The shipment of Journey 2 this year is expected to be over 100,000, and the overall shipment for this year is expected to reach 150,000. Next year, it will reach over 500,000 and target 700,000, according to Zhang Yufeng, VP and General Manager of the Horizon Smart Driving Product Line, at the 2020 Beijing International Auto Show media interview.

At the same time, Zhang Yufeng also mentioned that Horizon has more than 50 cooperation projects with OEMs and Tier 1, has signed more than 20 pre-installation projects, and will launch six mass-produced models equipped with Horizon car AI chips in 2020.

For Horizon, these numbers mean that they have achieved a phased victory in the research and commercialization of visual perception algorithms and AI chips. For users, it means that there are more options for vehicles with ADAS advanced driver assistance functions on the market.

To avoid any misunderstandings, before explaining why I believe Horizon has achieved a phased victory, let me first introduce what Horizon does and what it has to do with the cars we buy on the market.

“Horizon = China Mobileye?” can be understood in this way.

On the homepage of the Horizon official website, there are eight characters: “Endless Chips, Empowering Openness.”

First, let’s take a look at the first half of these characters, which is “Endless Chips.”

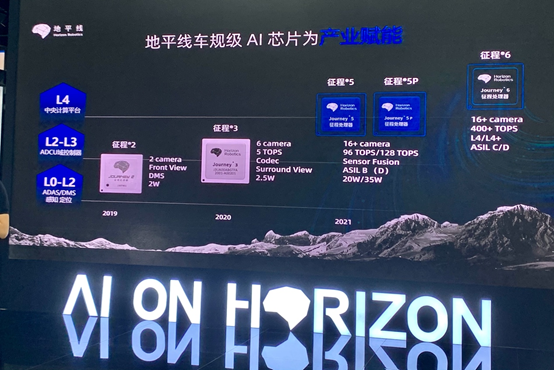

One of Horizon’s core businesses is to provide AI chips and solutions. Currently, there are six chips in the Horizon product line: Journey 2, Journey 3, Journey 5, Sunrise 2, Sunrise 3, and Sunrise 5.

The Sunrise series of products mainly targets AIoT scenarios (AI + IoT) and is not within the scope of today’s discussion. We will focus on the Journey series of chips.

Looking back, 13 months ago at the 2019 World Artificial Intelligence Conference, Horizon officially released the Journey 2 chip with the following core parameters:

- Typical computing power: 4 Tops

- Typical power consumption: 2 W

- Number of connectable cameras: 1 channel

- Chip format: TSMC 28 + nm HPC+The chip is currently in mass production and is mainly responsible for processing image data, supporting two functions: DMS driver monitoring and ADAS visual perception information processing.

As for the visual perception used for ADAS function, we are all familiar with it already. The role of Horizon Journey 2 in this regard is just as famous as Mobileye Eye Q4.

The camera collects image data, and the proprietary algorithm of Horizon can extract traffic participants such as lane lines, signals, cars, and bicycles from the image. These are used as core decision-making information for assisted driving, and the entire image processing process takes place in Horizon Journey 2.

As for the DMS function, the principle is the same as that of the ADAS perception function. The only difference is that the core information that the system needs to extract has changed from lane lines, cars, and bicycles to human faces. After obtaining this facial information, the system can judge whether the driver is making a phone call or yawning.

Currently, the DMS function has been implemented in Changan UNI-T, and the ADAS function will also be officially available after the listing of Chery Ant in late September.

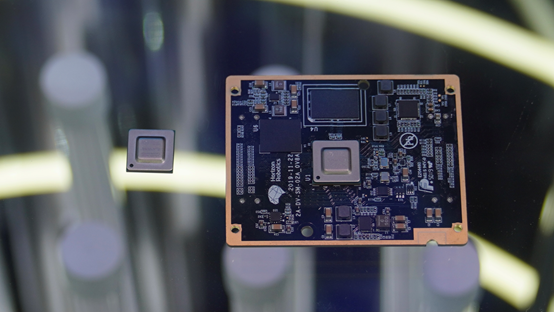

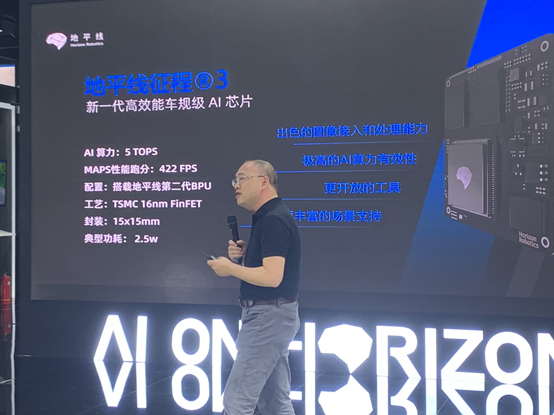

At this year’s Beijing Auto Show, Horizon also officially released the Journey 3 chip, with the following core parameters:

- Typical computing power: 5 Tops

- Typical power consumption: 2.5 W

- Number of connectable cameras: 6 channels

- Chip process: 16nm

Compared with the Journey 2, the computing power parameter has not been significantly improved. However, in the media interview after the release conference, Zhang Yufeng, Vice President of Horizon and General Manager of the Intelligent Driving Production Line, said: “When we talk about computing power, we are referring to the AI acceleration computing power of our BPU, and other computing power is not counted. If we count the general calculation in the SOC, the computing power has actually doubled.”

Another key parameter change is the number of connectable cameras. On the Journey 2 chip, only one channel of camera data can be connected at most, which means that a car can use only one Journey 2 chip to achieve basic L2-level assisted driving at most.

However, on the Journey 3, up to 6 channels of camera data can be connected, and this optimization brings two benefits.

- More functions can be realized.

Six cameras can be one front camera + four surround cameras + one rear camera, or one front camera + four surround cameras + one driver monitoring camera.After integrating four surround-view cameras, the visual perception system can achieve 360-degree perception of the vehicle, providing richer information for a higher level of assisted driving. Moreover, the system enables visual fusion perception automatic parking, which is a significant improvement compared to traditional ultrasonic radar parking from our experience with the XPeng car series.

- Cost reduction.

In traditional L2 level assisted driving models, the front-view cameras and surround-view cameras are separate modules. However, the Horizon 3 chipset integrates the original distributed computing and domain controller into a domain controller. According to Zhang Yufeng’s interview, this integration saves more than 1,000 yuan in cost.

In addition, at the Horizon 3 chipset launch event, Horizon also revealed some information about the Horizon 5 chipset. Compared to the Horizon 2 and Horizon 3, the Horizon 5 has significantly improved computing power, achieving 96 Tops/128 Tops high computing power while only consuming 20W/35W of power. Moreover, it can connect to more than 16 camera information channels.

Open Empowerment

After understanding the first half of the sentence, let’s take a look at the second half, “Open Empowerment”.

In plain English, “Open Empowerment” means “I know how to do this, let me help you do it together.”

As we can see from the above description, Horizon does not directly provide ADAS functions to automakers. Instead, Horizon plays a role in providing computing capabilities and sensing algorithms for the underlying ADAS function. If you compare a complete ADAS function to a computer, Horizon’s role is more like a supplier providing a graphics card and driver.

Although sensing technology is the fundamental ability of autonomous assisted driving, only Tesla and XPeng Automobile have self-developed sensing technology. The majority of manufacturers use supplier solutions.

The mainstream L2 level ADAS solutions are mostly supplier packages or manufacturers finding their own suppliers for sensing, vehicle control, and other areas of integration.

We do not want to judge the strength of an automaker’s autonomous assisted driving based on whether they are self-developed or not. Self-development can undoubtedly give companies more control over their permissions and data, but it also places high demands on their research and development capabilities.

If the professional tasks are left to the professionals to handle, and both parties can cooperate efficiently and closely, it will also be a win-win situation.# Facing the great success of Tesla’s self-developed perception, many automakers have shown unprecedented anxiety. In order to ensure that their products are not bound by the limits of perception, Mobileye and Nvidia’s latest autonomous driving perception chips have become products that everyone is vying to choose.

According to the test results of 42Mark, models that adopt the supplier’s bundled ADAS solutions generally perform weaker.

On the one hand, the models that adopt the bundled solution are relatively cheap, and it is difficult to use good hardware.

On the other hand, the cooperation between the supplier and the automaker is not deep enough, and there is not much optimization for different models. The space for optimization and upgrading in the future is also very limited.

Higher-level automakers hope to control more core technologies themselves. Although Mobileye’s capabilities are strong, they are not friendly to automakers. It is well known that Mobileye’s visual perception data is a black box, and only specific data is output to automakers. Automakers have very limited ability to optimize visual perception.

At this time, the advantage of Horizon Robotics , which enters the market with hardware and algorithms, is gradually emerging.

As a Chinese company, the advantage of localization of Horizon Robotics does not need to be overstated. Let me explain two additional advantages.

- Strong recognition capability and low cost.

Although Journey 2 can only support access to one camera, it is slightly inferior to the three-camera system in terms of quantity. However, in the eyes of Horizon Robotics’ engineers, there is still a lot of space to explore with just one camera.

After we tried the vehicle equipped with Journey 2 chip, we found that the number of recognizable objects of Journey 2 far exceeds the 10-20 thousand models currently available on the market. It can not only recognize conventional vehicles, but also non-standard vehicles such as express delivery tricycles, elderly scooters, traffic lights, and various styles of lane markings.

More importantly, while ensuring the basic capabilities, Horizon Robotics has kept the hardware cost of this equipment below 1000 yuan, reducing the threshold for L2 functions.

- Ability to continue iterative updates.

During our live broadcast with Horizon Robotics, their Director of Intelligent Driving R&D, Yu Yinan, revealed to us that Journey 2 chip currently has the ability to recognize traffic lights and stop lines, and can be upgraded through OTA for already delivered models in the future.

Different from traditional well-known suppliers, Horizon Robotics has a very open attitude towards partners. Not only can we provide software and hardware algorithms, but we can also provide toolchains to accelerate customers’ development and deployment of their own algorithms, and improve their product development efficiency. This indirectly proves the slogan “Enabling Openness” on the Horizon Robotics official website.

Different from traditional well-known suppliers, Horizon Robotics has a very open attitude towards partners. Not only can we provide software and hardware algorithms, but we can also provide toolchains to accelerate customers’ development and deployment of their own algorithms, and improve their product development efficiency. This indirectly proves the slogan “Enabling Openness” on the Horizon Robotics official website.

In this fast-changing environment, this is particularly important.

Regarding ADAS, in addition to providing hardware and algorithms, Horizon Robotics also has the technical ability to crowdsource the construction of high-precision maps. Based on the Journey 3 chip, models not only achieve ADAS functions, but also can use the images captured by the camera to construct high-precision maps. The accuracy of the constructed high-precision maps can reach the sub-meter level and have already been deployed on thousands of buses in Korea.

That is to say, the more vehicles equipped with Journey 3 chips, the faster the construction speed of high-precision maps, the wider the coverage area, and the faster the update speed. These three indicators happen to be the core to measure the “quality” of high-precision maps.

However, Horizon Robotics’ friends also pointed out that they themselves do not construct high-precision maps, nor do they become high-precision map operators. They only focus on technology development and provide this technology to map vendors or vehicle companies in need, which further clarifies their Tier 2 status.

Victory in the stage of domestic AI chips for vehicles

Thanks to the increased emphasis on ADAS by automakers and the progress of the industry chain, the price of ADAS systems has been pushed down, and the functionality has experienced explosive growth in recent years.

Taking the well-known Mobileye as an example, the shipments of their EyeQ series chips were 8.7 million in 2017, 12.4 million in 2018, and reached 17.6 million at the end of 2019, with an annual growth rate exceeding 40%.

From million-level luxury cars to A00-level cars of tens of thousands of yuan, more or less possess certain ADAS capabilities.

In this trend, many players have entered, but Horizon Robotics is one of the few that ran ahead, which is extremely important for the future development.From the chip parameters and the business model of Horizon, it can be seen that Horizon did not take the high-end route and launch short-term products such as super high computational chips or L4 autonomous driving. Instead, it chose to prioritize meeting the largest demand of the current market and relatively more mature L2 market demand, and launched a cost-effective chip that was rapidly commercialized. After the chip shipment volume continued to rise, not only could it reduce the company’s financial pressure, but it could also enter a stage of virtuous cycle.

Conclusion

In the many assisted driving models we tested, most brands used algorithms and hardware provided by Bosch or Mobileye, and few domestic suppliers. However, as assisted driving functions become more and more enriched, the demand for localization is increasing. Consumers need a more understanding of Chinese road conditions and better assisted driving, which also puts higher demands on suppliers of perception systems such as Mobileye and Horizon.

Chinese companies have unique advantages in this regard, and whether Horizon can take advantage of this opportunity remains to be seen after experiencing mass-produced products.

However, the new car industry is a wave, and so is the autonomous driving industry.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.