-84.8 kWh battery pack, NEDC range of 555 km, MEB electric platform, rear-wheel drive + four-wheel drive, and the distinctive Volkswagen ID.4 made its dazzling debut in China tonight.

However, these are just side dishes.

After the news that the ID.4 post-subsidy price does not exceed RMB 250,000 (approx. USD 38,000), the audience below erupted into cheers. At first, I was excited too, but soon fell into deep thought- RMB 250,000 is exactly the starting price for the Model 3 in the Chinese market.

What’s up with RMB 250,000?

Let me ask you a question, are there any worthwhile electric vehicles on the market between RMB 200,000 and RMB 300,000?

I believe that most of you will quickly say Tesla Model 3, followed by BYD Han EV and XPeng P7.

No problem, so let me add an adjective. Are there any worthwhile pure electric SUVs on the market between RMB 200,000 and RMB 300,000?

In the face of this question, are you hesitating?

And this is ID.4’s goal- to become the first choice for pure electric SUVs in the RMB 200,000 to RMB 300,000 price range.

The Arrival of the Big Boss

Before the arrival of ID.4, let’s take a look at Volkswagen’s pure electric products in China:

-

e-Golf, RMB 147,700 to RMB 168,800 (imported version RMB 240,800)

-

e-Lavida, RMB 148,900

-

e-Bora, RMB 136,800 to RMB 146,800

-

e-Tharu, RMB 194,800

Except for the recent addition of the e-Tharu, all of these products have huge discounts at the terminal. The reason is simple- as “oil-to-electric” models, they are priced higher than the original fuel-powered cars, but the products themselves are actually ordinary.

Naturally, consumers are not keen to pay for such products. Although this phenomenon has been somewhat improved in the hybrid product line, it is still not ideal and the reasons behind it are also different.

But let’s get back to the point, it is reasonable for electric models to be more expensive than their fuel counterparts, within the same manufacturer and same level of vehicles. Actually, this is not a problem. The key is how the price compares to other pure electric competing products.

Compared to the fierce competition of the home-use pure electric sedan market, in China, the market for home-use pure electric SUVs in the RMB 200,000 to RMB 300,000 price range is quite different.

Among the existing products, the comprehensive abilities of most of the traditional brand models are not very good, and most of the leading new forces choose to avoid this price range. Only Guangzhou Automobile Aion LX, BYD Tang EV, ARCFOX αT, Sky ME7, and WM EX6 products are available in this price range.

Let’s take a look at the market performance of these 5 models.The ARCFOX αT has not yet begun delivery, and the sales of the remaining four models in September and the cumulative sales in the first nine months are as follows:

-

GAC Aion LX: 152 units, 2062 units

-

BYD Tang EV: 27 units, 729 units

-

WM EX6: 57 units, 534 units

-

TANK Sky ME7: 6 units, 6 units (delivery starts in September)

The data is already self-explanatory about how poor it is, and the cruel fact also proves that ID.4 hasn’t faced a competitor yet in this range.

What? Why not mention NIO? They are aiming for the luxury market. A brand with an average transaction price of 380,000 yuan has little to do with “home use.”

Moreover, the 250,000 yuan price is the launch price of the first edition of the ID.4 CROZZ from FAW-Volkswagen. According to industry norms, this is most likely the top model in the series. In other words, the starting price of the ID.4 series will be lower than 250,000 yuan, which is almost the same level as the Volkswagen Touareg, a fuel car in the same class. This is quite unconventional for Volkswagen, which has always set high prices.

In the 200,000 to 300,000 yuan range, as a joint venture brand at the top level of national acceptance, if you play the Volkswagen brand card, none of the current competitors can withstand it. The brand power below this range is just a card, and the other card that ID.4 has in its hand is its high product power that can be foreseen.

What can you get for 250,000 yuan?

As the climax ends, let us return to the rational level and take a look at the product level of the ID.4.

Today is a completely “new look” for Volkswagen. From the style of the press conference to the appearance, interior, platform architecture, and electronic and electrical architecture of the ID.4, all have undergone a thorough transformation.

The ID.4 introduced to China today is produced domestically by FAW-Volkswagen and SAIC Volkswagen, and is named ID.4 CROZZ and ID.4 X, respectively.

ID.4 CROZZ

-

Length x Width x Height: 4592 x 1852 x 1629 mm

-

Wheelbase: 2765 mm

-

Curb weight: 2130 kg

-

Battery capacity: 84.8 kWh

-

NEDC range: 555 km

-

Battery pack energy density: 175 Wh/kg

-

Maximum power of the motor: 150 kW- Maximum torque of the motor: 310 N·m

ID.4 X

-

Dimensions: 4612*1852*1640 mm

-

Wheelbase: 2765 mm

-

Curb weight: 2120 kg

-

Battery capacity: 83.4 kWh

-

NEDC range: 555 km

-

Maximum motor power: 150 kW

-

Maximum motor torque: 310 N·m

Although the length and height of the ID.4 X are slightly higher than that of the ID.4 CROZZ by 20 mm and 11 mm respectively, both are built on Volkswagen’s MEB EV platform.

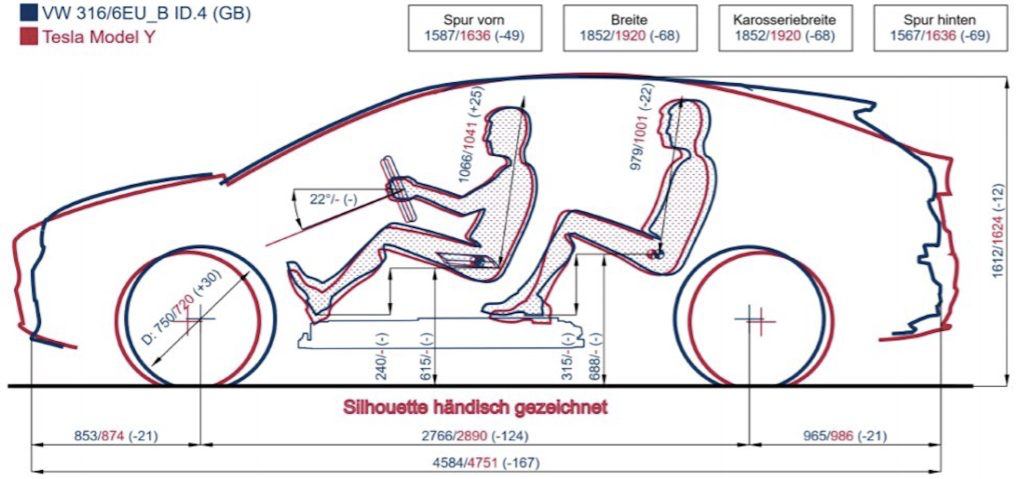

Although the ID.4 is positioned as a compact SUV based on size, according to the comparison chart produced by foreign media, the ID.4’s passenger space is no inferior to that of the mid-size SUV Model Y.

As for range, taking the just-launched ID.4 CROZZ Yueliang special edition as an example, the long-range model is equipped with an 811 battery provided by CATL, with a capacity of 84.8 kWh and a range of 555 km.

Don’t rush to criticize the range as short. In terms of price, the same-class standard-range upgrade Model 3 also sells for around RMB 250,000, but its NEDC range is only 468 km, while the ID.4’s is 555 km.

Looking at the class, with a length of only about 4.6 meters, the ID.4 is a compact SUV, and only it and GAC’s Aion V can deliver a range of over 550 km in this class.

So, isn’t the range of the ID.4 particularly attractive?

Some people believe that the high-end ID.4 selling for RMB 250,000 is a market-grabbing price that compresses profit, as a T1 JV brand SUV with an exclusive EV platform of 84.8 kWh and NEDC range of 550 km selling at this price is really surprising.Behind Volkswagen’s ability to lower the price of ID.4 to 250,000 RMB is the huge output of the MEB platform.

Volkswagen expects to deliver 20,000 ID. models in 2020, 100,000 to 160,000 in 2021, and 600,000 by 2025. This platform scale is unmatched by all other new force automakers.

As a leader in the development of multi-model platform development, Volkswagen is well versed in this field. With this expertise, Volkswagen has achieved both cost and new car development efficiency in the field of fuel vehicles.

Although this is Volkswagen’s first pure electric platform, its investment and level of attention to electrification and MEB are not low.

Not to mention the R&D investment in MEB, Volkswagen has invested 17 billion RMB in its Shanghai MEB factory alone.

On October 31, 2019, at Volkswagen’s MEB launch event, it announced that its supply orders with international leading battery suppliers had reached $40 billion, and planned to reduce battery costs to $100/kWh.

Volkswagen claimed that by 2023, it will launch 8 MEB-based models in China, with 4 each from SAIC and FAW. The global product planning of MEB includes different sizes of cars, coupes, SUVs, MPVs and other models. Volkswagen once again demonstrated its strong modularity and sharing capabilities on the MEB platform.

Under the highly scalable platform, as a veteran enterprise in the global automotive market, Volkswagen’s experience in supply chain and cost control is once again highlighted.

According to the news from the supply chain, the battery cost of ID.4 is currently about 70,000 to 90,000 RMB. Considering that this is a battery with a capacity of up to 84.8 kWh, a battery cost of 90,000 RMB means that Volkswagen has reached a cost parity with gasoline vehicles at around $100/kWh, which is an industry-recognized threshold for electric vehicles.

Of course, solving the range problem is not enough. What has also won praise from consumers for new automakers is the behind-the-scenes energy replenishment system. In this regard, Volkswagen’s target stated at the launch event is to promise that by the end of 2021, every 5 km in 10 key cities will have a cooperative super charging station, which can be reserved via a mobile app.According to the news we received from FAW-Volkswagen, their goal is to popularize 120 kW DC high-power charging stations, which is Volkswagen’s contribution to the entire industry as an old car manufacturer.

The biggest problem restricting the popularity of electric vehicles is currently the convenience of energy replenishment. The quantity and quality of charging stations are far from the level of gas stations. With the entry of Volkswagen and the surge in demand, we hope to drive the progress of the entire industry.

After talking about energy, let’s talk about intelligence.

Volkswagen has also made huge changes in this regard, starting with what we can see.

Regarding the interior, ID.4 uses a 5.3-inch LCD screen as the instrument panel, supplemented by AR-HUD, and the center console is a 10-inch touch screen, equipped with L2 level assisted driving, and supports OTA for the entire vehicle.

Looking at the electronic and electrical architecture level, Volkswagen has integrated the original distributed ECU into ICAS1 comfort driving controller, ICAS2 intelligent driving controller, and ICAS3 entertainment control. Based on the brand new electronic and electrical architecture, in theory, ID.4 can achieve rich functions, but from the currently delivered ID.3 models abroad, there are still a large number of software bugs.

ID.4 has established its position in terms of price, space, and endurance, but how well it performs in intelligence still needs to be verified.

Compete with Tesla? No, they are partners!

After talking about the product information of ID.4, let’s return to the lingering topic at the beginning-the starting price of 250,000 RMB, which is obviously intentional.

This starting price is also the cruelty of ID.4-it seamlessly connects with the Model 3 and becomes a complementary product to the Model 3 from perspectives of model, space, and practicality.

There are already many people around me who have a budget of over 200,000 RMB to buy a family car in a restricted plate city. They finally chose Model 3 after careful consideration.

Model 3 is indeed a good car, but space and practicality are not its strengths. The reason why people still buy Model 3 is also very simple: even if the practicality is insufficient, considering the brand and product power, Model 3 is still the first choice in this segment.

The addition of ID.4 precisely fills this gap, whether it is at the price level or the product level. On the other hand, with the addition of ID.4, Volkswagen and Tesla also form an encirclement of pure electric products priced between 200,000 RMB and 300,000 RMB.

“If you want driving pleasure and a sense of technology, buy Model 3. If you want space and practicality, buy ID.4.”

I believe this will be a sentence that will be frequently heard when buying cars with a budget of over 200,000 RMB in the near future.## After the Giant Went to the Sea

As a top player in the automotive industry, Volkswagen’s giant ship has caused quite a wave since it entered the new energy market.

In September, during the first month of ID.3 deliveries, a staggering 8,571 units were sold in the European market, achieving the third-highest sales in the new energy market, trailing only Renault Zoe and Tesla Model 3. Keep in mind, this is a new car that has just been delivered and is still in its ramp-up phase.

Returning to the Chinese market, what kind of impact will the launch of the ID.4 have on us, along with its enormous and lethal price tag?

From a consumer perspective, this is definitely a positive move. First and foremost, it provides us with yet another household pure electric SUV model that is worth considering, filling the current demand gap. Furthermore, the launch of this powerful product will undoubtedly intensify market competition, promoting the price reduction or upgrading of competitors’ products.

For the industry, Volkswagen’s entry will further drive the development of related industries. According to the group’s plans, the expected sales of North-South Volkswagen MEB models in 2021 will range from 100,000 to 160,000 units. If achieved, this figure will almost equal that of the top three new forces combined in 2020.

At the same time, if Volkswagen’s move in the Chinese market is successful, it will certainly have a template effect on other joint venture brands.

However, for competition, especially independent brands in this segment, the ID.4’s entry comes with more danger than opportunity. The combination of brand, product power and price is a series of lethal moves. If there is no major response, the drama of Volkswagen dominating the gasoline car market may happen again in this segment.

Nonetheless, this does not mean that competitors have no chance at all.

As mentioned earlier, Volkswagen’s “intelligent” feature does not stand out compared to other intelligent electric vehicles in the European market, as there are many shortcomings and bugs in the ID.3 that do not match its futuristic exterior. It remains uncertain how long these issues will last.

Even if competitors surpass ID.4 in intelligence, exterior design, product power, and brand are still ID.4’s strengths. It is not about whether they can fully surpass or compete head-on, but at least they should have a fair fight, right?

All of these analyses and predictions are currently in the “hypothetical mood,” whether Volkswagen in the gasoline car market will continue to be successful in the electric car market. The answer will reveal itself after the ID.4 is released.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.