Selling Cars

Tesla’s current products on sale are primarily the Model 3, Model Y, Model S, and Model X. The magical year of 2020 is coming to an end. Based on Tesla’s sales data so far, it sold roughly 140,000 vehicles in China, 250,000 vehicles in the United States, and 100,000 vehicles in other regions (Japan, South Korea, Europe), bringing the total sales for Tesla this year to approximately 480,000 to 500,000 vehicles.

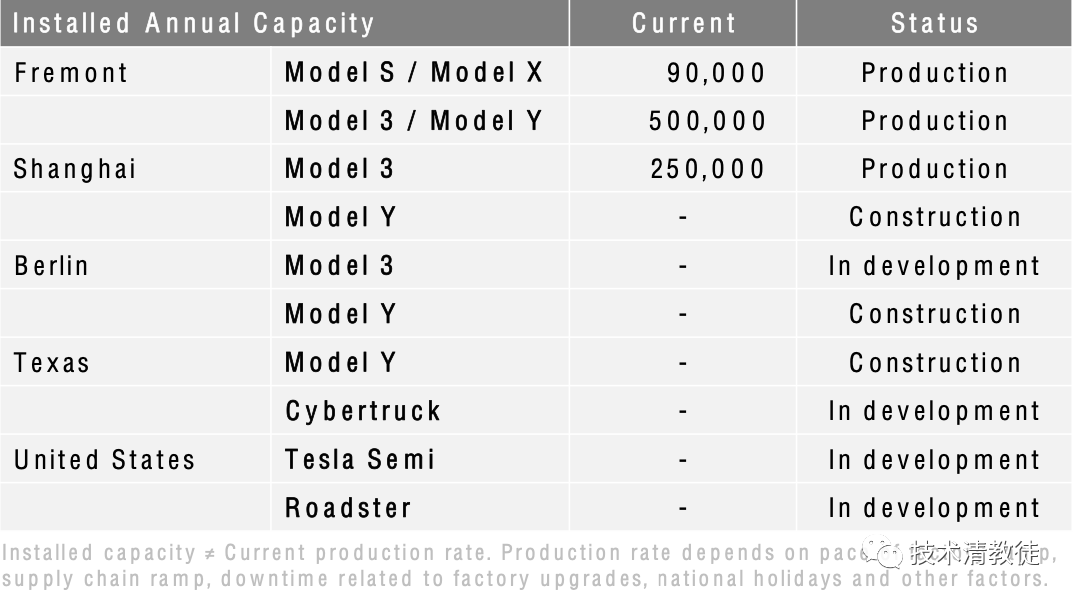

Let’s take a look at Tesla’s production capacity based on all of its super factories.

China Shanghai Super Factory Phase I

Production of Model 3: Designed capacity of 150,000 vehicles per year, currently at 300,000 vehicles per year.

The Tesla Shanghai Super Factory held a groundbreaking ceremony on January 7, 2019, and began construction. It was fully accepted in September, setting a record for completing all hardware construction and deployment within nine months. Later, Tesla delivered its first domestically produced vehicle on December 30, 2019, and then entered an 11-month production ramp-up period. Recently, various sources have indicated that the current weekly production capacity of the Shanghai Super Factory Phase I is around 5700 vehicles, reaching an annual output of 300,000 vehicles. News of Shanghai Super Factory Phase I Model 3 exports to Europe was buzzing around recently, with an initial export shipment of 7,000 vehicles, and sales in China for October were around 13,000 vehicles, basically confirming that the Shanghai Super Factory has achieved a weekly production capacity of 5700 vehicles.

China Shanghai Super Factory Phase II

Production of Model Y: Designed capacity of 250,000 vehicles per year, currently under construction.

The construction of the Tesla Shanghai Super Factory Phase II began in March 2020. According to the construction cycle of the Shanghai Super Factory Phase I, the completion of the Shanghai Super Factory Phase II should be in December 2020, and the delivery of the first vehicle should be in March 2021.

USA Fremont Super Factory

Production of Model 3 and Model Y: Designed capacity of 500,000 vehicles per year, currently at 400,000 vehicles per year.“`

Production of Model S and Model X: Designed capacity of 90,000 vehicles per year, currently at 90,000 vehicles per year.

Based on Tesla’s sales data this year, and considering Tesla only has two Gigafactories, (Fremont and Shanghai), Tesla produced all the Model 3 sold in China at the Shanghai factory. Subtracting the approximately 130,000 domestically produced Model 3s from the total global sales of 480,000, the remaining 350,000 vehicles were produced at the Fremont factory.

From this, it can be seen that the planned production capacity of the Chinese factory was 150,000 vehicles per year, but has now doubled to 300,000. In contrast, the planned production capacity of the American factory was 490,000 vehicles per year, but actual output is currently only 350,000 due to the impact of the COVID-19 pandemic. The pandemic caused interruptions in the production progress of the American factory and its suppliers. However, Tesla was fortunate enough to have started construction of the Chinese factory in early 2019, and completed it before the once-in-a-century pandemic outbreak in 2020. Tesla thus managed to jump on the high-speed train of China’s early resumption of production capacity. The back and forth between Tesla’s China and US factories is a microcosm of China’s position in global manufacturing during the pandemic. Therefore, the trend of the distribution of the world’s manufacturing facilities during and after the epidemic will likely continue to concentrate in China, rather than relocate from China. One must admire the wise decisions made by the Chinese government in response to the epidemic.

U.S. Texas Super Factory

Production of Model Y and Cybertruck: Designed capacity of 500,000 vehicles per year, currently under construction.

The construction of the Texas Gigafactory began in July 2020, and it is said to have begun building around the clock recently, with progress expected to surpass the Berlin factory. The Texas Gigafactory is expected to be completed in April 2021, and the first vehicle should be delivered in August of the same year.

Germany Berlin Super Factory

Production of Model Y and Model 3: Designed capacity of 550,000 vehicles per year, currently under construction.

“`The groundbreaking time of the Berlin Gigafactory is also in July 2020, with an expected start of production in April 2021. However, due to strict construction regulations and environmental requirements in Europe, Tesla has been penalized and halted construction multiple times. It is estimated that the completion time of the Berlin Gigafactory will be a few months later than that of the Texas Gigafactory, and the delivery of the first car should be expected in early 2022. Nevertheless, the European factories are the key to avoiding tariffs and increasing sales through local production. Tesla is expected to focus on completing the Berlin factory first.

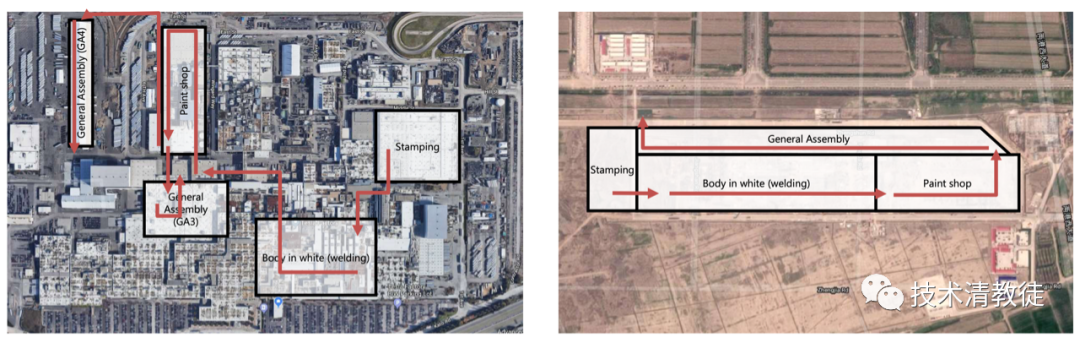

Here is a bird’s-eye view of Tesla’s global Gigafactories at the same scale.

In summary, Tesla’s production capacity in 2021 is expected to come from the Fremont Gigafactory, Shanghai Gigafactory (Phase 1 and 2), and the Texas Gigafactory, with a total annual production capacity of 1.32 million vehicles. After the completion of the Berlin Gigafactory in 2022, the total production capacity may reach 2.19 million vehicles.

To be more aggressive, the planned capacity of Phase 1 of the Shanghai Gigafactory is 150,000 vehicles, and the production can double to 300,000 vehicles by operating at full capacity for 12 months without the need for additional construction. This may be due to the use of new technologies and equipment in the Shanghai Gigafactory Phase 1 that allow Tesla to quickly expand production. Therefore, the Texas and Berlin Gigafactories, which will be built after the Shanghai Gigafactory, are expected to have the same ability. Theoretically, Tesla’s total production capacity in 2022 can reach 3.49 million vehicles.

Assuming all Tesla models are priced at the middle price between Model 3 Standard Range and Model Y Standard Range, with a sales price of $42,000, and 80% of the annual production capacity is used as the estimated annual sales volume, the sales volume in 2021 will be 1.05 million vehicles and the revenue will be $44.1 billion. The sales volume in 2022 will be 1.75 million vehicles and the revenue will be $73.5 billion.

Energy NetworkTesla’s increased ownership directly brings about “soft” income, which is the increased income from Tesla’s self-built supercharging network. In our previous article, we estimated that based on an average daily driving distance of 50 kilometers per car, 2,600 kWh/car/year is required. Based on Tesla’s global ownership of 1 million vehicles at the end of 2020, 26 billion kWh is required. Assuming that 50% of the electricity is used to charge Tesla’s supercharging network, Tesla’s supercharging network revenue will reach $300 million in 2020, $600 million in 2021, and $1.15 billion in 2022.

Insurance

Tesla’s insurance business has been discussed in a previous article. Assuming that Tesla sells insurance at 30% below market price, the insurance premium for a car worth $42,000 is approximately 2-3% of the vehicle price, with a 30% discount, and a premium of about $600/car/year. By the end of 2021, assuming that 20% of Tesla owners choose Tesla car insurance, revenue will reach $240 million in 2021 and $660 million in 2022.

Autopilot

The value of the autonomous driving system was fully explained in our previous second article. Here, we further divide this suite into two parts: full autonomous assisted driving (FSD) and full autonomous driving (which is possible but still far from mature, requires sufficient training data, and a theoretical breakthrough in computing power).

These two parts, compared to each other, lack the word “assisted”. The former can allow Tesla to open up a market worth hundreds of billions of dollars in cash flow, while the latter means that it can open up a market worth trillions of dollars in cash flow. Here, we only discuss the former, which has already generated cash flow. We’ll discuss the latter in the future if there is an opportunity.

The price of the full autonomous assisted driving FSD suite is $10,000. By the end of 2021, assuming that 10% of car owners will purchase FSD at once, revenue will reach $1 billion in 2021 and $1.75 billion in 2022.

The price of subscribing to the full autonomous assisted driving FSD suite is $100/month. By the end of 2021, assuming that 30% of car owners subscribe to FSD, revenue will reach $700 million in 2021 and $1.3 billion in 2022.

Future of Tesla

Tesla’s vehicle sales revenue in 2021 was $44.1 billion, and its service revenue was $2.54 billion. By the end of 2022, vehicle sales revenue is expected to reach $73.5 billion and service revenue to reach $4.86 billion.According to the gross margin, the gross margin of vehicles is about 27.7%, the gross margin of the supercharging network is about 60%, the calculation method of insurance gross margin is unclear for now, and the gross margin of software such as FSD is estimated to be 90%. Tesla’s gross margin in 2021 is approximately $14.14 billion, while the gross margin in 2022 is expected to be approximately $23.8 billion.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.