2020 is the last year left for NIO.

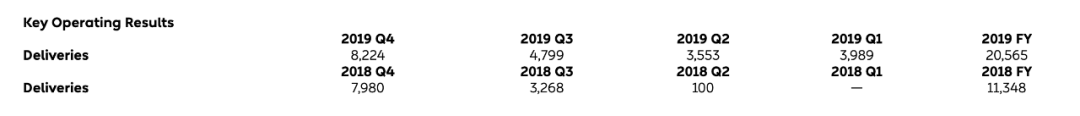

On the evening of March 18, 2020, NIO released its Q4 2019 financial report. Despite a significant increase in deliveries, an annual loss of RMB 11.2957 billion and a sharp downward adjustment of Q1 2020 expectations caused a more than 16-point drop in NIO’s stock price, reflecting the attitude of the capital market.

Survival

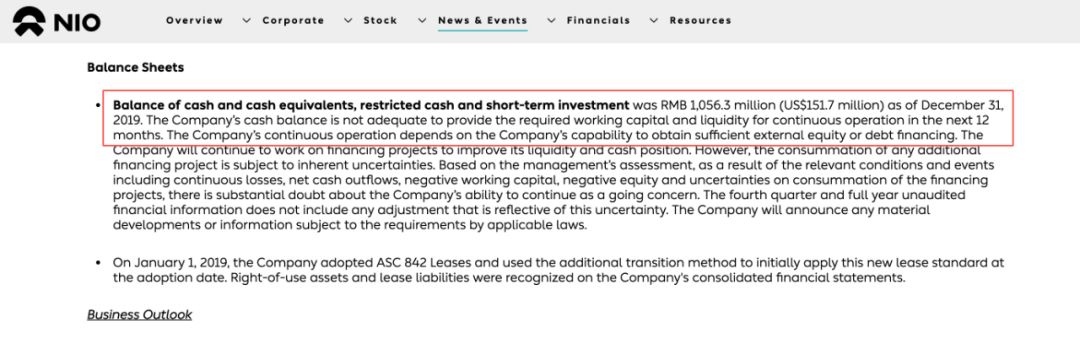

Survival is still a major issue surrounding NIO. As of December 31, 2019, NIO had an aggregate amount of RMB 1.0563 billion in cash and cash equivalents, restricted cash, and short-term investments, while its quarterly losses are as high as RMB 2.5-2.8 billion. In Q1, Q2, and Q3 of 2019, NIO had an aggregate amount of 7.5365 billion, 3.4556 billion, and 1.9607 billion in cash and cash equivalents, respectively. This means that NIO has reached its poorest day ever, and it is difficult for the company to survive beyond Q1 2020. In the balance sheet of the financial report, NIO also reminds investors that “as of December 31, 2019, the company had a cash deficiency to support its working capital and liquidity needs for the next 12 months of continuous operations. The company’s continuous operations are dependent on its ability to obtain adequate external equity or debt financing.“

Since May 2019, there have been a series of financing projects in the industry about NIO, beginning with the signing of a RMB 10 billion investment framework agreement with Beijing E-Town Capital, followed by negotiations with the Huzhou government for a RMB 5 billion financing, then GAC’s planned acquisition of NIO’s 1 billion USD, and finally Geely’s planned acquisition of 10% of NIO’s shares for 300 million USD. Unfortunately, none of these successive investments have been completed, and NIO has reached the limit.

Now NIO is like a player in a PlayerUnknown’s Battlegrounds game, who has not had to take drugs because he/she still had half a tube of blood. However, NIO, who has been staying outside the safe zone for too long, now has only one point of blood left.

For NIO, financing is becoming increasingly urgent. At the beginning of 2020, NIO issued three convertible bonds totaling $435 million (approximately RMB 3 billion). Li Bin mentioned in the conference call that these $435 million convertible bonds have all been completed and in addition to the remaining $1 billion, NIO now has $4 billion in hand. So, how long can the $4 billion last?Based on the net loss of RMB 2.8646 billion in Q4 2019, NIO can barely sustain itself until Q2.

In the earnings call, Li Bin revealed that the net loss in Q4 increased compared to Q3 due to “one-time adjustments and other related costs” (in simple terms, NIO faced one-time expenditures of RMB 400 million in Q4 due to layoffs, leading to an increase in net loss). These adjustments have already been completed and will not incur further costs. With the improvement in gross margin, NIO expects the loss to decrease by 35\% in Q1 2020.

This means that the expected loss in Q1 2020 is around RMB 1.86 billion. If Q2 can continue to improve, at least RMB 4 billion can sustain NIO until the end of Q2 2020.

However, NIO is still far away from achieving profitability. The three convertible bonds are like three band-aids and can support NIO for a while. To survive the crisis, NIO needs more support – at least one “medicine chest”.

Yes, that is the RMB 10 billion funding provided by the Hefei government.

On February 25th this year, the People’s Government of Hefei City announced that it signed a RMB 10 billion financing framework agreement with NIO. Li Bin mentioned in the conference call that the final agreement is expected to be signed before the end of April.

Before this RMB 10 billion is in place, the crisis faced by NIO has not been resolved.

Improving Gross Margin

After satisfying NIO’s funding needs for nearly two quarters, we turn to the second important topic – gross margin.

In the coming days, NIO must strive to achieve a “self-sufficient” state. After all, it is unrealistic to rely on financing to survive until 2021. This is why I wrote at the beginning of this article that “2020 is NIO’s last year”.

Li Bin stated in the conference call that improving gross margin is one of NIO’s core goals in 2020. NIO is confident that it will achieve positive gross margin in Q2 and double-digit gross margin by the end of the year.

According to the financial report, the vehicle gross margin in Q4 2019 was negative 6\%, slightly higher than the negative 6.8\% in the previous quarter. The total gross margin in Q4 2019 was negative 8.9\%, compared to negative 12.1\% in the previous quarter.

Here is another figure – NIO delivered 8,224 vehicles in Q4 2019, including 6,824 ES6 and 1,400 ES8, a significant increase of 72\% compared to the delivery of 4,779 vehicles in Q3 2019.

However, despite the significant increase in delivery volume, the gross profit margin of vehicles has not improved much and is still at minus 6%.

The CFO of NIO stated in a conference call after the financial report that “The sales volume in the fourth quarter mainly came from the basic version of ES6, whose selling price is lower than that of ES8, resulting in a limited increase in gross profit“. Therefore, to increase the gross profit margin, it is important to reduce the material and sales costs of vehicles.

There are three ways for NIO to achieve positive gross profit through cost control:

First, to reduce other material costs except battery pack by 10%.

Second, with the increase in production, the production break-even point will gradually decrease, so the manufacturing cost can be reduced by 30% in 2020.

Third, reduce battery cost per Wh by 20% in Q4.

It can be seen that with the increase in production, NIO’s voice in the supply chain has begun to have a certain weight, and the cost reduction is also a visible trend, which is most evident in the reduction of battery costs.

As mainstream battery factories such as CATL continue to increase production capacity, the scale effect gradually emerges, and the decline in battery costs is an inevitable trend.

On the other hand, NIO’s annual sales volume has exceeded 20,000 vehicles, leading many new car-making forces and traditional car companies in the sales of pure electric vehicle models. Moreover, NIO’s battery capacity per vehicle is at least 70 kWh, and it will deliver a 100 kWh battery in Q4 this year. With the increase in battery demand, NIO can also negotiate better conditions with CATL.

In addition to saving material costs, there are also savings in operating costs. At the beginning of 2019, NIO’s total number of employees was close to 10,000, but now it is less than 7,000.

Obviously, as sales increase, NIO will gradually enter a virtuous circle of cost control. In addition to gradually decreasing operating costs, we are waiting to see what changes will occur to NIO’s gross profit margin.

Selling cars

The official of NIO did not give a clear sales target for 2020 in the financial report and conference call, only stating that there is a clear internal target and confidence in achieving it.

NIO’s goal for Q1 2020 is to deliver 3400-3600 vehicles, a significant decrease of 56.2%-57.6% compared to Q4 2019.

The reason for the significant decline is not entirely due to a decrease in demand. The Chinese New Year holiday and the epidemic have caused a delay in the recovery of the supply chain production, which also limits the capacity of NIO’s factories.

During the conference call, Li Bin revealed that NIO still has orders awaiting delivery for more than 5,000 vehicles, and the number of new orders in the past 30 days has exceeded 2,100, almost 2200. The daily order volume exceeds 70 vehicles, which has returned to about 70% of the level in December 2019.In the current economic environment, it is not easy for NIO to achieve this order volume. On the one hand, it shows that consumers’ recognition of NIO is getting higher and higher. On the other hand, under the epidemic situation where people cannot go out, the flexible and changeable sales methods under NIO’s direct sales system have effectively promoted the conversion rate of orders.

Here is a data point: Recently, the proportion of old users recommended to buy cars reached 69%, higher than the full-year level of 45% in 2019. Clearly, old user recommendations are an important part of increasing overall sales.

In addition, NIO aims to achieve 200 NIO Spaces by the end of 2020. Besides using NIO’s own funds to set up, NIO will also expand through partnerships.

According to Garage 42, the cooperation method of NIO Spaces is that the partner provides the venue and decoration, while NIO provides staffing and training. For every car sold, the partner can receive a commission of RMB 10,000.

For NIO, setting up NIO Space channels not only has lower costs, but can also reach consumers in second- and even third-tier cities, which is significant for increasing sales.

This is also an important foundation for NIO’s sales growth in 2020.

Finally, let’s talk about the challenges NIO faces in selling cars in 2020.

From the currently announced sales figures, although the domestically upgraded long-range version of the Model 3 has entered the RMB 300,000 range, its impact on NIO is very limited. In February, Model 3 deliveries approached 4,000, and NIO’s order volume was also at a good level.

After the domestic long-range Model 3 goes on sale, it will also have a certain impact on NIO’s sales, but because the positioning of the two cars is completely different, the impact will also be very limited.

For NIO, the biggest challenge comes from the domestically produced Model Y, which will be launched in 2021. When the positioning of the two cars completely overlap, consumers’ choices will depend on the differentiation and price of the two.

ES6/EC6 and Model Y have differences, but the price is also an important factor affecting consumer decisions. We estimate that the price of the domestic long-range version of the Model Y is expected to drop below RMB 400,000, while the ES6 does not have any price advantage after selecting the 100 kWh battery and NIO Pilot as options.So in 2020, NIO must work hard to sell cars, increase sales, reduce costs, and improve gross profit margins to gain a certain amount of price reduction space for themselves, in order to have an advantage in the 2021 Model Y competition, a price war is inevitable.

That’s why I believe that 2020 is the last year for NIO.

In conclusion:

NIO ended 2019 successfully with NIO Day, but was hit hard by the black swan of the epidemic in 2020.

This financial report and conference call brought more severe signals in financing, operations, and sales. Needless to say, 2020 is crucial for NIO, and it will also be a brutal elimination match for the entire new energy vehicle industry.

For companies striving to succeed, every year could be the last year, and every year must be treated as the last year.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.