Translation

November was a magical month for the three new car-making giants, NIO, Li Auto, and XPeng, listed on the US stock market. Since the end of October, the stock prices of the three companies have soared nearly 100%, and their market values have squeezed into the top 20 of the global car company market values. NIO, the leader of the three giants, even temporarily became one of the top 5 car companies in the global market value ranking.

What have these three companies, which have only been established for 5 years, done? And what do they want to do? What makes them so promising for the capital market?

Coincidentally, these three companies released their financial reports, revealing more information. After comparing the financial data of the three companies, I also found many interesting things. This time, let’s conduct a financial review of the three companies to see how much money they spent, what they did, and what their future plans are.

Delivery Comparison: Li Auto has the highest single-car delivery rate, and NIO has the highest brand delivery rate

First, let’s take a look at the performance of the three companies in the car market.

During the third quarter of three months, all three car companies have been increasing their delivery volumes at a fast pace. Even the lowest monthly growth rate is 8%, and the highest growth rate has exceeded 30%. However, Li Auto and NIO have the “driest” data.

In the months of July, August, and September, XPeng P7 began large-scale deliveries for the first time, so the delivery volume here is to some extent the release of a backlog of orders, and the volume depends more on the speed of capacity climbing.

Meanwhile, NIO and Li Auto’s data are already a real-time display of order volume, and the growth here is a real increment rather than a release from backlog orders.

In other words, more and more people are recognizing the quality of Li Auto ONE and NIO ES6 and ES8 models over time. As for XPeng, we still need to see the delivery volume in the coming months to verify this.

If we combine the delivery volume of October, we can also draw a conclusion: the delivery volume of Li Auto ONE is still maintaining a very rapid growth rate, and the delivery growth momentum of the NIO brand is also strong. However, XPeng has been somewhat affected by Tesla’s price reduction.

Due to the National Day and Mid-Autumn Festival holiday, the actual delivery days for October were only 17 days, 5 days less than September, and in this case, NIO and Li Auto have both demonstrated their strength by ensuring that the delivery volume continues to rise.

If we break down the data by car model, we can also see the three companies’ product planning and product strength.

NIO

In October, NIO’s delivery volume increased to 5,055 units, a new high. At the same time, October was also the month when EC6 began large-scale deliveries, so the delivery volume in October included the release of backlogged orders for EC6. In the eyes of many people, the decline in delivery volume of ES6 was just a peak production capacity limit of 5,000 units/month, and ES6 had to give some production capacity to EC6.

I do not deny this fact, but I still hold the judgment made when NIO Day EC6 was released last year. Due to the overlap of the positioning of EC6 and ES6, it is inevitable for these two cars to have mutual exclusion, although the total delivery volume of the two cars will continue to increase in a continuously improving market, it is highly probable that the delivery volume would still be at a level where 1+1<2.

Of course, looking back at the “FURY” project (EC6 internal code) with a budget of 150 million RMB at the time, this was also a very cost-effective project for NIO.

Another noteworthy data point is that the monthly delivery volume of ES8 has exceeded 1,000 vehicles for three consecutive months and is still growing, which not only promotes gross margin growth for NIO but also further consolidates its position as a “luxury brand”.

LI Xiang’s Ideal

If we exclude EC6, which just started delivery, and the popular small SUV XPeng G3 that is not a main part of the delivery volume, LI Xiang’s Ideal ONE is the only model with a month-on-month delivery volume growth in October and currently the EV with the highest single-month delivery volume among emerging automakers.

Image source: CICC Research Department

According to statistics from CICC Research Department and official data released by XPeng, as of September this year, Ideal only has 35 stores nationwide, far lower than NIO’s 160 stores and XPeng’s 110 stores.

In other words, despite the disadvantage of Ideal’s product and store quantity, its delivery volume is already on par with the other two players and the trends imply that it is not falling behind.

This is also in line with LI Xiang’s logic in making Ideal ONE a best-seller.

XPeng

Although there were indeed 5 fewer delivery workdays in October, from the brand’s delivery volume perspective, XPeng was the only one with a decrease. However, if we look at individual models, it was only the P7 that observed a decrease in delivery volume.

Clearly, Tesla’s Model 3 price reduction on October 1 had an impact on XPeng, but whereas for Ideal and NIO, who offer mid to large-sized SUVs with distinct differences in positioning from the Model 3, this price reduction did not have a significant impact.# XPeng Motors follows Tesla in P7 product planning

XPeng Motors is following in the footsteps of Tesla in the product planning of the P7. All in on long-range and automatic assisted driving, the model is positioned very close to the Model 3. XPeng hopes to take market share from the Model 3 with advantages in body size, intelligence, and price. Although this learning method can ensure that XPeng will not make fatal mistakes, they will also have to compete with their role model after learning, which puts extremely high demands on the product capability of the P7.

Of course, we cannot yet assert the sustained impact of the Model 3 price reduction on the P7, with only a month of downturn. After all, the market is still in a rapidly expanding era, and there is an opportunity as long as the product capability is strong.

The leaders of the three companies also released their expectations for Q4 after the financial report teleconference.

- NIO: 16,500-17,000 vehicles

- Li Auto: 11,000-12,000 vehicles

- XPeng Motors: 10,000 vehicles

Excluding the already announced October delivery volume, the average delivery volume demand for November and December is as follows:

- NIO: 5,723-5,973 vehicles

- Li Auto: 3,654-4,154 vehicles

- XPeng Motors: 3,480 vehicles

Well, everyone has set higher goals for themselves.

Li ONE has become the car model with the highest monthly delivery volume among new car manufacturers with accurate product positioning and has maintained good growth momentum.

XPeng’s product capability is not weak, but encountering strong rival Model 3 during the start-up phase has inevitably been somewhat passive.

NIO has the most models on sale and the highest overall delivery volume, but the products are relatively homogenized, and the advantage has not reached the crushing level due to the number of models. However, this advantage is gradually expanding.

Li Bin, founder and chairman of NIO, also stated that NIO’s entire supply chain capacity will reach 7,500 vehicles by January next year, which means that NIO is already preparing to deliver more than 20,000 vehicles in the quarter.

This is the current status of the three new car manufacturers in terms of products and delivery volume.

After talking about delivery, let’s examine the financial reports to see the highlights of the financial data under the current delivery status.

Financial Report Data Evaluation: The Comprehensive Gross Margin Turns Positive

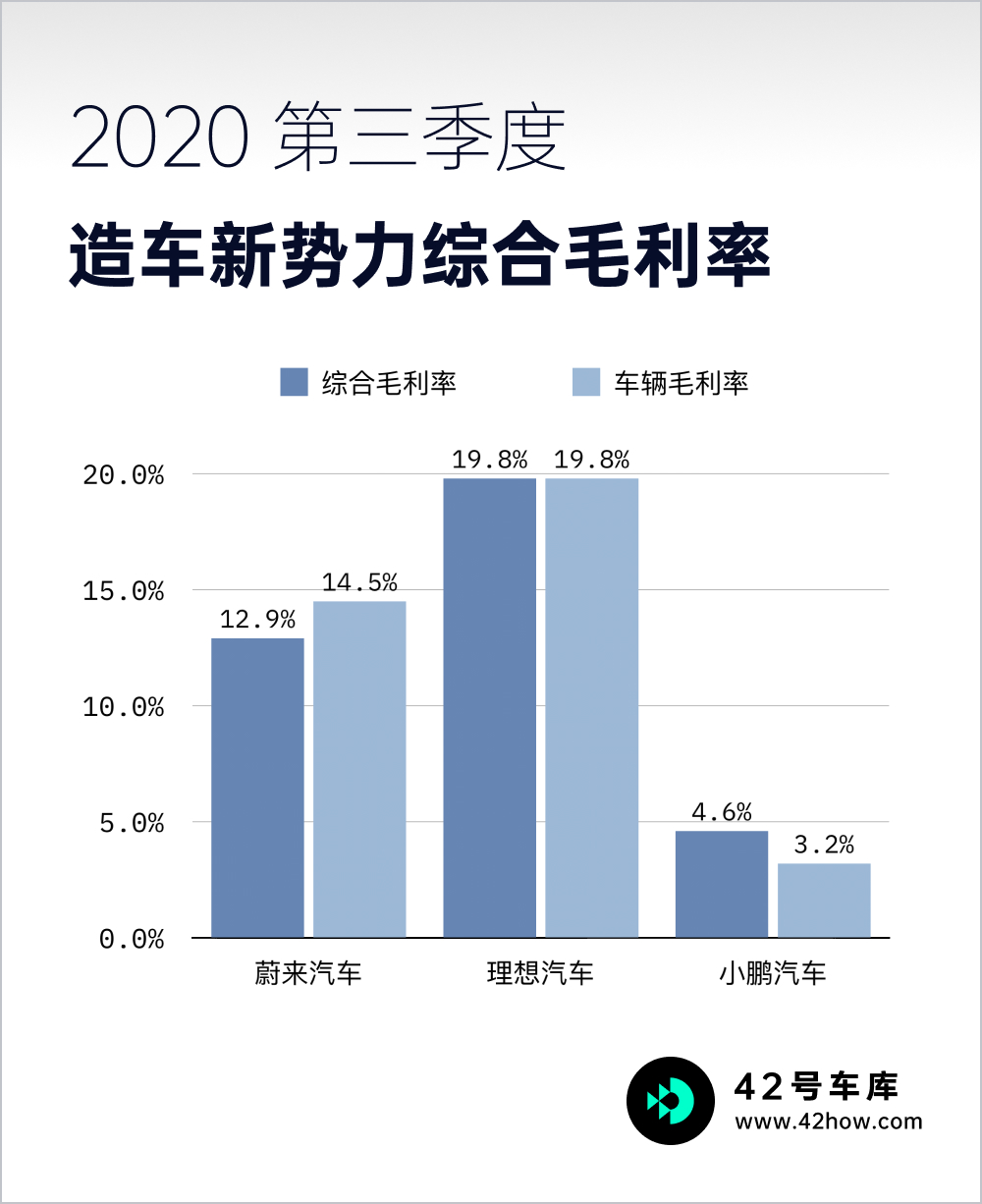

The most impressive number in the financial reports of the three companies is the comprehensive gross margin (in brackets is the vehicle gross margin).

- NIO: 12.9% (14.5%)

- Li Auto: 19.8% (19.8%)

- XPeng Motors: 4.6% (3.2%)

NIO has successfully achieved a double-digit comprehensive gross margin, one quarter earlier than predicted in the Q4 financial report from last year.The ideal gross profit margin of 19.8% is not only the highest among the three new car makers, but also surpasses many traditional car brands. XPeng Motors also achieved a positive gross profit margin.

Both NIO and Ideal mentioned in their financial reports that the improvement in gross profit margin is mainly due to the “reduction in vehicle BOM cost” and “the unit manufacturing cost reduction brought by the increase in production capacity.” As delivery volume rises, the trend is for BOM costs to decrease.

In the post-earnings conference call, Qv Yu, the CFO of NIO, mentioned that the BOM cost of NIO vehicles in the third quarter decreased by RMB 7,000, which was mainly due to the decrease in the cost of battery packs and motors.

Gross profit margin has always been one of the most core parameters in the financial reports of auto companies, and the high or low gross profit margin largely determines the self-generation ability of auto companies. In the Q4 2019 conference call earlier this year, Li Bin said that “improving gross profit margin is one of NIO’s core goals in 2020. NIO is confident in achieving positive gross profit margin in the second quarter and reaching a double-digit gross profit margin goal by the end of the year.” Obviously, NIO not only achieved it, but also completed the task one quarter ahead of schedule.

Similarly, Ideal also values gross profit margin. In Q2, with a delivery volume of only 6,604 vehicles, Ideal achieved a vehicle gross profit of 13.7% and a comprehensive gross profit of 13.3%. After the delivery volume in Q3 climbed to 8,660 vehicles, Ideal’s vehicle and comprehensive gross margins reached 19.8% directly.

In the case where the delivery volume is not particularly advantageous compared to other automakers, being able to achieve such an amazing gross profit means that Ideal not only has strong cost control ability, but also has tasted the sweetness of its product planning advantages.

In the financial report, Ideal also stated that thanks to the company’s plan of only having one configuration for each model, the company can be particularly efficient in software iteration and development, supply chain, and internal efficiency.

Here, we introduce another data as evidence. In Q3 2020, Ideal’s sales and general administrative expenses were RMB 342 million, corresponding to a delivery volume of 8,660 vehicles. That is to say, for Ideal, the sales and general administrative expenses per vehicle is RMB 39,500. During the same period, NIO and XPeng were RMB 77,000 and RMB 140,300 respectively.You don’t need to be too surprised about XPeng’s data. As for Q2 and Q3, which are the time points when P7 was just launched and released, market promotion and publicity are definitely indispensable. Although the efficiency of spending money cannot be compared with the ideal, the single-car sales of 85.99 million and general management expenses when ES8 was just launched in 2018Q3 are still much lower than that.

Next, let’s take a look at vehicle sales revenue.

- NIO: CNY 4.267 billion

- IDEAL: CNY 2.465 billion

- Xpeng: CNY1.898 billion

Combining with the delivery volume, the average revenue per car for the three companies is as follows:

- NIO: CNY 3.496 million

- IDEAL: CNY 2.846 million

- Xpeng: CNY 2.213 million

After adding 13% VAT, NIO’s average transaction price is close to 4 million, IDEAL is over 3 million, and Xpeng is over 2.5 million. For self-brands with a generally lower transaction price of less than 200,000 yuan at the time of the transformation of new forces in electrification and intelligence, they not only overtaken the curve, but also completed the upward transformation of their brand.

The more crucial point is that NIO, IDEAL, and Xpeng each hold a cash reserve of nearly CNY 20 billion, so after the first step is stable, everyone should work hard on the second step.

The planning that follows is also the reason why the three giants are favored by the capital.

Horizontal evaluation of long-term planning: focusing on autonomous driving together

Regarding the planning that follows, the financial reports and conference calls of the three car companies have more or less mentioned some of them. Let’s summarize them according to the brand first.

NIO

NIO plans to release a car based on NT 2.0 at this year’s NIO Day. At the same time, Li Bin emphasized in the conference call that the core of NT 2.0 is the industry-leading mass-produced autonomous driving system.

Li Bin did not reveal which chip NT 2.0 will use. He hopes to announce more detailed information at NIO Day, but it can be guaranteed that this is the industry’s most advanced solution, and we can also maintain the lead in the next few years.

At the same time, Li Bin highly recognizes the value of LiDAR and believes that LiDAR is a very meaningful supplement from a technological perspective.

IDEAL

In the conference call, IDEAL stated that its autonomous driving team will triple in size by the first half of 2021. IDEAL has integrated its own software algorithm into the Nvidia platform for road testing and has achieved good results.In 2022, Ideal will launch a brand-new vehicle architecture that can gradually achieve L4 level autonomous driving by upgrading ECU and hardware sensors.

XPeng

Although XPeng did not reveal too much about its future development plans in the financial report and conference call, its Intelligent Day on October 24 actually revealed XPeng’s plan for autonomous driving in the future.

At the upcoming 2020 Guangzhou Auto Show, XPeng will also share its understanding and thinking on the next-generation autonomous driving software and hardware system.

Overall, all three are betting on the field of “autonomous driving”.

In terms of batteries, the actions of the three companies are still fully cooperating with and utilizing supplier resources.

NIO and CATL have just teamed up to create a 100 kWh CTP battery. He XPeng said in a conference call, “Now battery manufacturers are preparing for capacity and entering another arms race again. I am more confident about medium and long-term batteries for a period of time.” Li Xiang also stated in the conference call that after the 400 kW fast charging technology industry matures, Ideal will launch a pure electric vehicle. However, at present, large SUVs and MPVs have a very big advantage in using range-extending technology.

Since everyone is all in the field of autonomous driving, let’s take a look at what these three companies have done.

At present, the hardware for Ideal ONE’s assisted driving is the simplest, although it is not a big problem to achieve basic L2 assisted driving, the development of its functions in the future is also more restricted.

Although NIO has relatively rich hardware and launched the NOP navigation assistance based on high-precision maps in September, the bottleneck of Mobileye EyeQ4 perception chip on computing power also determines that it cannot achieve higher-level assisted driving.

XPeng is taking a more advanced step, P7 is equipped with the highest available computing power of NVIDIA Xavier autonomous driving chip, and is equipped with extremely rich perception hardware.

If this is XPeng’s first step in autonomous driving, then this step has already left the other two far behind.

In order not to fall behind in the next stage, Ideal has hired Wang Kai, former chief architect of Wei Si Tong, as the company’s CTO, who is responsible for the research and development and mass production of intelligent automobile related technologies, including electronic and electrical architecture, intelligent cabin, autonomous driving, platform development and Li OS real-time operating system.In September of this year, NIO announced a strategic partnership with NVIDIA and Desay SV to use NVIDIA Orin autonomous driving chips in its upcoming full-size SUV.

NIO has elevated the importance of autonomous driving to a new level. In August 2020, it hired former Momenta R&D director, Ren Shaoqing, and raised $1.7 billion through stock issuance for autonomous driving related technology research and development.

Although Li Bin has not revealed what chip the NT 2.0 platform will use, there are not many choices available to maintain NIO’s leadership in the next few years. The competition will undoubtedly be fierce.

In 2020, the automotive industry has faced challenges due to the impact of the pandemic. However, new forces in the car-making industry have achieved breakthroughs in product development, stock prices, and profits through their unique vision and strong products.

Although the three companies have converged in data, they have taken three different development paths. In addition to sales and financial data, these three companies have done many impressive things in brand building, product planning, and existing achievements. Their strategies are worth studying, but due to space constraints, we will have to discuss them next time.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.