On April 23, 2020, at 4:00 PM, a message that had been awaited for four months by the entire automotive industry finally came. Faced with a three-month slump in the automobile market due to the pandemic, the 2020 new energy vehicle subsidy policy was officially implemented. Let’s focus on the key points:

- Subsidy period extended to 2022. In principle, the subsidies for 2020 – 2022 will reduce by 10%, 20%, and 30% respectively based on the previous year, with an annual subsidy scale limit of about 2 million vehicles.

- The battery energy density technology index will not be adjusted. The subsidy for range still has two tiers, with the first tier threshold increasing from 250 km under the standard condition in 2019 to 300 km, and the second tier remaining at 400 km. At the same time, the subsidy amount will slightly decrease.

- The pre-sale price of new energy passenger vehicles must be below 300,000 yuan (including 300,000 yuan). To encourage the development of new business models such as “battery swapping” and accelerate the promotion of new energy vehicles, vehicles under “battery swapping” mode are not subject to this regulation.

- From April 23, 2020, to July 22, 2020, there is a transition period. Vehicles that meet the 2019 technical requirements but not the 2020 technical requirements that are sold and registered during this period will receive a subsidy of 50% of the standard. Vehicles that meet the 2020 technical requirements will receive the standard subsidy.

The most crucial issue is that a “price” threshold has been added to this year’s subsidy policy, set at “300,000 yuan,” except for “battery swapping” mode vehicles.

Who is the protagonist of this drama?

First of all, let’s take a look at which electric cars are available in the 300,000 yuan price range.

- Over 300,000 yuan: Tesla Model 3, NIO ES6, Polestar 2, Xpeng P7, Skywell ET5, Byton M-byte

- 20,000 to 30,000 yuan: XPeng P7, BYD Han, Aion LX, HYCAN 007, MARVEL X, AIWAYS U5

Although there are many models listed, the Tesla Model 3 is the absolute leader in sales.

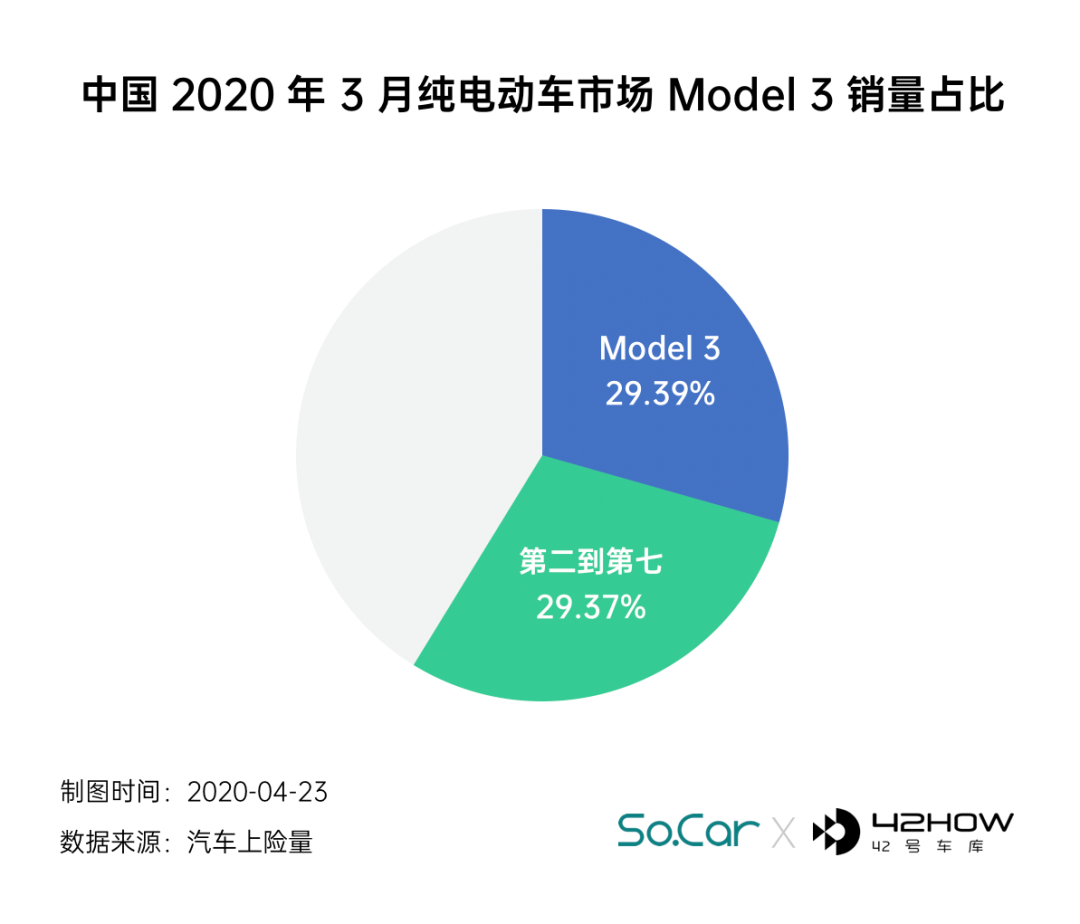

11,278, this is the monthly sales number of domestically produced Model 3 in the third month of delivery, accounting for 29.39% of China’s total sales of pure electric vehicles in March, ranking first and approximately equal to the total share of the second to seventh places.

Even for a gasoline-powered car, exceeding 10,000 monthly sales is a hurdle in the Chinese market, but Model 3 seems to have crossed it as if the hurdle does not exist.In the past three months, Model 3 ranked 11th in total sales among all models, only behind the perennially dominant A-class cars.

When news of localization was announced, the discussion of “will there be the bandwagon effect” was never-ending. After a few months, the number 10,000+ has basically verified the authenticity of this big fish in the past few days.

Not to mention the contrarian advance in the overall market decline amid the epidemics after the localization of the rear-wheel drive long-range and performance versions, coupled with the Model Y no longer holding back, the “slaughter of the land” in the 300k+ market has quietly begun.

This used to be a playground for the three brands of BBA who were both friends and foes.

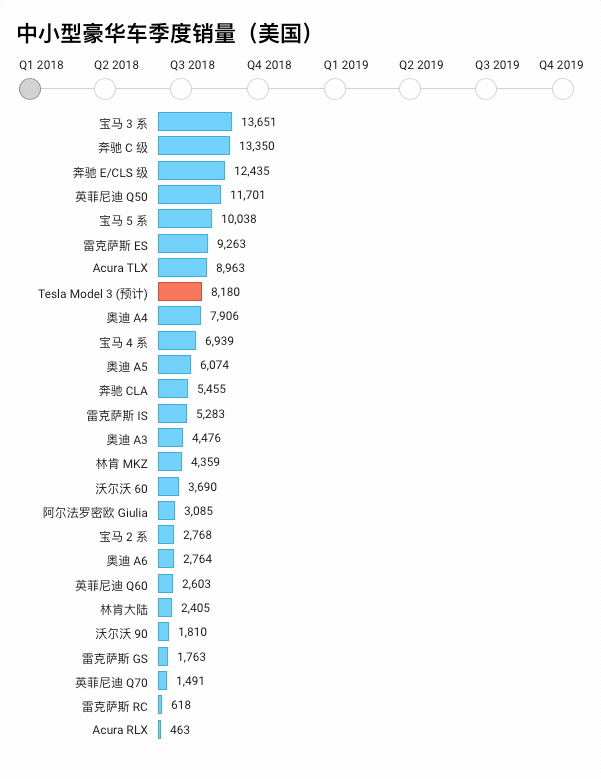

In the North American market in 2019, whether Model 3 can replicate this miracle in China is not discussed, but the attack of electric cars on the traditional market has officially sounded on the land of China, the world’s largest automotive market, through Model 3.

The question is here, Tesla is obviously the protagonist of this game, but is it assisted by the new policies or becomes the “sacrifice” of the 300k subsidy threshold status? Today, there are two different voices.

Forget about them, listen to me.

Let’s first look at the pre-subsidy price of the current Tesla flagship model, Model 3, in the Chinese market.

- Domestic standard range upgrade version of Model 3: CNY 323,800

- Domestic long range version of Model 3: CNY 366,550

In terms of price, both of these models will be excluded from the subsidy, but it is not far from the 300k threshold. Therefore, as long as Tesla tries hard, it is also possible to meet the requirement. Based on our understanding of Tesla, we can provide two predictions.

- First, the pre-subsidy price of the domestic standard range upgrade version of Model 3 will definitely be reduced to within 300k after July 22.

The subsidy policy document clearly states that April 23 to July 22 is the subsidy transition period. That is to say, Tesla only needs to reduce the price to within 300k after July 22 to meet the subsidy requirements.

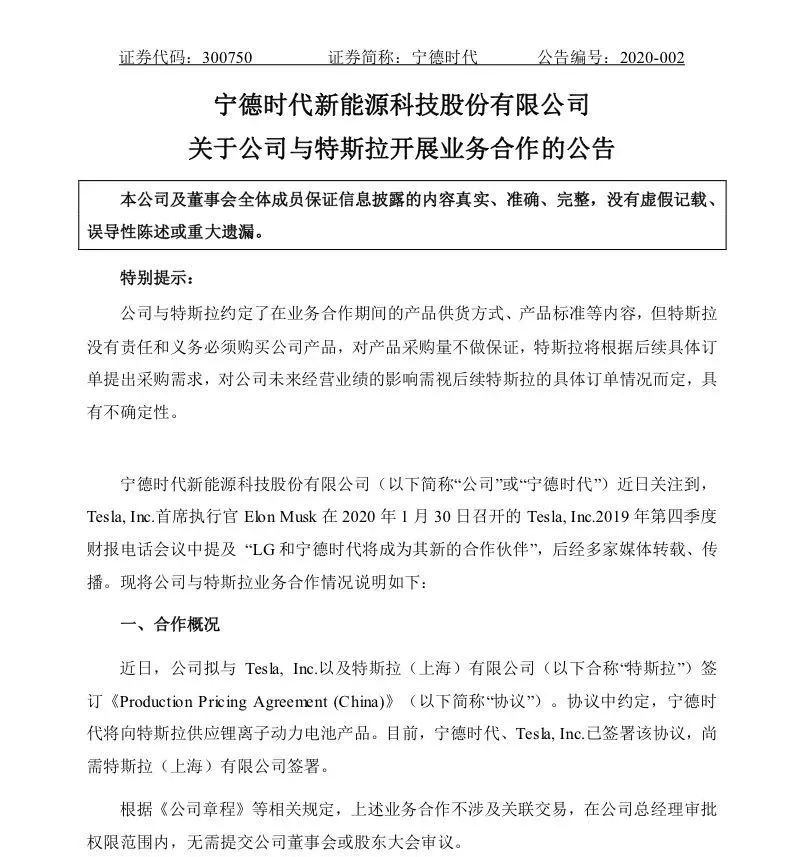

And July is a critical time for Tesla. In July, Tesla will equip the domestically-produced upgraded version of Model 3 with lithium iron phosphate batteries provided by CATL as the power battery. At the same time, July is also the time for Tesla’s Chinese factory to achieve a 70\% localization rate. Both of these points can provide Tesla with greater profit margins. Therefore, for Tesla, it is entirely capable of lowering the price of domestically-produced upgraded standard range Model 3 by 23,800 yuan, and reducing 40,000 yuan by lowering the price by 23,800 yuan. Tesla, a cunning company, must have already figured out the calculation. Therefore, the post-subsidy price can be reduced to at least around 270,000 yuan.

And July is a critical time for Tesla. In July, Tesla will equip the domestically-produced upgraded version of Model 3 with lithium iron phosphate batteries provided by CATL as the power battery. At the same time, July is also the time for Tesla’s Chinese factory to achieve a 70\% localization rate. Both of these points can provide Tesla with greater profit margins. Therefore, for Tesla, it is entirely capable of lowering the price of domestically-produced upgraded standard range Model 3 by 23,800 yuan, and reducing 40,000 yuan by lowering the price by 23,800 yuan. Tesla, a cunning company, must have already figured out the calculation. Therefore, the post-subsidy price can be reduced to at least around 270,000 yuan.

Secondly, the domestically-produced long-range version Model 3 will no longer enjoy subsidies, but after July 22nd, there is a chance that the price will drop to around 330,000 yuan.

Currently, the pre-subsidy price of domestically-produced long-range Model 3 is 366,550 yuan. It is unlikely for Tesla to lower the price by 66,000 yuan. Tesla will not lower the price so drastically just for subsidies, and if the long-range model price is reduced to within 300,000 yuan, the standard range must follow suit.

For Tesla, there is no demand problem with the long-range version Model 3, only a production capacity issue. Therefore, even if a price cut is required, the price can be lowered to the current level at most after the subsidy is reduced.

If anyone here is considering the long-range Model 3, hurry up and order. The last train for subsidies can be caught up by delivering the car by July 22nd, and there is no need to worry about Tesla “cutting leeks” again.

After the announcement, many users who ordered the long-range version of Model 3 in 42 garage’s Weibo comments area had questions. According to the current subsidy policy, will the subsidies for Tesla standard range upgraded version and long-range version Model 3 purchased or delivered from April 23rd to July 22nd be halved? Let’s be clear here: it will not be halved, but it will be reduced!

The subsidy policy document makes it clear that during the transition period, vehicles which meet the technical indicator requirements of 2019 but not those of 2020, are eligible for sales and license plate registration. The judgment standard here is the technical indicator. The standard range upgraded version and long-range version Model 3 of Tesla meet the requirements of the technical indicators of 2019 and 2020. The threshold of 300,000 yuan does not belong to the technical indicators so it can enjoy 100\% subsidy. But vehicles that meet the technical indicator requirements of 2020 for sales and license plate registration are subsidized according to the 2020 standards!

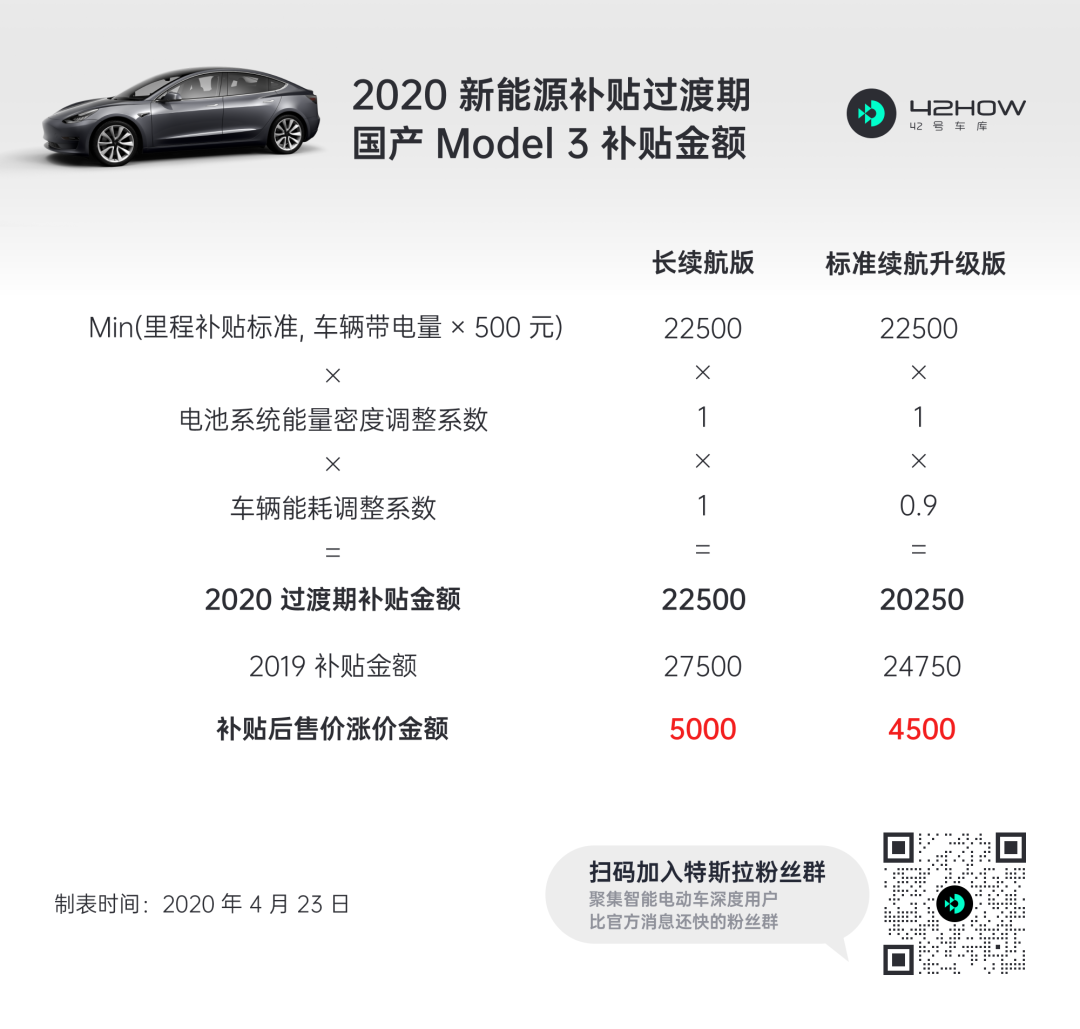

According to the 2019 standards, the subsidy for the Model 3 Standard Range Plus (SR+) upgraded version is 24,750 RMB, while the subsidy for the Long Range (LR) version is 27,500 RMB.

According to the 2019 standards, the subsidy for the Model 3 Standard Range Plus (SR+) upgraded version is 24,750 RMB, while the subsidy for the Long Range (LR) version is 27,500 RMB.

According to the 2020 standards, the subsidy for the Model 3 SR+ upgraded version is 20,250 RMB, and the subsidy for the LR version is 22,500 RMB.

The subsidies for both the SR+ and LR versions are reduced by 4,500 RMB and 5,000 RMB respectively.

Who is affected by the Model 3?

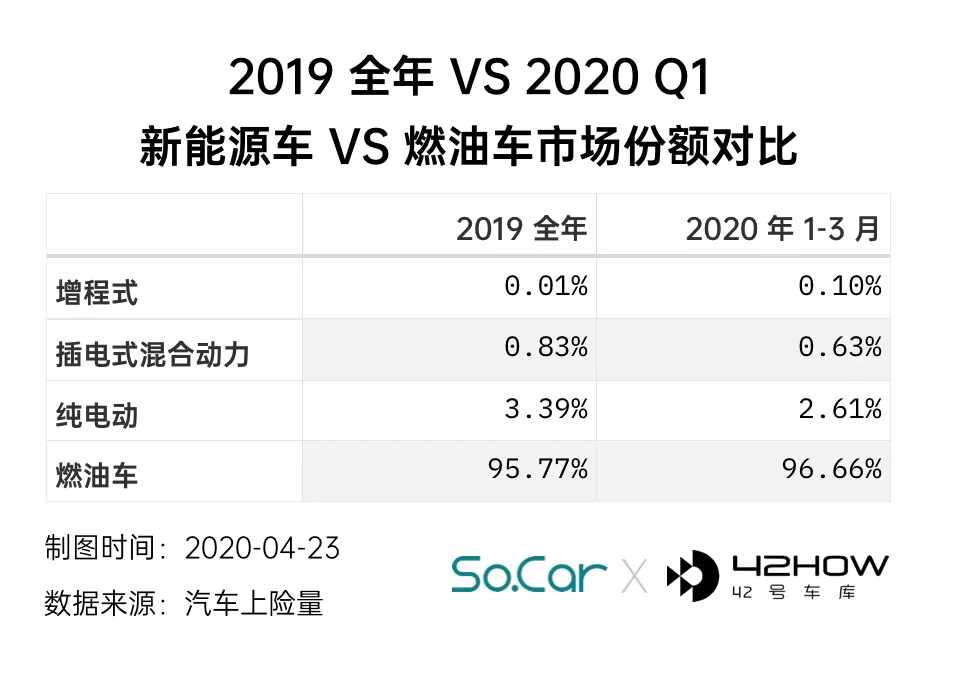

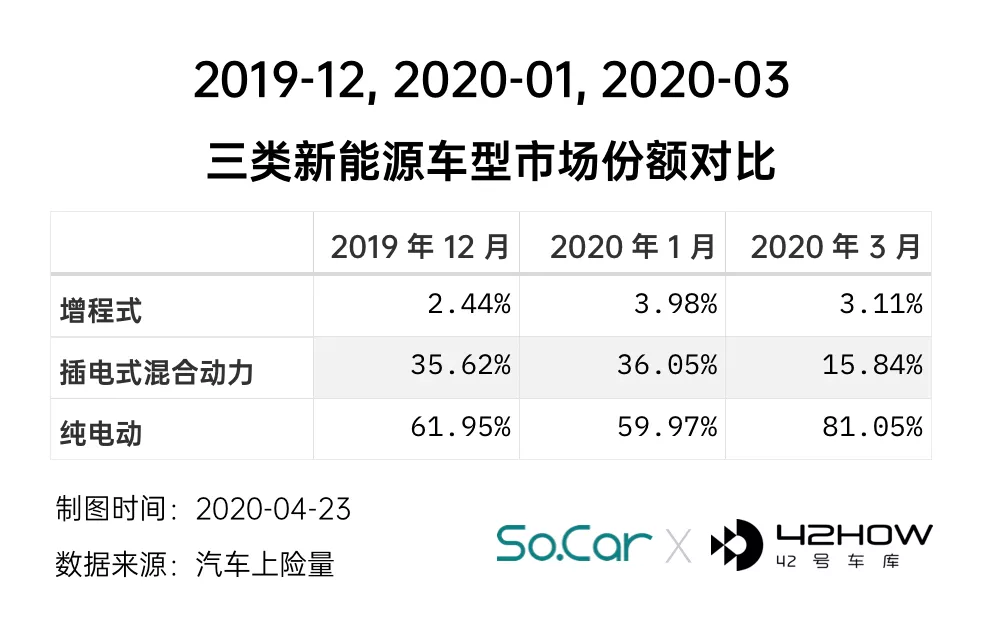

Looking at the pure sales data over the past year, in the first three months of 2020, during which the entire electric vehicle (EV) market fell by nearly 0.8 percentage points, instead of solely because of the strong growth in sales of the Model 3, the EV market had a decrease in market share. Plug-in hybrid EVs have declined by 0.2 percentage points.

That is to say, Model 3’s bite might really only be on EV’s own market territory.

This is very “catfish”.

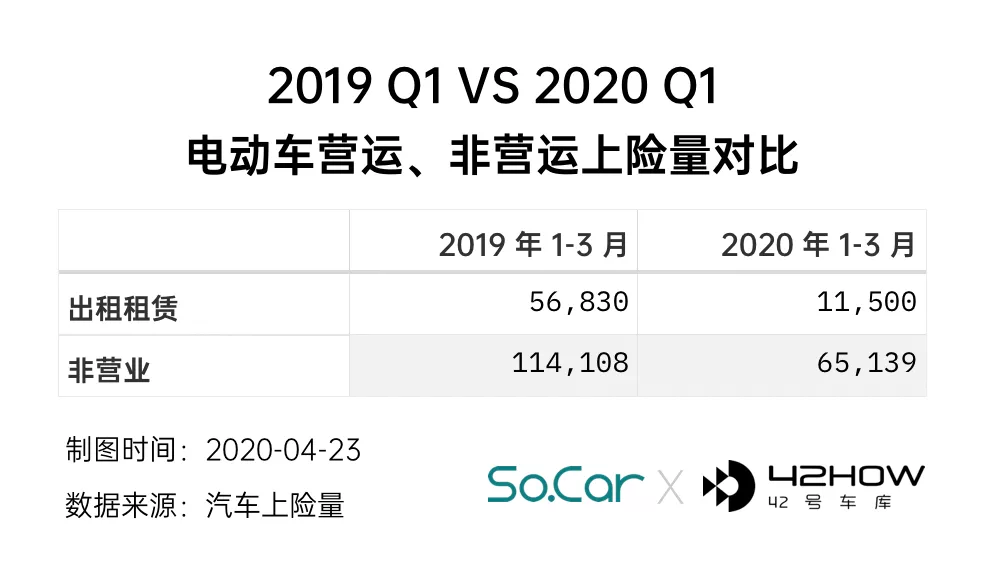

However, it’s better to first look at why the overall EV market is declining. The primary reason is the contraction of rental and operating vehicles. In the first three months of this year, affected by the outbreak of COVID-19, the overall automobile market sales dropped from 4.95 million units in the same period of 2019 to 3.03 million units, a YoY decline of 38.7\%, and total sales of BEVs also decreased by 55.2\%. Among them, operating and rental vehicles fell the most, with a YoY decrease of almost 80\%.

In 2019, the top two-selling EV models, the BAIC EX5 and the BYD e5, had total sales of around 60,000. Almost all e5 models were used as operating and rental vehicles, while besides being used as taxis, almost all EX5 models were purchased by Didi (a Chinese ride-hailing service company). These two models alone accounted for 17.5\% of all BEVs sales in 2019.

However, in the first three months of this year, even if the Model 3 (subtracting the 11,278 units) were out of the denominator, this number would be only 4.5\%.

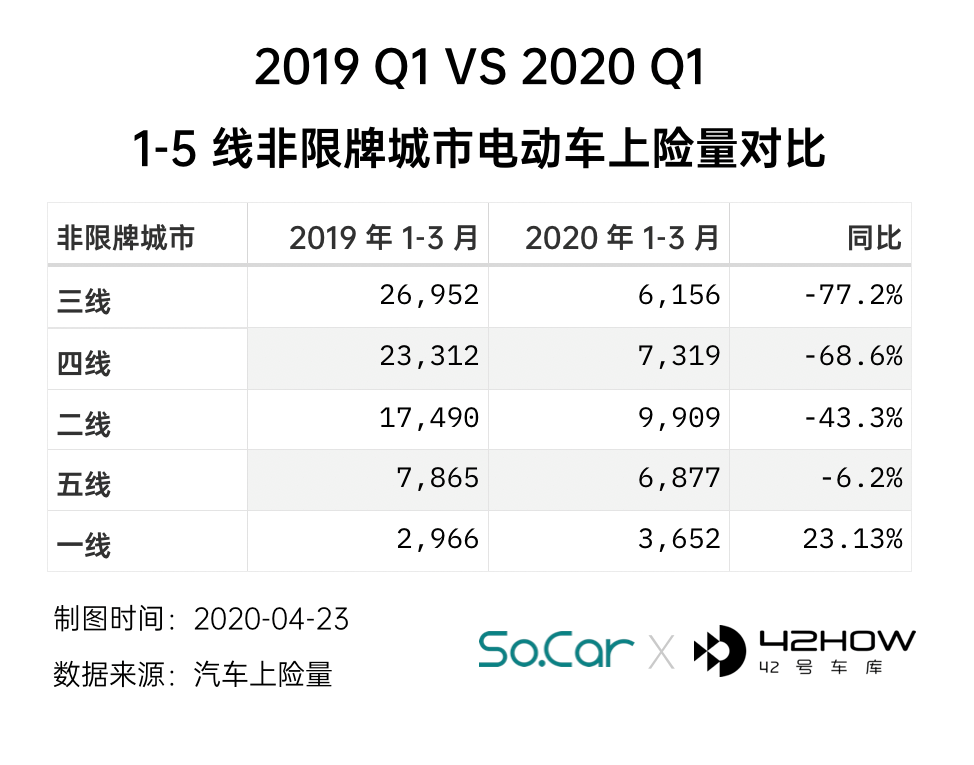

The second reason is the non-limited license plate cities. If the rental and operating vehicles mentioned above are excluded, in 2019, over 650,000 EVs (43\% of the total) without operating and rental license plates were sold in non-limited license plate cities, which may seem counterintuitive to many people.

Among these non-limited license plate cities, the four small EV models–Chery eQ1 in Wuhu, Baojun E100 and E200 in Liuzhou, and the Ora R1 in Baoding– alone accounted for over 8\% of this 65\% number.Similar to them, these products that play the role of upgrading and sharing low-speed electric vehicles in second- and third-tier cities have been giving financial support to the pure electric market for the past few years. In the pandemic, they have fallen even more miserably.

And in the first quarter of this year, the year-on-year decline in pure electric vehicles in third and fourth-tier cities was 77.2% and 68.6%, respectively, and 43.3% in second-tier cities, which is not as bad as the overall 55%.

At first glance, it sounds terrifying, but these two big “decreases” actually represent “watering down” the numbers for the pure electric market. Model 3 is attacking in such a seemingly counter-trend environment.

If there were no Model 3, the number of pure electric vehicles in these two months would have fallen even higher.

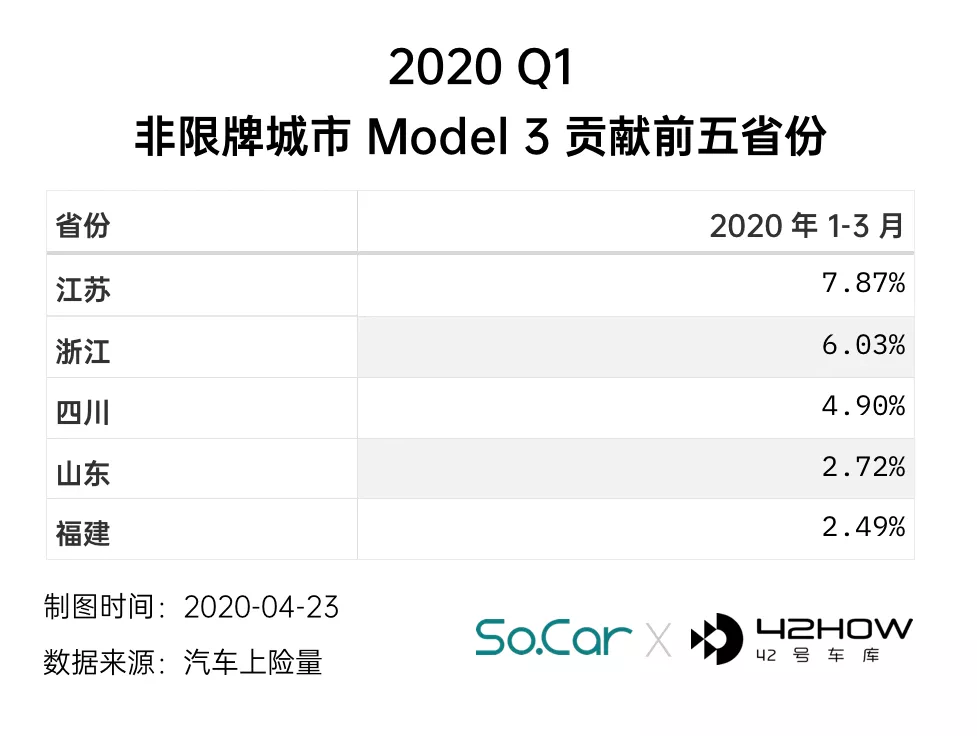

When looking inside these two markets, the situation is as follows: Model 3 has not even been sold as a taxi. In non-limited license plate cities, the three first-tier non-limited cities (Chengdu, Suzhou, and Chongqing) have risen by more than 23% in total in the past three months. So, which pure electric car sells the most in these three cities? The answer to this question is not necessary, it is definitely the Model 3 – it is inevitable for potential Tesla owners in these cities to want to get their hands on one.

The same is true for coastal provinces such as Jiangsu, Zhejiang, Shandong, and Fujian… I can even imagine their friends shouting in their hearts when they hear the domestic price of the Model 3 – “Please take my money”.

So, let’s answer the question in the above paragraph: Has Model 3 gained any market share of traditional cars?

The main competition with traditional cars is the effective penetration of non-limited license plate cities as mentioned above. Even if restricted license plate cities are high-end and popular, it is still a competition within the new energy market, which will be discussed in the next section.

Therefore, it can almost be certain that after “watering down” the pure electric market, the main source of Model 3’s ability to instantly accumulate such a large market capacity is the above-mentioned economically developed non-limited license plate cities, where users’ purchase decisions for this car have little to do with their license plates – although they may really be concerned about the green license plate not looking good at first.

And is this market share rightfully belonging to fuel vehicles? Let every observer judge for themselves.

I believe that many people here have never even considered traditional fuel vehicles.

Who is affected by the bidirectional impact of the catfish effect?Just now, it was said that in limited license plate cities, the competition for customers among new energy vehicles is already fierce. The impact of the Model 3 on this market is structural, and the total amount is determined by the number of license plates issued. However, the total amount for the first three months of this year decreased from over 53,000 to over 42,000 compared to the same period last year.

Here, we only consider non-commercial vehicles.

Among the new energy vehicles in non-commercial use in limited license plate cities, Model 3 accounted for 9,640 units in the first quarter of 2020, accounting for as much as 22% of this market segment. Considering that Model 3 was 0 last year, which mouths did this 22% snatch from?

Intuitively, cars close to the price of the Model 3 should not do well, after all, the new energy vehicle market in limited license plate cities is a true zero-sum area without new policy incentives, where there are many wolves and little meat, and the competition is fierce.

February was not considered because of the Chinese New Year holiday affecting the market trend.

Almost all price segments were affected by this, which is still frightening.

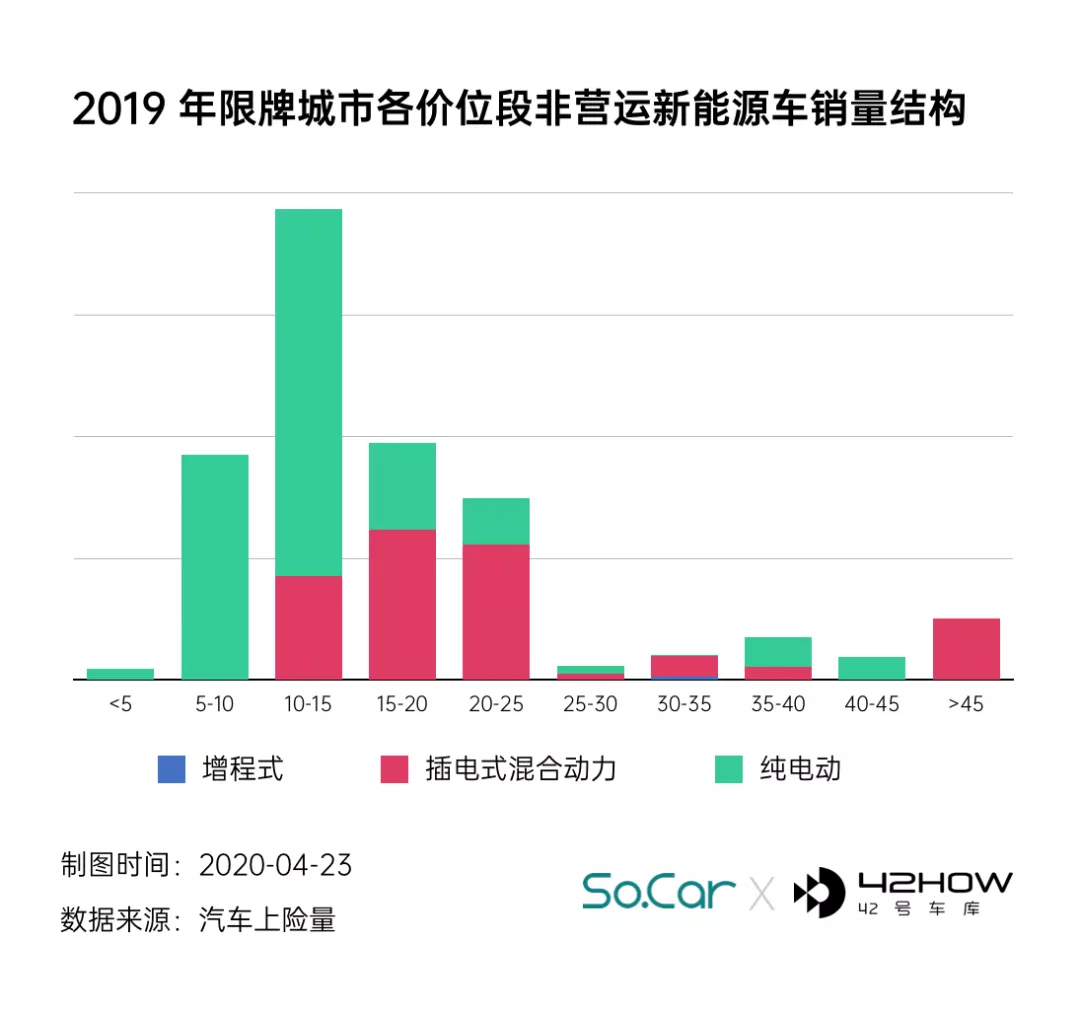

If we have to analyze it, the 20-25 million yuan price segment of new energy vehicles is the one most affected by the competition with the domestically produced Model 3.

However, obviously, the market from 50,000 to 350,000 yuan is also suppressed at the same time. So, it seems that price is not the only factor.

When we look at it from a different perspective, we know that — without any more suspense, here is the conclusion.

https://mmbiz.qpic.cn/mmbizpng/9PZBJyZYKRkKeH3zhib2eibbrzgOdzzOc7a4fMdOp67ibVHFVA430fYaK1qAhOneRezpGw9dvuUCtyCAI2OaialKZg/640?wxfmt=png&tp=webp&wxfrom=5&wxlazy=1&wxco=1

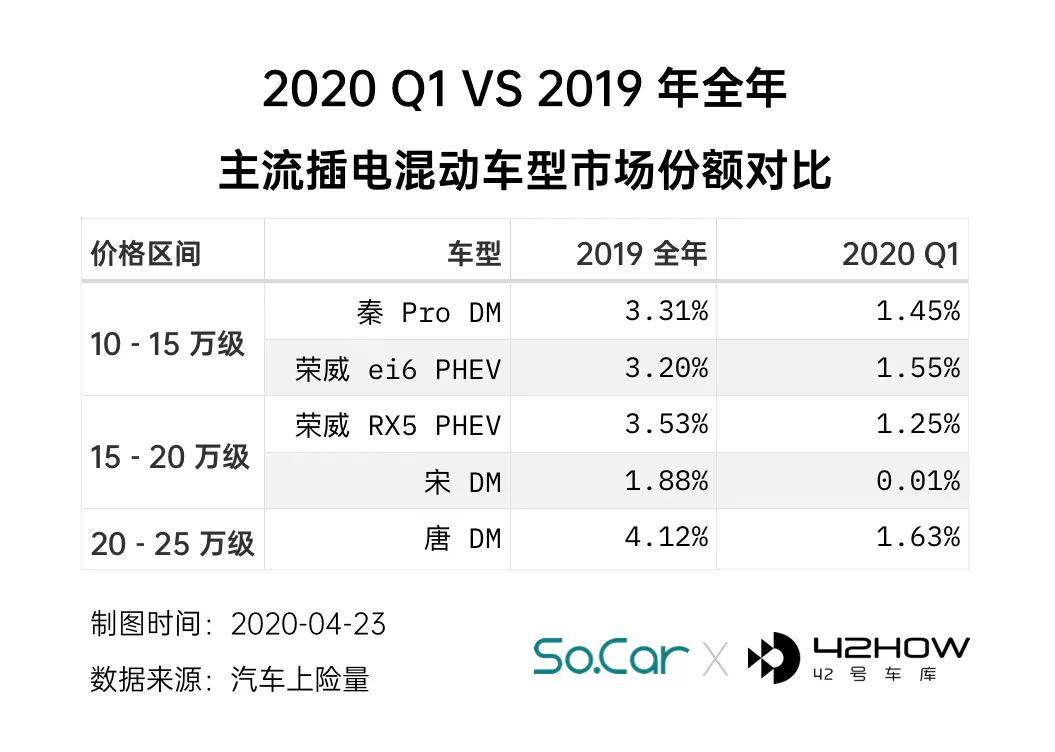

Yes, plug-in hybrids are the ones truly affected, particularly in the price segment of 200,000 to 250,000 yuan. Not to mention, they are priced so close to the Model 3. Thus, it is reasonable that the plug-in hybrids are being replaced. It can be seen from the chart below that the lower the price segment which plug-in hybrids occupy, the greater the drop on the chart above.

Plug-in hybrid itself is a product with unclear user value, or a policy product especially in China. Many manufacturers’ products cannot withstand scrutiny.

Turning back to the data, the PHEVs of the Chinese brands Roewe and BYD, which were ranked first or second in their respective segments, were most affected among the plug-in hybrid models in the restricted license plate cities in various price ranges.

I remembered my neighbor who drives a Song DM, he had an indescribable expression when asking me about the precautions for installing a charging station, while looking at the Model 3.

When the catfish twists its big tail, it first breaks the waist of the plug-in hybrid.

It seems that the Model 3 has eaten up 22% out of thin air, and the plug-in hybrid has also spit out almost the same.

On the other hand, who is thriving in the catfish effect?

We have seen some signs, but they are not yet obvious. We wish them to continue to survive and prosper.

After the subsidy policy, who will tremble?

Setting the subsidy threshold at below 300,000 yuan, theoretically the most affected one is NIO. NIO’s current three models are all priced above 300,000 yuan, and NIO’s gross margin is already negative, with no room for price reduction.

William Li, CEO of NIO, once stated at the 2020 EV Car 100 People Forum: “We won’t lower our prices even if Tesla does. We all have negative profit margins and no room for price reductions. Although NIO won’t lower its prices, we will make our services better.”

However, the latter half of the subsidy policy states that “new energy passenger cars with a pre-subsidy price of 300,000 yuan or less (including 300,000 yuan) are encouraged to develop the “battery swap” new business model, and vehicles using the battery swap model are not subject to this provision.”

Therefore, NIO, which supports battery swapping, is almost unaffected by this subsidy change.

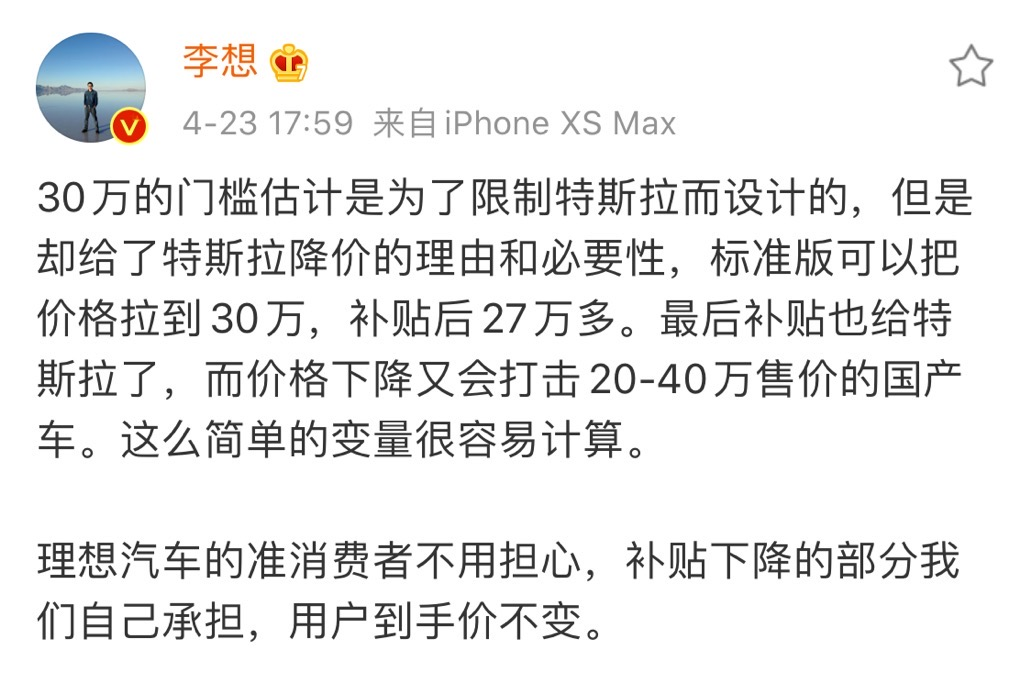

As for the Ideal ONE, which is priced at 328,000 yuan, it is an extended-range plug-in hybrid. Its subsidy was 10,000 yuan in 2019 and 8,500 yuan in 2020, which is relatively less than that for pure electric vehicles, and its price has not changed significantly.

Moreover, CEO of Ideal Auto stated on Weibo after the subsidy policy was launched in 2020: “Consumers of Ideal Auto don’t need to worry. We will bear the reduction in subsidies ourselves, and the final price for users will remain the same.“

In addition, there is the XPeng P7, which aims to hit the high-end market. Currently, the pre-sale price of the P7 is 240,000 to 370,000 yuan. Some models are blocked outside the subsidy threshold. However, XPeng He confidently wrote these in his Weibo:

Overall, the only model that needs to be adjusted among the current models is Tesla. The newly added “300,000 yuan” threshold in this subsidy policy has forced Tesla to cut prices again. This is definitely good news for consumers, but for self-owned brands that have not yet entered the market but hope to move upward to hit the high-end market, such as Techrules X and Byton M-Byte and other models, it is quite painful.

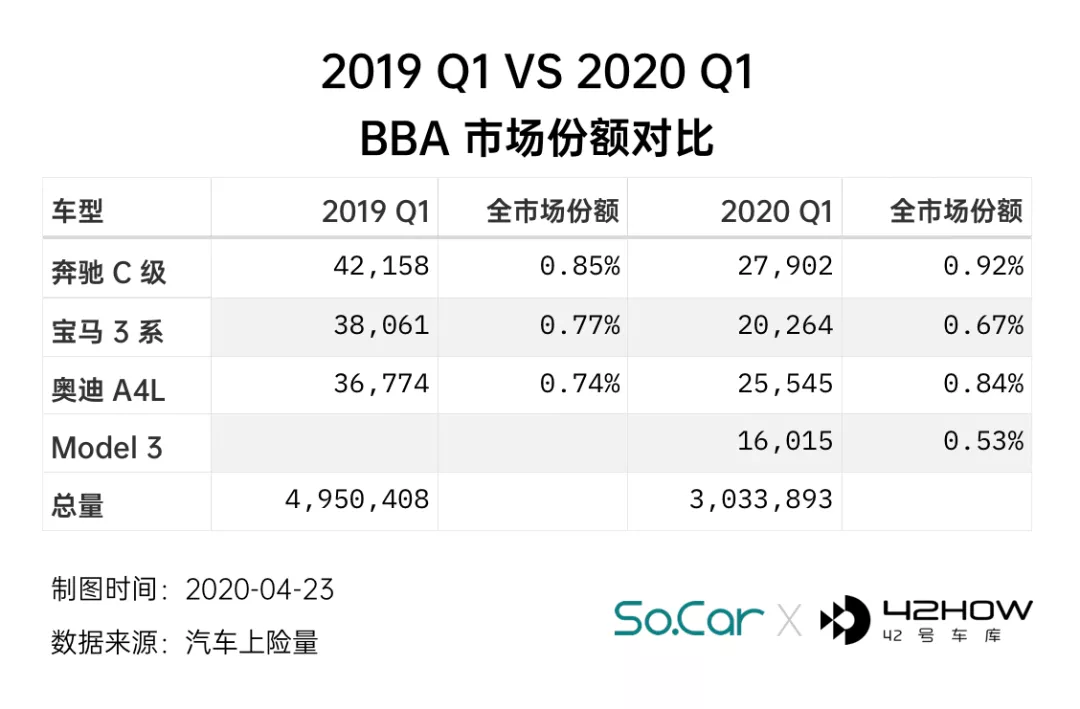

Finally, let’s talk about BBA. How heartbreaking the chart from North America is. I don’t think it is impossible in China. However, from the current data, BBA is not affected at all.

Of course, Model 3 climbed in production capacity in the first two months, and the impact has not yet surfaced. Although Model 3 surpassed BBA comprehensively in March but has not entered into a direct confrontation.

As mentioned at the beginning, doing these analyzes and records is to watch all of this happen in the front row.

Oh, I forgot to mention that it is very interesting to compare how cars are sold.

Tesla has 40 experience stores nationwide, while Mercedes-Benz has 31 dealers in Beijing alone.

The total number of dealers of the three brands of BBA is around 600.

Think about this difference.

Data Intelligence Bureau is taking you to see how electric vehicles gradually erode the fuel vehicle market. See you next time.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.