Recently, two low-key news have been released. The first is that Huawei Hisilicon has signed a cooperation agreement with BYD, and the first product is the Kirin 710A car chip used in the field of intelligent car cabins.

Starting from this Kirin chip, Hisilicon’s self-developed chips have officially begun to independently explore the application of digital car cabin in the automotive market. According to reports, “BYD has obtained the technical documentation of Kirin chip and started development.” At the beginning of this year, Kirin chips have been actively expanding into the automotive market, and cooperation with BYD is to achieve the landing of products through new car models.

The other news is that BYD Semiconductor has completed a Series A+ funding of RMB 800 million. The investors include 30 strategic investors, such as SK Group from South Korea, Xiaomi Changjiang Industry Fund, ARM, and SMIC. The valuation of this round of funding is as high as RMB 10.2 billion.

Huawei has already had cooperation with BYD in car intelligence. Prior to this, BYD has applied Huawei mobile NFC car keys, HiCar mobile phone screen projection schemes, and Huawei MH500 5G module in the new flagship car model, Han. However, this cooperation seems to be a step further. The Hisilicon department of Huawei is cooperating directly with BYD, and this Kirin chip has never been supplied to the market outside of Huawei mobile phones before.

This means that the Kirin chip may take the first step towards external openness, and it is also the beginning of Huawei’s chip “getting on board”.

More importantly, this cooperation means that chips with independent intellectual property rights in China have the capability to be “commercialized for cars”.

Huawei’s Road “On Board”

Huawei does not produce cars, but it has never been less present in the field of automotive.

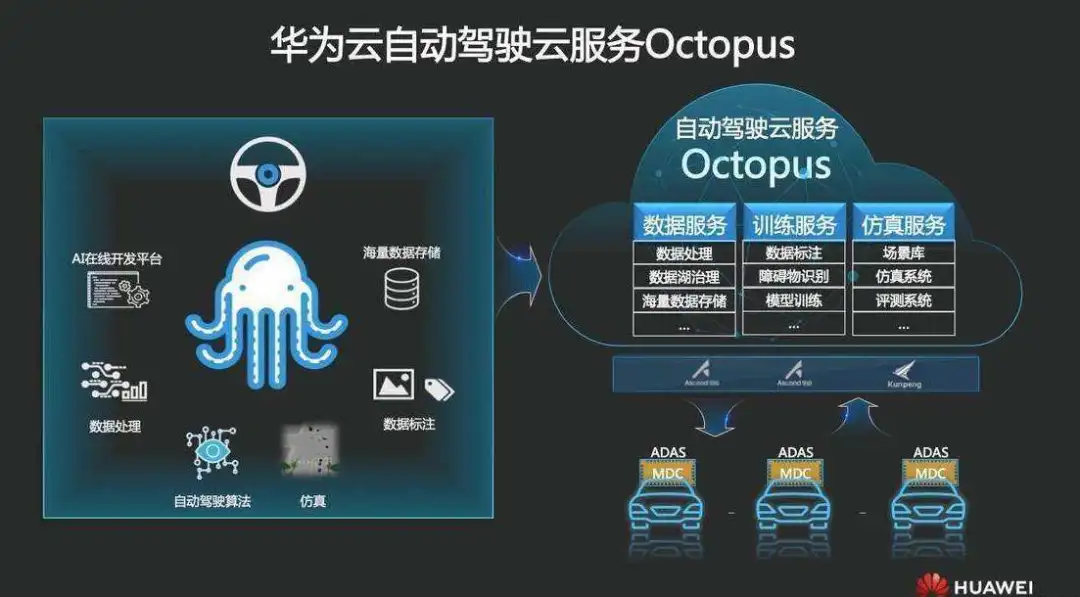

Since 2009, Huawei began to enter the intelligent automotive field, but the strategy was not to make hardware, only to focus on information and communication technology (ICT), positioning itself as a supplier of incremental components for intelligent cars, which means that Huawei’s task is to transform traditional cars into intelligent cars and serve as the “brain” of cars.

With this background in mind, let’s take a look at how Huawei did it. Since the establishment of the Intelligent Automotive Solutions Business Unit in May 2019, Huawei’s speed of “getting on board” has accelerated significantly. This can be seen from Huawei’s main progress in the automotive market in 2020.- In February, Huawei’s MDC intelligent driving computing platform and mPower intelligent electric platform obtained the ISO 26262 functional safety management system certification from international authoritative institutions successively;

- In April, Huawei’s advanced autonomous driving solution (ADS) also successfully passed the ASIL D certification of the automotive industry functional safety management system;

- In May, Huawei joined forces with 18 domestic and foreign automakers to establish the 5G Automotive Ecosystem, with the aim of accelerating the commercial use of 5G technology in automobiles.

In other words, after a series of layouts, Huawei has initially established a relatively complete set of software and hardware product systems in the fields of intelligent cockpit and autonomous driving.

Although the progress is fast, it is not easy for Huawei to do “incremental” in the solidified and tightly-knit automobile industry chain. First of all, what does Huawei mean by “incremental parts”?

It is very difficult to find the incremental market in the traditional automotive field. The main technology of the whole vehicle is firmly controlled by the host plant. Because the automotive industry has developed for a long time, there are mature suppliers for upstream and downstream parts of the vehicle, and there are intricately connected relationships between suppliers and host plants. Therefore, the success rate of breaking through barriers in this field is very low.

Note that the above-mentioned traditional automotive field, and the transformation towards intelligent automobiles is the trend. In the era of intelligentization, the “car” itself will become a hardware carrier, while the underlying technology and functional application of “intelligence” will become the core ability to differentiate the experience.

The incremental aspects of intelligent automobiles include intelligent driving, intelligent cockpit, intelligent network connection, and automobile cloud services.

In simple terms, to achieve these intelligences, both the underlying technology and the upper-layer applications are a kind of “information technology” service, which can be summarized as follows: intelligent driving means autonomous driving; intelligent cockpit refers to human-vehicle interaction, which is the space for intelligent automobiles to deliver functional applications to people; intelligent network connection represents the interconnection of vehicles through communication technology, and in the future, the interconnection of vehicles with roads; cloud services mainly serve the autonomous driving platform to enable real-time data sharing.

And what actually determines the competition is “chip strength.” Intelligent driving, environment perception, and human-vehicle interaction all require chips with high computing performance to support.

China wants to achieve overtaking on the smart car industry, and “chips” are an unavoidable obstacle. Currently, Huawei is the only company in China that can achieve independent “chips” with complete product lines for consumer, industrial, and automotive levels. Thus, smart cars have brought a new industry gap, and whoever has the ability to occupy and complete the gap will gain the greatest voice and commercial benefits.

China wants to achieve overtaking on the smart car industry, and “chips” are an unavoidable obstacle. Currently, Huawei is the only company in China that can achieve independent “chips” with complete product lines for consumer, industrial, and automotive levels. Thus, smart cars have brought a new industry gap, and whoever has the ability to occupy and complete the gap will gain the greatest voice and commercial benefits.

A gap torn by Kirin

For autonomous driving to truly land, it requires high computing power from autonomous driving chips. Similarly, a smooth operating car machine requires high-reliability car machine chips.

Therefore, in competition with foreign competitors in these two aspects, China cannot easily let go; otherwise, the bend will only bring a “rollover.” Let’s take a look at these two areas;

First, take a look at the almost monopoly of foreign companies in autonomous driving chips.

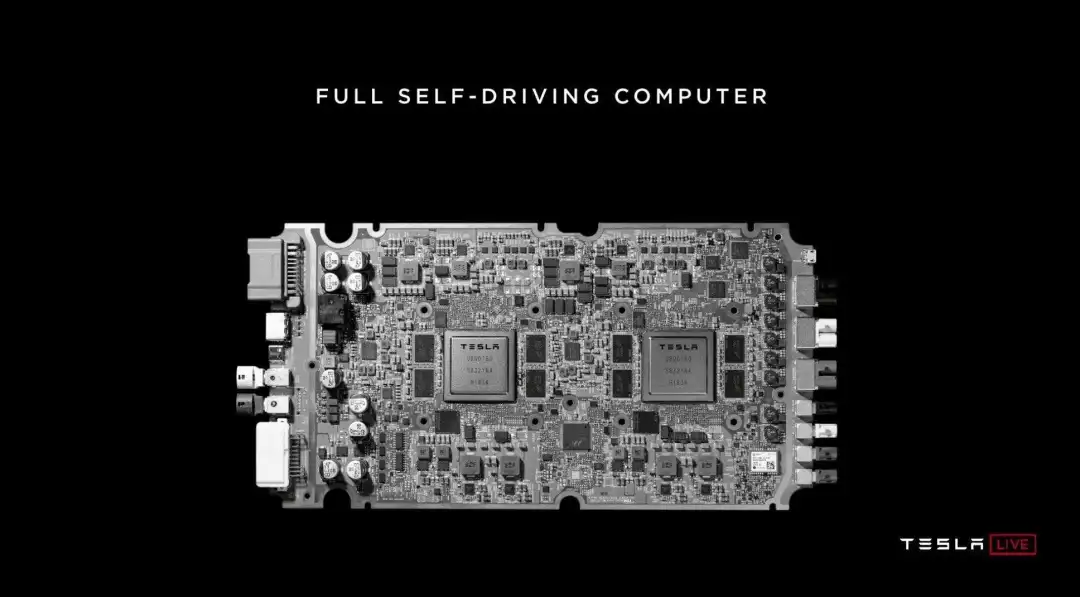

Even if Tesla is strong, what can it do? Before 2019, it had been constantly bullied between Mobileye and NVIDIA. This is why it has its own self-developed FSD chip. The 144 Tops computing power is absolutely devastating among chips that are already in production.

Although Tesla skipped NVIDIA and chose to self-develop its own chips, NVIDIA is well aware that there are not many manufacturers like Tesla, and currently there is only one. FSD cannot be supplied externally. Moreover, FSD is known for its “image processing capability,” and Tesla adopts a visual perception route. Therefore, FSD is more like a chip customized for its own advanced driving assistance system.

NVIDIA is different. Firstly, as a supplier, this chip must meet the needs of most manufacturers, and it also needs to meet special customization, so the comprehensive strength is more balanced.

Secondly, there are many domestic and foreign manufacturers now joining the NVIDIA team, including XPeng, Volkswagen, Daimler, and Toyota.

Mobileye’s strength in the field of autonomous driving chips cannot be underestimated either. It is a subsidiary of Intel and can provide a series of chips, hardware, high-definition maps, driving strategies, and safe software, including EyeQ series. Team members include NIO, Ideal, BMW, Great Wall, and other manufacturers.To make sense of what follows, you might ask: What does this have to do with BYD and Huawei? As it turns out, the answer is that this relationship is not only relevant but also very important. Looking at the cooperative car companies between NVIDIA and Mobileye, we can see that except for Tesla’s self-developed chips, the two companies have almost monopolized the chip market for automotive driving. Moreover, the two companies are clearly divided – Mobileye mainly monopolizes the L2 level of automatic driving market, although it is currently cooperating with NIO to develop the L4 level, while NVIDIA is more inclined to control the L4 and higher level of automatic driving chip market.

This brings three potential risks to Chinese manufacturers:

-

Price hikes: Once the industry continues to deepen, manufacturers will be bound by chip manufacturers if they cannot self-develop chips. Furthermore, as the industry is still in its early stage, chip manufacturers need to team up with automakers to expand the market. When the industry matures and automakers form a technological reliance on specific chips, manufacturers will lose their bargaining power.

-

Reduced production or supply interruption: There are two aspects to this issue. One is the “supply interruption” caused by subjective will, which would be a fatal blow for domestic manufacturers. The other is the production reduction or supply interruption caused by the technological restrictions imposed by the US government, for example.

-

Priority updating rights for the latest technology: In addition to supply interruptions and bargaining power, there is another important issue: technological restrictions on China, which can be simply understood as the inability of Chinese manufacturers to have the priority updating rights for the latest technology. This will seriously limit their technological development.

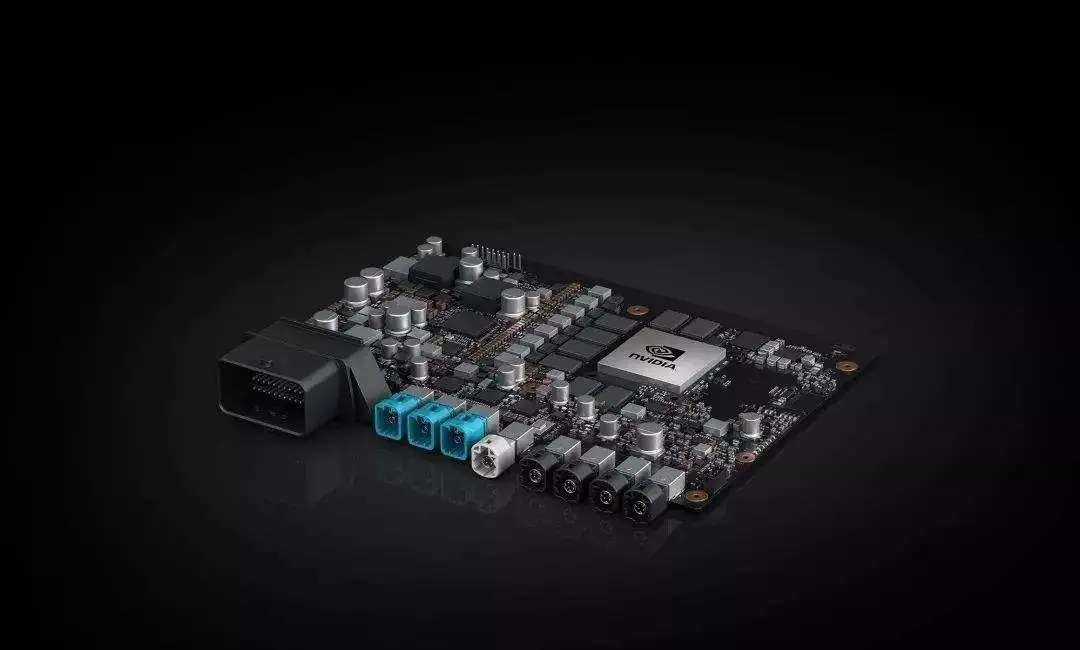

Therefore, Huawei’s release of the MDC600, a computing platform that supports L4 and above level of automatic driving, offers Chinese manufacturers another choice that is more in line with the Chinese autonomous driving scenario.

The MDC600 is composed of eight Ascend chips, CPU, and ISP modules, with a system computing power of 352 Tops, surpassing NVIDIA’s highest 320 Tops, while reducing power consumption by 35%. Although this chip has not been mass-produced on a large scale, it is the driving force behind enhancing confidence in China’s intelligent automotive industry.

Secondly, let’s take a look at the field of smart cabins.

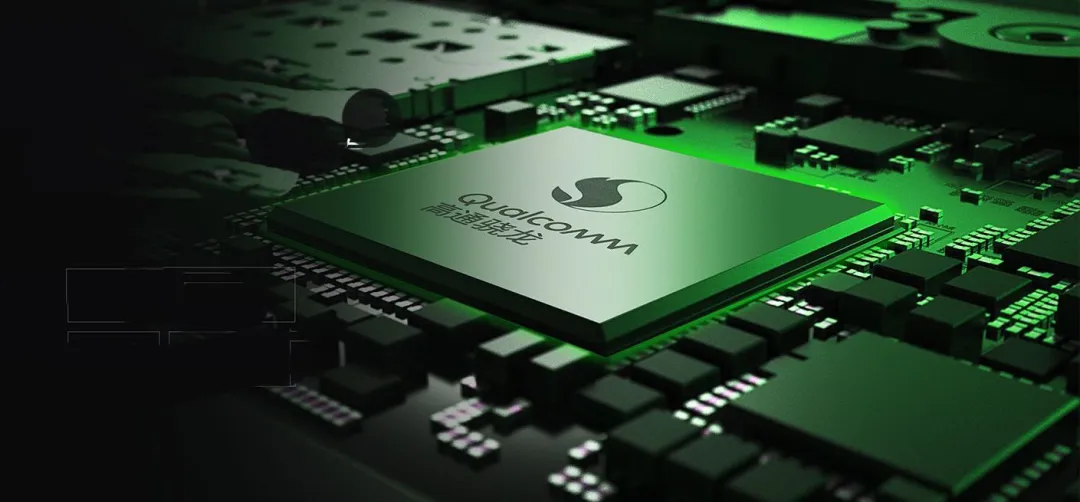

The development of smart cabin functionality is mainly focused on Infotainment, and chips are the decisive factor in whether the Infotainment system is good or not.Among the mainstream car manufacturers, NIO uses NVIDIA Tegra X2, while Tesla has used Tegra 3 and Intel Atom A 3950. XPeng P7, Li ONE, and Lynk & Co 05 all use Qualcomm 820A chips, which are so powerful that they were once bought out by car manufacturers.

In the field of in-vehicle chips, NVIDIA and Qualcomm dominate the market. Of course, you might say that there are other chips such as NXP, but you can see from XPeng’s first generation G3 in-car system, which had problems with lag and delays, why manufacturers choose Qualcomm, because the others are just not good enough.

Like autonomous driving chips, in-vehicle chips also face the risk of supply disruption, so Huawei’s 710A also plays a role in filling the market gap.

It’s not easy to compete with Qualcomm to get into the game.

So let’s take a look at the specs of Kirin 710A compared to Snapdragon 820A.

The 710A, which was launched by Hisilicon in April of this year, was originally used for mobile phones, just like the Qualcomm 820A. Originally, the 710A also used TSMC’s 12nm process, but due to the US sanctions, Huawei placed a production order with SMIC, and the process was switched to 14nm. In terms of manufacturing process, there is not much difference between these two chips.

The 710A’s CPU features 4 A73 and 4 A53 cores, using ARM’s big.LITTLE hybrid architecture design, with maximum frequencies of 2.2GHz and 1.7GHz for the big and small cores, respectively.

The GPU is integrated with ARM’s Mali-G51, supporting a maximum resolution of 4K; it also includes Huawei’s 4G communication module, which contains a Cat 12/13 modem with a peak download speed of 600Mbps and an upload speed of 150Mbps.

Unlike the Kirin 710A, which is based on ARM’s public CPU architecture and GPU core, the Snapdragon 820A integrates more self-developed architectures, cores, and communication modules from Qualcomm.The CPU of 820A is a 64-bit quad-core processor (Kryo CPU) with a custom-made main frequency of 2.1GHz by Qualcomm. The DSP used is Hexagon 680, also developed by Qualcomm, which supports vector extensions. The GPU is Adreno 530, also from Qualcomm.

Simply put, the 820A has better specifications in terms of materials and is superior to the 710A mainly in CPU and GPU. For example, while the 710A supports up to 4K resolution, the Snapdragon 820A can support multiple 4K touch screen displays.

In terms of CPU processing, there is not much difference between the two chips. In other words, the data performance of the 710A is not inferior to that of the 820A. Moreover, the 710A was released in 2018, while the 820A was theoretically superior to the 710A in terms of technical specifications since it was released in 2016.

Therefore, Huawei’s entry into the industry can fill the gap in China’s car chip market and provide car manufacturers with more opportunities for selection.

Why BYD was chosen

This may be the beginning of Chinese companies helping each other in the face of external pressures.

Why did Huawei choose BYD as its first partner for the 710A? Let’s think about it from two aspects:

First, Huawei needs BYD to act as an experimental field.

As mentioned earlier, the 710A marked Huawei’s entry into the industry, but the biggest problem is that the 710A has no practical experience, while the 820A has been validated on products such as Xpeng and Li Auto, which is Huawei’s biggest practical problem.

New domestic car makers dare not be the first to use the 710A because they do not have practical experience and their development is not yet stable. If a function is not done well, it could be infinitely magnified and thus affect the survival of the enterprise.

Domestic car manufacturers hope to achieve rapid delivery of functions, and thus have no time to build rapport with Huawei.

Traditional car makers have a slow process of intelligent transformation, and some car makers do not even have a basic understanding of intelligent transformation, so there are few companies that can be cooperative.

BYD is an automaker facing automotive change. Every step it takes now and in the future must be careful. 710A is installed in the Han model, which is BYD’s flagship model this year and shoulders the heavy responsibility of BYD’s intelligent development. If there are bugs or delays in large-scale delivery of the solution, it could be a fatal blow to BYD. Even if it can be replaced, it will cause huge losses.

For BYD, the risk is enormous. BYD could have used a more mature solution from Qualcomm, but it still chose Huawei. This is indeed commendable.Therefore, BYD and Huawei’s move is quite bold and courageous. Of course, the 710A is certainly validated through a testing process.

Second, BYD is the most like a new force among traditional automakers.

There has always been a question of whether BYD is a new car maker or a traditional automaker, but no matter what, BYD’s performance in new energy products is indeed outstanding, with a sales volume ranking in the top two in the industry.

Why is BYD considered a new force? In addition to producing new energy vehicle products, BYD is relatively aggressive in intelligence, taking the lead in proposing self-developed vehicle-machine systems and building its own application ecology, and attempting new human-vehicle interaction methods with a rotating vehicle-machine screen.

BYD knows that the vehicle-machine system is an important window for host manufacturers to interact with users, and the core of supporting the in-car system ecological strategy is the vehicle-machine chip. Therefore, Huawei can have more room for cooperation with BYD in the direction of intelligent cabins.

If Huawei’s entry into the automotive chip market can provide more choice for Chinese automakers, then automakers embracing Huawei and other chip companies is a move to break through the technology blockade of foreign companies with practical actions.

Although Huawei’s Kirin chips are available, production limitations still put pressure on the Kirin chip’s delivery. Many people have been pessimistic about the short-term development of Chinese semiconductor companies, and in the uncertain situation of the future, the cooperation between BYD and Huawei could be considered a bold bet based on trust.

BYD’s Independent Semiconductor Company – A New Imagination?

Some believe that BYD’s establishment of a semiconductor company may prepare for Huawei’s OEM work. Previously, there have been cases of BYD’s OEM consumer electronics products for Huawei, so the production problems caused by TSMC will be solved by SMIC and BYD.

This view is basically untenable because BYD’s semiconductor business is highly probable to focus only on products related to automotive electronics.

If we were to introduce BYD now, it is no longer a single “automotive” company. Batteries, electronics, and semiconductors constitute BYD’s current business as a whole. As early as 2007, BYD spun off its mobile phone components and module, printed circuit board assembly, and other businesses into a subsidiary, BYD Electronic (International) Co., Ltd., which was listed on the Hong Kong Stock Exchange in December 2007.

Today, BYD Electronics’ revenue has remained stable. Now, BYD has established a semiconductor company and is seeking independent listing.BYD Semiconductor’s main business is IGBT (Insulated Gate Bipolar Transistor), which is one of the most important high-power mainstream semiconductors currently used in motor control, power conversion, uninterruptible power supply, and other scenarios, and is crucial for controlling the power of electric vehicles. In addition, IGBT can also be applied in household appliances, industry, and other fields, with a large market space.

According to professionals on the internet, BYD’s “IGBT technology is quite mature; the difficulty is not great. However, the international market is still dominated by foreign companies.” Currently, the global IGBT market is long-term dominated by five foreign companies, including Infineon, Mitsubishi Electric, and Fuji Electric, with a market share of over 70\%.

However, these companies are still unable to completely dominate the Chinese market. Public information shows that with the advantage of its electric vehicle business, BYD’s domestic IGBT shipments in 2019 were approximately 190,000 sets, with a market share of 18\%, second only to Infineon.

“The Chinese new energy vehicle industry will continue to expand, and the great probability that it brings will be a huge, brand new automotive parts supply chain pattern.” The scale of the IGBT market will continue to expand. According to the “2019 Chinese IGBT Industry Development and Market Report,” it is estimated that the scale of China’s IGBT market will increase from approximately CNY 16.2 billion in 2019 to CNY 52.2 billion by 2025.

BYD’s IGBT 4.0 launched in December 2018 can output 15\% more electric current than mainstream products, reduce comprehensive losses by 20\%, and have a temperature cycle life of more than 10 times that of mainstream products, breaking the situation in which IGBT is constrained by foreign countries.

As for the next generation of silicon carbide technology, BYD also has reserves. They have successfully developed SiC MOSFET and are expected to achieve full replacement of IGBT with silicon carbide by 2023. Based on the above information, it can be concluded that BYD still has great development space in the IGBT business.

Finally, with Huawei’s HiSilicon opening up the car chip market, the possibility of Qualcomm and other vendors’ monopoly will decrease. Unlike Qualcomm, if Huawei can integrate its automatic driving chips, algorithms, and car-based Hongmeng OS, it will not only have its own commercial value, but also provide a strategic choice for Chinese car companies. Even if it is not currently used, car companies will still cooperate with Huawei.“`

Huawei HiSilicon’s entry into the automotive field with the Kirin 710A is just the beginning, as the Kirin series of chips will have more products targeting the automotive market in the future, snatching market share from competitors such as Qualcomm.

As a new entrant among the world’s top ten semiconductor manufacturers, no one can predict how large a wave Huawei HiSilicon will create in the automotive chip market, and this journey is bound to be full of dangers.

“`

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.