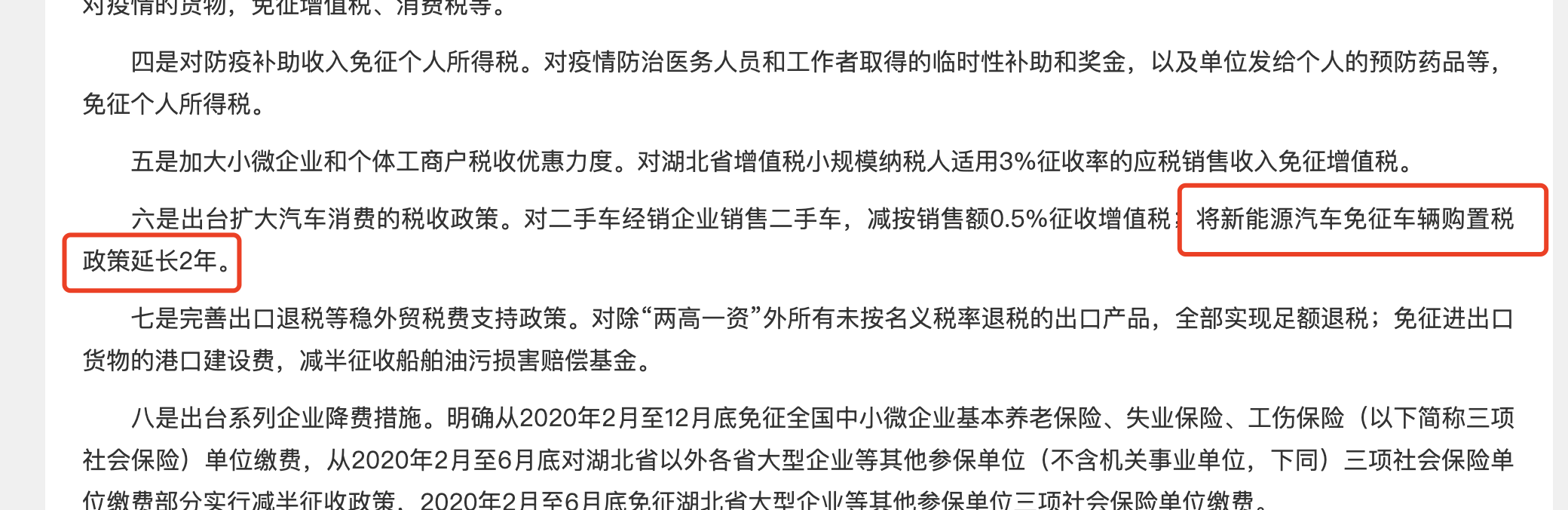

On August 6th, the Ministry of Finance website released the “Report on the Implementation of China’s Fiscal Policies in the First Half of 2020”. To support the development of the new energy vehicle industry, the policy of exempting new energy vehicle purchases from purchase tax will be extended to the end of 2022.

The government has been providing subsidies for new energy vehicle purchases since 2009. Starting from September 1, 2014, new energy vehicle vehicle purchase tax has been exempted. The tax reduction policy for new energy vehicle purchases was originally planned to end at the end of 2020, but due to the impact of the epidemic this year, the government decided to extend this policy to 2022.

On April 23rd this year, the Ministry of Finance website released the “Notice on Improving the Financial Policies for Promoting the Application of New Energy Vehicles”, which extended the subsidy period to 2022. The subsidy will be reduced by 10%, 20%, and 30% respectively based on the previous year from 2020 to 2022, with a maximum annual subsidy scale of about 2 million vehicles.

At the same time, the threshold for subsidy of new energy passenger vehicles was increased to a maximum pre-subsidy price of CNY 300,000 (including CNY 300,000). However, in order to encourage the development of the “battery swapping” new business model and accelerate the promotion of new energy vehicles, vehicles using the “battery swapping” model are not subject to this regulation.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.