The various analyses on Tesla’s data in the current articles are quite detailed, but it is tough to make judgments on the future of a company by simply looking at data. Here, we take a different approach, starting from the traits of the founder, to look at Tesla’s corporate culture, followed by Tesla’s products and the company’s impact on the industry.

We choose to discuss the founder first, because the founder is essential to a company. If Jobs hadn’t returned to Apple, there would be no Apple as we know it today. From a mystical point of view, it is precisely because the founder believes in the project that the world’s energy can be gathered towards the company.

Elon Musk

Some Tesla enthusiasts often compare Tesla to Apple to illustrate its disruptive nature. This is mainly because Apple pioneered the revolution in smartphones, while Tesla seems to be initiating a revolution in electric vehicles. However, although both are American companies, technology companies that stay ahead of a huge market, the culture of the two companies is starkly different. This is because the founders of the two companies have different styles.

(Jobs holding an iPhone 4 at the conference)

Apple has a founder, Steve Jobs, who values industrial design, is perfectionist, and has a strong insight into users.

Most of the products launched by Jobs, such as graphical user interface for computers, Mac, mouse, iPod, and iPhone, were already present in the market before their launch. He took existing technologies and, through super powerful industrial design, turned them into products with excellent user experience and pushed them to the market.

Even after Jobs’ death, Apple’s team was still “troubled” by his values and launched a series of popular products in various categories, such as the iPad, Apple Watch, and AirPods.

This culture of products that must be nearly perfect before launching to the market, has resulted in the fact that even objectively experienced products, excluding the brand factor, no competitors in the market can reach the quality of Apple.

It is precisely because the quality of competing products has always been more or less lower, that Apple’s products have always had the highest price among the similar competitors in the market, allowing Apple’s hardware products to maintain high profit margins.

Therefore, in the beginning, most of Apple’s profits came from these hardware products with outstanding quality. Later, services like App Store, iCloud, and Apple Care developed.

(SpaceX launches a Roadster into space for real photography)

Elon Musk, the founder of Tesla, is an engineering geek who is extremely obsessed with technology and space exploration.From Tesla、SpaceX、Neuralink, there is a similar characteristic of introducing an imperfect product and then gradually improving it through iteration.

Firstly, this is completely different from the perfectionism philosophy of Apple products. For example, Elon Musk’s earliest release of Roadster and Model S were introduced when various technologies were immature, and they did not become explosive products in the market.

Later on, Model X, Model 3, and Model Y were introduced with slightly more mature technology, and each of them was an imperfect product with rough quality, far from the kind of quality that can beat the market competing products like Apple products.

On the contrary, Tesla’s quality may be even worse than its peers.

But why did Model 3 and Y achieve staged success and become explosive products in the market?

(The production line and painting line of Tesla Model 3)

The route Tesla products took to become explosive products is completely different from that of Apple products.

Apple sells products with perfect customer needs, high-quality industrial artwork, and high premiums.

Tesla sells products with advanced autonomous driving technology, highly engineered mass production, and low prices.

This means that Apple rejects competitors through craftsmanship and quality, while Tesla uses technology and scale to reject competitors.

But one thing Apple and Tesla have in common is their persistence in integrating hardware and software, and their ecosystems are very closed.

Because their founders believe in one thing – companies that truly want to do good software must do their own hardware.

The meaning behind this is that hardware builds the stage while software acts is the core. Software-formed barriers are difficult to cross, and software can generate network effects, which means that products in the same software ecosystem can further improve the user experience through seamless integration of functions, etc.

For example, iPhone can be paired with MacBook, Apple Watch, iPad, etc., and users can achieve seamless transitions and functions with these devices.

The devil is in the details, and only by experiencing it firsthand can you realize it.

If smartphones must integrate hardware and software to achieve the ultimate experience, then how can smart cars or autonomous driving cars, as the crowning achievements of human engineering, achieve the ultimate experience through software and hardware separation?Like Apple, Tesla has adopted a closed ecosystem by implementing integrated hardware and software.

Tesla is the only automaker in the market that has achieved an integrated hardware and software system.

(Tesla’s Model 3 is the core product that has realized the super price)

The two distinct roadmaps have resulted in completely different pricing models. Apple’s model focuses on perfect user experience, creating products with high quality and value, and generating significant profits for upstream supply chains with reasonable margins. In contrast, Tesla’s model is centered on advanced autonomous driving technologies, highly engineered mass production, and low-cost, leaving limited margin for upstream suppliers. In order to maintain low costs, they must reduce expenses in every aspect possible.

Thus, Elon Musk is meticulous about cost control. Tesla must construct its own super factories, purchase directly from Tier 2 suppliers, and even build its own super battery factory, which accounts for a significant portion of the cost of electric cars.

All cost-cutting measures are reflected back to the market, gradually resulting in the production of super-price products.

Therefore, Apple products are never discounted, while Tesla’s products are frequently discounted, highlighting a direct result of the pricing model.

Hardware profit is often one-time, primarily derived from user purchases. On the other hand, software and service profit are long-term and annual, mainly derived from the subscriptions of all stock users who have purchased hardware. Therefore, software and service income is of higher quality revenue.

According to the latest Apple 2020 Q3 financial report, the composition of gross profit margin is about 31% for hardware products and about 65% for software and services.

If Apple maintains high prices with its usual high quality hardware, it will also create significant software and service income gains from their immense user base. These support Apple’s high gross profit margin.

So, where does Tesla’s gross profit for its super-price products come from? The answer is evident: future software or services.

(Autonomous driving software and service diagram)

Tesla’s hardware – cars – maintains the industry average gross margin of approximately 20%, while high-margin software or service, such as FSD software and supercharging network, can have a gross margin of up to 90% and 60%, respectively.

To some extent, Tesla relies more on software to increase profit margins compared to Apple.And in fact, the unit price of Tesla software is indeed much higher than Apple’s, for example: FSD subscription price is 100 USD/month, while iCloud subscription price is 10 USD/month.

Apple’s software and services mainly have two modes of purchase: one-time purchase of apps or subscription of apps and iCloud, Apple Care. The revenue of both modes is constantly increasing as more and more people buy iPhones and Macs.

For example: I subscribe to Ulysses and Office 365, as well as iCloud services, and haven’t spent any money on other software.

The software and services of Tesla are also similar: one-time purchase of FSD, various function upgrades (such as zero-to-60 acceleration, seat heating, etc.), or subscription of FSD, monthly data service package (charged in the US, not yet in China), and insurance. For example: I bought a one-time EAP, which is a cheaper enhanced version of assisted driving, with fewer features than FSD, and haven’t spent any money on other software.

Such comparison reveals that, like Apple, Tesla should hope to generate software and service revenue with a huge hardware base in the future.

Is it possible for the automotive industry to achieve high profit margins by pursuing ultimate hardware? In my opinion, it is almost impossible for automotive hardware to outperform the market by a large margin in terms of technology and quality.

Also, the cost of doing so is not comparable to producing an ultimate iPhone or ultimate AirPods, and applying those costs to retail prices will prevent Tesla from achieving super sales figures, resulting in an inability to generate software and service revenue based on a large stock of users.

Moreover, Tesla has no advantage in this regard, and traditional automotive companies are better suited for this approach, which contradicts Elon Musk’s personality traits. Why fight a losing battle and not play to one’s strengths?

Therefore, Tesla cannot follow Apple’s path of creating hit products, so Tesla has chosen a different approach: imperfection. Tesla is using advanced self-driving technology to lead the way, and relying on extraordinary engineering capabilities to lay the foundation, creating a super-advanced technology product at a super price point.

Steve Jobs, a perfectionist and a great user needs advocate, brought out the Apple team and products, which constantly confirmed the characteristics of the founder.

Elon Musk, an engineer and geek with extraordinary engineering capabilities, brought out the Tesla team and products, also reminding us that Tesla is a non-conformist company with a culture full of out-of-the-box thinking.

Apple and Tesla are so different, but seem to have reached the same destination.

Super Price

If Tesla is pursuing the path of advanced technology at a super price, two questions need to be answered: first, does this path have a chance to defeat the huge traditional automotive giants? Second, can Tesla achieve super prices?Buffett once said when evaluating Tesla’s high valuation that he didn’t think Tesla would necessarily succeed.

The original idea was that traditional car companies have many resources, such as cash and production capacity. And the long replacement cycle of cars, which lasts 6-8 years, means that traditional car companies have enough time to adjust their strategies and turn around. Even with an advantage, it’s difficult to quickly achieve a certain penetration rate.

What is the impact of replacement cycles on product competition patterns?

We often use the transformation of smartphones as an example. People make a decision to purchase a new smartphone every 2 years.

When someone starts using a smartphone, people around them will want to switch phones after seeing the advantages of a smartphone experience, but these people have to wait until the next replacement cycle to switch.

Through 3-4 replacement cycles and rapid penetration, the full penetration of smartphones can be completed within 6-8 years.

This is similar to our experience.

For example, the iPhone started becoming popular in China with the iPhone 5, from the first generation iPhone released in 2008, to iPhone 3G, iPhone 3GS, iPhone 4, iPhone 4S, released every year, until 2016, when smartphones became dominant.

It was the short replacement cycle of phones that accelerated the penetration of smartphones within less than 10 years, which made it impossible for Nokia and Motorola to recover. So, you have to fight a lightning war in the smartphone market, but you can only fight a prolonged war in the car market.

This logic makes sense. But it is not unbeatable.

Tesla has an implicit secret weapon, which is super pricing. Super pricing means achieving the ultimate in pricing while maintaining an excellent level of user experience.

Achieving either one of these is relatively easy, but achieving both at the same time is very difficult.

Tesla’s super pricing makes it difficult for traditional car companies to enter this market. Why is that? From the perspective of timing, geographical advantage, and human resources, I think it is more appropriate to discuss this. Real things are extremely complex, and things are intertwined. Making a car is not just about making a car.

Let’s first look at the revenue of the best traditional car company, Toyota. In 2019, it was about 280 billion US dollars, selling nearly 10 million cars.

The gross profit margin has remained around 20%, and the net profit margin has remained around 8% in 2019. However, in the past year, due to economic recession and the COVID-19 pandemic, its net profit margin has fallen to about 6%.

This financial situation supports Toyota’s current market value of about 200 billion US dollars.

(One of Toyota’s best-selling models, the Corolla, undergoing a facelift)Assuming that Toyota decides to develop a pure electric platform to create a product with excellent user experience while achieving an ultimate price point.

This decision involves resource investment, such as: the pre-investment of funding for the development of pure electric vehicle models, which is just a transfer from the budget of other traditional fuel vehicles which are also under development; furthermore, the production cost of electric vehicles is higher than that of traditional fuel vehicles because of the high cost of batteries, which may result in lower gross margins per vehicle than traditional vehicles; there are also fixed asset expenses involved in building and maintaining a charging network, which means increased capital expenditures.

Therefore, it is highly likely that in order to sell an electric vehicle with a super price point, Toyota could face a decrease in gross margins per vehicle and an increase in capital expenditures, which combined, would result in a further decline in net profit margins.

The capital market may likely give Toyota a lower valuation based on the new profit margin level, and shareholders’ interests could be damaged, leading to the cessation of innovation. Therefore, manufacturing a car is not as simple as just producing a car, as there are many interests at play.

If a founder of a company lacks a clear vision of the future, or there is no strong control over the enterprise, then most great ideas will face many obstacles, such as young Steve Jobs being fired from the company that he founded. This is the complex reality of the world.

It can be imagined that the resistance that Toyota will encounter during its transition will be much higher than that of Tesla. Sometimes, the advantages in one field can be a hindrance in a new field. It is better to have no baggage and to be unencumbered. For every step that Tesla takes, the market helps to imagine and visualize that entire path.

Therefore, market valuation is not entirely rational, as it contains high expectations for Tesla.

Returning to the essence of the product line, how can Tesla achieve its super price point?

(1) By leveraging Tesla’s strong engineering capabilities, the layout and machinery of its factories are tailored to suit the production of Tesla. Tesla has sold more than 1 million cars to date, with a total of 4 models, and there is a trend towards concentrating on two models, the Model 3 and the Y, which account for more than 70% of total sales. Therefore, Tesla has designed many machines specifically for producing these cars, and each factory is a factory built for the product, which means “Gigafactory as a product.” This allows the production process to be fully integrated with the design of the cars, leading to optimized production costs for specific vehicles.First and foremost, reducing the number of components and simplifying assembly processes is key. This can be achieved through simplified product design, modular integration in vehicle design, simplified wiring harnesses, and simplified interiors. Additionally, simplifying production assembly processes can also be achieved, for example, with the Model Y’s integrated die-casting machine, reducing the number of body parts from 70 to just 2. Furthermore, increasing the interchangeability of parts between different product lines can further reduce the variety and types of parts required, as well as increase bargaining power in procurement negotiations. For example, Model 3 and Model Y, despite being different product lines, have a parts commonality rate of over 70%. This may also enable the sharing of some production lines for easy adjustment of production capacity in response to market demand. These innovations all make vehicles more adaptable to large-scale production while quickly reducing manufacturing costs.

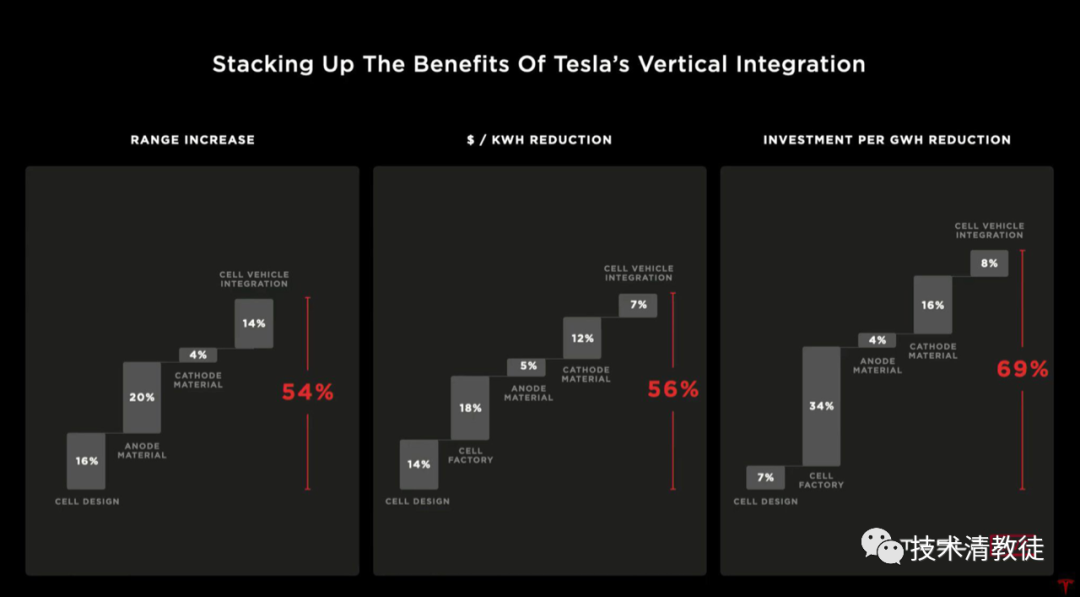

(2) Significantly reduce the cost of core components that make up a high percentage of total costs by developing proprietary components. For example, Elon Musk once disassembled the cost of batteries and believed that the final cost should be the sum of all the materials that make up the battery, or $56/KWH, whereas the current cost is $140/KWH. So how does Tesla achieve this cost reduction? Tesla’s Battery Day in September provided an answer: through cost optimization in various areas such as battery materials, battery design, battery production, and vehicle design, it is expected to reduce battery costs by approximately 56% from current levels.

(3) By integrating the production and distribution system and removing intermediaries. Traditional automobile companies adopt a dealership model in which dealerships make money by competing with customers as well as with the car company for profits. Therefore, there are many opaque areas in the traditional car dealership, and car purchases often involve bargaining and tricks. A while back, there was a Pinduoduo incident involving Tesla, which showed that Tesla was determined to eliminate any form of middleman participation in customer purchases. By sticking to a direct sales model, Tesla eliminates all intermediate profits.

Tesla must quickly achieve a certain level of vehicle penetration to lead the new energy revolution. Therefore, Tesla must achieve a super price to continuously lower the threshold for customers to switch cars and shorten the car replacement cycle to accelerate product penetration.Tesla’s ability to command a premium price that traditional car companies find hard to match is built upon a deep foundation of technology accumulation and product design. At its core, Tesla has created engineering and technical barriers to entry by developing key components in-house. Through its system integration design, Tesla has achieved global control of the entire vehicle system from the bottom up. By maximizing the commonality of components between products, Tesla has expanded its advantages, and increased efficiency in the supply chain.

Tesla’s ability to vertically integrate and design for product commonality has created a “depth and versatility” capability matrix, providing a scale advantage in the future competitive landscape. In short, Tesla relies on an extraordinary engineering ability, delving into the component level of vehicle development, to lay the foundation for achieving premium prices.

Superb engineering capability

Tesla’s superb engineering capabilities are attributed to the company’s founder, Elon Musk, who has instilled his philosophy of “thinking from first principles” in his teams.

The first principle is to break everything down to the atomic level and reconsider combining it in a new way. For example, if a battery is made by assembling raw materials, what steps in that process can be streamlined to reduce costs?

Elon Musk even practices what he preaches when it comes to educating his own children. He hired his own preferred teachers to teach a “problem-solving mindset” through “first principles” education at his school. If the next generation is educated according to this principle, he must be deeply ingrained in this methodology.

Musk’s “first principles” approach is similar to Steve Jobs’ idea of “constantly rethinking the common.” Both men prioritize thinking about “why” rather than “what.” One is the perspective of an engineer, and the other of an artist.

Tesla’s strong engineering capabilities make it invest heavily in the hardware development sector. The company develops components that are highly relevant to future core values in-house, or walks down the path to independent research and development based on the solutions provided by suppliers.

Elon Musk said the internal Tesla team operates in a manner similar to small start-up companies, with each team working on a few key core value points that are important for the long-term sales success of the car.

(Recent interface of Tesla’s latest FSD Beta version)(1)

Autonomous driving is a core feature that can bring about a brand new world through long-term evolution. The ultimate achiever in the future can achieve fully autonomous driving, eliminate drivers, significantly increase the time for vehicles to be on the road, and reduce idle vehicles in parking lots, thus greatly reducing the overall social cost of travel. Even if fully autonomous driving cannot be achieved in the short to medium term, it can only be achieved through automatic assisted driving, and in certain situations, humans may need to take over driving. Most drivers can also be liberated from their energy and reduce accident rates in daily driving. This is a strong ability in the process of daily car use and a core part of contributing to user stickiness.

Modules related to autonomous driving, such as sensors and chips, are not subject to large improvements. Tesla has changed the parts that have significant room for improvement from outsourcing to self-developed, such as chips. Starting from early 2019, all Tesla vehicles are equipped with HW 3.0. All chips have been replaced with Tesla’s self-developed FSD chips. The overall calculation power is more than 20 times higher than the previous generation. There are reports that HW 4.0 has completed the design and is beginning production by TSMC, and is expected to be installed in vehicles by Q4 2021. Its calculation power is more than three times higher than HW 3.0. Fully mature sensors such as cameras, millimeter waves, and ultrasonic waves are procured externally.

It is worth mentioning that Tesla’s long-term evolution technology route for autonomous driving is a visual route, which adopts a humanoid model to evolve its own capabilities. There are high requirements for the sensor layout of the vehicle in this plan. The core of machine learning lies in the accumulation of data, which in turn trains deep learning networks to gradually achieve high reliability in statistics. Therefore, the layout of sensors, and even differences in pixels, may have a certain impact on the coherence of data and the generality of network training. Therefore, in my understanding, the reason why Tesla maintains the stability of the sensor plan is because it is an optimal solution obtained through long-term exploration and a responsible plan for the coherence of the training network system.

(2)

Components that help with endurance have a direct impact on the sales of electric vehicles. Users generally first consider whether the endurance can meet their needs, and then consider other functions. Modules related to endurance include motors, power management, and thermal management.

Tesla has been self-developing in the motor system, but the efficiency of motors on the market is basically above 90%, and there is limited room for further improvement.

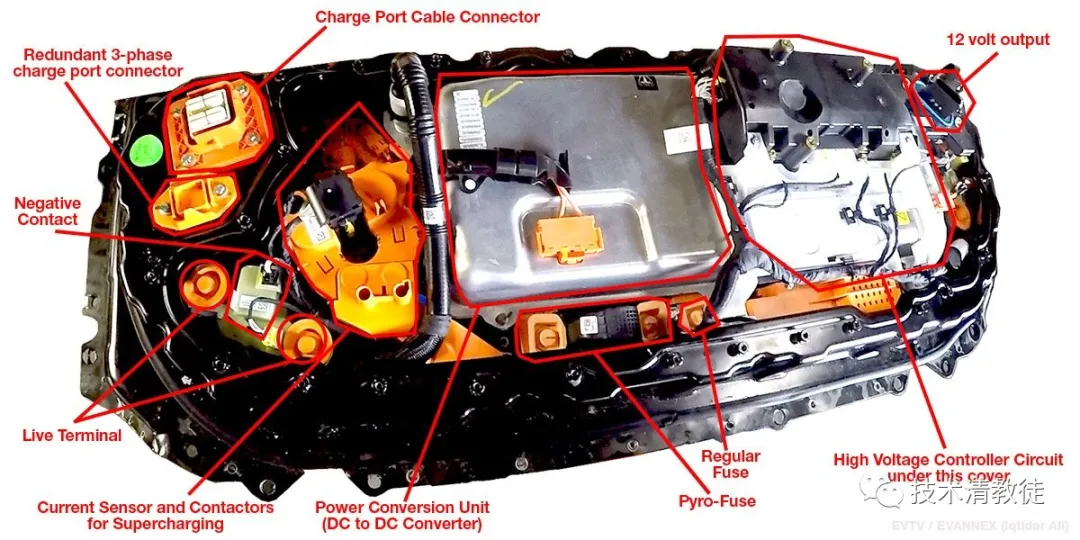

Tesla’s power management system is also self-developed, including self-developed battery charging and discharging management, which is crucial for the long-term lifespan of the battery. If using the battery at maximum capacity damages the battery, then charging and discharging individual battery cells also damages them. Therefore, it is necessary to manage the status of all battery cells and balance the usage of each cell as much as possible to delay the rate of decay.

One of the keys to Tesla’s thermal management system is the self-developed heat pump, which is important because the charging and discharging of electric vehicle batteries have temperature limitations; the batteries need to be heated by electricity in low-temperature environments to reach a stable operating temperature. The heat pump works by collecting the heat energy from the charging and discharging of the battery, the ambient air temperature, and the heat generated by the motor, then distributing it to heat the battery and the cabin, so managing all the heat sources in the vehicle is one of the keys to increasing range. Data shows that the heat pump can save around 10% of electricity, which is a 10% increase in range.

(Tesla’s latest 4680 battery and integrated body layout)

- Battery – In 2020’s “Battery Day”, Tesla unveiled its latest self-developed 4680 battery design. The battery has been engineered to optimize the size, internal structure, and heat dissipation layout. The heat efficiency during charging and discharging has been greatly improved while the number of battery cells and their components has been reduced, which has made battery management easier. The greatly improved battery heat efficiency plays a decisive role in increasing the rate of supercharging and adding durability during high-intensity driving.

First principles played an extremely important role in Tesla’s car-making process. If everyone from the founder to the bottom-level employee deeply believed in this principle and saw themselves as challengers, it would enable the Tesla team to continuously break down conventional wisdom and develop their engineering capabilities.

The openness of the mind leads to liberated ideas, while liberated ideas lead to progress.

Because Tesla’s ecological system is closed and its hardware and software are integrated, it has maximum control over the entire vehicle, which enables Tesla to optimize its autonomous driving system, power system, battery system, thermal management system, cabin system, etc. as a whole.

For example, in order to improve user experience, improving the range of electric vehicles is one of its key goals. One way to achieve this is to increase battery capacity, but it leads to higher vehicle prices, which reduces market demand, and increases vehicle weight, which reduces driving efficiency.And Tesla can also improve energy efficiency by developing a heat pump system that manages environmental, cabin, battery, and motor heat energy, reducing energy consumption for heating and cooling and ultimately improving range.

Another option is to develop a new 4680 battery pack that reduces the weight and cost of battery management system components while using a poleless ear design to reduce heat generated during energy transmission and reconstructing the distribution of battery core heat dissipation to increase heat dissipation area and maximum power output during charging and discharging. This strengthens both the charging capability of supercharging and the heat dissipation capability of electric batteries during high-stress driving situations.

In turn, increasing battery heating efficiency improves range in low-temperature environments.

With the ability to control from system to the ground level, Tesla can achieve multiple goals with one move in many aspects, even numerous moves with one arrow.

For instance, in terms of range optimization, Tesla is making significant efforts to achieve more with less, even lowering costs. Such efforts may all be spurred by high-threshold global optimization design.

This advantage of coordinating overall and partial optimization is perhaps several times greater than optimizing each part individually.

(Structure of traditional automobile industry chain)

However, Tesla’s ability to control the entire vehicle on a global level is not easy to come by because the traditional automobile industry chain involves dozens or even hundreds of companies such as Tier One, Tier Two, and Tier Three as well as thousands of suppliers behind them.

How to gain a voice is the core of Tesla’s real ability.

When Tesla has super engineering capabilities, it has the opportunity to redefine and design everything, which is important for improving user experience and reducing the overall cost of the vehicle. Another even more significant advantage of this super engineering capability is that Tesla can start to vertically integrate upstream suppliers.

Reshaping the Supply Chain

The vast majority of traditional automobile companies’ components come from Tier One mature solutions, including hardware and software that often involve hundreds of individual companies, each with their unique software encoding. The existence is reasonable and all automobile companies follow this model, and there must be an irresistible reason behind it.Fundamentally, the reason for the current situation is that the development of automobiles has taken more than a hundred years, during which time all functions have gradually emerged and matured in the long development process. Large systems such as steering and infotainment systems, and small systems such as electric rearview mirrors, electric seats, and laser headlights. Therefore, all functional modules have separate hardware and matching software. The vast majority of automobile companies require Tier One to provide a software-controlled interface, directly load these functional modules into the next generation of vehicle models, and will not rewrite the internal software code for this function.

When all functions gradually emerge and mature, the software in the car on the market will become more and more cumbersome and complex. Later, even the car company does not know what the software code is in each functional module, let alone rewriting the code. There is an interesting joke that the code in each functional module is like a black box for traditional car companies.

Therefore, after several chief engineers of many automobile companies have seen the software system architecture of Tesla Model 3, some of them candidly admit that their software architecture is indeed several years behind Tesla.

With the accumulation of technology for the past hundred years, Tesla has the opportunity to rethink the control and integration of all components by standing on the shoulders of giants. Moreover, based on the electric platform, the transmission system has been further simplified, and the integration of the entire vehicle’s software and hardware has been further improved, allowing the integration and control of the entire vehicle platform from various functional modules to the transmission system to become possible. It can be said that its degree of integration is armed to the teeth.

Return to the essence and rethink everything.

These capabilities allow Tesla to bring us a super-advanced technological product at a super price.

Perhaps Tesla’s starry sky and the ocean have just begun. And Elon Musk’s starry sky and ocean may not have started yet.

But as long as the direction is right, we are not afraid of distance.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.