After jumping several times, the red line rushed up to the high point of the blank area without reservation. Yes, Tesla’s stock price broke through $1000 and surpassed Toyota Motor to become the world’s largest car company by market capitalization. It closed at $1025 per share with an increase of 8.97%, resulting in a market capitalization of $190 billion.

Although just over a month ago, Tesla CEO Elon Musk tweeted: “Tesla stock price is too high imo”, his modesty ultimately failed to stop the bullish trend. With the successful launch of brother company SpaceX Falcon 9, its stock price broke through a new high.

We knew this moment would come, but it came earlier than expected. At this bleak moment, Tesla’s stock price really went up for no reason.

The mystery surge

2020 is a year that everyone wants to delete from the calendar, even the robust Tesla has been greatly affected.

In mid-March, the COVID-19 outbreak in the United States forced Panasonic to withdraw 3,500 employees responsible for battery production from Giga Nevada. With the shutdown of Giga Nevada, the Fremont factory, responsible for vehicle production, also shut down.

For Tesla, whose inventory cycle is only 11 days, production shutdown means no sales. This situation lasted from the end of March until early May.

According to EV Sales data, Tesla’s global sales in April this year were 14,793 units, while global sales in March were 60,131 units, a MoM decline of over 75%.

If you think this is normal for Tesla, which always rushes sales at the end of each quarter and has the worst sales in the first month of each quarter, let’s take a look at another comparison.In April of last year, Tesla sold 20,823 vehicles, which means a year-over-year decline of 28.9%.

It should be noted that in April 2020, compared to April 2019, Tesla not only had the new Model Y, but also had a larger customer base. Moreover, Tesla’s delivery guidance increased from 360,000 in 2019 to 500,000, so no matter from which perspective, the sales volume in April is very bad.

I believe Elon also sees this data, but the factory still cannot reopen due to COVID-19 prevention measures.

On May 12th, Elon couldn’t take it anymore and directly shouted to local governments on Twitter: “Tesla is restarting production today against Alameda County rules.I will be on the line with everyone else.If anyone is arrested,I ask that it only be me.”

Tesla restarted production against the rules in Alameda County today, and I will return to the production line with everyone else. If anyone is arrested, it should be me.

But what are the results?

In May, in China, where the epidemic had a relatively small impact, with the help of the Tesla Shanghai Super Factory, sales of 11,095 Model 3s were achieved, but the US region is still not optimistic.

In the Q1 2020 earnings call at the end of April, Elon said that even if restarted, the factory would face capacity constraints due to the slow supply chain response.

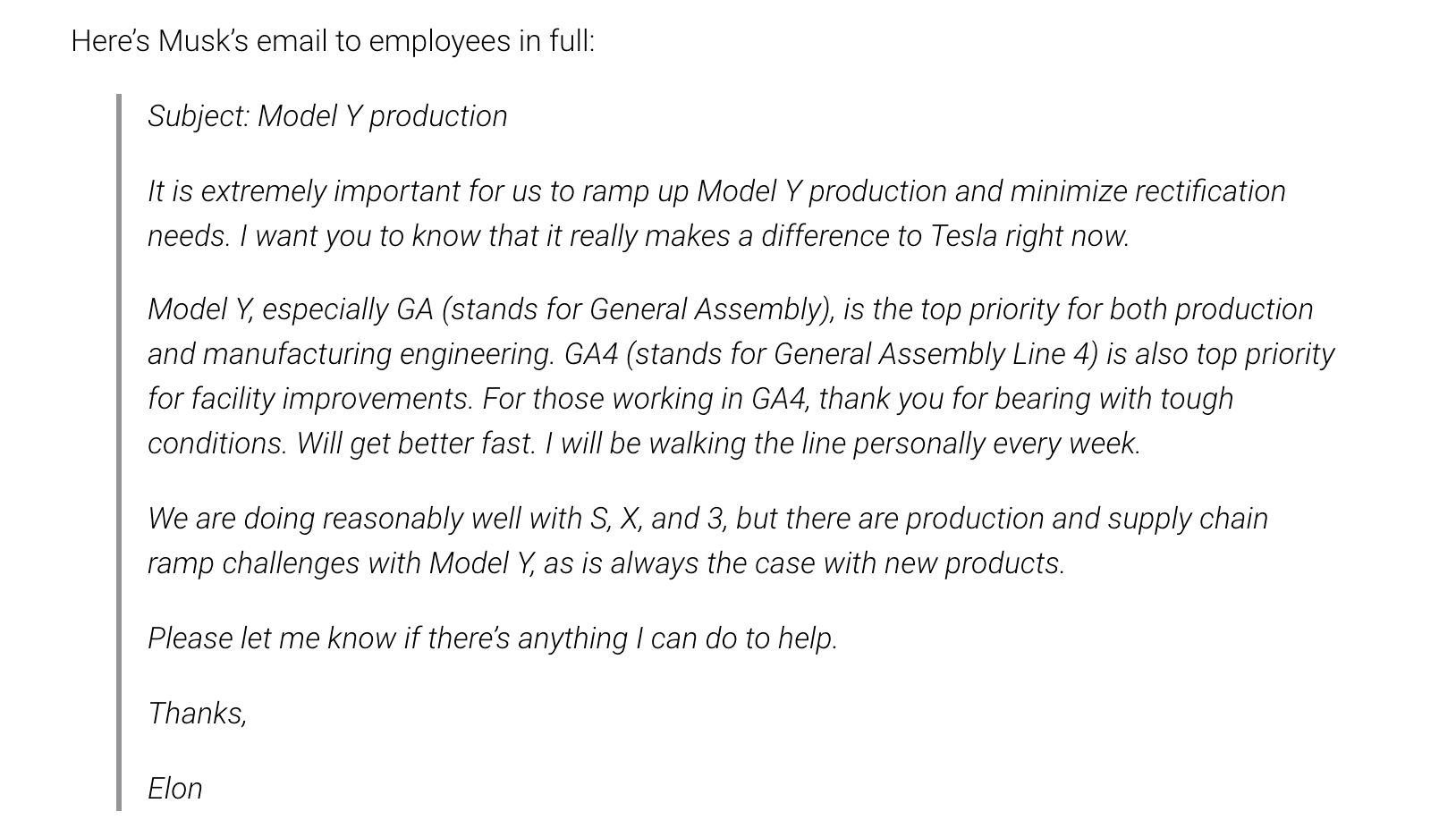

In a recent all-team email, Elon emphasized again: “For us, it is very important to increase the production capacity of Model Y and reduce the number of corrections. I want you to know that this is very important to Tesla. We have done very well on Model S, X and 3, but Model Y faces challenges in production and the supply chain on capacity climbing.”

Clearly, the epidemic has had a profound impact on Tesla’s production and sales.

To make matters worse, according to sources, four employees on the Model S/X production line tested positive for the novel coronavirus (COVID-19).

At such a difficult time, Tesla’s Vice President of Global Business Development and the only Chinese participant in the shareholders’ meeting, Ren Yuxiang, officially resigned in June 2020.

At this bleak time, there are no good news to stimulate Tesla’s stock price, yet still surpassing Toyota, making it the world’s most valuable automaker.

Goodbye, Toyota

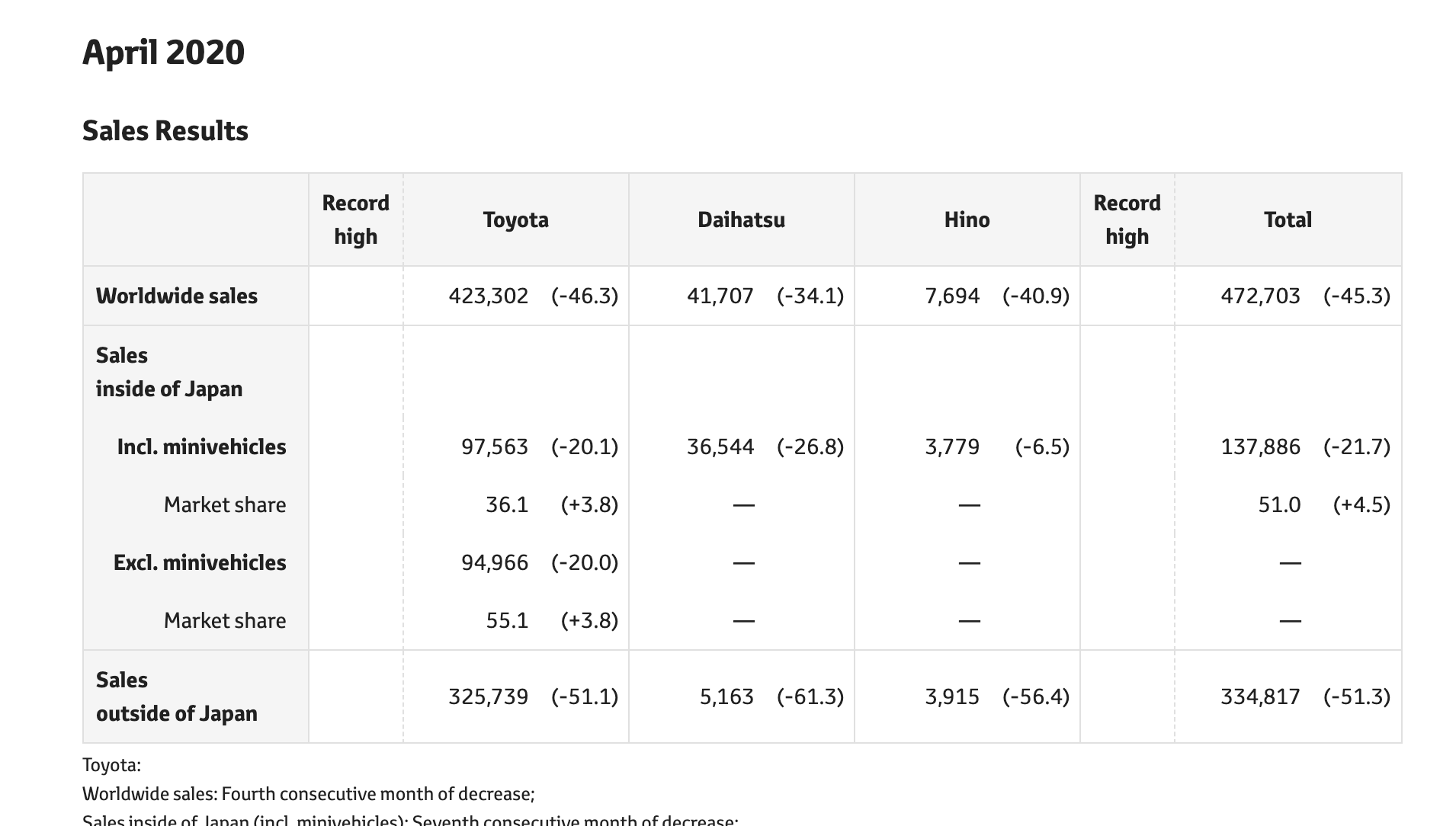

Toyota sold 423,302 cars globally in April 2020, a 46% drop year on year, but it is still more than 25 times Tesla’s global sales in April 2020.

With such a huge difference in sales, what supports Tesla’s high market value?

We can no longer simply look at the “automakers” from the perspective of “sales” because fundamentally, these two automakers are doing different things.

Tesla has been striving to achieve two things to the extreme: electrification and intelligence. As the leader in these two fields, it’s only a matter of time before its market value surpasses Toyota.

Why is that?

Seeking alternatives to fossil fuels with renewable sources of energy is something that every country is doing. Whether you admit it or not, Tesla has already found a way to replace fuel vehicles with electric ones, and as time goes by, more and more automakers will follow this path.

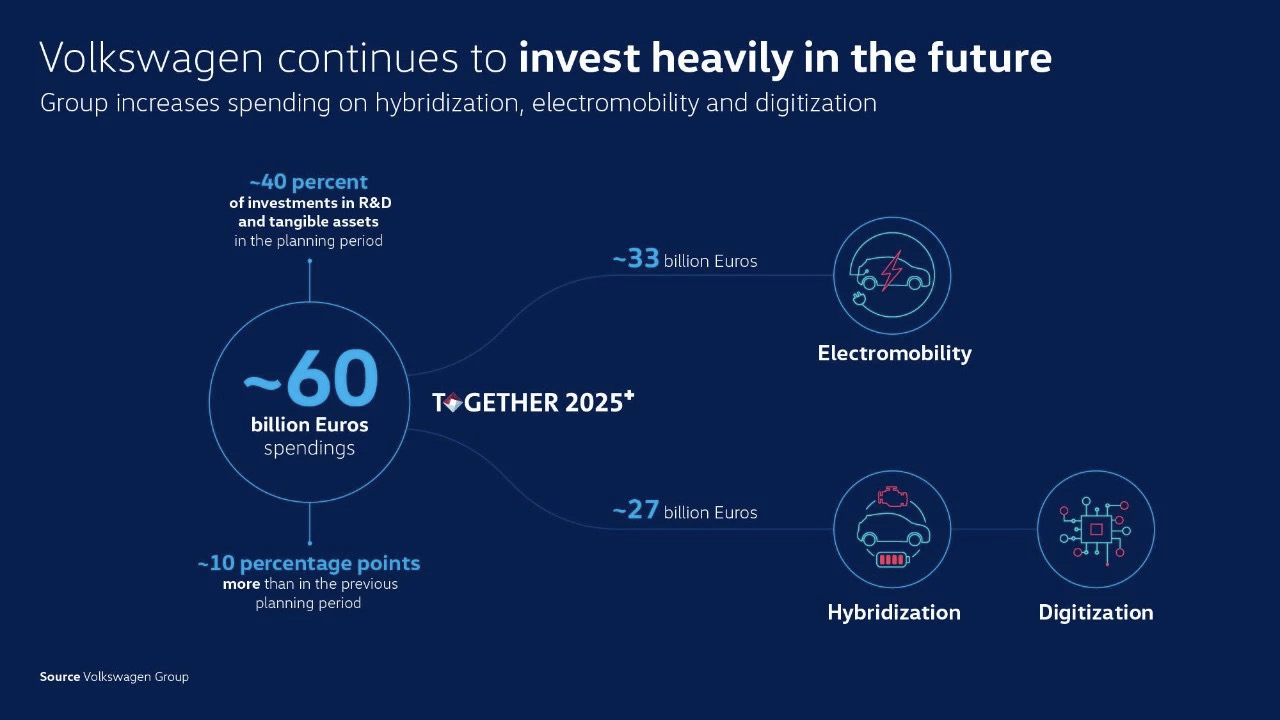

From 2019, the Volkswagen Group announced that it would invest 60 billion euros in hybrid and electric vehicles and digitalization from 2020 to 2024, of which 33 billion euros will go to electrification. Volkswagen expects to achieve mass production of 1 million MEB platform models by 2025.

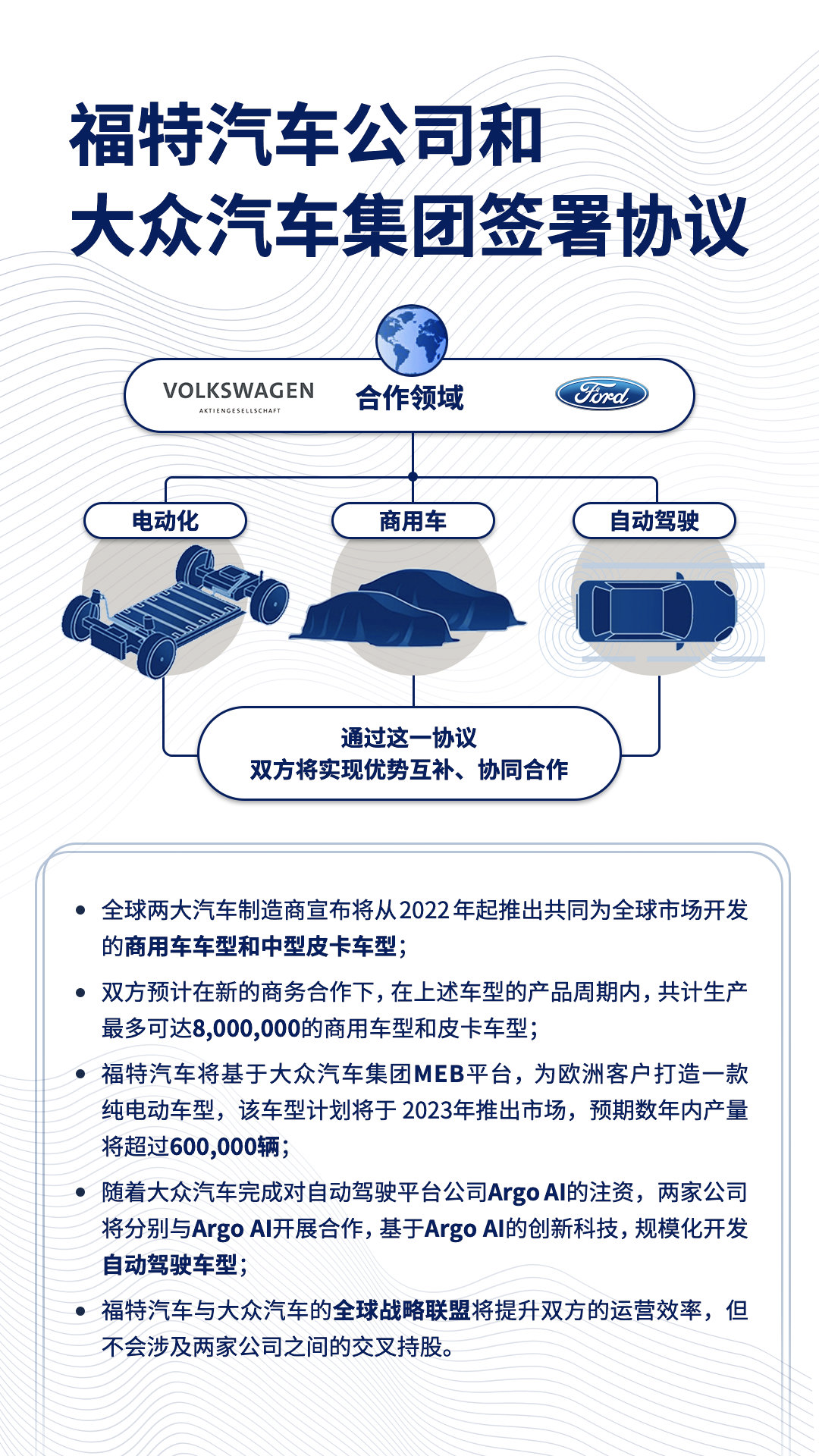

On June 10th, Ford and Volkswagen officially signed an agreement: Ford will create a pure electric vehicle based on Volkswagen’s MEB platform for European customers, and the vehicle is expected to be launched in 2023 with a production target of over 600,000 units in the next few years.

On June 10th, Ford and Volkswagen officially signed an agreement: Ford will create a pure electric vehicle based on Volkswagen’s MEB platform for European customers, and the vehicle is expected to be launched in 2023 with a production target of over 600,000 units in the next few years.

General Motors has also announced that it will invest $20bn in electric vehicles and autonomous driving technology from 2020 to 2025.

With more and more automakers recognizing this trend, Tesla’s advantage is becoming increasingly apparent.

Although Chinese automakers have launched models with a range of over 600 km on the NEDC cycle, seemingly catching up to Tesla’s Model 3 in terms of battery technology, the Model 3 was released four years ago and put into production three years ago, meaning that Tesla has at least 3-4 years of technological advantage in battery technology.

Tesla CEO Elon Musk has also revealed several times that Tesla will host its Battery Day event in the near future.

From what we currently know, Jeff Dahn’s research group, which has signed an exclusive partnership agreement with Tesla, has developed batteries with a lifespan of over 1.6 million miles.

In February 2019, Tesla acquired Maxwell, a company that mastered “dry electrode technology” and “super capacitor technology,” at a premium of 55%.

At the beginning of 2020, Electrek revealed that Tesla had acquired battery production equipment manufacturer Hibar System and established a battery pilot production line in Fremont.

Therefore, it is highly likely that Tesla will launch its proprietary cells on this year’s Battery Day, and achieve a new level of energy density and cycle life.

At the same time, Tesla has already extended its reach into the commercial vehicle market.

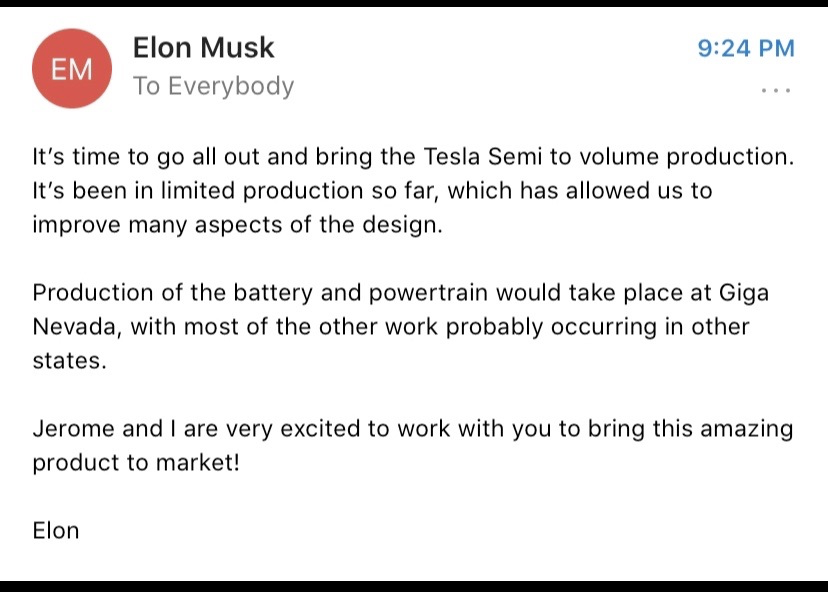

In a recent company-wide email, Elon revealed that the Tesla Semi-trailer will soon be put into production, with a range of 300-500 miles, which not only proves the superiority of Tesla’s battery technology, but also marks a substantial step forward in Tesla’s mission of “accelerating the world’s transition to sustainable energy.”

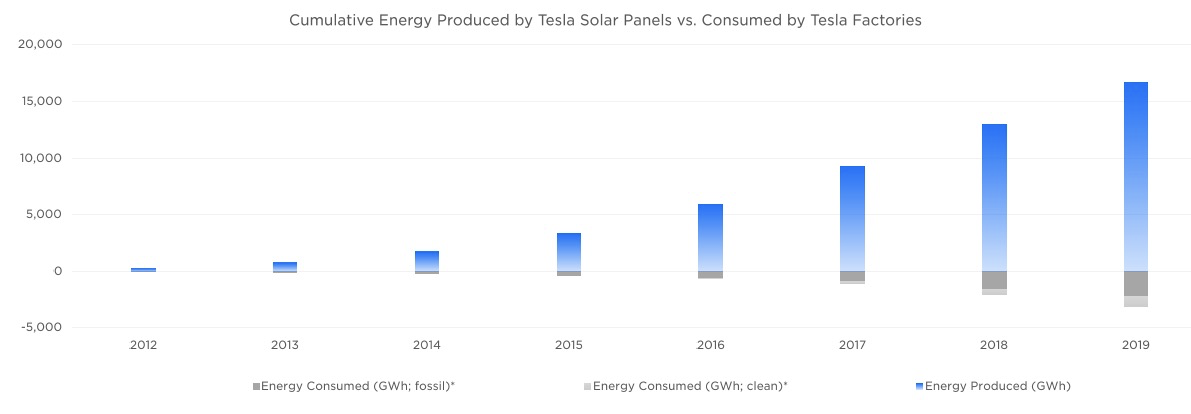

Tesla’s reduction of emissions is not just limited to the transportation sector. According to Tesla’s latest released “Tesla Impact Report 2019”, as of 2019, Tesla has installed a total of 3.7 GW solar energy systems, producing more clean energy than the amount of energy consumed in its factories.

Tesla’s reduction of emissions is not just limited to the transportation sector. According to Tesla’s latest released “Tesla Impact Report 2019”, as of 2019, Tesla has installed a total of 3.7 GW solar energy systems, producing more clean energy than the amount of energy consumed in its factories.

Now let’s talk about their advancements in intelligence. In 2020, the frequency of L2 level ADAS (Advanced Driver-Assistance Systems) has increased, and this feature, which was once dismissed by many car enthusiasts three years ago, has become one of the selling points of car companies.

However, as early as 2014, Tesla had already introduced the first-generation Autopilot, achieving L2 level ADAS. When traditional automakers began to launch L2 level ADAS, Tesla had already implemented the high-speed NoA (Navigate on Autopilot) function. In terms of both functionality and user experience, they were ahead of their competitors by a significant margin.

Another aspect of “intelligence” is Tesla’s electronic and electrical architecture, which may be a strange term for many people. In order to help people understand Tesla’s advantages in a more straightforward way, here is a conclusion drawn by an engineer from a Japanese automaker who dismantled a Model 3: “Tesla’s electronic and electrical architecture is six years ahead of Toyota and Volkswagen.”

Entering the Million-Selling Club

Based on these two points, let’s take a look at their sales performance. From 2015 to 2019, Tesla’s growth rate has been stable at more than 36% every year, with the largest growth rate reaching 137.74% in one year. It was also in this same year that the Tesla Model 3 surpassed other luxury cars to become the best selling in the United States.

Facing the larger market for luxury SUVs, it’s only a matter of time before the Model Y eclipses the Model 3.

Because of this, despite the auto industry’s recession and the contraction of other car companies, Tesla continues to expand globally at breakneck speed. They laid the first foundation stone of Giga Berlin on May 15th, and the second phase of Giga Shanghai was topped out on June 4th.

A factory located in Europe and another in Asia are important chess pieces in Tesla’s global layout.

After completing the expansion of production lines, the total production capacity of Model 3 and Y in Fremont factory will reach 500,000, and that of Model S and X will reach 90,000, with a total capacity of 590,000.

The production capacity of the Giga Shanghai Phase I factory, which is responsible for producing the domestic Model 3, is 100,000-150,000 vehicles per year. The Giga Shanghai Phase II factory, which plans to produce the domestic Model Y, is expected to be completed by the end of 2020 and achieve mass production in 2021, with a planned capacity of 100,000-150,000 vehicles.

After Giga Berlin is completed, it will also be used to produce the Model Y, achieving mass production in July 2021, with a capacity of 100,000-150,000 vehicles.

Therefore, by 2022, these three factories of Tesla worldwide will have a production capacity of over 1 million vehicles per year. To meet the expanding market demand, Tesla is also striving to catch up with Toyota.

Of course, we do not blindly praise Tesla’s super speed. In the process of rapidly advancing, Tesla still has many issues to solve, such as uneven assembly process, unsatisfactory paint quality, and fluctuating prices. These are problems that Tesla, as a car manufacturer, must solve in the process of sales growth.

Final words

Tesla was officially established in July 2003.

In June 2010, Tesla officially went public with an issue price of $17.

In April 2017, Tesla surpassed Ford in market value.

In May 2017, Tesla surpassed General Motors to become the highest-valued American car company.

At the beginning of January 2020, Tesla’s market value surpassed the sum of Ford and General Motors.

At the end of January 2020, Tesla’s market value surpassed Volkswagen to become the second-largest auto company in the world.

In June 2020, Tesla surpassed Toyota in market value to become the world’s highest-valued car company.

It may be difficult to imagine that a car company whose demand was questioned and was largely viewed negatively by institutions just a year ago is now worth more than Toyota. 2020 is magical, and although surpassing Toyota at this point in time is somewhat unexpected, it is undoubtedly a matter of time for Tesla’s market value to surpass Toyota, only achieving it earlier than everyone expected.

If you view everything from the perspective of a car manufacturer, you will never understand it, because Tesla is not just a “car manufacturer,” but also a “technology company.”

Tesla has brought too much fresh blood to this stagnant automotive industry, and single-handedly pushed the entire industry to change.

Looking back at the entire U.S. stock market, several technology giants, including Apple, Amazon, Microsoft, and Facebook, all hit new historic highs last night. It’s not surprising that Tesla’s stock price is also rising.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.