2020 Began with the Adversely-affected Automotive Industry Due to the COVID-19 Outbreak

The announcement of Ningde Times entering Tesla’s supply chain brought a glimmer of hope to the industry during this difficult time as it may result in the use of cobalt-free batteries in the Model 3, a vehicle produced by Tesla China. Furthermore, this move also signifies Tesla’s potential adoption of Lithium Iron Phosphate (LFP) batteries from a supplier for the first time.

However, even with good news, there are those who provide troublesome interpretations, which once again proves the frightening aspect of ignorance.

In a Taiwanese TV show, a so-called “expert” named Zhuang Zhengxian misunderstood Tesla’s adoption of the Ningde Times battery. He believed that Tesla’s success was mainly due to its use of ternary lithium batteries whose advantages included high density and strong power compared to other batteries. Therefore, he questioned why Tesla would give up this advantage and turn to LFP batteries in China, claiming that it was a kind of “compulsion” in order to comply with China’s battery technology standards. He also insisted that Ningde Times doesn’t produce ternary lithium batteries.

The expert’s imagination was so vivid. However, how automakers choose and make decisions are different from his imagination.

This good news that Tesla would adopt batteries produced by Ningde Times became a headache for Ningde Times. But worry not, they took the humorous approach and even asked for people’s opinions on their social media accounts during their month-long inactivity on Weibo.

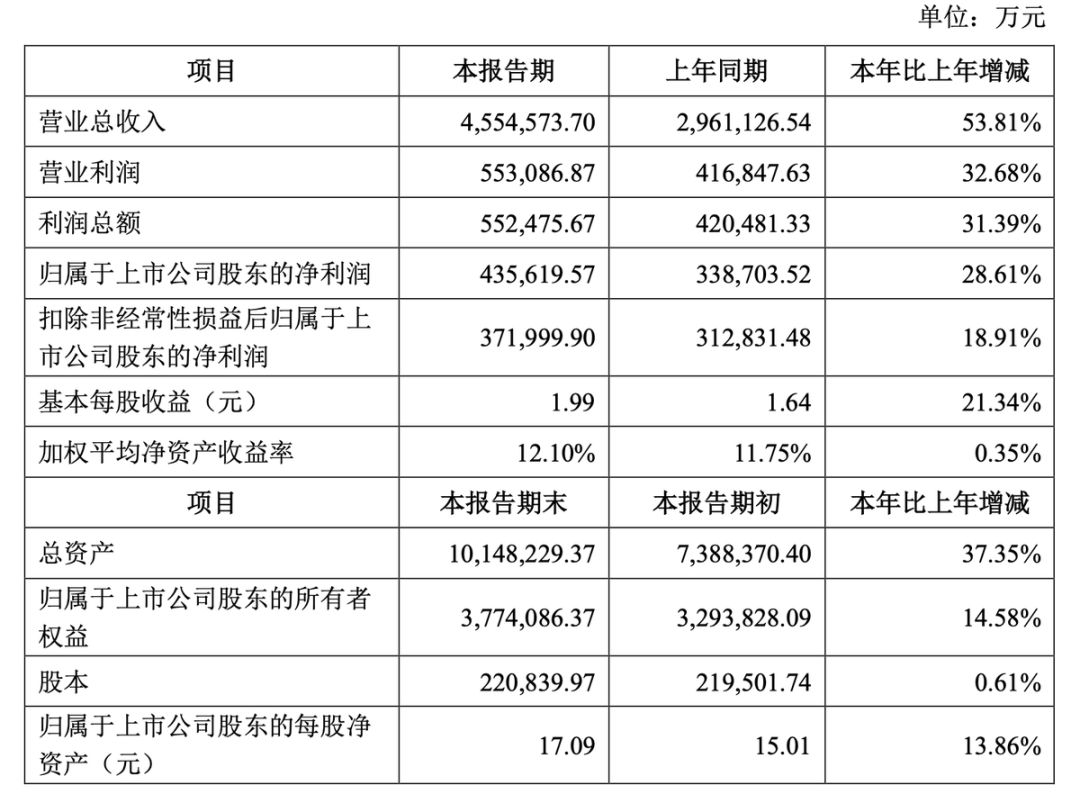

Automakers had their fair share of jokes about this as well. Dongfeng Yueda Kia jokingly suggested that they may use an “electric eel” for power, while others joked that they use “love” to generate electricity.It’s no wonder why “experts” find it difficult to understand. Ningde Times has not even launched its Taiwanese official website. Even the 2019 annual performance announcement released by Ningde Times cannot be found. The announcement shows that Ningde Times had a revenue of RMB 45.546 billion in 2019, a year-on-year increase of 53.81%, and a net profit attributable to shareholders of listed companies of RMB 4.356 billion, a year-on-year increase of 28.61%.

The great performance of Ningde Times is mainly due to the rapid development of new energy vehicles and the increase in demand for power batteries compared to the same period last year, as well as the expansion of its partners.

However, “experts” may also choose to believe that Ningde Times may have earned money by selling turnip slices.

Since Ningde Times posted “Let’s reason together” on its official Weibo account, the comments section has become lively. More than 15 car companies, including NETA, NIO, Geometry, Dongfeng Fengshen, Aiways, Roewe, GAC New Energy, WEY, WM Motor, and BAIC New Energy, which all adopted Ningde Times’ ternary lithium battery solutions, supported Ningde Times in the first place.

On March 9, Ningde Times launched the campaign “Electric Times, Are You Coming?” on Weibo and has received responses from domestic and foreign car companies. “Experts” find it difficult to respond to such a hardcore approach because it may expose their own weaknesses. Even car companies cannot stand it anymore, so they have responded in succession.

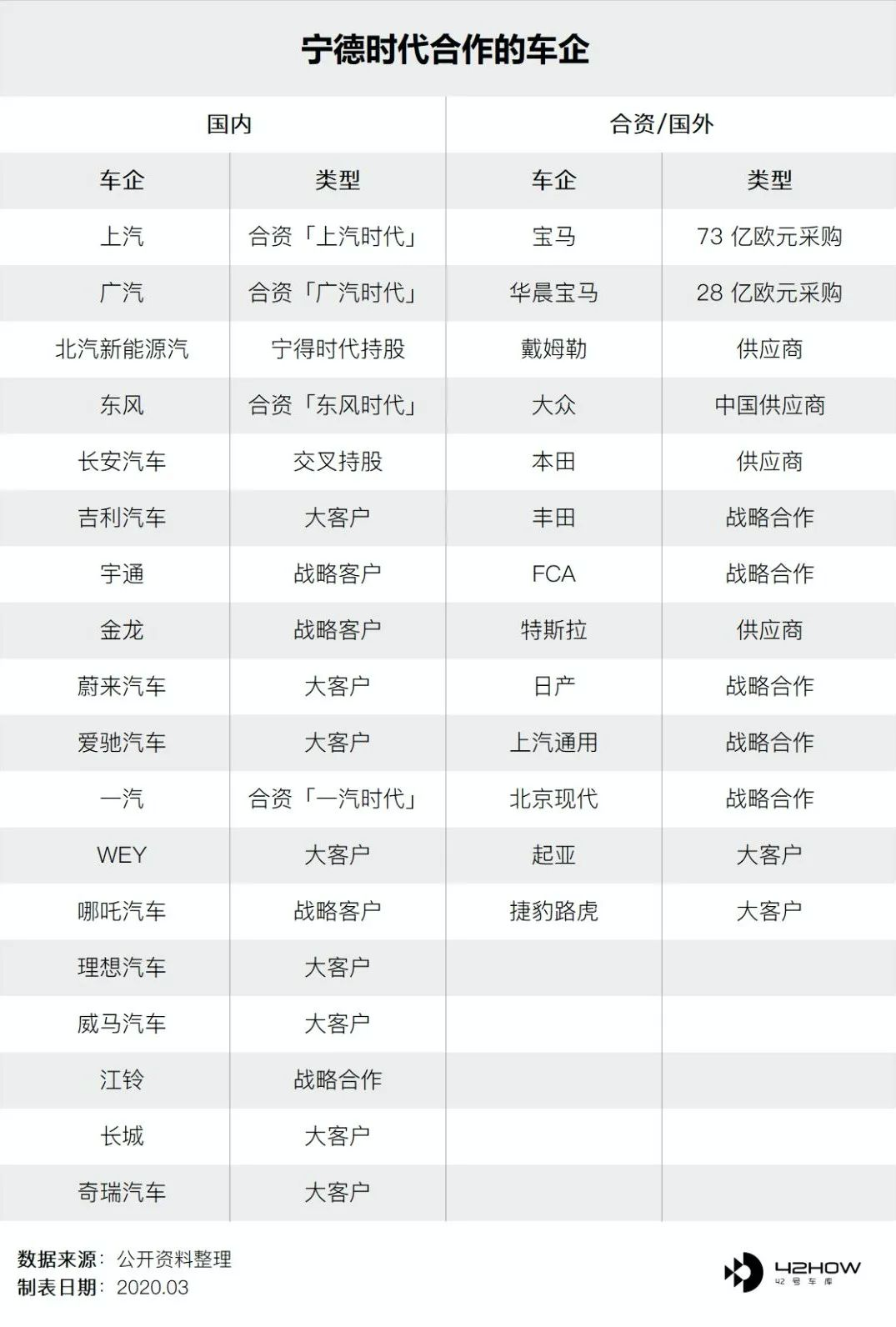

According to incomplete statistics, almost all major global car companies are customers of Ningde Times. Is it possible that these top-tier car companies did not conduct research and investigation? Of course not. This is related to the technological production capacity and cost control of Ningde Times. According to data from the China Automotive Power Battery Industry Innovation Alliance, China’s installed capacity of power batteries in 2019 was 62.2 GWh, of which Ningde Times’ installed capacity reached 31.46 GWh, with a market share of more than 50%. Before cooperating with Tesla, Ningde Times had already reached cooperation agreements with many car companies.# Here is the English Markdown text with HTML tags preserved

This includes Chinese automakers such as SAIC, Dongfeng, Changan, BAIC, Geely, GAC, and international car brands such as BMW, Daimler, Hyundai, Jaguar Land Rover, Peugeot Citroën, Volkswagen, and Volvo. In addition, CATL is actively expanding overseas, with plans to build the largest lithium-ion battery factory in Germany in Europe.

Now, without exception, the main models sold in China by new automakers at home and abroad all use CATL’s ternary lithium batteries, such as NIO ES6, XPeng P7, AIWAYS U5, FISTA electric version, and so on.

According to CATL’s latest announcement, it will also raise 20 billion yuan to expand production capacity. It is expected that by the end of 2020, CATL will be able to provide a production scale of 100 GWh.

Seeing this, some “experts” may think and say, “These automakers have chosen CATL as their partner, which shows they do not know how to build cars.” The most “ignorant” of all is BMW, which has signed a €7.3 billion deal.

CATL’s Products

The core view of Taiwanese “experts” is that CATL cannot make ternary lithium batteries, and iron phosphate is an old technology from ten years ago.

If we review CATL’s history, we will know that after entering the field of power batteries, it has always had a dispute between iron phosphate and ternary lithium in its technical path. At the beginning, CATL focused on ternary lithium batteries with higher energy density. Because it succeeded in betting on the technology of ternary lithium batteries, CATL has rapidly become the world’s number one power battery company.

Formerly the leader in China, BYD has also been surpassed, and there are signs of a widening gap in terms of installed capacity and production capacity.

Of course, CATL has also diversified its product line. Although CATL’s shipments of ternary lithium batteries currently dominate, CATL has also made significant contributions to iron phosphate technology, which is why it has attracted Tesla’s attention!

In terms of technology, power batteries can be classified according to battery materials and packaging methods. The battery materials are mainly NCA/NCM ternary materials and LFP iron phosphate, while the packaging methods are mainly cylindrical, square, and soft pack.The thermal stability of lithium iron phosphate (LFP) is high, but the energy density is slightly worse. It is widely used in electric buses and logistics vehicles, and its application in passenger cars is gradually decreasing.

Ternary materials include nickel-cobalt-manganese lithium NCM, which can be divided into 333, 523, 622, and 811, and nickel-cobalt-aluminum lithium NCA. The energy density is higher than LFP, but the safety is poor, and it has a relatively large share in the passenger car field, making it the main power battery technology currently.

In the Chinese market, NCM 523 and 622 are mainly used, while 811 has not yet been widely used. NCA has a higher energy density and requires strict production conditions, and can only be used in cylindrical single cells, mainly produced by Japanese and Korean companies such as Panasonic, and mainly used in Tesla models.

In China, ternary materials are almost entirely NCM. NCM 523 and NCM 622 battery materials have been maturely applied, and the energy density of NCM 811 has basically reached the level of NCA, but the production difficulty is much greater than that of NCM622. Currently, efforts are being made for the industrialization of NCM 811.

China’s previous ternary lithium battery market was mainly NCM batteries, not NCA ternary lithium batteries used in Tesla. Both NCM and NCA are primarily constructed with high-nickel ternary lithium batteries.

The advantage of NCA is higher energy density, but there is a high demand for balance between processes and costs. However, Tesla’s goal in local production is to reduce costs and achieve large-scale sales, so it chooses to cooperate with CATL.

CATL currently has a product line for the passenger car market, which mainly consists of ternary lithium batteries, while for commercial vehicles, iron phosphate lithium batteries are used more. As we mentioned earlier, one of Tesla’s core tasks for local production is to further reduce costs. Therefore, the rumored Tesla will use cobalt-free batteries, which may be CATL’s iron phosphate lithium batteries.

The advantage of CATL’s LFP compared to NCM is its low cost. According to data, the price of LFP is about 0.65 yuan/Wh, while NCM is about 0.85 yuan/Wh. The cycle life of LFP can reach about 4,000 times, while NCM can reach about 2,000 times. Not only are ternary lithium batteries good, but iron phosphate lithium batteries are also good.

The disadvantage is that the energy density of the individual LFP can only reach about 180 Wh/kg, while NCM can reach 250 Wh/kg. However, CATL’s CTP technology can just make up for the shortcoming of iron phosphate lithium in energy density.

There is more advanced technologyNingde Times is a technology geek. In fact, on July 1, 2019, at the “2019 World New Energy Vehicle Conference”, Chairman Zeng Yuqun of Ningde Times publicly shared the research and development of power battery technology and will continue to make breakthroughs.

Regarding the breakthroughs in which technologies of power batteries can meet the needs of the electric vehicle era, Ningde Times has its own goals and interpretations.

In terms of system energy density, by 2025, the system energy density can reach 250 Wh/kg, and this is still a conservative estimate of Ningde City.

In terms of price, by 2025, battery costs can reach $100 per kWh, which is approximately ¥700 RMB. According to the technology currently released by Ningde Times, 700 RMB should be the cost of CTP Pack.

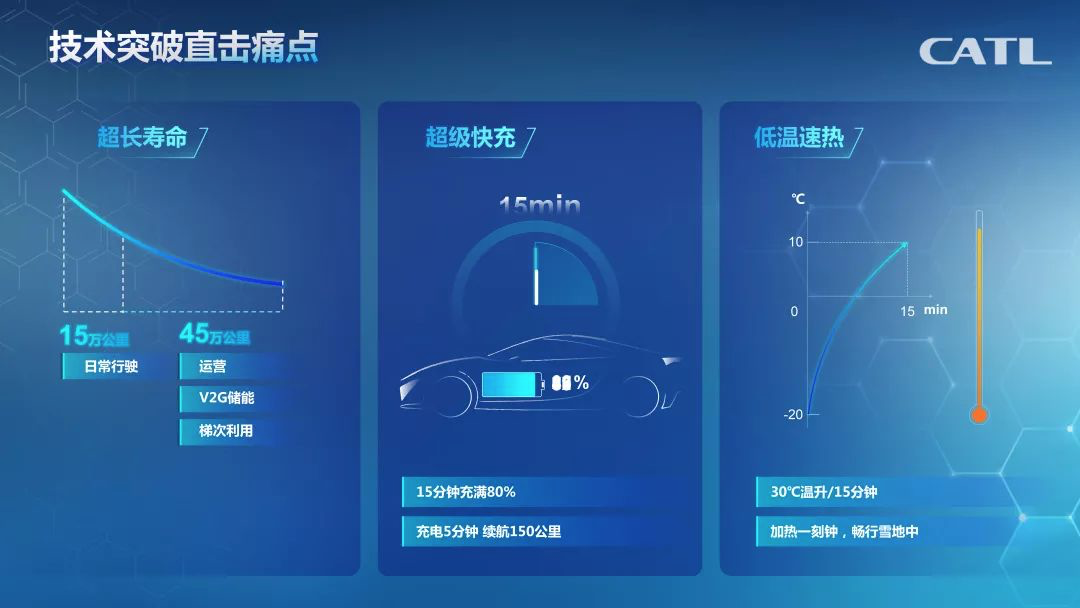

In terms of cycle life, the typical lifespan of an electric private car is 150,000-200,000 kilometers, but Ningde Times directly promotes battery technology with a lifespan of 600,000 kilometers. The excess value can be used for the step-by-step utilization of the power grid industry. It also aims to achieve fast charging technology implemented with a special graphite system, which can reach 80% in 15 minutes.

Implementing power battery self-heating technology without changing the battery structure, without increasing hardware and costs, and using about 6% of the battery’s own energy can raise the battery temperature from -20℃ to 10℃ in 15 minutes. The heating efficiency can reach 2℃ per minute.

These technologies are genuine and innovative, and Ningde Times not only produces ternary lithium batteries and lithium iron phosphate, but also continues to make technical breakthroughs in the future.

Summary:

Lithium iron phosphate is an old technology ten years ago? To be honest, after watching the “expert” video, I think it’s brave to say that the development of lithium iron phosphate technology has a timeline, but it does not mean it is outdated. After nearly a hundred years of development, the internal combustion engine is still in use, and the technology is always advancing. Does the “expert” not know that? Ternary lithium batteries and lithium iron phosphate have their own advantages and disadvantages, but technologies such as Ningde Times’ CTP can complement each other.

Ningde Times has taken nearly 8 years to overcome numerous difficulties, broke through the blockade of technology by Japanese and Korean power battery companies, and created a path. Moreover, in terms of ternary lithium batteries, it has been recognized globally, with customers covering high, medium, and low levels. In the face of the expanding market, Chinese companies will inevitably demonstrate stronger advantages in the market, cost control, and collaborative research and development.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.