Introduction

The penetration rate of 48V systems in the Chinese market has always been low, but the situation has changed since 2020. With the implementation of version 2.0 of the “Energy Conservation and New Energy Vehicle Roadmap”, the expectation for the hybridization of traditional vehicles has been raised. This year, the overall trend has shown differentiation. In reality, even with strong subsidies available in Europe, China will not follow such a strategy again. Therefore, the future direction of the automotive industry in China is more practical. The primary way for car companies to implement their strategies is through dual credits. Objectively speaking, the changes in 2020 have had a significant impact on corporate operations. At present, the best solution seems to be to balance out the cost of dual credits by developing low-fuel-consumption hybrid vehicles (including the 48V transition strategy) while simultaneously developing electric vehicles.

2020 Penetration Rate Data for 48V Systems in China

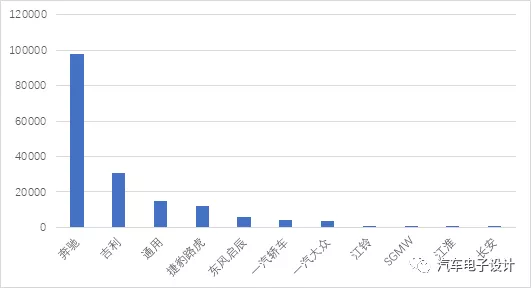

According to two articles by the NE Times, the 48V market in China in 2020 was mainly promoted by European and American automakers, with Mercedes-Benz, General Motors and Jaguar Land Rover being the main players, accounting for 73% of the market in the first 8 months. Mercedes-Benz has been promoting 48V systems heavily since the beginning of 2020, with nearly 100,000 vehicles registered, accounting for 1/4 of the 392,700 registered Beijing Benz vehicles.

Overall, the installation rate of 48V systems in China will experience a turning point in 2020. Companies like General Motors accounted for over 50% of 48V installations from January to August. As the installation rate continues to rise, the penetration rate will steadily climb. In August, 32,291 48V vehicles were sold, which is a recent small peak.

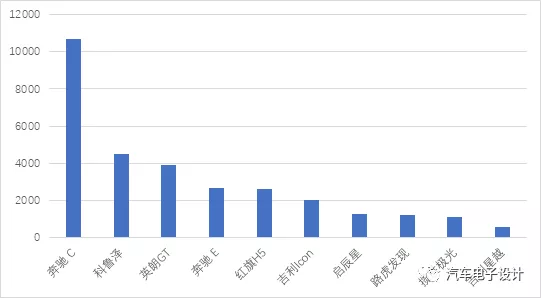

From the monthly sales of cars, the major models are the Mercedes C and Mercedes E-Class; the popular Chevrolet Cruze and Vauxhall Astra GT also have a quantity of about 4,000, accounting for 41% and 14.8% of the total models, respectively. The data for the four-cylinder and three-cylinder engines of these two models are 6757 vs 4220 and 21680 vs 4757, respectively. From this perspective, the decision to adopt three-cylinder engines seems somewhat hasty. Currently, the acceptance of 48V and four-cylinder engines across the product line is much higher. In terms of independent brands, Geely is relatively early to adopt 48V, but the individual penetration of the model is not particularly high. Whereas, the quantities of the 48V of the Hongqi H5 are growing rapidly (there are currently two 48V models, Hongqi H5 and Hongqi HS7, and 48V may become the standard equipment in subsequent models).

From the monthly sales of cars, the major models are the Mercedes C and Mercedes E-Class; the popular Chevrolet Cruze and Vauxhall Astra GT also have a quantity of about 4,000, accounting for 41% and 14.8% of the total models, respectively. The data for the four-cylinder and three-cylinder engines of these two models are 6757 vs 4220 and 21680 vs 4757, respectively. From this perspective, the decision to adopt three-cylinder engines seems somewhat hasty. Currently, the acceptance of 48V and four-cylinder engines across the product line is much higher. In terms of independent brands, Geely is relatively early to adopt 48V, but the individual penetration of the model is not particularly high. Whereas, the quantities of the 48V of the Hongqi H5 are growing rapidly (there are currently two 48V models, Hongqi H5 and Hongqi HS7, and 48V may become the standard equipment in subsequent models).

As we can see, except for Japanese enterprises Honda and Toyota, Nissan is doing 48V on the Qichen brand, and the Japanese automotive brand series will subsequently introduce mainly HEV projects. BMW will be standardizing 48V across its entire series, and the demand in this area is not low. Audi will also follow gradually. It is expected that German luxury car brands will be the main force in the 48V demand. As for independent brands, according to this wave, Geely, FAW, Changan, Chery, and Great Wall will not be absent, and 2020 is a turning point for 48V.

Battery Supply

From the overall supply pattern, Wanxiang A123 was the earliest to sign a large 48V contract with SGM and Geely, among other independent enterprises. This area is absolutely a specialty of Wanxiang A123. Interestingly, Camel and Sail, who transitioned from lead-acid batteries, are also trying to do a good job in power-type cells in this field. According to the roadmap plan for 50% HEV with 48V by 2025, the transformation of batteries is unavoidable. This area will become the focus of the automotive parts industry.

Conclusion

I think we must pay attention to 48V this year. It is possible that by December, the overall quantity will greatly exceed our original expectations. This is truly remarkable.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.