Title | From James Yang

The automotive market was undoubtedly hit hard by the COVID-19 pandemic, with sales plummeting.

According to data from the China Association of Automobile Manufacturers (CAAM), sales of domestic passenger vehicles in February of this year were only 250,000 units, a year-on-year decrease of 78.7% compared to 1.174 million units in the same period last year. The sales of new energy vehicles in February were only 14,200 units, a year-on-year decrease of 65.87% compared to 41.6 thousand units in the same period last year.

At first glance, it seems that new energy vehicles were less affected by the epidemic than traditional cars. In fact, the opposite is true. The domestic Model 3 was the main driver of the new energy market in February.

Model 3 Rises Sharply

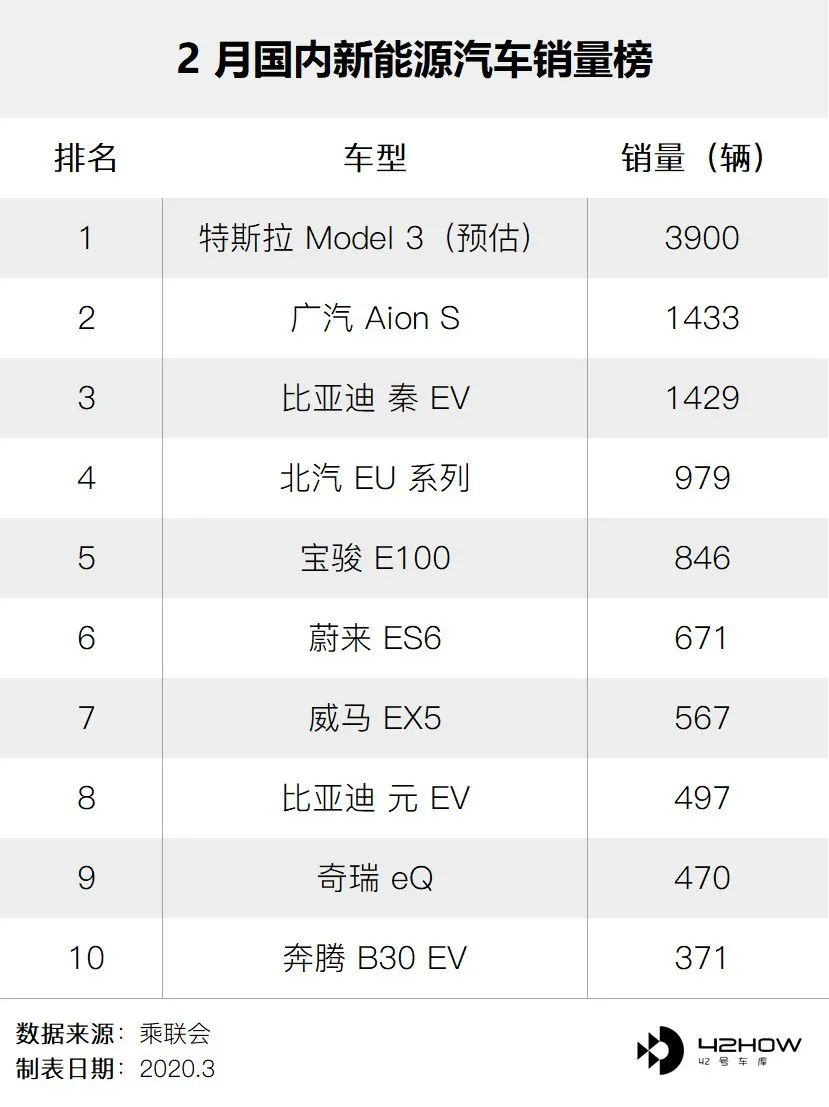

According to CAAM data, the estimated sales of the domestic Model 3 in February were 3,900 units, ranking first in the sales of new energy vehicles, with a market share of 27.46% for all new energy vehicles sold in February.

In addition, we also obtained the number of insured vehicles for some of the models in the table above in February.

Note: Due to inconsistent statistics, the number of insured vehicles is usually lower than that of CAAM sales.

The number of insured domestic Model 3 vehicles in January and February, including imported models, were 3183 and 2284 respectively, a decrease of 28.24% compared to the previous month. Other models, such as NIO ES6, had even higher declines, up to 58.06%. Compared with them, the performance of Model 3 was impressive.

In addition, in the CAAM high-end car sales rankings, the domestic Model 3 was ranked first in February, surpassing traditional luxury brand models such as the Mercedes-Benz C-Class, Audi A6, and BMW 3 Series. It even made it to the top 5 in the overall sedan sales rankings.

The outstanding performance of Tesla Model 3 in China is due to the large backlog of orders in the early stages of production and the company’s online ordering and delivery process, along with its “flatbed truck to your doorstep” service that ensured a certain amount of delivery during the pandemic. Traditional car companies, on the other hand, had almost shut down due to the pandemic since they did not have a backlog of orders and customers had to visit the dealerships to test-drive and collect their cars.

The outstanding performance of Tesla Model 3 in China is due to the large backlog of orders in the early stages of production and the company’s online ordering and delivery process, along with its “flatbed truck to your doorstep” service that ensured a certain amount of delivery during the pandemic. Traditional car companies, on the other hand, had almost shut down due to the pandemic since they did not have a backlog of orders and customers had to visit the dealerships to test-drive and collect their cars.

With most new energy vehicles produced by new automakers being SUVs, we see the top 10 insured pure electric SUVs in February. Except for BYD Song, which only dropped by 35.6% MoM, other models experienced a drop of around 60-90% MoM. Although new automakers also use a direct sales model, unlike the Tesla Model 3, they do not have a backlog of orders. Therefore, although they tried to sell cars through online streaming during the pandemic, actual visits to dealerships and test-drives remained necessary, and thus, online streaming appeared to be more of a publicity stunt than an actual sales tool. Nonetheless, the mainstream models produced by new energy vehicle manufacturers still ranked in the top 10 of insured pure electric SUVs, demonstrating their appeal to consumers.

Among them, NIO ES6 still ranked first and had over twice the insured vehicles compared to the second-ranking WM EX5. According to data from the China Passenger Car Association, NIO ES6 is also among the top five high-end SUV sales in February.

NIO ES6 is a domestically produced medium-sized pure electric SUV with an average price of around RMB 350,000, which has achieved such remarkable results in such a difficult period and deserves recognition. I believe this success can be attributed to three factors:

- NIO brand and the product strength of ES6 are recognized by many consumers.

- About 50% of NIO’s sales come from its existing customers, who can place an order through direct sales with no need for any sales staff.- One of the flexible selling methods under the direct sales system of NIO, which is one of the manufacturers that started live streaming car talks the earliest during the epidemic, has also initiated home test drive services, effectively promoting order conversion.

In addition, there is an important player in the new car-making forces—Li Auto.

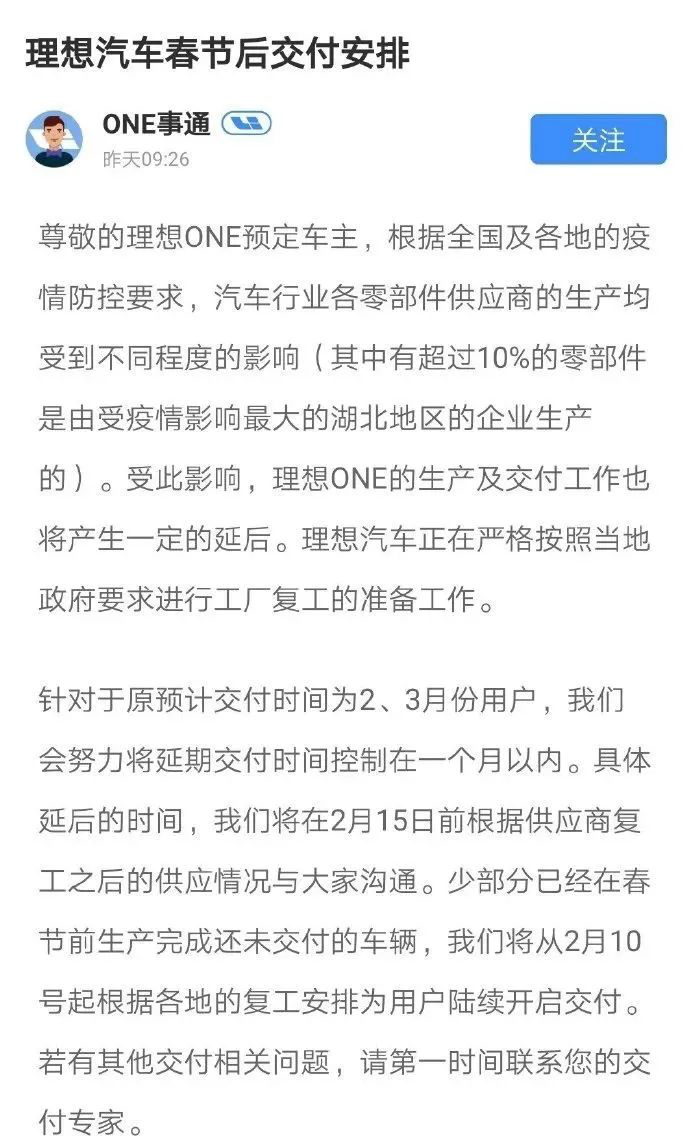

The insured amount of Li ONE was 307 in February and 1207 in January, with a month-on-month decrease of 74.57%. The main reason for the significant decrease in the insured amount of Li ONE, which is directly under the proprietary system and had a large backlog of orders in the early stage, is that more than 10% of its parts are produced by enterprises in Hubei, which are most affected by the epidemic.

Affected by the epidemic, the originally expected delivery time for users in February and March will be delayed, and the delay time will be controlled within one month by Li Auto. But even so, according to data from the China Passenger Car Association, Li ONE also ranked tenth in the high-end SUV sales list in February.

Of course, the tenth place this time does not indicate any problems, because the backlog of orders for Li ONE has not yet been digested. It is believed that with the recovery of Li Auto’s production capacity, sales over the next few months will still be eye-catching. As for how Li ONE’s sales will be after the backlog of orders is digested, we will wait and see.

Summary:

Under the influence of this epidemic, traditional car companies, independent brands, and new car-making forces have all been severely affected and no one has been spared. After all, when an avalanche happens, no snowflake is innocent. New car-making forces, especially NIO and Tesla, have demonstrated the flexibility of the direct sales system during the epidemic by providing services such as home test drives and home deliveries, which have gained them more sales.

Although the domestic epidemic has been effectively controlled, there are still many consumers who are worried before the epidemic is completely resolved. For example, in our Beijing New Energy Vehicle Buying Group, many friends just obtained the long-awaited new energy indicators on February 26, but still choose to wait for the epidemic to pass completely. It can be seen that the sales volume in March will still have a significant decline compared to the same period last year, but whether the Model 3 can perform as well as in February is indeed worth looking forward to.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.