Quote

A few days before New Year’s Day in 2018, I was talking with a close friend who was going to work for BYTON after the holiday. The topic was full of confidence after our exchange. However, two and half years later, several of my friends who worked for German car manufacturers went to work for BYTON and then left. This once promising startup has encountered many problems. I will explain my understanding of the situation, mostly based on my conversations with some friends, which may not be comprehensive but can serve as a reference.

Team and Work Method

BYTON is a very special case because its founding team is mostly made up of foreign personnel. Established in 2016 by FMC, which was invested by Harmony Auto and Future Mobility Corporation, and co-founded by ex-BMW executive Carsten Breitfeld and former Dongfeng Infiniti CEO Daniel Kirchert, the majority of its team comes from traditional car manufacturers such as BMW and Mercedes-Benz, as well as emerging companies such as Google and Tesla.

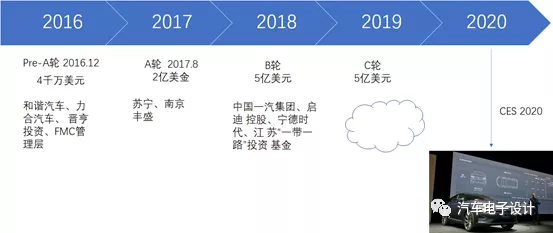

Due to the existence of this management and engineering team, BYTON was relatively easy to raise money. In 2016, when there was an abundance of venture capital available for various internet car manufacturers and new car makers, BYTON was taking advantage of this trend. First it raised $40m, then $200m, followed by $500m before its C round of financing. At CES 2020, BYTON made its final push for funding.

Actually, BYTON’s positioning as a high-end electric vehicle is very consistent with its future direction. The difference lies in founder Carsten Breitfeld’s ability to raise funds, and whether he is personally wealthy enough and willing to invest all his worth into his own project. A high-end route is an oil-adding strategy that requires sustained oil (funds).

BYTON’s financing history is shown below.

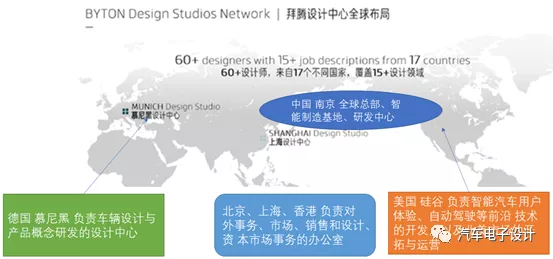

BYTON’s corresponding organizational structure is also shown here, with a global layout for seeking resources and opening offices worldwide. Although it is understandable to follow the practices of BBA (BMW, Benz and Audi), it is costly for a pure EV development company like BYTON to allocate so much money to so many locations with so many different responsibilities. The overall communication costs of such a heavily scattered organization are very high.

This brings up a core issue with Byton’s planning ability, or rather the part that can be imagined is very good, but the ability to quickly push new cars with product strength to the market, which is the most crucial aspect of evaluating a new car-making enterprise, has been continuously pushed back due to the characteristics of their previous human resources and management. The speed of consuming funds is fast and a lot of money is spent on the enterprise itself, but the lack of investment in quickly advancing the product is the main reason why the cars can’t be produced. There are a few paradoxes at play:

This brings up a core issue with Byton’s planning ability, or rather the part that can be imagined is very good, but the ability to quickly push new cars with product strength to the market, which is the most crucial aspect of evaluating a new car-making enterprise, has been continuously pushed back due to the characteristics of their previous human resources and management. The speed of consuming funds is fast and a lot of money is spent on the enterprise itself, but the lack of investment in quickly advancing the product is the main reason why the cars can’t be produced. There are a few paradoxes at play:

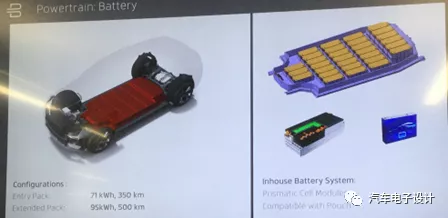

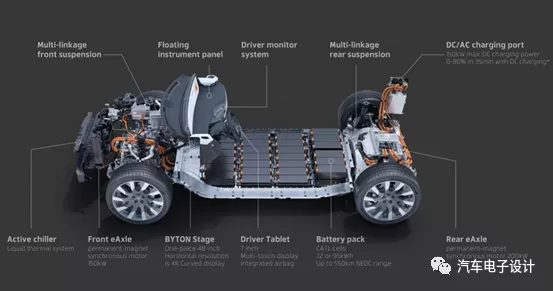

1) The concept car has too many cool features, such as a large screen, two battery and power systems configurations, and many high-end features that require a lot of funds to develop with suppliers and a lot of resources to be spent.

2) The positioning and team configuration are relatively open and relatively complete systems built to get things done, compared to traditional car companies. However, the problem is that to complete such a car, it requires a lot of people, money, and time which are difficult for a start-up company to achieve. If the management doesn’t tighten up their time management and instead only focuses on gathering funds and navigating restrictions, it will cause various delays to the product.

3) Later on, investors have to look at the progress of time, the speed of resource consumption, and compare them with other companies. Starting from 2016, struggling until 2018 when the car was not ready to be released, then delaying it again in 2019. This situation makes it difficult to achieve results, because starting in 2018, it was time for various new car-making enterprises to produce results.

In the end, this matter can only be considered for overseas sales because the cost of establishing a system in China is high. There is no room for the story to iterate due to the lack of speed. Then the pandemic made all new car-making companies face financial difficulties indiscriminately.

Product Update Speed

2020 was very unique because Tesla quickly localized and conquered the Chinese market. This process was absolutely stressful for new car-making companies. The high-end new car-making enterprises were the first hit, and their products needed to be competitive.Let’s review the design of this battery system. If it had been put into production in 2018 with its cutting-edge design, it still would have been mainstream in 2019, but in 2020, if they continue producing standard modules with 71 kwh and 95 kwh, they won’t have a big advantage compared to Audi E-tron’s 390 module.

In other words, with the passage of time and the technological iteration of the Chinese market, the value of this previously high-end powertrain system has basically become worthless. If they continue using this system, there won’t be cost advantages for vehicles and they’ll fall behind in many features. In 2020, the main models are heading towards 500 km and 600 km.

Conclusion

In my personal opinion, Byton’s survival space is narrow due to time wasted by the management and execution team, which has led to missed opportunities. With Tesla entering China and producing high-end electric cars, Byton won’t have much space left to survive. Why buy their cars when you can buy a similar one from Tesla? NIO is a good example of a company working hard to polish their product and gain competitiveness in the market.

As my friend says, “it’s a mess, and the employees who are struggling to make a living are the unfortunate ones.” In the future of the automotive industry, both personal struggle and corporate development must be considered to survive and thrive. If the company is going downhill, then the individual’s hard work will be in vain. The individual’s survival and development also require a proper assessment of the situation.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.