“Future Map” – a roundtable discussion on the future of automotive technology initiated by Garage 42, gathers the most valuable insights in a complex flow of information, to glimpse together at the shape of the future. This column welcomes submissions and can be contacted via WeChat account “iidaji”.

Author introduction: Procsql, a professional in digital automotive industry, formerly a product manager in a foreign-funded automaker. Enjoys reading, writing, and making friends, and welcomes everyone to explore and exchange ideas about industry issues.

I was fortunate enough to read an article by Peter Mertens, former Head of R&D at Audi, titled “There will be blood, we all did sleep,” which is a sharp piece. Mertens experienced the dilemma of Volkswagen’s software transformation and pointed out the serious and unsolvable underlying problems encountered in digital exploration.

However, Mertens placed too much emphasis on the role played by software, which is obviously not in line with the industry’s cutting-edge cognition. The key to the future development of the automotive industry is to open up the “Junction Points” of the overall architecture. In addition to software, the three key elements of the architecture are hardware processors and communication modules.

#

The article made an analogy: an octopus has 8 arms, and each arm has an independent brain to manage it. These 8 little brains communicate with the central brain. Mertens views the arms of the octopus as different subsystems in the car. As the ICE (Internal Combustion Engine) industry has matured, each subsystem has been fully defined and outsourced to more efficient and lower-cost tier 1 suppliers…real innovation is no longer happening.

When traditional mechanisms are highly advanced for a long time, the automotive industry happens to face digital transformation. At this time, car companies have lost their innovation and can only helplessly hand over the entire product to (equally clueless) third-party suppliers, but car companies don’t even have the ability to inspect the quality. (90% of Volkswagen’s software is outsourced, and the final ID.3 has “huge software vulnerabilities”- Volkswagen official announcement)

Herbert Diess lost his position as CEO of Volkswagen Group due to the software disasters of Golf 8 and ID.3, but his successor, Brandstätter, cannot reverse the situation. Mertens pointed out that old school career managers never wrote a line of code during their entire careers, or don’t even understand it, but they are making critical decisions in software.

Awkward situations are not only troubling the public. When Mercedes-Benz and BMW face the (relatively) advanced stage of autonomous driving, both sides are dumbfounded by the new ideology, so they can only huddle together and establish a research and development cooperation to keep warm. Sure enough, due to unclear strategic goals, the cooperation was suspended less than a year later after it was established…

Awkward situations are not only troubling the public. When Mercedes-Benz and BMW face the (relatively) advanced stage of autonomous driving, both sides are dumbfounded by the new ideology, so they can only huddle together and establish a research and development cooperation to keep warm. Sure enough, due to unclear strategic goals, the cooperation was suspended less than a year later after it was established…

Although innovation is difficult, German car companies still have strong momentum. Mercedes-Benz quickly teamed up with NVIDIA to develop the next generation of in-vehicle architecture for 2024; while BMW’s ADAS system has always been the industry’s leading standard, laying a solid foundation for future actions. In comparison, non-German car companies are more dangerous. Many car companies don’t even struggle, pretending to be dumb or sleeping, and some car companies directly “cut themselves” and sacrifice themselves to technology start-ups. I won’t go into details here.

Peter Mertens’ article raises a question: the importance of software is emphasized many times in the text, so is software the stumbling block to innovation? By solving the problem of software, can most of the problems of digital transformation of the automotive industry be solved easily?

To answer this question, it is necessary to first understand when software became the “thorn in the eye” of car companies. A few years ago, the industry began to spread the concept of “software-defined vehicles (SDV)”, which did not originate from rigorous academic arguments, but from a quotation from the then-CEO of Volkswagen:

“In the not-too-distant future, cars will become a software product, and Volkswagen will become a software-driven company.”- Dr. Herbert Diess, CEO of the Volkswagen Group

This concept was discovered by Wang Jin, one of the “Four Heavenly Kings” of Baidu’s autonomous driving at the time, and then spread domestically. Diess represents traditional giants, and Wang Jin represents the Internet. The square of the big shots is the infinite expansion of big shots’ golden sentences.

Looking back at the environment at that time, although Volkswagen’s proposal of “software-defined vehicles” was limited by the times, Diess was leading the pack in terms of vision and scale at the time. However, after careful consideration, European companies are not necessarily advantageous by relying too much on software (making software is actually just a heavy operation). Compared with Chinese companies that rely on demographic dividends, European companies are inflexible. They cannot compete with mature outsourcing in terms of cost control and cannot surpass the United States in terms of innovation.When car companies realized the necessity of transformation, they didn’t know which direction to take. Mercedes put together CASE (Connected, Autonomous, Share & Services, Electric) with the help of McKinsey, while BMW rearranged the letters to come up with ACES. On the other hand, Diess’s strategy was relatively pragmatic, focusing on the MEB platform for new energy vehicles and quietly experimenting with digital software.

Jack Welch emphasized many times that a company’s strategy is for the top leader to point a direction and have everyone run towards it. However, the four letters indicating four different directions each require a lot of money and have complicated overlaps, making everyone confused about the future at that time.

As Li Xiang once said, “Would a company like Baidu be afraid of Sogou and Yahoo doing search engines? No, what Baidu is truly afraid of is new media like WeChat and Toutiao taking away traffic.” Similarly, do car company giants fear new energy vehicles? No, they relax and wait for a head-on challenge like a sparrow hawk. However, what Volkswagen truly fears is the industry not developing according to the original script. When the core of the automobile becomes a highly integrated digital platform and delivered to consumers via OTA updates, Volkswagen does not want to follow in the footsteps of Nokia.

With the rapid evolution of the entire industry, “big names” are quickly being questioned. Who will define the operating system for software-defined cars? How to deal with information silos in software development? How can we create an ecological scenario for software on a car? Product managers encounter many similar “killer questions” in their daily work. Finding answers from a software perspective is impossible.

The main task of a car is transportation, and passengers need to get out of the car once they reach their destination. Even if there is a song that hasn’t finished playing or a short film that is still playing, they are just side tasks. This makes it difficult to bring popular mobile applications such as “PUBG” to the car-side.

Starting from the car-side scenario is the key to good product development. For example, a relatively mature car navigation software’s functionality is still “neutered” compared to its mobile version. Is it because product managers are not focused enough? Of course not. The current lack of a convincing business cycle to motivate developers to invest in car-compatible software is the underlying cause.

Fragmented in-car scenarios are not issues that software applications like “Super ID” or “Family Bucket” can solve. These are strategic problems that involve fundamental business decisions. Software issues such as user interaction and UI design may only solve surface-level tactical problems. As history has taught us, we cannot disguise strategic laziness with tactical diligence.##

As the digital module becomes more important in the overall vehicle architecture, car-mounted software needs to break out of information silos. The term “software” is no longer adequate to define the characteristics of integrated applications. As software iterations become faster, the hardware requirements behind it become greater. In other words, software often solves surface-level issues. If the hardware and communication have not kept up, deeper and more fundamental issues should be addressed first.

Fundamental issues can be roughly divided into two categories: narrow hardware chip computing power and broad communication issues. Where there are problems, there are people trying to solve them. Companies like Qualcomm, NVIDIA, and Intel are entering the high computing power chip market, and communication infrastructure issues are being addressed by “base station fanatics” such as Huawei and the three major operators.

The entry of non-automotive chip giants into the closed and highly segmented automotive chip market depends on finding a balance between performance, quality, and cost. Quality requires time to be tested, but chip companies have indeed put in effort in terms of product performance and cost:

Xiaohan, the editor-in-chief of Auto Review, has written about the performance advantages of Qualcomm chips – “the new models can be said to have installed several tablet computers inside the car; as entertainment demands inside the car increase rapidly, computational demands are also increasing…In the face of complex task processing, the performance of old-fashioned car machine chips is stretched; comparing the specifications of the Qualcomm 820A chip with traditional car machine chips, the performance gap is evident (regardless of process or CPU frequency), not to mention that the 820A is the only chip on the market that supports “one chip and four screens””.

Comparison of product technical specifications between Qualcomm and several traditional automotive chip vendors (Source: Auto Review)

From a cost perspective, “car-grade chips” are not worth the expense. How many high-performance chips does an automobile typically need? What about the number of smartphones? Who wouldn’t first calculate whether the cost is sufficient for the scale of amortization? In fact, more and more mainstream automakers are abandoning “car-grade” chips and using consumer-grade chips directly. A few months of development is sufficient, and performance has been rigorously tested and proven durable by smartphone users. Most of the cost is also amortized. This avoids the massive financial and time costs of “car-grade” and ASIL certification requirements. The car’s own level threshold is a barrier to traditional automakers, which is not discussed in depth in this article.

Some people are concerned that consumer chips may not meet the working life requirements for temperature environments that car regulations demand (-40°C to 125°C). But extreme temperature environments are rare in reality… If passengers can’t tolerate the temperature, how can they require the cockpit to meet extreme temperature values?

#

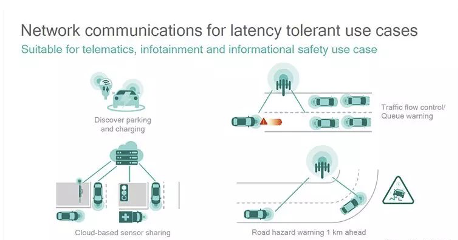

Car communication is a further challenge to automotive digitization, with significant returns: 5G technology will greatly change intelligent cabins, driving assistance, and other areas, bringing a comprehensive experience upgrade to the travel ecosystem.The software in the intelligent cockpit requires upgrade and update. Nowadays, having a system that can be upgraded is essential for a car to have “life”, as it is no longer the era of “standalone” that can satisfy consumers. However, the current transmission capability of vehicles can barely support basic OTA and cannot meet higher requirements, such as the C-V2X depicted by the interconnection of vehicles with other terminals. For this, a high-bandwidth, low-latency, and highly reliable communication system called “C-V2X” is required.

Before 5G communication technology matures, driving assistance solutions are achieved by sensors’ perception of the surrounding environment. The sensors carried by the car, whether it is a millimeter-wave radar or a camera, require a series of prerequisites to ensure safe driving, such as closed-loop road conditions, low-speed driving, and the processor needs to have high redundancy of computing power.

Some people in the industry compare sensors to canes for the blind, and they are by no means the “eyes” of the car; imagine a person using a cane to walk with their eyes closed, to avoid collisions with obstacles, they can only walk slowly and cannot run while the brain also needs extra redundant space to analyze complex road conditions.

“Driving it makes me more nervous than it does itself” – this is the true feedback of countless drivers after experiencing the driving assistance system.

This kind of experience is transitional and will become history with the commercial use of 5G: High-precision maps can play a greater role, such as providing a God’s eye view in real-time, and even allowing vehicles to communicate with other intelligent facilities. This will fundamentally change the driving assistance technology solutions, truly achieving “communication positioning as the main and perceptual scheme as the auxiliary”; at the same time, it also provides a technical path for a higher level of L4 autonomous driving.

Betting on software for an intelligent future is a bit like the “improving ourselves through the learning of the western world” advocated by China’s self-strengthening movement a hundred years ago. The backwardness of late Qing’s dynasty was not a technological problem, but the agrarian civilization could not provide a cradle for science and technology. The transformation of auto companies to digitalization is also the same; on the surface, it seems to be a software problem, but its core is the backwardness of infrastructure.

When Elon Musk developed the Model S, he obsessively controlled the entire vehicle wiring harness within 3 kilometers. Later, the harness requirements for Model 3 were 1.5 kilometers, while Model Y was only 100 meters. This forced Tesla to gradually optimize the EE network architecture and cable topology by trimming and integrating what could be consumed and removing what could be wireless.

As a driving assistance product manager of a foreign-funded car company at that time, I sent an email to the R&D department and asked, “What is the length of the whole vehicle wiring harness of our next-generation flagship product?” The reply I got was short and powerful: “Why? Who cares?” When it comes to Tesla’s products, some people see rough appearance interiors, while others see the ultimate art of mechanical aesthetics. It’s all in the eye of the beholder.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.