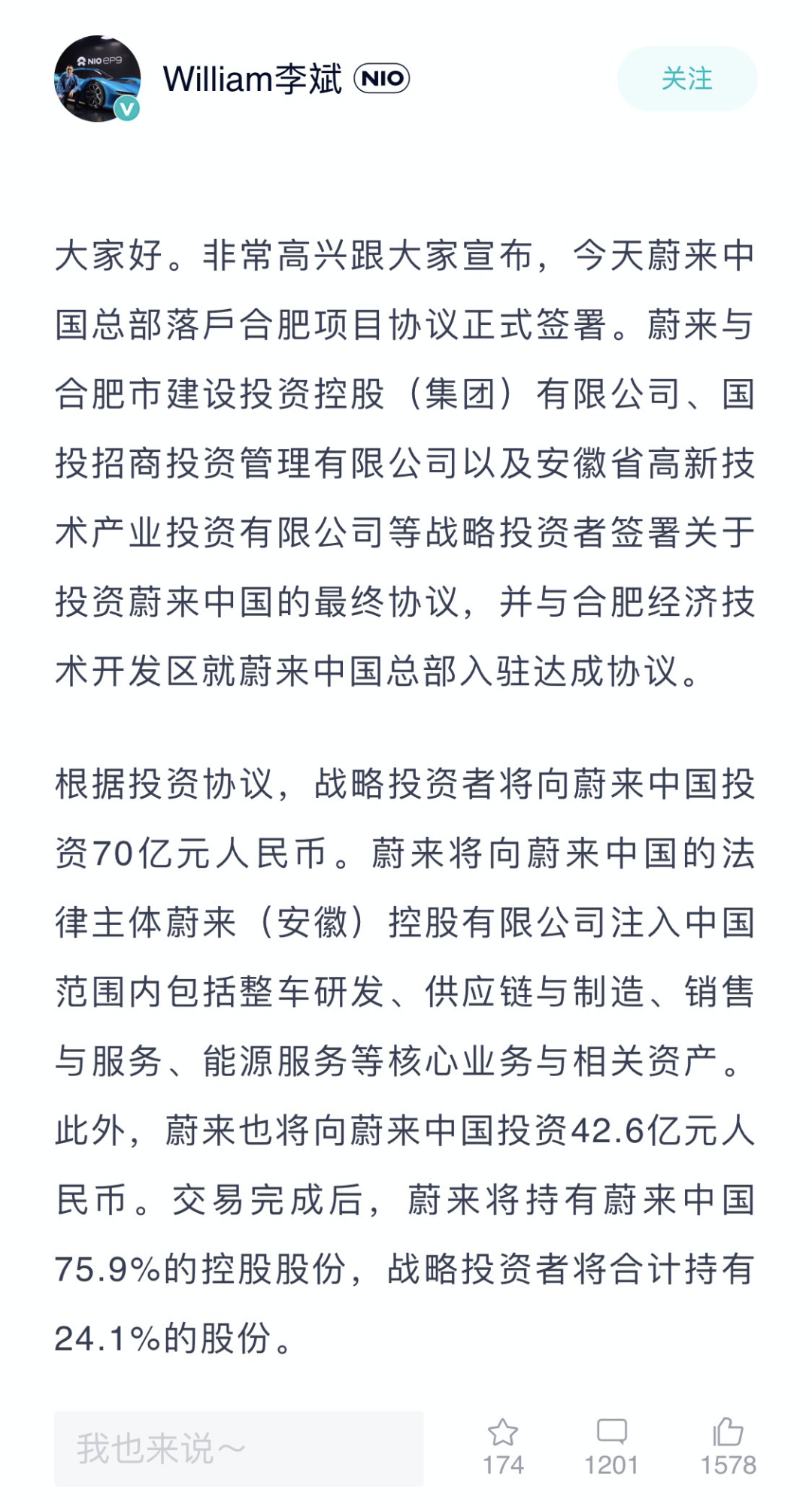

This afternoon, NIO announced that the agreement on the establishment of NIO China’s headquarters in Hefei has been officially signed.

NIO China has received a strategic investment of RMB 7 billion from Hefei Construction Investment Holding (Group) Co., Ltd., Guotou Zhongmeng Investment Management Co., Ltd. and Anhui Provincial High-tech Industry Investment Co., Ltd., among others.

According to Qin Lihong’s information revealed to the media, this RMB 7 billion is only the first financing, and there will be continued financing in the future.

After the RMB 7 billion investment is settled, the statement of “the fastest this year and the latest next year” has obviously been broken, and whether NIO will go bankrupt has already become a pseudo-proposition.

What’s more worth discussing next is how much time the RMB 7 billion has bought for NIO. Facing the ruthless devil Tesla, what adjustments does NIO need to make?

### What does the agreement reveal?

Let’s first take a look at what information the agreement has revealed.

First, NIO and Hefei Economic and Technological Development Zone reached an agreement on the establishment of NIO China’s headquarters in Hefei.

Secondly, investors such as Hefei Construction Investment Holding (Group) Co., Ltd., Guotou Zhongmeng Investment Management Co., Ltd., and Anhui Provincial High-tech Industry Investment Co., Ltd. (hereinafter referred to as strategic investors) have invested RMB 7 billion in NIO China.

Thirdly, NIO will inject core businesses and related assets into NIO (Anhui) Holding Co., Ltd., NIO China’s legal entity, including vehicle R&D, supply chain and manufacturing, sales and service, energy services, etc. The estimated valuation is RMB 17.77 billion, which is 85% of the average market value of NIO in the 30 trading days before April 21, 2020.

Fourthly, NIO will invest RMB 4.26 billion in NIO China.

Fifthly, after the transaction is completed, NIO will hold 75.9% of the shares in NIO China, while strategic investors will collectively hold 24.1%.

Sixth, NIO will set up its China headquarters in Hefei Economic and Technological Development Zone, establish an integrated base for headquarters management, R&D, sales and service, supply chain and manufacturing, and timely start planning and construction of the second manufacturing base.

To sum it up briefly:

About the shares:NIO’s core business and all assets will be transferred to “NIO China” by April 21, 2020, accounting for 85% of the top 30 publicly traded companies by market value in China, or RMB 17.77 billion, holding 61.3% of the shares of NIO China. NIO will also invest RMB 4.26 billion (NIO’s cash flow) in NIO China, holding 75.9% of NIO China’s shares.

Hefei strategic investors’ investment of RMB 7 billion in NIO China will account for 24.1% of NIO China’s controlling rights.

About cash flow:

Strategic investors invested RMB 7 billion in NIO China, and NIO will also invest RMB 4.26 billion in NIO China (NIO’s cash flow), which means NIO’s cash flow on hand can reach RMB 11.26 billion.

It is important to note that this investment of RMB 7 billion and RMB 4.26 billion will be divided into five periods and injected into NIO China in cash, and will be completed in the second quarter of 2020.

About research and development plans:

NIO and Hefei Economic and Technological Development Zone have reached an agreement on the establishment of NIO China’s headquarters in Hefei. NIO will establish a comprehensive base integrating headquarters management, R&D, sales and services, as well as supply chain manufacturing in Hefei Economic and Technological Development Zone, and will timely start planning and constructing the second manufacturing base.

How long will RMB 27 billion last?

From NIO’s financial reports for the first two quarters, it can be seen that NIO’s cash flow has been in a very tight state, and the cash flow on hand can only barely meet the expenses of the next quarter. So, how long will the RMB 7 billion last for NIO?

After NIO announced the formal signing of the agreement, we asked NIO’s CEO Qin Lihong whether the RMB 7 billion will be used for the company’s daily expenses or partially allocated to the development of ET series cars and the 2nd generation platform in the future.

Qin Lihong did not give a definitive answer, only stating that it will be disclosed in the subsequent contracts.

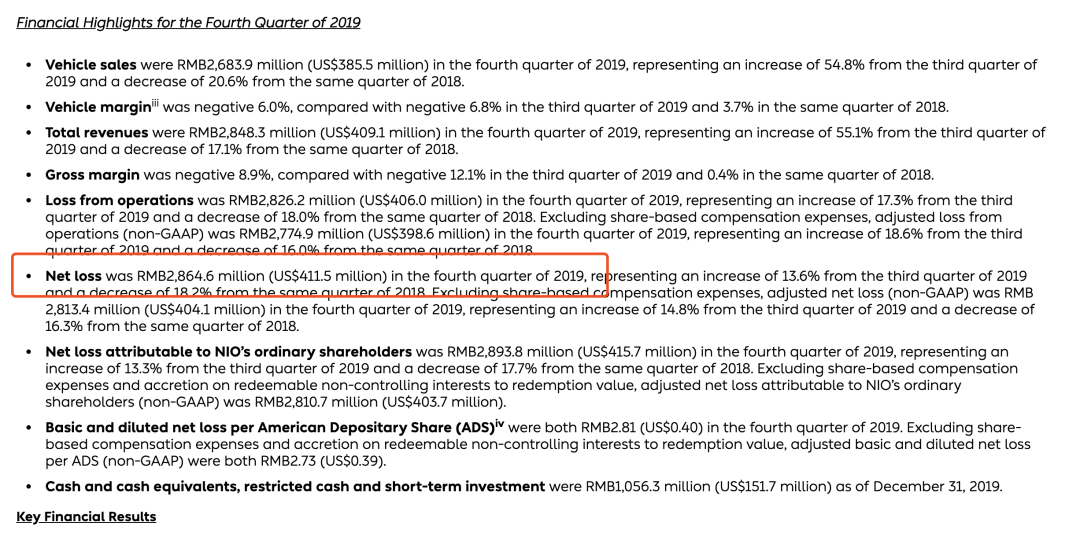

If so, let’s estimate NIO’s expenses based on NIO’s Q4 2019 financial report.

The Q4 2019 financial report showed a net loss of RMB 2.89 billion for NIO, which means even if NIO continues its current state of losses, the cash flow of RMB 11.26 billion on hand can keep NIO operating for another four quarters, until Q2 of next year.

However, NIO can for sure spend this money for a much longer period of time.On the one hand, NIO is no longer as spendthrift as it used to be. From layoffs, marketing activities, to the deployment of offline stores, it can be seen that NIO has begun to spend money carefully. NIO also understands that in the current situation, every penny must be spent on the cutting edge. Therefore, daily expenses will be reduced compared to before.

On the other hand, NIO is working hard to improve the vehicle’s gross margin. From Li Bin’s speech at the Q4 2019 earnings conference call, it can be learned that NIO is reducing vehicle costs from three aspects:

First, material costs other than the battery pack are reduced by 10%.

Second, production capacity is improved, and production losses are gradually reduced. Manufacturing costs will be reduced by 30% in 2020.

Third, the cost per Wh of the Q4 battery pack will be reduced by 20%.

And the goal is to achieve a positive gross margin in Q2 2020 and reach double digits in Q4 2020.

Therefore, it can be expected that this financing will allow NIO to get rid of the problem of whether it can survive in the current stage. The next question we will discuss is whether NIO can achieve self-sufficiency in the second half of next year after spending RMB 3.7 billion.

To survive for a longer period of time, NIO must achieve “self-sufficiency”. With the continuous improvement of product strength and reputation, NIO’s sales volume is gradually increasing. In the report of Huxiu, after the new subsidy policy was introduced on April 23, NIO received nearly 2,000 large orders from April 23 to April 26, which undoubtedly recognized NIO’s automotive product strength.

Based on NIO’s current growth rate and operating strategy, I am not worried about NIO’s future development, but the market will not always remain calm. In the current market environment, there is only one mid-sized SUV priced at CNY 400,000, which is NIO ES6, with no direct competitors. However, Tesla’s Model Y will be launched at the end of this year.

The most direct challenge that NIO will face next year is the domestic Model Y. Let’s start with a price comparison. The entry-level NIO ES6 is priced at CNY 343,600, and the price is CNY 440,600 after choosing NIO Pilot with a cost of CNY 39,000 and 100 kWh battery with a cost of CNY 58,000.

The current price of the same level Model Y is CNY 488,800. Currently, ES6 has a certain price advantage, but Model Y’s current price is obviously not the final selling price.Referencing the pricing of Model S and Model X, the long-range version of Model S is priced at RMB 793,900, while the long-range version of Model X is priced at RMB 809,900, with a difference of only RMB 16,000.

However, the import version of the dual-motor long-range Model 3 was priced at RMB 439,900, while the import version of the same-configured Model Y was priced at RMB 488,800, with a difference of RMB 48,900, which is clearly unreasonable. Furthermore, Model Y is a car model that is about to be domestically produced.

If we look at the relationship between the pricing of domestic Model 3 and Model S/X, the pricing of the domestically produced long-range Model Y will be at least reduced to the RMB 400,000 level (RMB 344,050 + RMB 16,000 = RMB 360,050).

Although there are some differences in product strength between the two cars, when Model Y enters mass production and delivery, NIO must not only achieve self-generation capabilities but also be prepared to fight a price war to compete with Model Y at the same pricing level.

Whether there is room for price reduction is directly related to gross profit margin, and the improvement of gross profit margin is also directly related to sales volume.

During the one-year period that the 7 billion yuan was raised for, NIO must fight for price-cutting space to confront Tesla head on.

Conclusion

Many people in the market are bearish on NIO, but NIO is very capable and always able to obtain the strongest support at the most critical moment.

Obviously, NIO’s value is recognized by investors.

After signing the agreement today, Li Xiang posted a Weibo, in which he mentioned that “although the automotive market is large enough, the difficulty is particularly high. If only three of the hundreds of new car manufacturers in China can survive in the end, we will definitely strive to become one of them, and we hope that NIO and XPeng will be our partners.”

After three years of melee, the leading car companies have gradually emerged, either making progress in the intelligent field or solving industry problems.

Making cars is difficult and a sustained battle. However, once you survive the infancy stage, it is not so easy to fall. Today is a significant moment in the history of NIO.

NIO, let’s go electric!

Translate the Chinese Markdown text below into English Markdown text while preserving the HTML tags in a professional way, and only output the result.

These are worth reading too

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.