The epidemic has been going on for several months, and the comprehensive industrial chain of the automotive industry, which is so large, has been greatly and deeply affected. The factor of “sales volume” alone has already made many companies overwhelmed. Since the outbreak of the epidemic, the car sales in January and February can be described as extremely sad.

At this time, whether the traditional camp or the new car-making camp can survive the winter has always been the focus of industry discussions. Traditional manufacturers are generally considered to have deep pockets and can tighten their belts in the face of the epidemic, relying on their huge family assets to avoid hurting their roots.

But it is different for the new car-making camp. Tight cash flow is a major challenge they will face. Among the new car-making camps, every event of NIO can stir the hearts of the spectators. Although being “bankrupt” no less than dozens of times under the epidemic, NIO still saw a surge in sales in Q1.

As the tide recedes, NIO seems to be wearing clothes!

NIO Q1 Sales Volume Exceeds Expectations.

The term “new car-making” in my opinion, was somewhat ironic when it first appeared. For traditional automotive giants, the Internet car-making itself is like a “joke”. Whether it is self-deprecating by the internet people or others’ ridicule, new car-making does not seem to be a new interpretation of the word “car enterprise”.

“The tide is gone and we know who is swimming naked.” This sentence seems to be born for new car-makers, and the strangest thing is that all kinds of spectators seem to want to see new car companies who lost their pants.

As a leading company in the new car-making industry, NIO basically bears half of the public opinion artillery fire, and various news about NIO being “bankrupted” are numerous; and adding up all the different ones is no less than dozens. It is such a car manufacturer that saw an increase in sales under the epidemic.

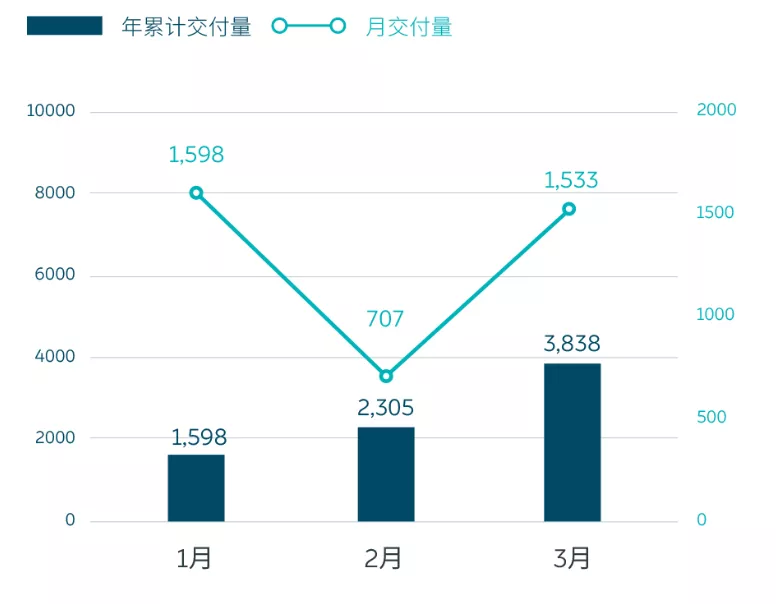

On April 7th, NIO officially released the delivery data for March 2020. The overall delivery volume of NIO in March 2020 reached 1,533 units, a year-on-year increase of 11.7%, and a month-on-month growth of 116.8%.

NIO delivered a total of 3838 units in Q1 2020, exceeding its 3400-3600 unit target in the 2019 Q4 financial report guidance. Since the start of delivery in June 2018, the NIO brand has accumulated a total of 35,751 deliveries, including 20,675 ES8s and 15,076 ES6s.

The delivery key points and the way NIO realized the sales growth are summarized as follows:

-

NIO delivered 1,533 cars in March 2020, and a total of 3,838 in Q1 2020, exceeding the sales volume guidance in financial reports.

-

NIO’s sales in March increased by 11.7% year-on-year and 116.8% month-on-month.- The combination of online and offline user community operation has continuously increased NIO’s orders since February;

-

The new ES8 will improve or upgrade a total of 180 details and will be delivered to the public in April;

-

NIO will continue to expand its sales network through NIO Space to further boost order growth.

According to data from China Automotive Engineering Research Institute, NIO was the only Chinese luxury SUV brand in the top ten in the second half of 2019.

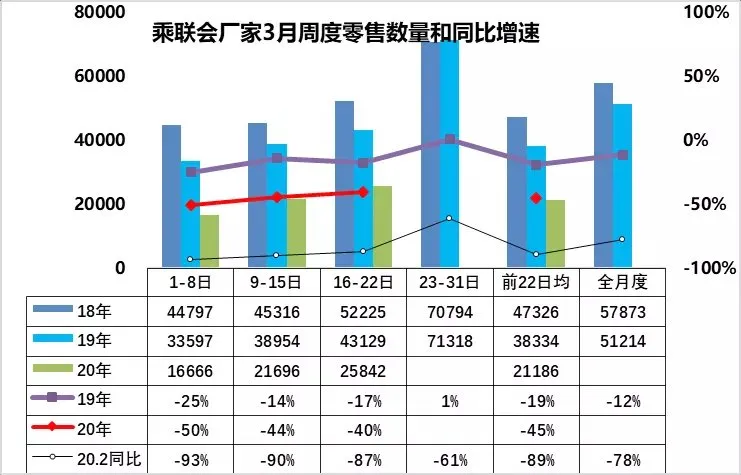

According to data released by the China Passenger Car Association on April 1st, the daily sales of domestic passenger cars in the first three weeks of March were 21,186. Although there was a significant improvement compared to February, it still decreased by 45% year-on-year.

Due to the slow progress of the supply chain recovery under the epidemic, the production capacity of the automakers is still climbing. NIO’s achievement in March, with a year-on-year growth of 11.7% and a month-on-month growth of 116.8%, is not easy.

NIO’s “Service” Advantage Highlighted

Under the influence of the epidemic, there are generally two reasons for the increase in sales: one is that the product itself is competitive, and the other is that the service system has unique advantages.

In NIO’s announcement, NIO emphasized the role of the NIO Service system in the sales growth. In fact, the service system itself is synchronous with the brand building system. In the special object of the automobile, the product and service are the fundamental for the existence of the brand.

In the domestic automobile consumer market, for a long time, consumers’ awareness of “independent high-end brands” and “user service-oriented enterprises” was basically zero. NIO’s appearance is the carrier of this concept’s development in China. When NIO was established in the early days, it also said that NIO hopes to become a user enterprise and aims to help users create a whole new way of life.

It sounds similar to other enterprises’ slogans, so let us see how NIO does it, starting with the establishment of the service system.

As we can see, NIO uses technology to create products and establish communication channels with consumers through services. Traditional automobile consumption is a one-off transaction, but NIO clearly wants to serve users throughout the entire product usage cycle. The product is only the carrier of the service, and the service is the behavior that occurs in the usage scenario.

From this, we can see that NIO is creating an automobile lifestyle by creating scenarios, services, and operating users, and maintaining a competitive advantage beyond the product competition in the future.# Electrification and Smart Technology are Just the Beginning, Technology and Products Remain the Basis of Industry Competition

For now, however, homogeneous products have entered the market, and so the question of how to maintain brand differentiation and competition has been on NIO’s mind for some time.

We are not saying that there is no differentiation in technology, nor are we saying that product quality is unimportant. Instead, we are suggesting a different perspective in which to view the current consumer experience.

For brands, a higher level of service is key to differentiation, and it is crucial to make sure that consumers feel the difference.

NIO’s Customer Operation

Customer operation is essentially the cultivation of a fan culture. As a company with internet genes, NIO recognizes the importance of this type of support for idol development.

There have been numerous events, such as NIO owners paying out of their own pockets to advertise for the company, Macau owners taking their NIO vehicles to participate in the Macau International Auto Show at their own expense, Hunan owners inviting over 390 people to test drive NIO within 400 days, successfully converting 45 people into owners, and so on.

“Customer recommendations are an important factor in promoting sales growth.” Li Bin also stated that over the past year, NIO has received returns on its investment in its products and services. One piece of data demonstrates this success: “For every 100 cars sold by NIO, 69 are the result of customer recommendations.”

These are examples of NIO’s expertise in customer operation, an aspect of the automotive industry in which NIO has managed to stand out.

How does NIO create this unique relationship with its customers and build loyalty for a brand so young?

Firstly, establish a connection with customers by connecting people who have a demand for high-performance vehicles and intelligent technology with ES8, ES6, NIO Pilot, and Nomi, and connecting people who have a demand for high-quality service and social interaction with worry-free service, NIO House, NIO Day, and so on.

Then satisfy the user’s immediate needs during the connection process. The NIO Center, for example, addresses the isolation and lack of car-buying experience in traditional 4S dealerships. Here, it is not just about training employees to have good attitudes, but rather about creating a presence that aligns with specific values. There is no hard selling or mechanical sales pitch, but rather a hands-on experience of the product.

In a sense, NIO users are a group of people with similar values.The Lincoln Center, which was done by Lincoln in traditional cars, is actually an improvement compared to traditional 4S stores, but it has not truly broken through the traditional concept. It’s like training the clerks better and making the decoration more beautiful, but it does not break the circle. Children will not go, and car buyers without corresponding budgets will not go. It is not a space with leisure and entertainment experience products.

So you will find that NIO House is an evolved version of traditional auto centers, and it is only the first step for NIO to connect with users. Liang Ning said, “Customer pain points are fear, itch points are to satisfy themselves.” NIO has achieved self-satisfaction for high-quality demand people through NIO House and NIO Day.

NIO Power is NIO’s ultimate solution to this problem. In the early stage, NIO’s charging and swapping service was seen as a money-burning project. It was not advisable to spend a lot of money to do such services when the car was not yet built.

But now, it seems that this has become NIO’s biggest moat. What is the “fear” of consumers about electric vehicles? Is it about the cruising range? Not necessarily, it should be about what to do when the battery is empty! Therefore, supercharging, swapping, and recharging are not pseudo propositions.

“Secondly, it is to deepen and continue to connect with users.” NIO allows users to provide feedback through the APP on product, technology, social and service issues, and users can complain at any time. The team will arrange, submit, and improve the problems. In addition, through various theme activities and different scenes online and offline, deep connection is achieved among different times and different roles, and new connections are also made.

To become a “user-centric enterprise,” NIO has also set up a user trust that transfers 50 million shares to NIO User Trust, and users decide how to distribute these stock dividends. This way is bold and innovative, and the advantage is that NIO users will feel that NIO is just like their own home, with a deep sense of participation.

On the surface, NIO’s strategy of burning money to please users seems to be just offering wool from its own back for users to pick, but many people overlook one thing: NIO has its own community (APP) and a dedicated user operation team.

For NIO, what it does for users in terms of communication will be spread through the community and then twice through the friends circle of NIO car owners, which has a much higher energy and efficiency than traditional brands.

The importance of user operation can be explained by the employee poaching strategy of Great Wall Motors.

Recently, Zhao Yuhui, former Vice President of User Center at NIO, joined Great Wall Motors as General Manager of User Center. From March 2017 to May 2019, Zhao was mainly responsible for the development of NIO House, exploring ways to maximize user benefits through brand experience stores.

Recently, Zhao Yuhui, former Vice President of User Center at NIO, joined Great Wall Motors as General Manager of User Center. From March 2017 to May 2019, Zhao was mainly responsible for the development of NIO House, exploring ways to maximize user benefits through brand experience stores.

The position of General Manager of User Center at Great Wall Motors Sales Company is a newly established position and is under the organization structure of Great Wall Motors Sales Company, reporting to Li Ruifeng, Vice President of Great Wall Motors Sales.

It is rumored within Great Wall Motors that the digital marketing department of Great Wall Sales Company may be placed under this new leadership position. The department was previously managed directly by Li Ruifeng, responsible for public opinion monitoring, KOL development, forum organization, and car club operation.

Moreover, it is reported that Great Wall Motors specifically requires that this position be filled by personnel from NIO. This is seen as Great Wall’s attempt to learn from NIO, which reflects NIO’s business strategy beginning to influence traditional automakers. NIO’s model has indeed proven to bring significant premium to its brand, and NIO internally believes that “NIO has established the image of a luxury brand”.

In conclusion

NIO’s “success” is a systemic success, and opponents might ask if NIO has really succeeded. This depends on how one interprets it. If we define NIO, from its inception until now, as China’s first high-end automotive brand and the first user enterprise, and if we consider that NIO has established such an image in users’ minds through a series of operational support and even spawned a unique fan culture, from the starting point and stage results, then it is indeed a success.

NIO’s service system is not isolated, and NIO’s services are not just a slogan of “cloud service” but are something that consumers can truly feel, such as battery swapping and charging. Moreover, NIO’s center is no longer just a buying and selling space.

If NIO’s initial strategy tested Li Bin’s creativity and innovation, which determined how high NIO could go, then what is being tested next is Li Bin’s wisdom, which will determine how far NIO can go.

Looking at Li Bin’s layout in the transportation industry, he does not seem to want a brief moment of ecstasy, but what is most difficult is not the “what to say” but the “how to do” between “wanting” and “achieving”.

The competitive situation of smart cars still revolves around product and technology, but as core technology enters a global bottleneck period, service differentiation may become the breakthrough weapon.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.