Recently, a friend who is from out of town and not in frequent contact suddenly started chatting with me on WeChat about BYD’s fundamentals. As an automotive industry practitioner, while feeling honored, I also began to reassess this company whose stock price has risen from 50 yuan to 230 yuan.

Perhaps in the impression of many people, BYD is still a domestic brand that relies on “low-end” electric vehicles to open up the market.

Indeed, during the first wave of automotive electrification in our country, before new forces such as NIO, XPeng, Ideal, etc. appeared, there were a large number of traditional car companies that ran around trying out electric vehicles, mainly relying on state subsidies or imitating foreign-funded cars to make a living. Familiar names include BAIC, Chery, Dongfeng, BYD, Zotye, Lvyuan, and so on.

However, times have changed. Except for occasionally seeing this batch of “fraudulent subsidies vehicles” as black cars on the road, news of some companies going bankrupt one after another has caused a wave of lamentation in the industry, such as Zotye, Lvyuan, and Changjiang.

Most of the remaining new energy OGs, such as BAIC, Chery, and Dongfeng, are still following the traditional car company’s low-priced car route.

On the other hand, some more enterprising car companies realized that their brand premium ability was low, so they started to form small groups and establish new brands to reset their influence, such as BAIC and Magna’s ARCFOX, Dongfeng’s Voyah, etc. It’s like wanting to use a smurf account to fight against someone else’s big account after abandoning the big one.

However, BYD is still BYD.

BYD is no longer just the BYD of the past. In 2020, with the dazzling topic of new energy, many people may not have realized that the new generation of “Han” can already achieve monthly sales of over 10,000 units with a price of over 200,000 yuan per unit. It should be noted that this price range is home to eye-catching competitors such as Tesla Model 3 and XPeng P7. The pure electric models that can also achieve monthly sales of over 10,000 units are the phenomenal products Tesla Model 3 and Wuling Hongguang MINIEV.

At the beginning of 2021, BYD announced a brand change, once again declaring to the outside world that this old new energy brand is constantly upgrading its strength.

Of course, today we do not want to continue discussing the hot sale of BYD Han, but rather to talk about BYD’s industrial layout.

Today’s BYD has actually split into five groups, namely electronic devices, batteries, passenger cars, commercial vehicles, and monorails. Among them, the batteries are divided into small batteries, power batteries, solar energy, and energy storage batteries.

The passenger car business, needless to say, as a witness of the first wave of electrification, it also experiences the second wave of new energy represented by start-up companies such as NIO, XPeng, and WM Motor. Today’s BYD no longer blindly follows the low-end route, but has launched products such as Han and Qin, which can reach up to the price range of 200-300 thousand yuan with the new round of industrial upgrading.

As for the power battery business, after cooperating with Toyota and launching its own blade battery, BYD’s battery business has also entered the public’s view, and its blade battery has broken through the bottleneck of energy density of lithium iron phosphate battery group, and now it has become one of the top players in the industry.

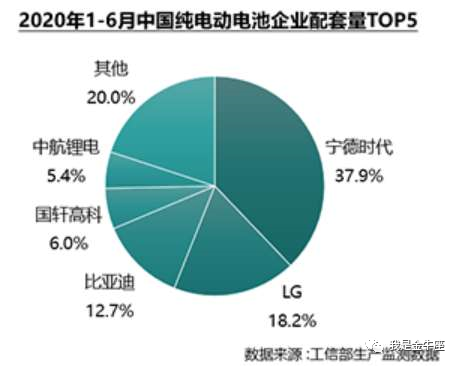

Moreover, it has passed the nail penetration test, which has raised the safety of batteries to a new level. At present, the Ningde era has the largest market share in the domestic automotive battery market, followed by BYD (LG is a supplier from South Korea), and the total share of the two far exceeds the sum of all the rest domestic players, forming an oligopoly pattern. I wonder how the brother companies in the same era as BYD who entered the industry as a whole vehicle enterprise would feel when they think of BYD opening up the battery battlefield early on.

Actually, I want to talk more about its semiconductor business, especially the power semiconductor part.

As the automobile industry develops towards modernization, it directly drives up the silicon content of automobiles. Power devices, especially IGBT (power semiconductor), are the core components in the field of industrial control and automation. As one of the key carriers of electric vehicles, the demand and value of automotive semiconductors are growing exponentially. It is estimated that the total value of semiconductors per pure electric vehicle is more than 70% higher than that of traditional vehicles, and the value of semiconductors in new energy vehicles has increased from $450 to $750 compared with that in traditional vehicles.

For example, Tesla’s three-phase AC asynchronous motor uses a total of 96 IGBTs, with a value of about $400 per IGBT.

Quoted from the Guosen Securities Industry Report on Power Semiconductors

Tesla released the Model Y on January 1, 2021 with a starting price of 339,000 RMB, which is 160,000 RMB cheaper than the previously predicted price. This has caused a rush to buy, demonstrating that local new energy vehicles in the future will face a severe cost reduction test in order to compete with international brands like Tesla.

Tesla released the Model Y on January 1, 2021 with a starting price of 339,000 RMB, which is 160,000 RMB cheaper than the previously predicted price. This has caused a rush to buy, demonstrating that local new energy vehicles in the future will face a severe cost reduction test in order to compete with international brands like Tesla.

Considering that Infineon, currently the world’s leading power semiconductor manufacturer, has a 58% market share, in order to reduce manufacturing costs, the domestic substitution of power semiconductors will be an unavoidable option for all domestic auto manufacturers.

BYD is currently the largest domestic IGBT manufacturer. Its semiconductor business covers the research and development, production and sales of power semiconductors, intelligent control ICs, smart sensors, and optoelectronic semiconductors, and has an integrated management system covering chip design, wafer manufacturing, packaging testing, and downstream applications. Currently, BYD’s IGBT is already in its 5th generation, while its SiC MOSFET is in its 3rd generation, and its own SiC production line is currently under construction.

As of now, there hasn’t been any news of BYD cooperating with other car manufacturers in the direction of semiconductors, indicating that BYD’s semiconductor manufacturing is mainly self-sufficient. So what comes next?

To summarize what might support BYD’s stock price increase this year:

-

In the new energy passenger car sector, although BYD’s Han sold 12,000 units in December, its annual sales of 426,972 vehicles decreased by 7.46% compared to last year. While the sales of BYD Han are currently good, for a company whose stock price has increased more than four times, the factor supporting the stock price increase is obviously not only this, and may only account for a small part.

-

There is a lot to say about the power battery segment. After Model 3 switched back to lithium iron phosphate, there is no doubt that lithium iron phosphate has re-entered the mainstream car manufacturer’s vision. Even the battery chairman He Long said, “Almost every automotive brand you can think of is cooperating with us based on blade battery technology. I believe everyone will soon see and hear more exciting news about blade batteries.” In the future, the power battery business has a lot of imagination space as an independent business module that can cooperate with other domestic auto manufacturers. After all, CATL, the neighbor, rose tenfold in 2020. People in the industry also know that over-reliance on the same supplier is extremely dangerous, undoubtedly making BYD a good challenger.- Power semiconductor section, the rise logic also comes from cooperation with mainstream automakers and Tier 1 suppliers in the industry. After all, Spower, also a leading player in the industry, saw its stock rise more than 17 times in the past year. At present, BYD’s power semiconductor section is still self-sufficient, but if we examine it with the same logic as with batteries, can BYD also become a supplier to other automakers once it meets its own needs? It is worth noting that the localization rate of IGBTs in current new energy vehicles is still less than 50%, and with the increasing size of the new energy vehicle market, this sector is still worth discussing stories in the capital market.

Finally, I want to say that opportunities and challenges always go hand in hand. BYD’s advantage lies in the low-cost LFP battery. However, for higher-end ternary batteries, BYD does not have any obvious advantages.

Furthermore, the development of new energy vehicles is still in the early stage, and the future of battery technology in the automotive industry is uncertain. The impact of NIO’s recent release of its solid-state battery technology on the stock prices of companies like CATL is the best example.

Although the switch to such technology may not show its effects in the short term, it has to be acknowledged that solid-state batteries are becoming the next hot spot for investment, which is also the direction many players in the industry are quietly laying out their plans. It remains to be seen whether BYD will remain visible in this new race track.

In addition, BYD, as a mainstream automaker, is inevitably in competition with major automakers. If BYD’s battery and power semiconductor businesses need to become new profit growth points, how to handle its relationship with its investors will also be a new challenge for BYD.

So, is BYD’s stock price high or not? Maybe you already have the answer in your mind.

- This article does not constitute any investment advice.

References

[1] Report by China Merchants Securities: “Semiconductor spin-off initiates revaluation of value, DM-I and pure electric platform welcome major breakthroughs”.

[2] Power semiconductor industry report by Guosen Securities: “New energy vehicles reshape the value of power semiconductors”.

If you would like to communicate with the author, you can add the author’s WeChat: wp7788999.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.