Introduction

I want to use data to illustrate the urgency of purchasing new energy vehicles in Shanghai recently. Buying houses and buying new energy vehicles have both been interesting things lately, both requiring quick orders. In Shanghai, the most important thing is license plate resources, which are highly scarce. With the implementation of the “Implementation Measures for Encouraging the Purchase and Use of New Energy Vehicles in Shanghai” formulated in February 2018 expiring on December 31 last year and a transitional period until February 28, with continued free allocation of special license plate quotas for new energy vehicles. Looking ahead, there will be different requirements from before in terms of quantity and qualification for application at the policy level, and this, together with the restriction on external license plates for the inner circle to be implemented next May, is the root cause of the acceleration of this wave of demand.

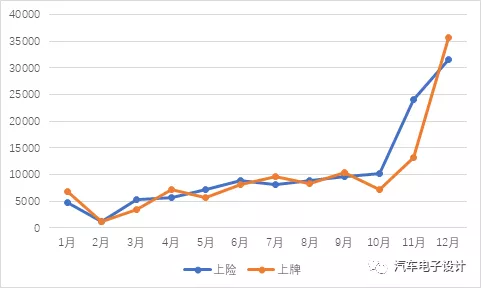

Shanghai licensing and insurance data

First, let’s take a look at the purchasing process of new energy vehicles in Shanghai, which is mainly divided into three parts:

1) Verification of purchase qualifications

2) Installation of charging facilities

3) Confirmation of vouchers issuance

In March, in response to the policies encouraging the purchase of new energy vehicles, the Shanghai Economic and Information Commission issued a notice on the relevant operating procedures of the “Implementation Measures for Encouraging the Purchase and Use of New Energy Vehicles in Shanghai in 2020”, accelerating the verification process of purchase qualifications for new energy vehicles: the frequency of sending basic user information to three departments was adjusted from once a week to twice a week, and the verification period was shortened from 10-15 working days to 5-7 working days (50% of the time).

Therefore, the speed of insurance application has been accelerated here. The sales departments of car companies send intention orders to the application process and then accelerate delivery as soon as possible. Therefore, we can see that the insurance data reached 23,998 and 31,531 respectively in November and December, which is around 10,000 units according to the previous average demand.

However, licensing data has a certain lag. The number of new energy passenger vehicles licensed was 13,200 in November and 35,670 in December, a year-on-year increase of 476%, which has greatly exceeded the number of license plates for private vehicles in December (14,000).

This reflects several issues:

1) Everyone wants to complete the licensing before the end of December, and the speed of licensing in December exceeded the speed of insurance data, completing the backlog. According to the calculation for 2020, there were 125,300 units insured and 117,200 units licensed, with 8,100 units not yet licensed.

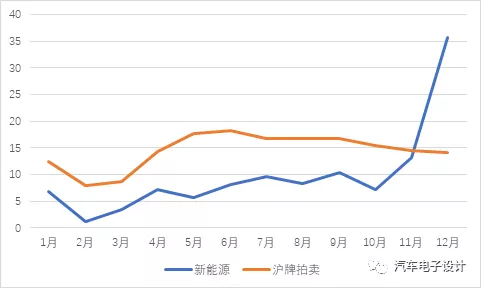

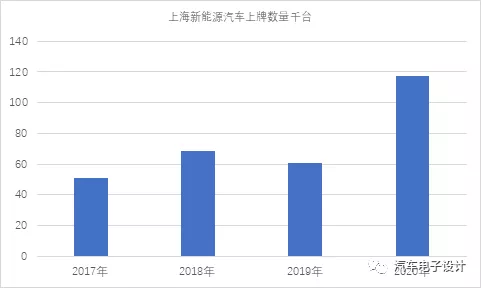

2) The monthly supply of new energy vehicles in Shanghai has greatly exceeded that of private fuel vehicle plates, with a monthly penetration rate of over 60\% in 2020 and a total of 117,000 new energy passenger vehicles registered (an increase of 95\% over last year’s 60,000 vehicles, maintaining a relatively stable state), with an annual penetration rate of 24\%. The base number here may not be particularly clear, but it is clearer when compared to the situation of Shanghai license plate issuance. This graph clearly shows that new energy vehicles have recently surpassed Shanghai license plates, in units of K. If estimated at 1 million yuan per license plate, this incremental amount is 5.67 billion yuan.

2) The monthly supply of new energy vehicles in Shanghai has greatly exceeded that of private fuel vehicle plates, with a monthly penetration rate of over 60\% in 2020 and a total of 117,000 new energy passenger vehicles registered (an increase of 95\% over last year’s 60,000 vehicles, maintaining a relatively stable state), with an annual penetration rate of 24\%. The base number here may not be particularly clear, but it is clearer when compared to the situation of Shanghai license plate issuance. This graph clearly shows that new energy vehicles have recently surpassed Shanghai license plates, in units of K. If estimated at 1 million yuan per license plate, this incremental amount is 5.67 billion yuan.

From this graph, we can see that the orders in Shanghai in December cannot be linearly extrapolated to 2021, and the comparison with the proportion of Shanghai license plate issuance is a better reflection of the problem. There were 174,000 license plates issued in Shanghai, and the overall proportion of new energy vehicle license plates should be compared to this data.

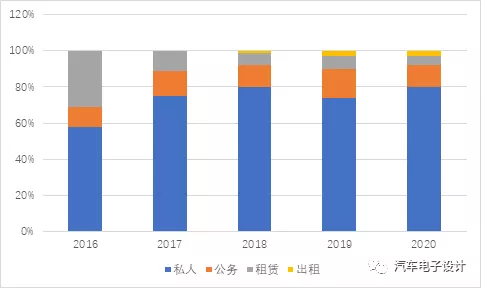

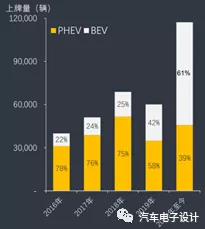

More importantly, this surge in demand is due to the rapid increase in the proportion of BEVs and the breakthrough of private ownership to over 80\%. Everyone now believes that this is a scarce resource that needs to be purchased quickly, similar to the fuel license plates in Beijing before the purchase restriction was put in place.

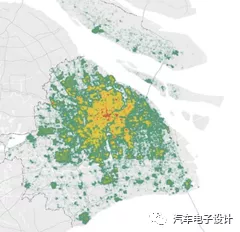

This year, the rapid market penetration of the Tesla Model 3 has shown structural changes in the Shanghai market, as shown in the chart below. Furthermore, most of these cars are concentrated in the inner and middle ring areas.

Outlook for 2021

Going from 60,000 to 117,000 with a monthly penetration rate that has hit 60\% is not something that can be sustained.

Shanghai is studying the new round of policies on new energy vehicles. In fact, as a matter of common sense, under the condition of scarce resources, the direction of tightening the application with total control will be followed. Actually, controlling the purchase of new energy vehicles is likely to be similar to the purchase of houses, which is configured on a household basis. Currently, it is aimed at individuals who:

-

Have good credit status

-

Hold a valid motor vehicle driver’s license

-

Have no records of relevant road traffic violations within one year prior to their self-application (driving a motor vehicle to commit road traffic violations five or more times; receiving administrative penalties such as the revocation or suspension of the motor vehicle driver’s license or detention)

-

Have local household registration

-

Are active servicemen and members of the Armed Police Force

-

Hold a valid residence permit in this city and have paid social security in this city for one year in the past 24 months for non-local residents

-

Hong Kong, Macao and Taiwan residents who have lived in the city for more than one year

-

Overseas Chinese and foreign personnel

Summary

The next step may be to limit according to households. Logically speaking, under the situation of limited resources, this is the trend. The growth of new energy vehicles in the restricted purchase area is a replacement for fuel vehicles. Under a certain scale, it is a zero-sum game, and the internal competition among new energy products will become more intense.

Of course, from a personal perspective, it is more appropriate for comrades who have a new energy vehicle to apply quickly. This free gift is not always available.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.