Tesla officially released its Q1 2020 financial report today.

Amid the global pandemic, many companies announced the postponement of their 2019 annual financial report release to mitigate the impact of the pandemic on their stock prices. Tesla, however, released their Q1 report at the end of the first month of Q2 in 2020, showing confidence in their market performance.

Two pieces of data in the report demonstrate this confidence: the continuously increasing per vehicle gross margin and the unchanged annual delivery guide of 500,000 vehicles.

What information can be found in the Q1 report?

As usual, let’s summarize the key points in the financial report.

Financial data:

-

Total revenue of $5.985 billion, representing a QoQ decrease of 19% and YoY increase of 32%.

-

Automotive sales revenue of $5.132 billion, representing a QoQ decrease of 19% and YoY increase of 38%.

-

Automotive sales profit of $1.311 billion, representing a QoQ decrease of 9% and YoY increase of 75%.

-

Gross margin of 20.6%. Per vehicle gross margin of 25.5%, which has increased by 3 percentage points compared to the previous quarter.

-

GAAP net income of $16 million. Non-GAAP net income (excluding share-based payment expense) of $227 million.

-

Cash and cash equivalents increased by $1.8 billion to $8.1 billion.

-

Negative free cash flow of $895 million, of which $981 million was due to increases in inventory.

Delivery data:

-

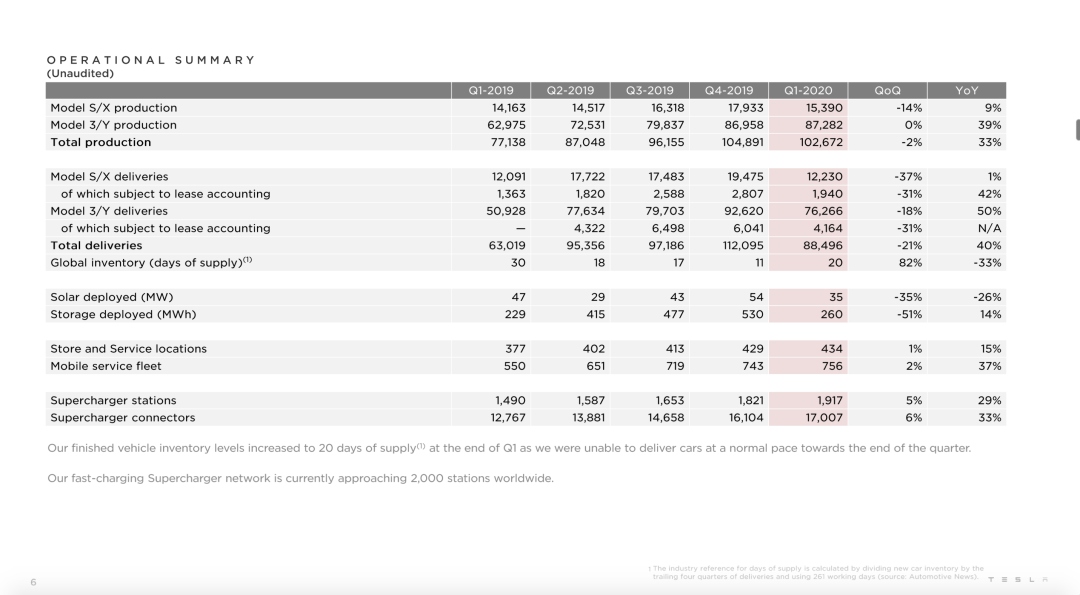

Total production of 102,672 vehicles in Q1 2020, including 15,390 Model S&X vehicles and 87,282 Model 3&Y vehicles.

-

Total deliveries of 88,496 vehicles in Q1 2020, including 12,230 Model S&X vehicles and 76,266 Model 3&Y vehicles.

-

Inventory turnover days were 20, up from 11 in the previous quarter.

About Factory and Production Capacity:

-

Tesla’s Shanghai factory’s production capacity is exceeding expectations, and it is expected to reach a capacity of 4,000 vehicles per week by mid-2020, which is equivalent to an annual capacity of 200,000 vehicles.

-

The gross margin of Model 3 produced at the Shanghai Super Factory is close to that of the Fremont factory in the United States and still has a lot of room for improvement.

-

The Berlin factory has completed land preparation and will start construction soon. According to the plan, it will achieve mass production of Model Y in 2021.

-

Fremont is currently in a shutdown phase. However, the delivery target for this year is still 500,000 vehicles. After resuming production, Tesla is closely coordinating with suppliers and relevant governments to ensure timely supply.

Other News:

-

The selling price of the upgraded Model 3 with a standard range will be reduced to less than RMB 300,000 tomorrow.

-

Model Y showed positive gross margin in Q1.

-

The delivery of Semi has been postponed until 2021.

-

Battery Day is expected to be held in late May.

-

The location of the next Super Factory will be announced within 1-3 months.

Why did Tesla make profits during the COVID-19 pandemic?

After the financial report was released today, Tesla highlighted one key point on social media, which was that “Q1 2020 was Tesla’s first quarter with positive GAAP net income despite the seasonally soft first quarter.“

This is a historic moment for Tesla and the entire automotive industry.

In Q1, for most car companies, it is the quarter with the weakest sales, due to holidays, consumer habits, marketing efforts, and many other factors. Therefore, it is expected that sales will decline compared to Q4.

The current environment in Q1 is also very difficult due to the impact of COVID-19 on the economy. It is not easy for Tesla to achieve GAAP profitability under these circumstances.

There are two main reasons for this.

First, higher gross margins.

The financial report showed that Tesla’s Q1 gross margin per vehicle has reached 25.5%, a 3% increase from the previous quarter. The overall gross margin also surpassed 20%. Due to lower expenses in market management and marketing, Tesla has significant advantages over traditional car companies in terms of overall net profit.In the quarterly earnings conference call, Tesla revealed that the gross margin of Model 3 produced at the Shanghai Super Factory is close to that of Model 3 produced at the Fremont factory in the United States. With the continuous increase in the localization rate of parts, there is still a lot of room for improvement in the gross margin of Model 3 produced at the Shanghai factory.

In addition, due to the fact that Model Y and Model 3 can be produced in the same line, the speed of production ramp-up for Model Y is very fast, and it achieved profitability in the first quarter of mass production.

Secondly, the impact of the epidemic on Tesla’s Q1 is very limited.

Due to the time difference of the outbreak, the impact of the epidemic on the Chinese market during the Q1 quarter was concentrated from the end of January to mid-March, and the impact on overseas markets was mainly concentrated in late March.

Therefore, the larger the proportion of the Chinese market, the more severe the impact of the epidemic on the car companies, and the smaller the proportion, the lighter the impact.

Tesla delivered 112,000 new cars globally in 2019Q4, with a delivery volume of approximately 13,000 in the Chinese market, accounting for only 11.6%.

As a reference, Volkswagen’s total global deliveries in 2019 were 10.97 million units, with 4.38 million units delivered in the Chinese market, accounting for a high proportion of 40%.

From the perspective of delivery volume, although Tesla delivered a total of 88,400 vehicles in 2020Q1, a year-on-year decrease of 21% compared to the previous quarter, it increased by 40% compared to 2019Q1, which is the highest delivery volume quarter in Tesla’s history.

From the perspective of delivery targets, Tesla’s delivery guidance for 2020 is 500,000 vehicles, an increase of 36% compared to 2019, and the 40% growth in Q1 not only meets the ultimate goal but also exceeds Elon’s KPI target.

Therefore, for Tesla, the impact of the epidemic on Q1 is very limited, and the real impact will be in the second quarter. Since Fremont factory officially stopped production on March 25th, it has not resumed work yet, with a shutdown time of more than one month, and the corresponding production capacity is about 40,000 vehicles.

However, Tesla did not adjust its delivery target of 500,000 vehicles.

The support for Q2 is Gigafactory 3!

Tesla currently has 3 factories worldwide for production. One factory with an annual capacity of 490,000 vehicles is located in the United States, and one factory with a capacity of 150,000 vehicles per year is located in Lingang, China. One factory, which has just completed land leveling work and is expected to start production in 2021, is located in Berlin, Germany.

In other words, the only factories that can contribute to Tesla’s production volume currently are the US and China factories.Let’s take a look at the situation in Fremont, which has an annual production capacity of 490,000 vehicles. On March 24th, Tesla officially stopped production and hoped that workers in the painting and stamping processes could resume their work on April 29th, and the factory would resume production as a whole on May 4th. However, the Bay Area extended the lockdown order until the end of May, which means that Tesla may have to continue to shut down for another month.

During the conference call, Elon expressed strong dissatisfaction with this, and Tesla also stated that even if production resumed, the factory would face capacity restrictions caused by supply chain delays.

Clearly, the Q2 setback of the Fremont factory is already determined. If Tesla wants to continue to achieve a delivery of 500,000 vehicles, the pressure will be transferred to the Shanghai Gigafactory.

At the end of 2019, when the first phase of Giga 3 was just completed, the peak production capacity was 150,000 vehicles per year. In the Q1 2020 financial report, the capacity has silently increased to 200,000 vehicles per year, and the weekly production has increased from 3,000 vehicles to 4,000 vehicles.

Well, production capacity can be squeezed, but what about sales?

Price reduction.

This is the first time that Elon directly announced during the conference call that the domestically-manufactured standard range plus Model 3 in the Chinese market will officially reduce its price tomorrow!

Later, Tesla also officially announced on social media that in order to meet the requirements of national new energy vehicle subsidies, the domestically-manufactured standard range plus Model 3 will be reduced to below 300,000 RMB, and the new price will be officially announced tomorrow.

Although the actual price is uncertain, it is certain that the selling price after subsidy will definitely drop to 270,000 RMB or less.

Although the price reduction does not involve the domestically-manufactured long-range Model 3, the price of about 340,000 RMB after subsidy has already attracted a large number of users. Tesla’s goal is not to reduce the price, but to start mass production as soon as possible.

As for the gross profit margin, as mentioned earlier, the gross profit margin of the Model 3 produced by the Shanghai factory has already caught up with that of the US factory. With the increase of localized production rate, there is still a lot of room for improvement.

Therefore, even if demand is exhausted later, Tesla, with its very high gross profit, can still stimulate demand through price reductions. Therefore, the production capacity of 200,000 vehicles per year at the Tesla Shanghai factory does not have too much demand problem.

Under the epidemic, the Chinese super factory and the Chinese market have stood out.

In conclusion

Tesla delivered a satisfactory report for Q1 2020. Q2 is a difficult problem that all car companies have to face, and Tesla’s hope is the Chinese factory. Under the catalysis of the epidemic, the construction speed of the second phase of the Shanghai factory and the first phase of the Berlin factory will only be faster.# Heading

Elon emphasized in the conference call that local production can effectively reduce vehicle costs as local factories are built. Many automakers are unable to reduce vehicle costs, so they can only cut investment. We are doing the opposite and we expect to become a truly global company at some point next year.

Author: Liu San

Editor: Da Ji

Related Articles

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.