NIO has set another historical record for its brand, this time in terms of gross profit. In Q2 2020, NIO’s gross profit per vehicle reached 9.7%, a significant increase from previous quarters and a successful achievement of profitability, indicating that NIO has the ability of self-reliance. Despite being on the brink of collapse multiple times, after receiving medical supplies from the Hefei government, NIO managed to bounce back and even received an AWM from an airdrop. Are you ready for NIO’s fight?

A beautiful financial report

Q2 2020 was the quarter most affected by the pandemic outside of China. Therefore, among most auto companies, the most common phrases on their financial reports were “significant decline” and “loss of xxx”. NIO’s report, however, stands out as exceptionally beautiful. Let’s take a closer look at the numbers.

Delivery volume

In Q2 2020, NIO delivered a total of 10,331 new vehicles, including 8,068 ES6s and 2,263 ES8s, achieving YoY growth of 190.8% and MoM growth of 169.2%.

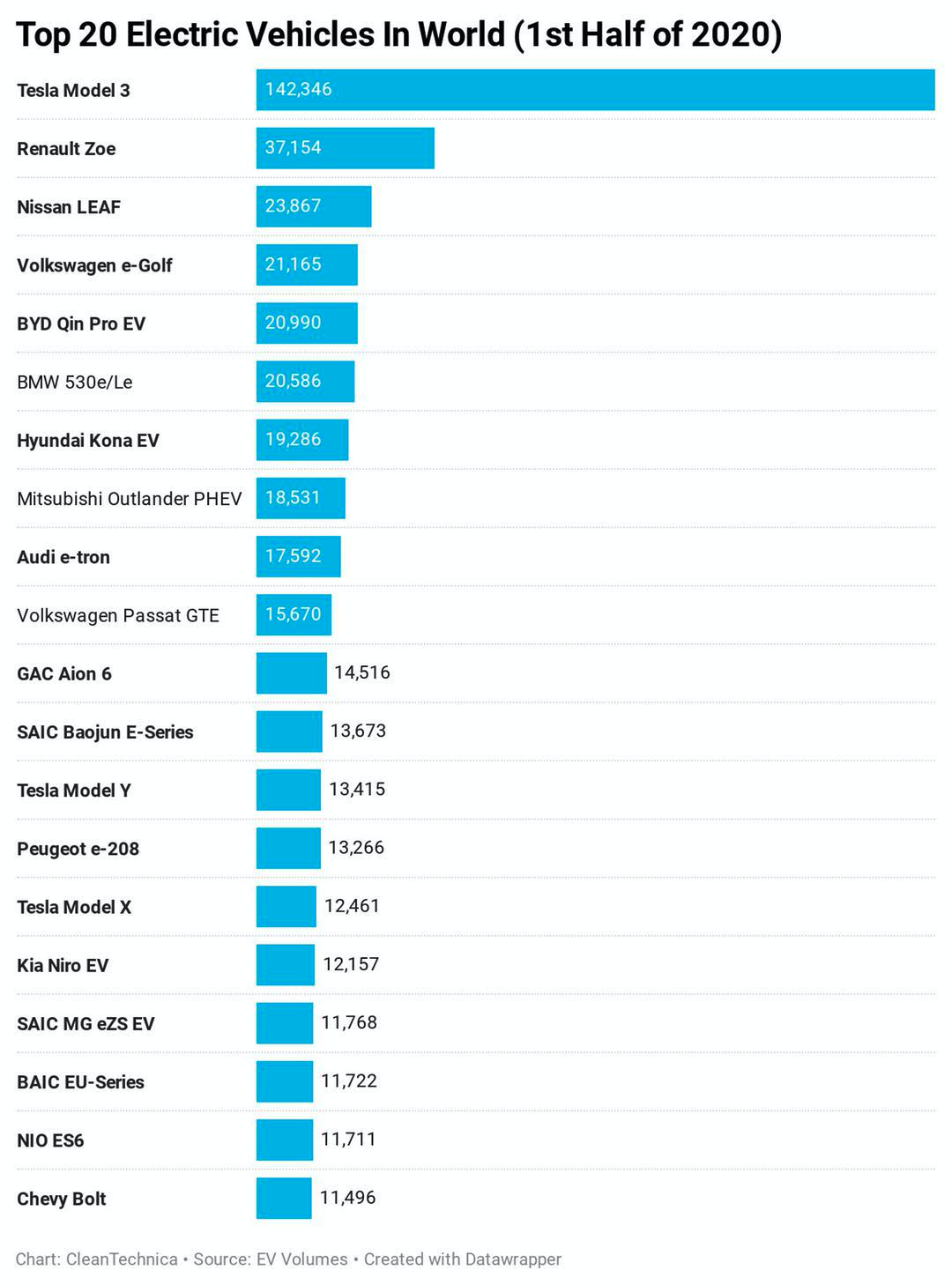

This is the single highest sales quarter in the history of NIO and the first time it has delivered more than 10,000 vehicles in a quarter. With such a surge in sales, the ES6 also entered the Top 20 list of global pure electric vehicle sales in H1 2020.

Additionally, since the launch of the all-new ES8 in April, ES8’s sales have returned to the four-digit range. This is an extraordinary feat for a Chinese brand, especially considering the price range of RMB 468,000 to 566,000 for this luxury electric vehicle.

This not only demonstrates that Chinese domestic brands have successfully sold vehicles in the price range of RMB 300,000 to 600,000, but also indicates that NIO has firmly established a foothold in the luxury car market.

Gross profit margin

This chart shows the gross profit margin of NIO in each quarter since its IPO. Starting from Q2 2020, NIO has transformed from losing RMB 24,200 per vehicle sold to making a gross profit of RMB 32,700 per vehicle sold.

In its financial report, NIO attributes the increase in gross profit to the following two factors:

- Reduction of vehicle bill of materials (BOM) cost;

- Reduction of unit production cost following an increase in sales volume.

With regards to BOM cost, it can be divided into two categories: “battery cost” and “material cost outside of the battery pack”.According to informed sources, the cost of 523 ternary lithium battery packs is currently around 0.9 yuan/Wh, a reduction of about 20% compared to 1.2-1.3 yuan/Wh in 2019. This is a change in the overall environment, and the bargaining power of each automaker with battery factories varies depending on their abilities.

According to data from GGII, in the first half of 2020, CATL realized installation of 14,769 vehicles for NIO, with the installed capacity reaching 1.04 GWh.

Let’s take a look at some more data. In the first half of 2020, CATL’s total installation of vehicles was 8.44 GWh, which means NIO alone accounts for 12.3% of CATL’s total production capacity in the first half of the year, emphasizing their significant presence in the market.

At the beginning of the year, we received news that NIO had reached a price reduction agreement with CATL. This means NIO cannot do without CATL and likewise. Therefore, NIO’s bargaining power can be imagined.

With NIO’s brand and sales gradually becoming stable, it is inevitable that “material costs except for battery packs” will decrease, as mentioned in Q1 financial report by William Li with a data reduction of 10%.

As for production costs, with a Q2 increase of 169.2% in sales, it is also very favorable for spreading production costs. Regarding this point, William Li’s goal in Q1 financial report was to reduce it by 30%.

Lastly, with higher-priced ES8 starting to sell in higher volume, it also helps boost the overall gross margin. Once again we refer back to the graph, where from sales revenue, we can see that Q2’s average unit price increased by 3% compared to Q1.

Let us review William Li’s accomplishments mentioned in Q4 2019 financial report: “in Q2, gross margin will turn positive and gross margin by the end of the year will reach double digits.”

Obviously, NIO has achieved this, and has significantly surpassed the goal of a single car gross margin of 5% and a total gross margin of 3% mentioned in Q1 financial report, with the single car gross margin also very close to double digits.

Q3 Outlook

NIO’s delivery target for Q3 in the financial report is 11,000-11,500 vehicles.

When we first saw this data, our editors, especially the one who holds a NIO stock, felt that this target was too conservative.As NIO gains more recognition, its sales continue to rise steadily. However, the core reason why sales have yet to exceed 4,000 units per month is a limited production capacity.

Q1 financial report revealed that due to suppliers, the production bottleneck around June was at around 3,400-3,500 units with a goal to achieve production capacity of 4,500-5,000 units in August-September. In the Q2 financial report, it was mentioned again that the production rate of the Hefei factory will be upgraded from 15 JPH to 20 JPH.

As for the friends who questioned in the comments that “there are not many orders, why not expand production earlier?” Li Bin explained that “we will be relatively conservative in terms of increasing production capacity. Our user demand is continuously increasing, and we will balance the plan to increase production capacity.”

However, it is predictable that when EC6 orders begin to be delivered in September, they will definitely bring a wave of new sales.

What Does NIO’s Improvement Represent?

NIO has proven the feasibility of both the ES battery swap system and the worry-free service with its own strength.

Going back to November 2018, when the NIO’s battery swap station first landed, people’s imagination of battery swaps stayed on the single indicator of “energy replenishment speed.” Those who were bearish about the battery swap model said the most common thing was, “What’s the point of battery swaps when charging speed comes up? The life cycle of battery swaps is at most 5 years, and the cost is high.”

If you still look at battery swaps as “energy replenishment speed” alone now, it is too one-sided.

Not to mention the many concepts of “rechargeable, swappable, and upgradable,” Li Bin revealed during the conference call after the financial report that “the first vehicle without a battery has been approved by the government and completed insurance, loan, registration, and other formalities.”

This means that the battery-as-a-service (BaaS) has been verified and completed.

Before this, if you bought an ES6, the remaining car price of 250,000 yuan could not be financed again after deducting the battery rental cost of 100,000 yuan. Now, a car worth 250,000 yuan can be financed, and the battery can be rented monthly, greatly reducing the down payment and monthly payments.

This plan seems to be just another form of financial solutions. However, behind it, the owner of the battery has undergone earth-shaking changes. By separating the “battery” and letting an energy company bear the responsibility, the owner only needs to focus on the car itself, completely solving the problems of battery life, battery cost, and rapid development of battery technology.

This is also a brand-new way of playing that has emerged under the “battery swap” model.

In previous media interviews, Li Bin proudly said, “We have been planning this program for five years.”

For NIO, battery swaps are part of the big picture. Under the strong support of national policy, we have also learned that some car companies have started planning to support models that can use battery swaps.

Key points from the conference call### About NP

NoP and summoning function are undergoing intensive testing and will be delivered to users within this year. NoP combines high-precision map information, and the summoning function will prioritize safety and focus on narrow parking space entry and exit.

Currently, the optional rate of NP in normal sales models is about 25%. The small NP, priced at about 10,000 yuan, includes some entry-level functions, and the optional rate is also good.

NP2 is under development, but NIO will not use L3 or L4 to define it. Instead, it will evaluate it based on “how much time it can free up for the user” and “how many accidents it can avoid.”

About Expanding Overseas Markets

NIO is currently conducting very detailed preliminary research and development on overseas markets and is expected to enter the overseas market this year.

About the Next Model

The next model will definitely be a sedan, but the level has not yet been announced.

About Additional Income

According to the double score policy algorithm, pure electric vehicle models with a range of over 350 km can generate 5 scores. NIO sold more than 20,000 vehicles in 2019 and accumulated more than 100,000 scores, which can generate a revenue of CNY 120 million based on the current price.

Currently, NIO is negotiating with some manufacturers and plans to sell these scores in Q3 and Q4, which can improve the overall gross profit margin. However, NIO stated that it would not be accounted for in the car sales revenue like Tesla, but only included in the overall gross profit.

NIO expects to generate 200,000 scores this year. The double score policy will gradually increase, and the scores will become more and more valuable. Most traditional car companies’ pure electric vehicles will not be popularized until 2023, so during this three-year gap, NIO’s scores will also generate considerable income.

Final Words:

Although NIO still has a certain distance to go to achieve profitability, both sales and gross profit have been on track. With the launch of the overseas market expansion project and the gradual landing of the BaaS project, NIO has more and more cards in hand.

Oh, by the way, the funding from the Hefei government has been basically received, and NIO’s cash reserves have reached CNY 11.168 billion, so…

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.