Introduction

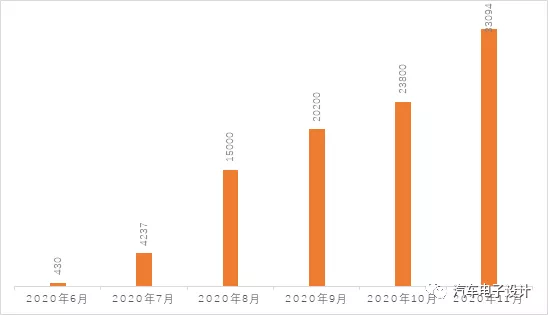

The sales data of Hongguang MINI EV is so impressive that SGMW announced the sales number of November, 33,094 units, which seems to be the first EV in China that can exceed 30,000 units of monthly sales, and according to previous data, this status may be sustainable.

Sales of Hongguang MINI EV

Sales of Wuling

Today, I had a discussion with Brother Moke and Chief Editor Qiu regarding the sales of Wuling MINI EV. In fact, this model is positioned as a legalized replacement for low-speed cars. With the support of Wuling’s production capacity and channel advantages, its sales have been booming. The success of Wuling Hongguang MINI EV can be simply summarized as follows:

1) Absolute affordability: With a price range of RMB 28,800 to 38,800 and a range of 120-170 km, through targeted channels, it solves the problem of legalizing low-speed cars with alternative products.

2) Positioning: Compared with low-speed cars, this is a BEV (a regular car with green license plate and insurance for consumers), which can reduce fuel consumption and earn NEV credits for enterprises. It also enjoys all the benefits of regular new energy vehicles without purchase tax. Compared with normal new energy vehicles, this car has basic demand and Wuling’s cost control ability is unparalleled, especially in terms of the need for getting rid of subsidies, other automakers’ products are not yet ready.

3) In addition, the cute appearance and overall design of the product are sufficient to compete with low-speed cars.

It can be expected that, according to this situation, the sales volume will reach 35,000 in December. In less than half a year this year, sales will exceed 130,000. This speed is really amazing.

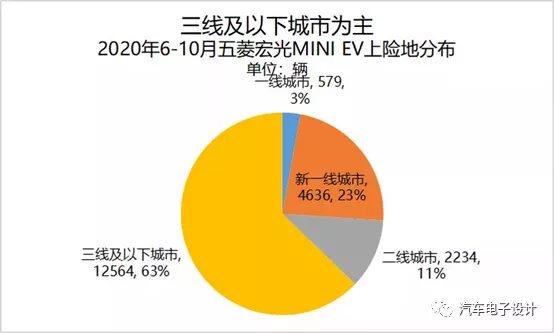

Currently, individual users account for more than 96% of Wuling Hongguang MINI EV’s sales. This means that this product is not based on model innovation, but fully demonstrates its characteristics under the original channel advantages of Wuling. In fact, for Wuling, the previous legendary Wuling Hongguang MPV sold 465,000 units in 2018, about 370,000 units in 2019, and cumulative sales exceeded 197,300 units in the first ten months of 2020 (Wuling Hongguang MINI EV sold more than 100,000 units in just half a year), which objectively reflects the change in demand. The demand for MPVs in third-tier and rural markets has been replaced by personal low-cost transportation tools. Therefore, the demand proportion of second and third-tier cities is close to 74%, which is completely opposite to the overall distribution of new energy vehicle demand this year.The new energy vehicles currently enjoy many policy benefits. With the subsidy, this vehicle has fully utilized the cost control and channel advantages of Wuling. According to its current production capacity layout, SGMW plans to produce 20,000 to 30,000 vehicles per month in the future, and if sales remain at this level, the demand will be very real, with over 300,000 vehicles sold annually, compared with the previously invisible low-speed electric vehicle market of over one million.

Conclusion

Therefore, I believe that in future statistics on new energy vehicles, this vehicle, which is outside the subsidy system, may need to be singled out to reflect the situation of the familiar new energy vehicles more objectively. If a total of 150,000 BEVs are produced every month, this model accounts for 20%.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.