I am curious about GAC New Energy Motors because it achieved a 78% growth in the current year’s new energy vehicle market despite the 32.8% YoY decline. A major contribution to this achievement was the Aion S model, which sold over 15,000 units in the first half of the year. However, over 10,000 units of this sales figure were in the B2B segment, which accounts for nearly two-thirds. Is this sales figure meaningful?

I attended the Third Global Intelligent Vehicle Frontier Summit last weekend and had the opportunity to listen to the remarks by Gu Hui’nan, the CEO of GAC New Energy Motors. He made several thought-provoking comments, such as “Software defines cars, why can’t hardware define cars?” and “Can the road standards in China be unified for vehicle-road collaboration?” He also mentioned that “Transforming into a technology company is just a saying, car companies are meant to be technology companies.”

What kind of company is GAC New Energy Motors? Let’s start with this interview and review the company that has been established for just over three years together.

An Innovative Car Company

During the Third Global Intelligent Vehicle Frontier Summit, Gu Hui’nan was invited to participate in a media interview where he discussed several industry hotspots and focal points. Among them, the remark that impressed me the most was his view on vehicle-road collaboration:

“The concept is simple: single-car intelligence comes at a high cost, and we don’t need it to be that intelligent. Vehicle-road collaboration is expensive, and the problem lies here – which comes first? China’s cars are only sold in China? Will vehicle-road collaboration be possible worldwide? If it is not feasible, and if you want to conquer the world, single-car intelligence is an essential path. The second point is that vehicle-road collaboration works for all cities and towns in China. If you only work on the intelligence of one road, you are making regional cars instead. As a car maker, my goal is to face both the city and the countryside, to build single-car intelligence is a must. I cannot take shortcuts and make half-baked products, especially when I want to target the global market.”

With a market overview and an awareness of the current situation in vehicle-road collaboration, Gu Hui’nan expressed his dedication to single-car intelligence, but he did not make a definitive statement regarding the importance of the issue. It reminded me of another topic discussed at the Hundred People Summit regarding the development of standards.Facing such diverse roads, regulations, vehicles, working conditions, and even weather conditions today, the development of vehicle-road collaboration certainly requires standards to integrate a framework. However, the current situation is fragmented due to too many scenarios, which makes it difficult to develop standards that must balance the development of the entire industry. Early standardization will limit innovation, but leaving it to grow freely will only exacerbate this fragmentation.

But how early is too early? For OEMs, the answer to this question is uncertain. Collaboration in the vehicle-road sector requires joint efforts from the industry. However, the decision to focus on single-vehicle intelligence is entirely in their hands. “Single-vehicle intelligence is an inevitable trend,” which is Guangzhou Automobile Group’s choice.

Regarding the view of the roadside, Gu Huinan did not forget to make another point:

“China’s roads, water, electricity, gas, sewage, communications, and so on are the busiest, and they are dug up and made so complicated. Some people may wonder where they can earn some money. When you ride a car, you may have to pay for road communication fees and other expenses in the future. It’s too complicated. I think it is not appropriate to complicate the roads. It is a waste of money and labor. I prefer the moderate vehicle-road collaboration with single-vehicle intelligence. This is a more suitable road for us. If we make the roadside too complicated, mystified and philosophical, taxpayers will not be able to afford it in the future.”

No Market Can Be Underestimated

As mentioned at the beginning, more than two-thirds of Aion S’s sales this year are from the TO B market. However, not only Guangzhou Automobile Group, but also BAIC, BYD, and Roewe’s pure electric A-level products mostly sell to ride-hailing companies. Therefore, some people naturally think that the sales of this market are virtual, and Gu Huinan also responded to this issue:

“When new energy vehicles were selling well last year, some people said that the sales of new energy vehicles were virtually high. Why? Because many cars were sold to ride-hailing and taxis. He said that the proportion of private cars is not high. I want to share a thought with you today. Have you ever thought about a question? Has China produced a good taxi yet? Have you ever thought about this? Why do some people look down on taxi? This topic is very interesting. Don’t you think the opposite is true? If ride-hailing and taxi are done well, what’s so difficult for other cars to do well? Toyota, for example, started as a taxi manufacturer. If you go to Japan, you will see that Japanese taxis are Toyota cars.”

“Our thinking is problematic. Why do we care so much about private consumption or any other consumption? The key is to make the industry bigger. When I was in my 50s, there were no personal cars. I entered Peugeot Automotive in Guangzhou, and at that time, they were sold mainly to units. At that time, there were no personal cars. Does this mean that there was no automotive market? Don’t look at this problem in such a way. The key is whether this industry is popular in the market. Certainly, the development of the private market is necessary, but the high-end market is small, and the bulk is still in the middle and low end markets.””But if you take a look at car consumption, I’ve been to the market recently and both Mercedes-Benz and Audi are selling cars for 160,000 yuan. During the epidemic, cars from all over the world can’t be sold to China. Where can they be sold? Luxury cars around the world, including Mercedes-Benz and BMW, are losing money. Now, just how high are the prices of gasoline cars? Many automakers’ profits can’t hold up. This is a reality. At this time, can electric cars really be elevated? No, it’s impossible. Although some manufacturers have sold a bit more, even if it’s a few thousand, tens of thousands of vehicles, this amount is too small compared to the whole industry. The new energy market is just getting started, and everyone should not underestimate any market. It’s an opportunity stage.”

Actually, Gu Huinan’s point of view is good. “Why does everyone look down on taxis?” “Has a good taxi been produced in China?” The reason taxis have become synonymous with low-end is because the cars used for taxis are low-end. Of course, we can’t underestimate any market. This is especially true for the transportation market. It’s a way for consumers to get in touch with your product, which is actually a form of promotion.

But I also think that Gu Huinan has a misunderstanding of the journalist’s question. The key issue here is not whether it is high-end or low-end, but TOB and TOC. As for why TOC sales are low, doesn’t the widespread use of taxis have a negative impact on the brand’s upward image?

Take a step forward with battery swapping

The heat of NIO’s BaaS also continued at this meeting, and in the interview, Gu Huinan also talked about his views on battery swapping:

“We have cars with vehicle-to-electricity separation. The Aion S has a vehicle-to-electricity separation version, but it seems that there are many difficulties in promoting it now. Building charging piles is so difficult, and building battery swapping stations is even harder. In addition, for the batteries inside, if you want to swap the batteries, you need a battery storage facility. The three models of cars I sell now all have three different batteries, with batteries from the previous year, last year, and this year all being different. So how do you store the batteries? When one company, three companies, or five companies come together, how is it unified? And how should we lay out the facilities in large cities, small and medium-sized cities, and rural areas? This is indeed a very difficult problem. I cannot comment too much on this industry, and we have it, but we’ll take a step forward and see.”The statement from Gu Huinan suggests that the Aion S’s separation of the car and the electric components is on a structural level rather than a property level. Gu Huinan’s view on battery swapping can be said to represent the industry’s perspective on the matter. For NIO, focusing on BaaS means that they have already accomplished many prerequisites, including some that were taken into consideration from the very beginning of the design process. For enterprises that did not have the same layout considerations from the beginning, such as Guangzhou Auto Group (GAIC), it will be more challenging to do such things at present, especially with regard to the batteries.

The advantages and disadvantages of battery swapping are obvious. If NIO’s BaaS can become a successful case in the future, I believe that enterprises like GAIC, which take it step by step, will have more confidence in investing in it.

Balancing Different Fields

In the future mergers of automotive companies and other industries, what are the things that automotive companies must take in their own hands? This is what Gu Huinan had to say:

“I think the most important core technology facing the future is nothing other than autonomous driving, intelligent connected vehicles, and electrification. The most important part of autonomous driving that a carmaker must control is the execution portion. A vehicle has a basic platform, from the operating system, operating platform, then the perception system, followed by perception plus computation, and then execution. The basic perception and computation, followed by the final computing and execution system are the parts that the automaker must control. Only by controlling this part can the car achieve differentiation. Without it, every car will be the same, and there will be no distinction between high, middle, and low.“

Gu Huinan’s importance on autonomous driving is emphasized very clearly. “Execution” and “computation” are actually translated as control and algorithm in daily discussions. As an executive in a “traditional independent-branded automaker,” Gu Huinan has a deep and insightful understanding of new technologies, which is also reflected in his views on “software-defined cars”:

“For a long time, due to China’s high-speed development of the Internet, the country’s focus on software exceeded hardware, which was a huge mistake. Professor Zhao from Tsinghua University gave us a classic saying: ‘Without software, hardware is a walking corpse. The hardware is a corpse with no soul. If you only have software and no hardware, it is a lonely ghost, floating above but unable to land.'””Now the country is strengthening the definition of software-defined cars. At the automotive blue book forum in Wuhan a few days ago, I raised the point that software-defined cars are not enough. Why can’t hardware also define cars? From the core perspective, our country should seize the entire industry chain in both software and hardware. The automakers should focus on integration, while at the application and execution layers, they must take control. The remaining parts must be controlled by our country in related industries. Guangzhou Automobile Group is also investing in hardware, such as graphene, and is also working on these technologies. The development of computing software in the future should also be strengthened.”

Before making these comments, he also used the current Sino-US relations as an example:

“From the perspective of the industry, our country previously lacked updates to the operating system and core hardware systems, such as chips. After this round of Sino-US trade war, everyone basically has a consensus.”

I believe that those who work in related industries, especially Huawei employees, will have a deep understanding of the above remarks. Gu Huinan is not actually trying to sing a different tune. As I understand it, he wants to express that in terms of industrial orientation, we must broaden our vision. Both software and hardware are indispensable, and excessive emphasis on “software-defined cars” can be misleading.

Interview Summary

The interview is not limited to this content, and the above excerpts are representative of the entire interview. During the interview of over 40 minutes, this 50-something senior executive of Guangzhou Automobile New Energy exhibited a profound understanding of the industry, and although he seems to have made some surprising comments, his viewpoints are well-grounded.

You can hardly see any radical traits in him, but as for his thinking, he is not backward at all. He is very conservative when it comes to difficult industry issues, such as the choice between vehicle-to-vehicle cooperation and battery swapping. But in my view, this kind of “fear of difficulties” is more of a respect for the industry accumulated over many years, and realizing the ease or difficulty of a situation.

Balance and a big-picture view, this is what I think about Gu Huinan. This kind of thinking is often cautious and rational, but on the other hand, it also limits the imagination and courage of changes in the industry. It lacks that kind of innovative and surprising brilliance.

Regarding Aion S and Guangzhou Automobile

Before the Aion S, I rarely saw Guangzhou Automobile’s new energy vehicles and was not interested in the brand. In addition, I have ridden in BYD E6, E5, Qin EV, and BAIC EU5 taxis and Didi cars on the streets of Shenzhen many times. However, the experience of driving and riding these electric cars in this category is only average. So when the Aion S was released, I just thought the car looked pretty good, and I didn’t have much expectations for the driving and riding experience of this car.

The mentality of “shouldn’t be that good” persisted until my first ride in a Didi Aion S, and until I stepped into the car with my left foot and felt the full support from the seat cushion in my buttocks and thighs, as well as ample leg and headroom. I was surprised. This is an A-class pure electric car, and it doesn’t look like it has a raised suspension. Shouldn’t it have a tiny back seat? The excellent performance of the Aion S’s rear seat completely exceeded my expectations. Moreover, the interior of the car is also outstanding, with beautiful colors, high-quality materials, and impeccable assembly. For the first time on this ride, I felt comfortable sitting in an electric car of this level. At that moment, my inherent understanding of A-class pure electric sedans was shattered.

After returning home in the evening, I specifically searched for information about the Aion S. The maximum NEDC range is 510 km, the wheelbase is 2750 mm, and the curb weight of over 1.6 tons are all excellent standards in the same class. As for the question I was particularly curious about, the rear space, I found the answer. Aion S is equipped with GEP, a Guangzhou Automobile Group’s self-developed pure electric platform. This platform is exclusive for pure electric vehicles, with a level chassis and high space utilization. This is why the Aion S has such excellent performance in the rear seats.

At that time, Aion S’s comprehensive product strength, with the best rear seat space in the same class, second-best range in the same class, and high-quality interior and exterior design, naturally came in first place in the same class without any suspense. However, better products are often more expensive. Compared with its competitors, the price of Aion S is not low. While other manufacturers are squeezing product costs and engaging in price wars in the market, Guangzhou Automobile Group’s high-priced and high-product strength competitive strategy is quite “unconventional”.

Don’t Worry About the Factory, After All, It’s Guangzhou Automobile Group.As one of the joint venture partners of Honda and Toyota, I have high expectations for GAC New Energy’s ability in vehicle manufacturing. After visiting the factory, GAC’s production workshop demonstrated automation and technological capabilities that are on par with joint venture factories. From the flexible production lines for multiple models, from painting to final assembly, to automated cold welding and blue light scanning for dimensional inspection immediately after welding, although these things are not rare among today’s Chinese car companies when taken separately, it is definitely not common to do well in all aspects and achieve such a high level of standard across the board.

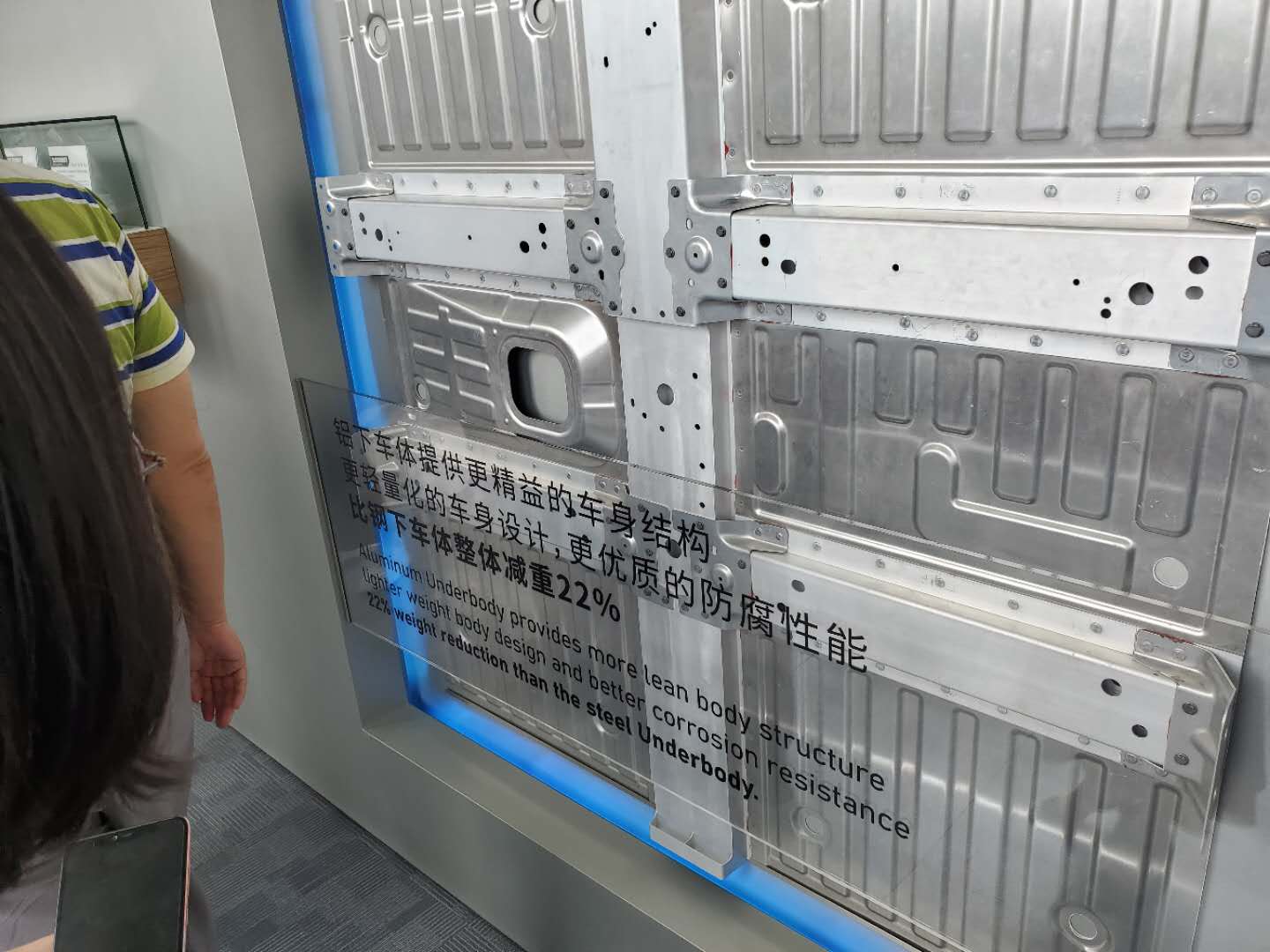

Moreover, the first domestically produced steel-aluminum hybrid flexible final assembly line, a vehicle body with aluminum below and steel above, combined with GAC’s pure electric platform, all these are truly high-level manufacturing.

As an engineer, when I saw GAC New Energy replacing traditional asphalt damping pads with water-based environmental liquid damping materials (LASD), I gave them a thumb up for this detail. I don’t know how many car brands I have visited are still using asphalt in places where the user doesn’t understand and can’t see, because it is cheap, but GAC does not.

From core to detail, GAC remains balanced at a high level.

According to GAC’s own plan, the current equipment capacity of its new energy intelligent ecosystem factory is 100,000 units per year, with an investment of 4.7 billion yuan for the first phase, and a planned capacity of 200,000 units per year. There is also a plan for the second phase, which is also planned for 200,000 units per year. Although GAC New Energy does not have a long history, the company has already made arrangements for its large-scale planning. I don’t want to use ambition to describe this plan, I just think that GAC has left room for both good and bad in its own pace.

Worthy of recognition, but please continue to work hard.If we start counting from GAC Group’s inception, GAC has a history of 23 years. However, GAC’s new energy brand was only established in July 2017, so it has just passed its third year. This brand has a lot of personality. They didn’t make A0 level micro cars or hybrid cars. Instead, they focus on pure electric models, and they don’t play the oil-to-electric game. They made models with a dedicated pure electric platform and priced them the same as those “oil-to-electric” models. This should be appreciated.

However, the road ahead is not entirely optimistic. After Aion S and Aion V, GAC’s new energy brand has already given up the two most popular segments: compact sedans and compact SUVs. Although Aion LX is performing well, its market performance indicates that this price segment is already beyond what GAC’s new energy can afford. Therefore, the upcoming challenges will be very difficult.

The excellent performance of Aion S in the TO B market actually has side effects. Many consumers don’t want to buy a taxi, and they don’t automatically assume a taxi is inferior or inexpensive, but due to long-term market education, the vast majority of consumers do classify taxis and ride-hailing cars as low-end vehicles. Although Aion S’s performance in TO C insurance is better than the competing models of BYD and BAIC, as of June, the total number is only 5167 units, which is less than 1000 units per month. This sales volume is far from excellent in the large market for compact models. Furthermore, talking about commercial vehicles, the demand orientation is mainly non-consumer, and there are ambiguous local protection policies. After the first wave of sales, it is unclear where the next wave will come from. Although this market is undoubtedly important, ultimately, TO C is the decisive factor. This market is extremely realistic and changeable, and it won’t protect you from fossil fuel cars. For now, GAC’s new energy brand still has a long way to go.

Overall, over the past few years, GAC’s new energy rise has not relied on any Tesla-level innovative breakthroughs or simply price war tactics. Instead, they have done their best to make high-quality pure electric cars that are suitable for China’s national conditions, and the market has proven that their understanding is not too far off. Competition is needed in the market, and it needs to be healthy. GAC has made a good start, but it will be difficult to continue. By the way, they should accelerate the research and development of graphene batteries. I am looking forward to writing a special topic on that.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.