expectations, and the pricing was forced to change from the originally planned 1499 yuan to 1999 yuan;

At the first product launch, there was a collective orgasm among fans that outsiders found difficult to imagine and understand;

The limited supply chain and manufacturing capacity forced users to wait, and people outside mistakenly believed that this was an innovative “starvation marketing” strategy;

Some of the practices that Lei Jun pushed internally were far from the industry tradition, and many internal staff were opposed to it;

There were many problems with early products, and negative public opinion was high, but a group of users loved Lei Jun and Xiaomi very much.

For those who are familiar with NIO, it’s easy to see that if you replace Xiaomi with NIO and Lei Jun with Li Bin in the above text, it will be equally harmonious. If you apply this story to Tesla that first launched the Roadster electric sports car in 2008, it also fits perfectly.

There is nothing new under the sun.

The stories of Nokia and Apple, which have been talked about to death,

continue to reappear in different times and places.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.