Introduction

Yesterday, on the first day of 2021, Tesla announced the official release of the China-made Model Y, following the incredibly unrealistic pre-sale price. This time, the pricing is more reasonable: the starting price for the Model Y Long Range version is 339,900 yuan, a price reduction of 148,100 yuan from the previously advertised pre-sale price, and the starting price for the Performance version is 369,900 yuan, also reducing 165,100 yuan.

At the same time, the China-made Model 3 was also adjusted with the Long Range Model 3 being taken offline, and the price of the Performance version dropping from 419,000 yuan to 339,900 yuan. The update also included locally updated interior parts.

My initial thoughts in light of these changes are as follows:

1) Initially, I heard that Tesla defined a weekly capacity of 5,000 for Model 3 and 15,000 for Model Y, which means a total weekly production capacity of 20,000. Model Y will strive for higher production targets.

2) Judging from the trend of the continuous price reduction of the Model 3, which went from import to domestically produced long range and standard range, it is inevitable that Tesla will continue to pressure both Model 3 and Model Y with its aggressive price strategy. Judging from Tesla’s impact on the domestic A ~ A+ level pure electric car market last year, the pressure on pure electric SUVs in 2021 is high. Given that the price difference between Model Y and Model 3 in overseas markets is only 6%-9%, the American market has already shown that the quantity of Model Y exceeded Model 3 in the pure electric SUV market. Model Y has strong competitiveness in this market.

3) The news of 100,000 orders in two days indicates the objectively existing demand for private consumption of electric vehicles in cities with purchase restrictions. High-quality products can continue to emerge from this demand.

Model Y Price

Tesla has always kept its pre-sale prices high in accordance with its usual approach. The pre-sale price of the Model Y, starting in August last year, was 488,000 yuan for the Long Range version and 535,000 yuan for the Performance version. This approach is consistent with the one of Model 3, which saw a pre-sale price of 328,000 yuan in 2019 and was reduced to less than 250,000 yuan. However, the price reduction of the Model Y is even higher. The table below shows this expected pattern.1) Tesla is currently promoting the long-range version of the Model Y, in order to make room for a 600 km product for the Model Y, they even stopped the production of the long-range Model 3, allowing users to switch to the domestically produced performance version of the Model 3. We can see that the price in Q1 2021 has remained stable.

2) According to the initial Model Y production curve, after this wave of 100,000 orders is gradually consumed in 3-5 months (I understand that this stage is all using LG’s ternary version), the LFP standard range version (CATL’s version) based on LFP will be released with a price of around 250-260,000 RMB. At that time, the standard range for the Model 3 will be around 230,000 RMB, which will create another wave of demand, this is the second stage Q2-Q3. By the time Q4 comes around, capacity will be fully ramped up, and the final pricing for 2021, the long-range version will be within 300,000 RMB, around 280,000 RMB without subsidies; the Model 3 will drop to 210-220,000 RMB and the Model Y will be around 230-240,000 RMB, if it needs to be scaled up to nearly 500,000 units.

Impact on other vehicles

For new energy products, the pricing of the Model Y has the greatest impact on Nidec ES6. Although Nidec ES6 is slightly larger, the range is similar, and the price is higher. Of course, Nidec plans to produce 100,000 units in 2021, resulting in significant pressure after direct competition from similar products due to the service system.

For joint ventures, iX3 and EQC, which are neither high nor low, are particularly affected. They also have a significant impact on the pure electric SUV of Volkswagen ID4, because the standard range of the Model Y may directly hit 250-260,000 RMB. For most domestic pure electric SUVs, 2021 is also a challenged area because a lot of demand is absorbed when looking up.

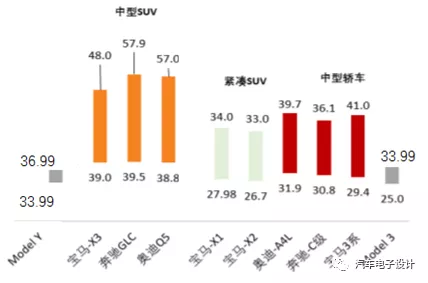

Looking at the impact on traditional fuel vehicles, in restricted areas such as Beijing, Shanghai, Guangzhou, Shenzhen, and Hangzhou, the first wave of demand will certainly come from this, and currently, the pricing of BBA’s compact and mid-size SUVs will face long-term challenges. Tesla’s biggest contribution is actually slowly eroding the pricing advantage of luxury brands. The prices of these high volume products cannot be maintained, and the pressure on BBA is very high. Their own BEV products conflict with these products, and with Tesla’s impact, it will be very difficult for them to compete.

Summary

In 2021, the order expectations of battery companies from various OEMs are generally high. However, with the arrival of this wave of price cuts, many products thrown into the market are simply not competitive. A large number of planned production capacity and planned quantities are impossible to realize, especially under the pressure of price reductions for star products, which directly impact the psychological impact on consumers.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.