2020 has gone.

When I opened the new energy vehicle sales data file in the last few months, I had a feeling: Am I looking at the “China Brand New Energy Product Sales Table in XX Month in 2020”?

The names of those familiar foreign big brands in the sales data table have been decreasing month by month, just like last month – in the ranking of pure electric vehicle sales in November, we could only see Buick-Velite 6 at 28th place, which sold 1,300 units last month. The BMW 5 Series Le is also basically at the 20th place of all new energy products.

It may also be that they have already achieved the sales target declared to the foreign headquarters at the end of the year and need to relax.

Anyway, it cannot be denied that in the smart electric car race in China, local brands have completed a stage of rapid expansion in 2020. The considerable increase and pleasing growth rate of China’s new energy market in the last quarter of 2020 is also driven by local excellent smart electric cars.

Especially after watching the video of the recent Douyin big brother complaining about his Taycan, it reinforces the confidence in local brands in the new game.

New Year’s Day has arrived, and there are a few things to mention in the last issue of 2020:

- New energy data hits a new high, and bad money does not drive out good money;

- Li Weipeng: Recognition of being imitated;

- Tesla really does not care about competitors, such opponents are terrible and admirable;

- The world is so big, we want to try.

Finally, I also make a prospect for 2021, and make a summary.

“Increase” From the Head, “Increase” From the Intelligence

The feature of the human head is that there is a brain inside, and other parts will act according to the signals sent by the brain, which is a key structure of human intelligence. The feature of the market head is only: more.

Let’s first look at the growth of the 2C new energy market in the fourth quarter of 2020.

In November, with the release of license plate policies in Beijing and Shanghai, new energy, especially pure electric, has surged in both the number of license plate registration and market share in 2C market. Different from the beginning of new energy when “no one wants license plates”, now mature technology and excellent products from different manufacturers have given new users another reason to pay for new energy vehicles besides the need for a car.

As the fourth quarter approaches, the market share of new energy products in the 2C market in China is expected to reach an unprecedented 4% for the full year 2020. In comparison, this number was 2.21% at the same time last year.

At the same time, since 2020, the sales of new energy vehicles in non-limited cities have also officially surpassed 50%, reaching 51%.

A passionate and applaudable first quarter of the game can be said to have ended in 2020.In over 900 passenger car models with recorded sales, the aforementioned new energy vehicles accounted for nearly 4% of sales, taking up more than 250 spots. This indicates that the inferior products were not able to drive out the good ones.

Upon closer examination, the good products at the top have been getting better and better, while the majority of the 250 cars cannot even be considered participants.

This year, the best-selling fuel vehicle is the Nissan Sylphy, which occupies 3% of the market share. However, the number of new energy models holding a similarly high market share is declining.

Visible increments and growth rates are primarily contributed by the “top” products. Except for micro electric vehicles, almost all “intelligent vehicles” carrying L2+ ADAS and supporting OTA can be considered as top products. Micro cars plus smart cars supported the thriving new energy market in 2020.

Of the 250 models, 220 had average monthly sales below 500 in 2020, 195 had sales below 200, and 168 had sales below 100, with 80 models selling fewer than 10 units per month.

The new energy market needs more and better intelligent and valuable products to drive sustained growth.

In the short, medium, and long terms, such products are bound to come more from Chinese brands.

Someday we will look back and lament: Starting from the fourth quarter of 2020, besides Tesla, we are unlikely to see familiar foreign brands among the top ten in the new energy market.

New car-making forces continue to shine in this, and the rapid catch-up of traditional domestic brands is equally important.

“New” players on Li Weiping’s new track

Li Weiping’s three intelligent electric vehicles have driven the introduction of new high-end intelligent electric vehicles and new products from traditional manufacturers.

SAIC IM, Dongfeng Voyah, Great Wall Saloon, and those who have persisted like Lynk & Co.

Overtaking in corners, enticing capital, seizing opportunities, leaving a lasting legacy–the motivation is not important, but the product is the only answer.

Tesla + Li Weiping, pure electric driving, OTA, L234, APP… these tags have also become the labels of these new players, and the new rules of the new track are being quickly adapted by everyone.

Even on the route of battery swapping and REV technology, which were once heavily criticized and mocked, competitors are preparing to make their mark.

After the gradual recovery from the pandemic in 2020, the total market share of China’s new car market single-month market share maintained at around 15%, which is essentially on par with the Model 3’s single-month market share.## A Battle Akin to Three Heroes against Lü Bu

If Li Xiang and Peng Wenyuan each drew different nourishment from Tesla and grew in their own value systems, then new players on this new racetrack of intelligent electric cars have found inspiration more suitable to local enterprises in the seed market cultivated by Li Xiang and Peng Wenyuan.

For Li Xiang, such “imitation” and “reference” is a huge affirmation.

After 2020, from brands, products, sales to service systems and user operations, Chinese brands have entered a new cycle of construction, preparing to overtake on the curves and accelerate out of them.

In the next race, let’s all prepare to compete side by side with Tesla.

Tesla’s Goal

Recently, the Internet dug up the video of Musk’s 2014 statement that “Tesla will definitely sell more than 500,000 cars in 2020.” The moment to resurrect the past has come.

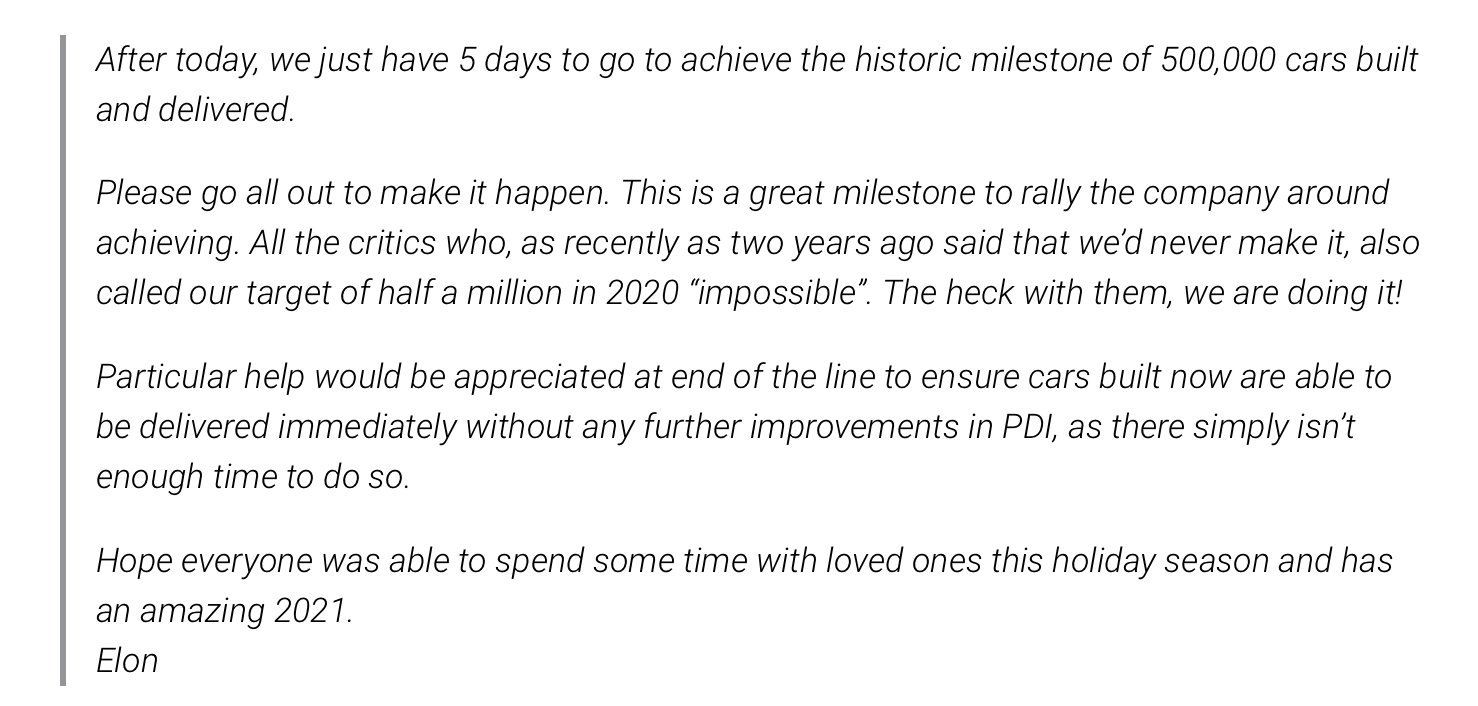

A few days ago, an internal email from Ma Yilong encouraging the company to strive for the goal of selling 500,000 cars in the last 5 days also became public.

If we go back to the first month of 2020, we will see how important this goal was for the Chinese market. So far, Tesla has sold nearly 130,000 Model 3s in China, which is basically in line with the sales targets of the brand and the population percentage of China in the world.

The ever-increasing rate of construction of supercharging stations, seemingly incessantly decreasing costs and prices, continual product improvements and optimizations: as a teacher and competitor, Tesla, despite being plagued by controversies, is still highly respected and admired.

With the continued growth of various vehicle-use demands in China at the end of the year – licensing policies, corporate tax exemptions, the impact of the pandemic, as well as purely the love and need for driving – the climax of the 500,000 goal is still taking place in that Shanghai factory during these last few days.

The word on the street is that the goal has already been reached.

The Horn of Going Abroad is Blown

The progress of Chinese car brands towards the world has been steadily advancing, and with the world being so big, we want to try it out.

Chinese brands have been operating in regions such as ASEAN, South America, Africa and Russia for a long time, and the export volume has been steadily increasing. In November, Chinese brands’ total export volume increased by 108% year-on-year, to 70,000 units.

In the fourth quarter, XPeng and NIO have also accelerated their pace of going abroad. Their destination is Europe.

NIO has developed the “Marco Polo plan,” while the XPeng G3 starts delivery in Norway.

Europe, the birthplace of traditional automobile industry, is currently experiencing the most interesting changes in the past century.# 2020 上半年,欧洲在全球新能源市场中的占比超过中国,其内部新能源份额超过 10%,同时政府补贴毫无褪去的意思,好大一块蛋糕。

Without surprise, the new players will become the first force of mature Chinese brands to form competitiveness in overseas automobile markets.

Tesla will also see that the “Three Kingdoms fight against Lu Bu” will be more than just a Chinese story.

For the “well-known brands” in the old brands, the visit of Chinese intelligent electric vehicles to their lair may be caught off guard.

In 2020, many people said that the first half was over and the second half was about to begin. I think it is more appropriate to describe the end of the first quarter. There are still three quarters to play, and the accumulation is getting richer and the plot is getting more intense.

I remember that when Professor Yi Zhongtian talked about the four stages of the Battle of Guandu: confrontation, confrontation, turning point, and victory, from this point of view, it seems that everyone has just received tickets and the confrontation has not yet begun.

2020 has laid a few tones:

-

Intelligent electric vehicles: officially start the transformation of the entire chain of the automobile industry, move trees to die and people to live.

-

Cars: New products have driven the change from policy to market-driven demand, and have reached the ramp.

-

Electric: The cost of new energy vehicles is approaching that of fuel vehicles, and charging benefits are the last puzzle piece.

-

Intelligent: The autonomous driving technology is gradually becoming similar and integration is the core competitiveness (for further understanding in this area, it is recommended to go to 42 Mark and watch several more videos).

In 2021, the second quarter of the game began.

Among these “tones”, the first one is that organizations that are not prepared for change will face the harshest cleaning; the second one is that products that are disconnected from demand cannot enjoy policy dividends; and the third one is that the players who solve the charging problem will lead.

Based on these fuzzy, macro-level judgments, we will set some Flags for 2021:

-

Real change is a change in organization, efficiency, connection, and relationship. In 2021, brands that only have “consumers” and not “users” will no longer have a chance to enter the smart electric vehicle track.

-

In 2021, the way products are subdivided will change, especially for new energy products. The size will be weakened, and the scenario-based market segmentation based on price will become more obvious. The top products of different scenarios will also emerge in 2021.

-

In 2021, pure electric brands without self-built or self-managed charging networks are anxious like their products every day, and different hybrid technology routes will gradually become similar in 2021- oil-electric balance.

-

Although Tesla’s FSD in China in 2021 has no Beta in the United States, it still leads the way in full-scene experience. The total sales volume of vehicles with L2 and above function packages in the entire Chinese market in 2021 will double.

These Flags are not meticulous analysis, but just like a year like 2020, it has come to an end, and I can’t help but be anxious to let it pass and look forward.No matter how the epidemic and international situation are…

In the Chinese market of intelligent electric vehicles in 2020, we have seen almost all beautiful hopes and tomorrows.

Therefore, I wish the intelligent electric vehicles a happy New Year, and let’s get ready to start the second quarter.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.