A Continuous Trading Limit

This is the performance of Guoxuan High-tech in the stock market in these two days.

It is not often that Guoxuan High-tech experiences continuous trading limits.

This time, Guoxuan High-tech has become famous because Volkswagen Group may invest 5.2 billion yuan in it. Before this, in China’s power battery manufacturers, Ningde Times and BYD Shine were too dazzling.

They always attract industry attention, and many people don’t even know about the existence of the third player, Guoxuan High-tech.

Putting aside the news itself, we are more concerned about whether Volkswagen will use 5.2 billion yuan to invest in Guoxuan High-tech and why Guoxuan High-tech has attracted the attention of top automobile groups like Volkswagen.

And if Volkswagen and Guoxuan High-tech eventually join hands successfully, will it affect the pattern of power batteries in China?

The Fiasco of 1.52 Billion for 30% Equity

On April 21, relevant media reported that there was new progress in Volkswagen’s strategic investment in Guoxuan High-tech. According to an insider close to the event, the acquisition of Guoxuan High-tech equity by Volkswagen has been approved by the board of directors, with a value of $740 million (about 5.2 billion yuan).

Volkswagen will obtain a 30% stake in Guoxuan High-tech through the issuance of shares and the acquisition of old shares, becoming the largest shareholder of the company, and will gradually increase its stake in the company over the next 3 years until it becomes the controlling shareholder.

As soon as the news was announced, the stock price of Guoxuan High-tech rose all the way and was firmly stuck at the limit price. As of April 22, the highest price per share reached 26.10 yuan, with a total market value of up to 29.363 billion yuan.

Short-term stock price fluctuations have also attracted the attention of the Shenzhen Stock Exchange, which has requested Guoxuan High-tech to verify and clarify whether the media reports are true.

On the evening of April 22, Guoxuan High-tech issued an announcement stating that “we are still discussing strategic cooperation in technology, products, capital and other aspects with Volkswagen, and have not formed a consensus on specific cooperation methods, content, price and other specific aspects, nor have we signed or reached any substantive binding agreements, commitments or other arrangements regarding the relevant cooperation matters.”

Although Guoxuan High-tech made a clarification announcement, it is possible that this is a routine operation before the official announcement of the acquisition. As early as January 16, 2020, Reuters reported that Volkswagen Group would spend $560 million to acquire 20% of Guoxuan High-tech’s equity.

On January 19, 2020, Guoxuan High-tech issued an announcement confirming contact with Volkswagen on related matters.

It seems that Volkswagen’s investment this time and possible future acquisitions may not be unfounded.

Why Does Volkswagen Intend to Acquire Guoxuan High-tech?## Volkswagen’s Battery Strategy and the Possibility of Acquiring Guoxuan High-tech

It should be noted that Guoxuan High-tech has already released a clarification announcement, so we can only wait for official news to confirm the facts regarding the previous rumors, but Guoxuan High-tech did not explicitly deny the rumors in their announcement.

However, based on the saying “where there’s smoke, there’s fire”, let’s take a look at the possibility of Volkswagen acquiring Guoxuan High-tech, as well as Volkswagen’s overall battery strategy.

Looking at Volkswagen’s previous announcements and press conferences, it is clear that their battery strategy is well planned, and can be divided into several stages:

Stage One: Develop strategic partnerships with strong battery suppliers.

These long-term partnerships ensure a steady supply of batteries and are crucial for technological breakthroughs. SKI, LG Chem, and CATL are the main suppliers in this stage.

Stage Two: Set up a strong technical team to conduct R&D on lithium-ion batteries.

Volkswagen’s battery development, procurement, and quality control research and development personnel are all located in Salzgitter, Bavaria, and will begin trial production in the second half of 2019. The entire transition is still focused on Europe.

Stage Three: Joint venture with partners to build a large-scale battery factory to share the large capital investment of battery production.

Currently, the large-scale factory may be located in Germany.

Stage Four: Establish a lithium-ion and solid-state battery production factory in Europe. Volkswagen will collaborate with Quantum Scape for solid-state battery production. Volkswagen views batteries as their core competitiveness for the future and will cover the entire process chain from developing, producing, and handling to recycling.

Volkswagen’s investment in the entire battery supply chain continues to increase to ensure a stable supply of raw materials. They are collaborating with Ganfeng Lithium for future lithium product supplies, and are working with other suppliers to systematically reduce the cobalt content of the batteries, with a goal of reducing it from the current 12-14% to 5% within the next three to five years.* Establishing the European Battery Alliance and cooperating with Northvolt to focus on the entire value chain of batteries, covering various fields such as raw materials, battery technologies, and recycling, accumulating broader experience in battery production and supporting industrial development in battery production.

- Starting the construction of an electric vehicle battery recycling center in Salzgitter using a special battery crushing machine to recycle about 97% of the battery raw materials.

Note that the aforementioned is Volkswagen’s battery strategic plan for future electrification, which includes collaboration, research and development, joint ventures and finally achieving proprietary solid-state batteries.

Diess has explicitly stated that Volkswagen will control the power battery supply chain and has established the Volkswagen Group Components responsible for constructing an in-house electrification supply chain.

Therefore, we can conclude that Volkswagen’s strategic goal is to gradually achieve “proprietary power battery”.

For traditional cars that have experienced ups and downs, they know the importance of mastering core components.

Depending on LG Chem in Europe and Ningde Times in China will affect Volkswagen Group’s premium ability and supply security in the core power battery supply chain.

LG Chem is not always reliable.

Earlier foreign media reported that due to a shortage of LG Chem’s power batteries, Jaguar announced that it would shut down its I-PACE production line in Graz, Austria from February 17 for a week.

Audi postponed the delivery of its first electric vehicle e-tron and planned to produce 55,830 e-tron vehicles in 2019, adjusting production capacity to 45,242 vehicles in early 2020.

Mercedes-Benz reduced its production target for the first electric SUV EQC under its brand from 60,000 to 30,000 in 2020, and originally hoped to sell about 25,000 EQCs in 2019, but only produced about 7,000.

It is evident that the above-mentioned vehicle models were forced to reduce production due to the problem of LG Chem’s power battery supply shortage.

Therefore, Volkswagen’s acquisition of a battery manufacturer is a logical step because nobody knows if such an important core component enterprise will continue to encounter such risks of uncontrollable force. Acquiring Guoxuan High-Tech can guarantee to some extent the supply security of power battery core components.

According to Volkswagen’s product plan, by 2029, Volkswagen will launch 75 pure electric models and 60 hybrid models. It is expected that the sales of electrified vehicles worldwide will reach 26 million by 2029.

According to Volkswagen’s product plan, by 2029, Volkswagen will launch 75 pure electric models and 60 hybrid models. It is expected that the sales of electrified vehicles worldwide will reach 26 million by 2029.

In addition, 18 factories will be transformed or built worldwide to produce electrified vehicles, of which eight factories will specialize in producing vehicles on the MEB platform.

This means that Volkswagen must have a battery capacity of 1.2 TWh by 2029 to meet the needs of 26 million vehicles, assuming a single 60 kWh battery per vehicle.

Therefore, even if Ningde Times, LG, and SKI’s planned production capacity are all given to Volkswagen, it may still not be enough, not to mention that these three companies supply the entire industry and cannot allocate all their production capacity to Volkswagen.

The MEB factories in Shanghai and Foshan have a total production capacity of 600,000 vehicles, including a capacity of 300,000 vehicles each, and will require 36 GWh of battery supply if single 60 kWh batteries are used.

The domestic ID.4 has already been produced in Anting and Foshan factories respectively, and the ID.3 is also striving for delivery.

The joint venture between Volkswagen and Northvolt AB has increased the planned battery production capacity from the original 16 GWh to 24 GWh. However, the factory will not start production until the end of 2023 or early 2024 due to the impact of the epidemic, and the time may be delayed.

Therefore, relying on third-party independent suppliers carries the risk of insufficient production capacity. With Guoxuan High-tech, Volkswagen can solve the problem of insufficient battery capacity to meet its own product planning needs.

From Volkswagen’s power battery strategy, joint construction of battery factories is mainly in Europe. However, why is there a “rumor” with Guoxuan High-tech? It depends on the importance of the Chinese market to Volkswagen.

Previously, Volkswagen’s global media conference announced that Volkswagen Group delivered 4.23 million cars to the Chinese market in 2019, and its market share in China increased by 1.4 percentage points, accounting for 20% of the global market share.

In terms of electrification, Volkswagen plans to deliver 300,000 new energy models in China in 2020. Volkswagen CEO Diess stated that this number will increase to 1.5 million vehicles by 2025, and the demand for power batteries will reach 75 GWh.Volkswagen has announced that China is already its largest single market outside of Europe. This indicates that the Chinese market will certainly be critical for Volkswagen in the future. However, it is not just Volkswagen, Toyota, Honda, GM, BMW, Daimler, and more are already selling more in China than in other regions.

Furthermore, the real “knife-fight” is yet to come based on the current electrification layout of major manufacturers in China. Tesla has already announced its plan to build a battery factory in China and to achieve 100% localization of parts in the future; Toyota and Panasonic will jointly establish five power battery factories and have also formed a joint venture with BYD; BMW has also partnered deeply with CATL (Contemporary Amperex Technology Co.).

Therefore, Volkswagen must have core spare parts capabilities in China, which is the “land grab” of the giant factories. The most important part of this is the battery, as the control of the battery can maximize the control of the overall vehicle cost. For many years, Volkswagen has had experience in optimizing the overall vehicle cost, but the only uncertainty in the electrification era is the battery.

Achieving local supply chain, optimizing cost structure, and avoiding core weaknesses in competition with other manufacturers are the reasons why Volkswagen has the right to acquire a battery company.

In fact, another crucial point is the issue of product stratification for future electric platforms of Volkswagen. The simple understanding is that Volkswagen’s electric product line will occupy the high-end luxury market with Porsche and Audi, and the middle-end market with Volkswagen, Skoda, etc., and the low-end market with Jetta and Seat. Additionally, Volkswagen has already stated that all these brands will have electric products. Therefore, based on the needs of different products, Volkswagen can use different versions of batteries.

Guoxuan High-tech is very suited to Volkswagen’s needs because firstly, Volkswagen’s own battery and external supply will surely coexist, and the top-tier battery manufacturers can still supply more advanced batteries for Porsche, Audi, and other high-end brands, which can balance the cost of batteries thanks to the brand’s premium pricing ability.

For low-end brands, Volkswagen needs to reduce costs. However, whether CATL and LG can supply the batteries needed by Volkswagen is uncertain. If not, it is unpredictable how low-end brands can achieve maximum single-vehicle profit.

Since Guoxuan High-tech has a product line of lithium iron phosphate and ternary lithium, even though ternary 811 has not yet been mass-produced on a large scale, lithium iron phosphate and ternary 622 have already been installed in a large scale, which means Guoxuan High-tech has a complete power battery production line.

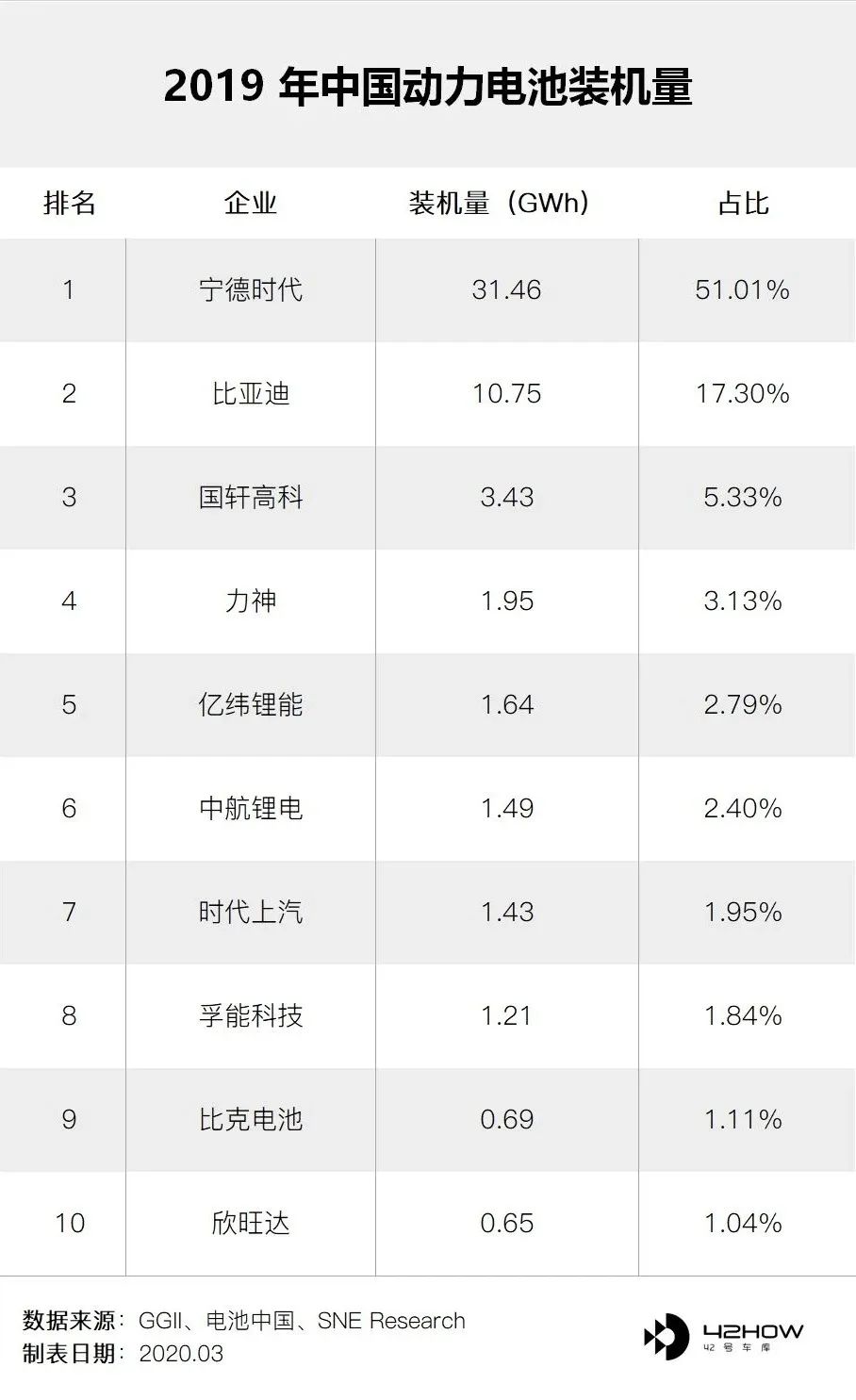

Moreover, there is another point why Guoxuan High-tech is the choice. Currently, among the Chinese power battery manufacturers, Guoxuan High-Tech ranks third only after BYD, but its market value was only 29.363 billion RMB even at its highest point. This is less than the value of CATL and BYD. Therefore, for Volkswagen, Guoxuan High-tech is relatively affordable and has good quality.

Guoxuan High-tech has not disclosed its 2019 annual financial report and first quarter report of 2020, but according to the company’s financial reports in recent years, its accounts receivable has been increasing year by year.

According to the 2018 annual report, the company’s accounts receivable reached RMB 5 billion, and by the end of September 2019, the company’s accounts receivable for the first three quarters had expanded to RMB 7.096 billion. However, as of September 30, 2019, Guoxuan High-tech’s cash reserve on the books was RMB 2.142 billion, a year-on-year decrease of 30.72%.

Assuming that Volkswagen does not buy Guoxuan High-tech in the future, it is highly likely that it will be eliminated in the face of full competition from foreign companies such as Ningde Times, BYD, and others.

In summary, we can obtain the reasons for Volkswagen’s possible acquisition of Guoxuan High-tech:

-

To ensure the safety of the supply of core accessories for power batteries;

-

To solve the problem of insufficient production capacity of power batteries that cannot meet the needs of their own product planning;

-

To achieve localization of the supply chain in the Chinese market and optimize structural costs;

-

To achieve diversified battery applications, parallel use of own and external supplies, i.e. optimizing core costs and ensuring consumer awareness;

-

The cash flow of Guoxuan High-tech is insufficient and needs a backer, and its overall valuation is relatively cheap.

03 Guoxuan High-tech’s technology is not just a “display”

When the news first came out, some people said it was “unreliable” because Guoxuan High-tech mainly focuses on lithium iron phosphate batteries, while the mainstream in the market is lithium ternary batteries, so Volkswagen would not acquire such a company. This view is obviously not objective.

According to Volkswagen’s product planning, the products of PPE and MEB have different market targets, so the use of batteries will also be used according to high, medium, and low levels.

First of all, let’s take a look at China’s installed capacity of power batteries in 2019. Guoxuan High-tech ranked third, accounting for 5.33% with 3.43 GWh, behind only Ningde Times and BYD. Its installed capacity in November 2019 (404.91 MWh) was almost the same as that of BYD (404.97 MWh).

Among Guoxuan High-tech’s cooperative automobile companies, passenger cars include Jianghuai Automobile, Chery, and Dayang Automotive; commercial vehicles include Zhejiang Feidie, Jianghuai Automobile, Jiangxi Dayang, Qingling Motors, Sichuan Geely, Changhe Automobile, Ankai, etc.According to the data, last year Guoxuan High-Tech provided battery support for 54 vehicle manufacturers, involving 281 models, in the new energy vehicle recommendation catalog, so Guoxuan High-Tech is not a “three noes” company in terms of overall production of power batteries and market recognition.

In terms of technology, Guoxuan High-Tech’s market in 2019 was mainly composed of two lines: square shell and cylindrical shell. The former is mainly for buses and commercial vehicles, and the latter is mainly for passenger cars using lithium iron phosphate.

Guoxuan High-Tech officially claimed that it has completed the upgrade of the energy density of lithium iron phosphate single cells to 190Wh/kg and can meet the range of more than 400 kilometers for new energy vehicles. In February this year, Guoxuan High-Tech announced that the energy density of lithium iron phosphate single cells had been increased to nearly 200Wh/kg.

Regarding the endurance, BYD’s latest blade battery has an energy density of 190Wh/kg, and the highest NEDC range for the dual-motor version of the “Han” using blade batteries reached 605 kilometers. This means that Guoxuan High-Tech’s official claims regarding the endurance in passenger cars will also be around 600 kilometers.

In terms of ternary batteries, the 811 soft pack samples made by Guoxuan High-Tech have passed the midterm assessment of the Ministry of Science and Technology, with an energy density of 302Wh/kg and a cycle life of more than 1500 weeks. It is expected that the 811 soft pack battery will be installed in cars in 2020. In addition, the company’s ternary 622 batteries have been supplied in bulk to automakers such as Chery and Leopard.

Guoxuan High-Tech has a current production capacity of 16GWh, and planned production capacity of 35GWh, which can basically meet the short-term demand of Volkswagen. Moreover, there is also a choice of lithium iron phosphate and ternary batteries to cope with Volkswagen’s high, medium and low-level products.

If Volkswagen intends to acquire Guoxuan High-Tech, it may directly become a first-line power battery company. Although Contemporary Amperex Technology Co. Limited (CATL) is also very strong, its market performance has been going smoothly after entering the supply chain of BMW. After entering the supplier list of Tesla, the market value has directly exceeded 3 trillion yuan. This is the effect of big companies.

Another point is that affected by the new coronavirus epidemic in 2020, the latest data released by the China Association of Automobile Manufacturers (CAAM) shows that in the first quarter of 2020, sales of new energy vehicles fell by 56.4% year-on-year to 114,000 vehicles; and the installed capacity of power batteries dropped by 53.8% year-on-year to 5.7GWh.### Different Opinions in the Market of 04

While GuoXuan Hi-Tech released an announcement, the wording is ambiguous and leaves room for imagination. Besides those who consider the acquisition only a matter of time, there are also many who doubt that Volkswagen will acquire GuoXuan Hi-Tech.

Firstly, some people who disagree believe that for such a major event, the news should first appear in Germany. However, Germany is almost silent this time, and the earliest report from Reuters indicated that GuoXuan Hi-Tech is in talks with Volkswagen, but there is basically no further news about this incident from foreign media.

Secondly, Volkswagen’s profits in the first quarter of 2020 fell by 81% due to the impact of the epidemic, and it has changed its market strategy for 2020. Volkswagen CEO Diess said that the market target has been downsized. Therefore, the investment estimate will become more cautious.

Lastly, Volkswagen’s battery strategy is mainly to establish a battery supply system in Europe. Volkswagen has invested in Northvolt AB and holds 20% of the shares. This battery cell company plans to supply battery cells to Volkswagen from 2023 onwards. The factory is planned to start with 16 GWh of production capacity and expand to 24 GWh in the future. The total area of the factory will be 180,000 square meters. The only European battery supplier for Volkswagen’s current MEB platform is LG Chem. As more strategic partners start production in Europe, the production capacity will be evenly distributed. Therefore, Volkswagen will not solely control a battery enterprise in China.

Furthermore, from a business perspective, there are certain obstacles to investing in GuoXuan Hi-Tech because the main product of GuoXuan Hi-Tech is lithium iron phosphate batteries, not the mainstream lithium-ion batteries used in current passenger cars. After acquiring GuoXuan Hi-Tech, Volkswagen will face the choice of switching the technology route.

Therefore, some insiders believe that although Volkswagen is wealthy, it still needs to face the market difficulties under the epidemic. Volkswagen’s battery strategy is not in China, and there is a time lag in switching its vehicle batteries. Currently, Volkswagen has no reason to acquire a Chinese battery company.

However, if we look at the timeline in the long run, it is actually not the case. Firstly, the price of acquiring GuoXuan Hi-Tech is really not expensive now. Secondly, the potential of China’s new energy market is endless, and China will still be Volkswagen’s largest single market.Localized battery supply is beneficial for cost reduction, but if using third-party suppliers between 2025 and 2030, Volkswagen will have to share with other automakers the production capacity of Chinese battery manufacturers, which is not good news for Volkswagen because success or failure is in the next few years.

Finally, there is a complete battery supply system in China, from the material end, manufacturing end, to the usage end, and finally to the reuse of old batteries. Therefore, if Volkswagen acquires Guoxuan High-tech, it will actually help Volkswagen implement its strategy in China.

Conclusion

First of all, on April 21, the acquisition was announced, and on the evening of the 22nd, Guoxuan High-tech issued a notice. However, note that this notice states that there is still cooperation under negotiation, and the specific cooperation projects and the amount involved have not been negotiated. Moreover, as of now, Volkswagen has not issued any statement denying the acquisition negotiations, so we have reason to believe that the objective fact of the acquisition negotiations exists.

For Volkswagen, facing this single large market in China, ensuring sufficient capacity and supply security is very important. Cooperation with battery companies such as CATL and LG is difficult to completely supply according to Volkswagen’s ideas. Therefore, self-owned batteries are very important. Moreover, Guoxuan High-tech’s product line is relatively complete, including lithium iron phosphate batteries and ternary lithium batteries. In the future, Volkswagen can use different batteries according to different product needs.

For Guoxuan High-tech, finding a giant like Volkswagen as a backing will bring immeasurable benefits to it, and it can also alleviate the problem of sales and installation volume decline caused by the epidemic.

If Volkswagen really becomes a shareholder of Guoxuan High-tech, it will set a precedent in the industry, and this will be the first time that an automaker invests in a mature power battery manufacturer.

This will bring two impacts to China’s power batteries. First, it may directly allow CATL, BYD, and Guoxuan High-tech to form a three-legged, competitive relationship. Second, it breaks the pattern of power battery companies building factories jointly with automakers and will prompt more automakers to invest in or acquire mature battery companies.

Author: Delu

Editor: Daji

You may also be interested in:

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.