Introduction

Nissan’s ProPilot and BMW’s previous driver assistance systems heavily rely on ZF’s S-Cam3.5 and S-Cam4 which use camera technology. From a hardware disassembly perspective, the traditional OEM and Tier1 share different responsibilities, with OEM defining the function and communication requirements and Tier1 implementing software and hardware integration. Tesla’s three-eye camera is purely hardware, which collects data and sends it to Autopilot controller. Therefore, from the perspective of sensors, ECU and actuators, the traditional Tier1 capabilities are weakened and form a situation where OEM controls both software and algorithms.

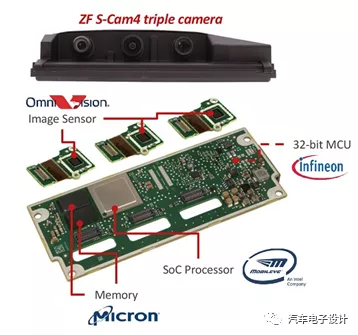

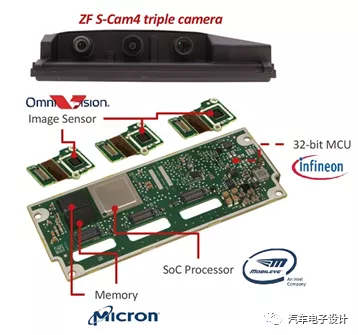

ZF’s S-Cam4

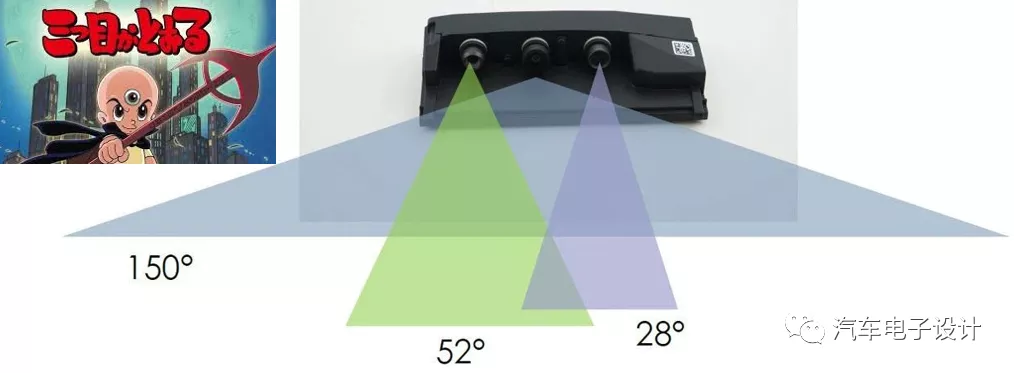

ZF’s S-Cam4 has two versions, a three-eye version and a single-eye version, with the former including a 150° wide-angle camera for monitoring the surrounding environment, a 52° middle-range camera, and a 28° long-range camera.

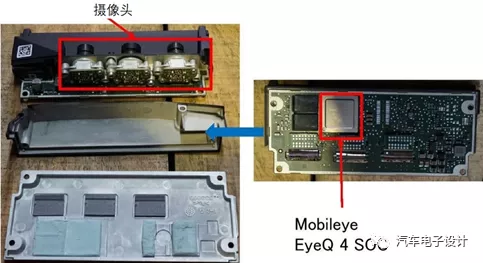

As shown in the figure below, S-Cam4 has three camera modules, which use Omnivision CMOS image sensors (previous generation S-Cam4 used Onsenns’ CMOS) and Mobileye’s EyeQ4 visual processor. The CMOS sensors are isolated on three different PCBs, and the main board of the system includes Mobileye’s visual processing function.

The main board includes a 32-bit MCU, Mobileye EyeQ4, and corresponding memory. Vehicle manufacturers give ZF the functional requirements and ZF integrates Mobileye’s algorithm to package it as required.

## Tesla’s Triple Camera

## Tesla’s Triple Camera

Unlike ZF’s product, Tesla defines the camera module as simply capturing images. Therefore, a triple camera module with three ON Semi AR0136A CMOS image sensors was developed, all based on the same 1.2-megapixel image sensor ON Semi released in 2015.

Note: Tesla probably made all the CMOS sensors the same and negotiated with ON Semi for a lower price. Therefore, the sensor’s advanced features are not essential as long as it is cost-effective. The sensor’s pixel size is 3.7 × um, and the resolution is 1280 × 960 1.2 Mp.

Tesla embedded all CMOS sensors into the PCB without requiring a SoC, and System Plus estimated the cost of this model to be $65. The autopilot controller handles image processing.

By doing this, Tesla has directly downgraded the value of traditional Tier 1 companies to a contract manufacturer that helps buy chips and make lenses. I don’t understand why Tesla’s suppliers are so popular in the market. In the endless bargaining process, if you open up this camera, how much processing fee can you ultimately make without the software (which is the most valuable part)? Tier 1 development is only a matter of ensuring reliability and process capability, and testing doesn’t require too much work.

Summary

I believe Tesla’s future profit margin will continue to improve because changing suppliers is easy, and after the software is collected, purchasing a bunch of assembly work with little software technology content is indeed inexpensive. Meanwhile, traditional Tier 1 companies are facing traditional OEMs’ self-built software capabilities and direct cooperation with chip manufacturers (such as Mercedes-Benz and NV), transforming their internal organizations and resources into a flatter structure than before, even flatter than Tier 1.The future value chain will be further reduced upstream from the automaker, and the automotive industry will generate a huge value of super vehicle factories in the future, but there will be no super suppliers. In this process, the trend in the field of three-electric is the same, just slower.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.