This article is reposted from the WeChat official account “新车一讲” (New Car Chronicles). The author’s Weibo: @不是郑小康.

On June 10, 2020, Tesla’s stock price broke the $1,000 mark, with a market value exceeding $190 billion, surpassing Toyota to become the world’s most valuable car manufacturer.

This is a milestone moment in the history of the automotive industry. Everyone in the automotive industry should be thinking: Why is Tesla the future of the automotive industry?

Terafactory – A Manufacturing Revolution

At Tesla’s Q1 2020 financial results conference, when Elon Musk and Tesla CFO mentioned the next-generation super factory Terafactory, almost all analysts and media focused on the 40% year-over-year growth in sales in the midst of the pandemic that had affected Tesla, ignoring this potentially “new product” that could impact the future of Tesla and the entire sustainable energy industry.

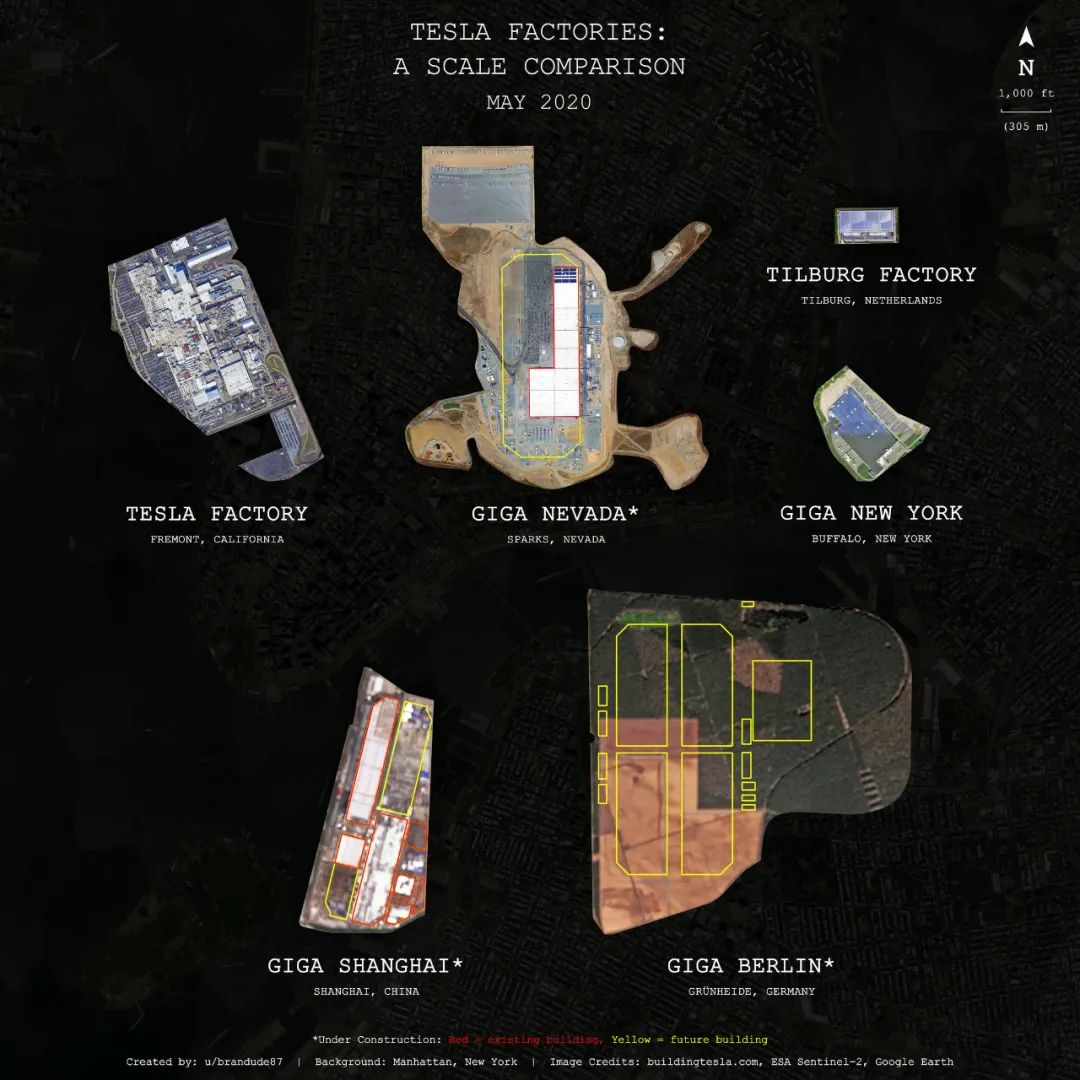

Terafactory is Tesla’s latest “new product.” This idea may seem abrupt, but since the first Gigafactory in Nevada, US was publicly announced in 2013, Elon has repeatedly emphasized the development philosophy of considering factories as the world’s largest product (thinking of the factory like a product).

This philosophy brought product development thinking such as modularity, rapid iteration, and scalability to factory construction, with engineers treating all problems encountered during the construction process as engineering or technological challenges to be solved.

Under this guiding philosophy, Tesla’s Giga 1 super factory, which was only 30% complete, was iterated and optimized several times, while Terafactory is Tesla’s next-generation super factory.

So what is Terafactory?

Wikipedia has a dedicated entry for Tesla’s Gigafactory, with “Giga” referring to gigawatt-hours, an electrical unit of energy. It means a super battery factory with a production capacity of one million kWh.

In Terafactory, “Tera” refers to terawatt-hours, another electrical unit of energy that means a super battery factory with a production capacity of 100 million kWh.The Tesla Gigafactory 1, which has an annual production capacity of 35 GWh, is the largest battery factory in the world. Meanwhile, the production capacity of the Tera factory will be more than 30 times that of the Gigafactory 1.

Elon Musk has had plans for the Tera factory for a long time, and batteries have become the biggest obstacle to Tesla’s rapid development.

During the Tesla Shareholders Meeting in 2019, Elon explained the reason for the continuous delay of the company’s most imaginative product, the pure electric Semi Truck:

If we don’t have enough batteries, then increasing the complexity of the product doesn’t make sense. That’s a complexity that has no benefit.

We match the launch of our products to the scale of our battery production capacity, which is indeed the main limiting factor.

After this statement, Elon added, “We will do everything we can to ensure that we expand at the fastest possible pace.”

All signs indicate that Tesla’s “doing everything we can” is not just lip service:

In the first half of 2018, the production capacity of Tesla was at its most difficult point ever. Senior executives slept in the factory to supervise the production ramp-up. Tesla continuously acquired electrochemical enterprise Maxwell and manufacturing automation enterprise Compass Automation.

In June 2018, former Tesla CTO JB Straubel revealed at the annual shareholders’ meeting that Tesla had already mastered the way to increase battery energy density by 30%-40% within the next 2-3 years.

In January 2019, GA4, the final assembly line designed by Tesla’s German automation factory, arrived in California and was put into operation. The new assembly line increased automation and improved efficiency while reducing costs.

In May 2020, Tesla finalized its construction plans for its Texas factory, which has not yet been officially announced. Elon Musk visited the UK to survey potential sites for a British factory.

While facing the most difficult battle throughout the company, Tesla’s management has not weakened, but instead increased its long-term investment in the company’s strategy.

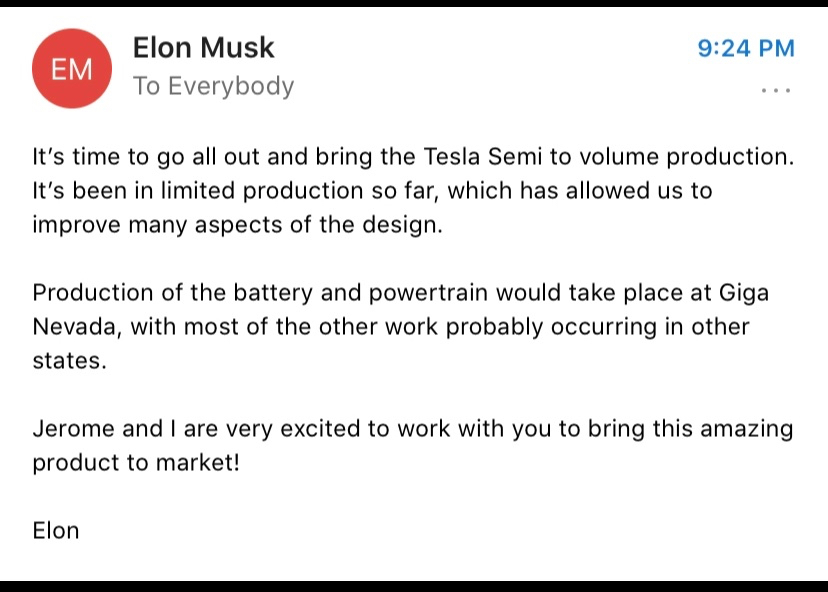

The turning point has come.Just yesterday, Elon sent an all-staff email saying “It’s time to go all out and bring the Tesla Semi to Volume production.”

The implication of this email is that “Tesla has seen the basic path to solving the battery limitation factor.”

One real challenge for Tesla that was not mentioned above is that, over the past 17 years, Tesla has gradually entered into battery design, development, supply chain management, and downstream recycling and reuse, but has never personally intervened in battery manufacturing.

This is the theme of the long-awaited Tesla Battery Day.

How should we view Battery Day? If you regard it as just another Autonomy Investor Day – a communication meeting to showcase the company’s latest technological advancements to investors, then you underestimate Battery Day.

This is Elon Musk’s view of Battery Day:

“In a sense, Battery Day is like Tesla’s ‘Secret Plan Part 3.’ It introduces how we will grow from a few tens of GWh to several TWh. This is a huge growth, about 100 times.”

What is Tesla’s “Secret Plan Part 3”?

Tesla’s Secret Plan Part 1:

- Make a sports car (Roadster)

- Make a luxury car model (Model S/X)

- Make a more affordable car model (Model 3/Y)

- Provide zero-emission power generation products (Solar panels & roof)

Tesla’s Secret Plan Part 2:

- Provide seamless integration of solar power generation and storage. (Powerpack+Solarroof)

- Expand the product line to cover all niche markets (pickups, semis, etc.)

- Through large-scale fleet learning, provide automated driving function ten times safer than human driving (FSD).

- Enable your car to make money for you when you are not using it (Tesla Network).Therefore, Battery Day will announce Tesla’s vertical integration development plan for design, research and development, manufacturing and recycling in the entire electrochemical field for the next decade.

In 2019, the global power battery industry had a total production capacity of 166.7 GWh, and the 100-fold expansion plan will face foreseeable ridicule and questioning.

However, this is not important. In 2013, Tesla publicly announced the Gigafactory plan with GWh as the production capacity unit. The global total production capacity of power batteries was 0.48 GWh in that year. Seven years later, in 2020, the Tesla Gigafactory 1 has a production capacity of 35 GWh/year.

Unseen, despised, incomprehensible and too late, history always repeats itself astonishingly.

Fully Automated Driving – Intelligent Revolution

Throughout 2019, many subtle major events occurred in the global autonomous driving field. For example:

- The world’s largest two luxury car manufacturers, Mercedes-Benz and BMW, announced cooperation in developing autonomous driving systems.

- Volkswagen injected its autonomous driving company AID into Ford’s subsidiary Argo.ai, and made additional large investments.

- General Motors Cruise announced that the commercialization of the autonomous driving fleet was delayed and did not announce new targets.

- Waymo completed the first round of financing, but the valuation was significantly lowered by investment banks.

Financing is still ongoing, and no one talks about commercialization anymore. Autonomous driving tells everyone in this industry: you have all underestimated its heavy asset attributes and the technical challenges of commercialization.

Where is the shock of the Volkswagen-Ford and Mercedes-Benz-BMW autonomous driving alliances?

If “the two big engines driving the future of autonomous driving new energy vehicles are the electric motor as the mechanical engine, and the autonomous driving system as the digital engine,” such an alliance is like when everyone sat together in the era of internal combustion engines and cooperated in the development of engines and transmissions, the most core technical assets.

In this context, Tesla, which operates alone, will become the fastest company to achieve large-scale commercialization of autonomous driving vehicles.

To explain Tesla’s core advantages, we must introduce the soul figure of Autopilot: Tesla’s Senior Director of Artificial Intelligence, Andrej Karpathy.In June 2017, Andrej Karpathy, a research scientist from the world’s top artificial intelligence research institution, Open AI, joined Tesla to lead the full-stack deep neural network development of Tesla Autopilot.

Five months later, he published a Tesla artificial intelligence “manifesto” on Medium: People usually see deep neural networks as “another tool in the machine learning toolbox” but in fact, it is more than just a classifier, it represents a change in the way we write software, it is Software 2.0.

After that, Karpathy repeatedly mentioned Software 2.0 in various public occasions including Tesla’s autonomous driving investor day. In his latest speech, he wrote on the PPT: “Software is eating the world, and Software 2.0 is eating Software 1.0.”

What is Software 2.0? Let’s start with the system-level software engineering of autonomous driving. Before the wave of deep neural network, autonomous driving software systems represented by Waymo took a rule-based solution in the technical route.

The so-called rule-based solution means that the main content of the entire solution needs to be split and constructed by software engineers, and finally establish an autonomous driving car perception-decision-execution system.

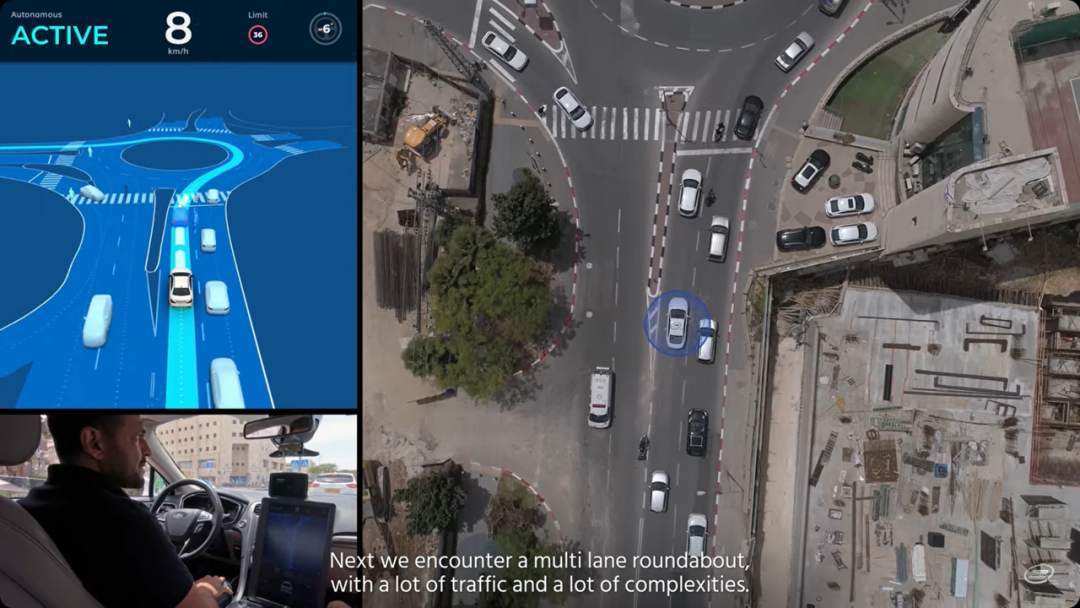

The above figure is a typical rule-based autonomous driving system architecture, and each part of it needs to be compiled by engineers. It should be pointed out that in order to simplify, the above figure is a highly abstract simple architecture, and there are many sub-modules that are not reflected in the figure.

In fact, a rule-based autonomous driving system requires thousands of sub-modules to be manually designed. After the rise of deep learning in 2012, a large number of independent deep neural networks were added to the sub-modules, making the engineering complexity and technical barriers of the entire autonomous driving system sky-high.Apart from that, based on rule-based approach, the solution heavily relies on high-precision maps as input, along with sensor data, and feeds them into the decision-making module. This makes high-precision maps a fundamental condition for the operation of autonomous vehicles, while “the update and maintenance of high-precision maps are extremely costly investments”.

This is one of the reasons why the Volkswagen-BMW alliance, caused by the software engineering route, has become costly, in terms of both technology and capital, exceeding the upper limit that a single company or even an industry giant can afford.

After the wave of autonomous driving start-ups in 2016, a new approach came into play: end-to-end deep neural networks (DNNs) driving autonomous vehicles.

End-to-end means greatly reducing or completely eliminating the “man-made design” process, which directly inputs the sensor’s perception and the vehicle’s raw data into the deep neural network, and outputs the result directly to the executing units, such as the acceleration, turning, and braking system. The system’s output experience is more similar to human’s driving habit.

Nvidia, Wayve, Udacity, Drive.ai, and many other autonomous driving companies have invested heavily in this approach, but they all ended up with good results in the beginning but with no outcome later.

This is because end-to-end DNNs have fatal flaws: they rely on massive amounts of data for training, and logic interpretability is extremely poor.

For regulatory agencies around the world, the logical interpretability of automated driving is of paramount importance, as it will be an important judgment criterion in case of accidents.

This almost completely blocks the possibility of commercializing autonomous vehicles based on end-to-end DNNs.

“Almost” does not mean “completely” though. Andrej Karpathy proposed a solution: software 2.0.

Tesla was the first to introduce a rule-based approach and wrote C++ code for the safety layer, named software 1.0. Based on this, the Tesla AI team led by Karpathy developed end-to-end DNNs and matching basic development tools, making them software 2.0.

Compared to rule-based routes, the end-to-end route has revolutionary improvements in several aspects.As an automotive industry translator, your task is to translate the following Chinese Markdown text into English Markdown text professionally. Keep the HTML tags within Markdown and only output the result.

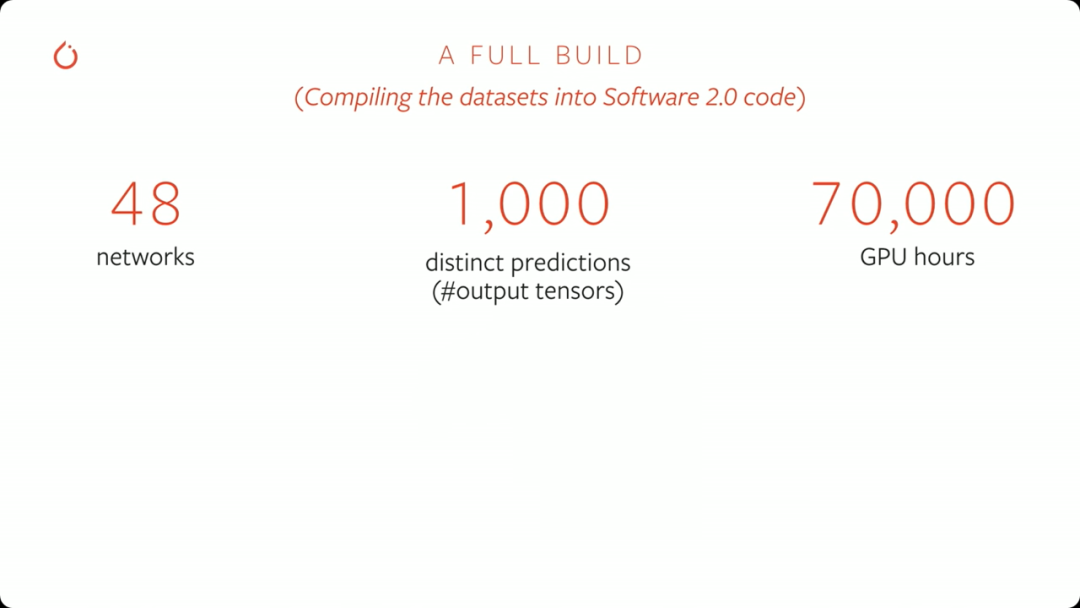

For example, in terms of the engineering complexity of the entire system, end-to-end deep neural networks have greatly simplified the entire architecture. In the case of Tesla, a main deep neural network, HydraNet, has 48 sub deep neural networks, which can simultaneously output 1000 different prediction tensors, detecting about 1000 obstacles.

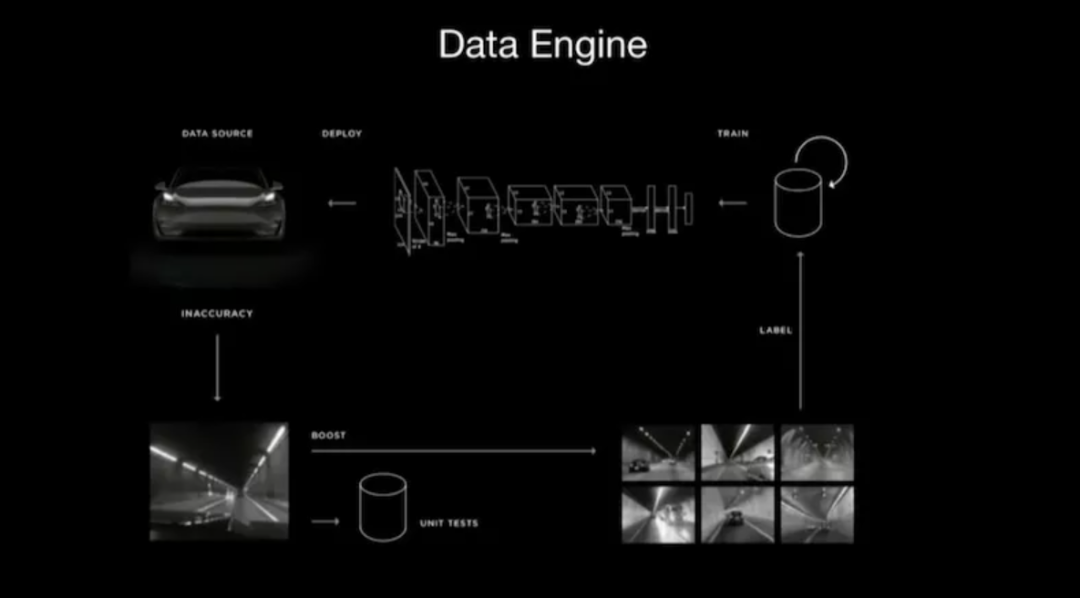

Even this “simple” deep neural network is not entirely developed manually. The basic algorithm code of HydraNet is shared, and whenever a new feature is initiated (such as detecting a cone-shaped bucket), Autopilot will seek specific scene uploads from Tesla vehicles around the world to the cloud environment as much as possible in a semi-automatic form (applying a large amount of self-supervised learning) and complete algorithm training using Tesla’s data engine.

This is why Tesla’s AI team of about 30 people can maintain the iteration and optimization of nearly 900,000 Autopilot 2.0/3.0 models around the world.

The benefits of this approach are not only the decrease in research and development investment, but also a significant improvement in improving the efficiency of the entire system, reducing system failure rates, and reducing energy consumption.

Secondly, Karpathy has publicly stated that Tesla does update its own maps, but Autopilot does not need high-precision maps.

This is because the static information in high-precision maps is difficult to integrate into the end-to-end deep neural network, which does not fully rely on high-precision positioning or accurate map information for positioning.

Compared to rule-based routes, end-to-end greatly improves the input efficiency of perception information, which objectively reflects the achievement of achieving automated driving capabilities close to a heterogenous redundant sensor architecture at lower cost and with homogenous perception architecture. Tesla and well-known vision perception leaders, Mobileye, have demonstrated similar videos.

Let’s return to the subject: with all the alliance players on the other side, what cards does Tesla, who insists on going it alone, hold?

- A global fleet of nearly 900,000 and more than 3 billion miles of road test data.- Powerful computing platform and industry-leading energy consumption (FSD single chip computing power of 72 Tops and energy consumption of 36W)

- Dynamic evolution of software 1.0 and 2.0 (safety layer + full-stack deep neural network)

Karpathy has strong confidence in software 2.0.

According to his prediction, as machine compilation capabilities improve and data collection becomes more abundant, software 2.0 will gradually cover the software 1.0 version, and eventually all code will be compiled by machines, which will make the self-driving strategy more accurate and the system more powerful.

This is “software is devouring the world, and software 2.0 is devouring software 1.0”.

Tesla’s “Road Confidence”

In February 2016, Tesla’s Vice President of Hardware Engineering and FSD chip designer, Pete Bannon, asked Elon Musk a question: Does independent chip development mean huge investment (which means amortization costs of at least 1 million vehicles/year sales volume)?

Elon’s answer was: Sure, Let’s do it. And in the whole year of 2016, Tesla sold 76,000 cars.

The independent development of chips is a microcosm: whether it is Giga factory, Tera factory, NO LiDAR, NO high-precision map, Autopilot software 2.0, Tesla has been floating outside the entire industry, promoting the advancement of all businesses and strategies based on self-consistent logic and vertical integration.

$1,000 is a turning point, but this turning point will soon be turned over. In the next ten years, Tesla’s “road confidence” will continuously output its endless impact and power.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.