*Author: Chris Zheng

Tesla China is undergoing changes.

In 2019, the Tesla China management team won a great victory at the Shanghai plant Phase I (the domestic Model 3 production line). However, they didn’t have a chance to catch their breath in 2020.

The Shanghai plant Phase II (the domestic Model Y) project followed one after another. Due to the brief interruption of the epidemic, the construction schedule was further compressed.

Under such circumstances, starting from April 2020, the Tesla management team led by the President of Tesla Greater China, Zhu Xiaotong, the Vice President of Global Tesla, Tao Lin, and the General Manager of Tesla China, Wang Hao, began a wave of intensive business trips, attending the “Tesla Owner Representative Conference” in more than a dozen core Tesla cities including Beijing, Shanghai, Guangzhou, Shenzhen, and Hangzhou.

Thus began Tesla’s localization war in China.

Owners, owners, or owners

Since the launch of the Model 3 in China in 2019, Tesla China has been rapidly expanding while facing increasing doubts. Among these voices, the most common joke is “to cut leeks” (a Chinese slang for “to make money off others through financial manipulation”).

How does Tesla China define its relationship with owners? At the Tesla Owner Representative Conference in Nanjing, Zhu Xiaotong used a practical example:

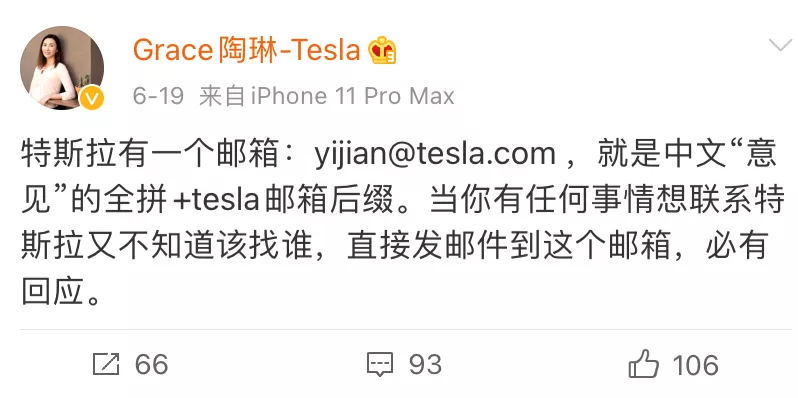

On June 19, Vice President of Tesla, Tao Lin, publicly announced an email address on Sina Weibo: yijian@tesla.com, with “yijian” meaning “opinion” in Chinese, plus the Tesla email suffix.

Zhu Xiaotong said that this email address is associated with seven people’s email accounts, including Zhu Xiaotong, Tao Lin, Wang Hao, Tesla China Service General Manager Xue Juncheng, China Supercharging Project Leader, Shanghai Factory Director, and China R&D Director.

All feedback sent by owners to this email must be personally replied by the above-mentioned seven people to ensure the most direct communication with owners.

In addition, at Tao Lin’s “request,” China’s executives collectively entered Sina Weibo. However, Tesla China’s almost stagnant communication with the outside world in the past few years has caused a serious backlog of owner’s opinions. As soon as Weibo was opened, all the executives’ comment areas were flooded. In Zhu Xiaotong’s words, it was like being at the scene of an accident.

However, according to Zhu Xiaotong, direct communication that Tesla China has with owners will be one of the basic tasks that it will continue to adhere to.

Of course, Tesla China’s problems to be solved are far more than just “direct communication.” Tesla China has provided a systematic plan to make comprehensive improvements:

Decoupling pricing strategies from the Tesla US headquarters and allowing China to set its own prices on Tesla products.Frequent price adjustments have become a major issue for Tesla in China. According to Zhu Xiaotong, this is due to the attention brought by price adjustments directly reflecting on the end price as well as the combined effect of import/export, local production, sales tax, and subsidies.

Tesla China has started to implement self-pricing. For example, after Tesla’s full-price adjustment in May 27 in the US, the price of Model 3 in China remains unchanged.

User data and authentication services have been transferred to China to improve response speed and reliability.

To address data delays and even failure due to server operations in North America for user information, Tesla China has formed a data center technical operation team to transfer Chinese user data and authentication services to China in order to improve service responsiveness and reliability.

Localization development, improvement of in-vehicle navigation performance and vision-based parking.

Since Tesla’s autonomous navigation experience has been poor, why not use systems from high-end vendors such as Amap or Baidu?

According to Zhu Xiaotong, all navigation software provided by vendors in China use a “black box” approach, where the vendors do not disclose their internal algorithms and principles to car companies, and Tesla specifically vetoed this approach.

Since every update to the self-developed navigation engine requires approval from the Survey Bureau, the Copyright Bureau, and other relevant agencies, the entire cycle is quite long. From the perspective of the user, Tesla’s navigation system has been underwhelming for a long time.

Currently, the navigation system in Tesla China follows a three-level hierarchical logic, consisting of basic data, search engine, and real-time traffic and POI, with the three modules corresponding to 4D Navigation, Tesla’s self-developed software, and Baidu Maps, respectively.

According to Zhu Xiaotong, there is now an executable plan to improve navigation experience, and the updated navigation system will improve not only route planning but also the overall intelligent call experience. “We will make gradual progress in the future.”

In addition, according to Wang Wenjia, Tesla’s Asia-Pacific engineering director, Tesla China will develop automatic parking based on ultrasound fusion visual perception to further improve the usability of automatic parking in China’s compact parking space.

Accelerating the construction of the Supercharger network to solve travel anxiety.

With the localization of Model 3, Tesla China’s sales have increased by 5-7 times year on year. This means that the Supercharger network for long-distance travel is in high demand.

As of 2019, Tesla China has built about 2400 Supercharger stations. In 2020, Tesla will add more than 4000 charging stations, close to twice the total in the past five years.# Translation

朱晓彤 mentioned that the epidemic at the beginning of the year had a certain impact on the supercharging infrastructural plan. However, currently, the team of nearly one hundred people in charge of supercharging site selection and installation has been redeployed throughout the country, and the total goal of maintaining 4000+ chargers in the latter half of the year remains unchanged.

To enhance user interaction, Tesla China has launched 42 verified blue V accounts on social media platforms such as Douyin, Weibo, and Xiaohongshu, in addition to the previously mentioned yijian@tesla.com email. Tesla stated that these accounts will focus on popularizing scientific knowledge regarding vehicles and product features, and will not use humor or vulgar content to attract new followers.

Moreover, Tesla has integrated the user account system with its official WeChat service account, allowing users to receive more convenient services through WeChat binding.

Lastly, Tesla China’s app will separate from its overseas counterpart, and work on building a community and seller platform. The app’s function will no longer be limited to vehicle control.

Overall, Zhu Xiaotong’s statement and Tesla China’s change conveyed a core message: to uphold transparent, direct communication with users and fully localize operations to enhance user experience.

About Zhu Xiaotong

Elon Musk has overturned the operational strategy of “California commands the world,” and granted Tesla China significant autonomy. To a certain extent, this means that the direct responsible person sitting across from domestic automakers, joint ventures, and new car manufacturers has changed from Elon Musk to Zhu Xiaotong.

Therefore, it may be necessary to learn more about Zhu Xiaotong.

In April of 2014, Zhu Xiaotong joined Tesla China as the director of China’s supercharging project. At that time, Tesla China was facing significant challenges with charging network development.

Eight months after joining, Zhu Xiaotong led the establishment of 34 supercharging stations, 142 supercharging piles, and 600 destination charging piles across seventeen cities in China. With these achievements in 2014, Zhu Xiaotong was promoted to Tesla China’s general manager, responsible for overall operations.In August 2018, Tesla changed its business registration to become the first wholly foreign-owned enterprise in China capable of producing, selling, providing after-sales services and performing maintenance for whole vehicles, after China lifted the joint venture limit for new energy vehicle manufacturing.

At the same time, Zhu Xiaotong was appointed as the President of Tesla Asia Pacific and head of the Shanghai Super Factory. The Shanghai Super Factory was approved in 5 months after 3 days of planning and site selection, with the project agreement signed in 6 months. The foundation of the Tesla Shanghai Super Factory was laid in January 2019.

In late April 2019, Elon Musk mentioned at the Tesla earnings conference that the construction of the Shanghai factory was “incredibly smooth” and he was synchronizing with the factory progress via emails with the factory head, Tom (Zhu Xiaotong), seven days a week.

A month later, Tesla restructured its Asia Pacific operations, and Zhu Xiaotong was appointed as the Vice President of Tesla Global and the President of Greater China, in charge of mainland China, Hong Kong, and Taiwan.

Looking at Zhu Xiaotong’s resume, his outstanding achievements in the engineering field have earned him high praise. Li Xiang, the founder of Ideals, once praised him as one of Tesla’s most stable executives with strong abilities. But can he continue his success in software engineering and user operations?

Car owners who have attended many owner conferences commented that Zhu Xiaotong is low-key, speaks rapidly, and is a typical pragmatic person.

Looking back at the localization work of Tesla in China, we can see that pricing, navigation, and server migration to China to improve app performance are all issues unique to Tesla.

After solving these problems, Tesla China was qualified to compete with Chinese automakers on an equal footing.

On the other hand, we can see subtle differences in the competitive dimension.

For example, Tesla’s service quality has been the most significant point of controversy over the past period, while NIO’s service quality has set an industry benchmark. Tesla’s Superchargers are lagging behind the growth rate of ownership, resulting in range anxiety in daily use, while Ideals have solved this problem by increasing the range of electric vehicles to almost 100%. Tesla’s Autopilot has long been biased towards “American” logic in automatic assistance and navigation driving and automatic parking, while XPeng’s intelligent parking has perfectly considered the differences in Chinese parking scenarios.

In the near future, perhaps more excellent independent and joint venture brands will join the competition.

In July 2015, Zhu Xiaotong, as the Tesla China General Manager, gave his first media interview since taking office and talked about his views on new car manufacturing: the production of cars is a long battle, and participants must be mentally prepared; the product should have a profound understanding of and insight into human nature from the starting point.

It’s a fascinating time for China’s automotive industry.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.