Welcome to E-Weekly News 👆

PART 1 Weekly Index

PART 2 Weekly News

① Domestic Model 3 Long Range Rear-Wheel Drive Version

In a recent batch of vehicle model applications released by the Ministry of Industry and Information Technology, the domestic long range rear-wheel drive Model 3 by Tesla was listed. With a curb weight of 1745 kg and a motor power of 202 kW, we can tell this is the long range rear-wheel drive version of Model 3.

Compared with the previously released domestic standard range Model 3 with a curb weight of 1614 kg, the long range rear-wheel drive version has increased 131 kg, most of which can be attributed to the added battery weight. The battery is a ternary lithium battery and is expected to use 2170 battery cells supplied by LG Chem in Nanjing. The car still features the combination of “Tesla” and “Model 3” at the rear, and it’s difficult to tell the difference from the appearance.

(Image Source: Website of the Ministry of Industry and Information Technology)

Quick Comment: Once the news of domestic long range version was released, our community exploded with questions about the delivery time and price. Based on the timeline of the release of the domestic standard range upgrade version Model 3, which was first listed on November 18, 2019 and delivered since January 2020, there was nearly a two-month gap. Therefore, the domestic Model 3 long range rear-wheel drive version might be delivered as early as April.

According to statistics, before the imported long range rear-wheel drive version was dropped, there was about a 15,000 yuan discount. Compared to the standard version, there was a difference of around 50,000 yuan after discount. Therefore, the domestic long range rear-wheel drive Model 3 will sell at a price of around ¥350,000 after subsidy.

Currently, the localization rate of parts for Tesla’s Shanghai factory is around 30\%. As Tesla’s localization rate and production capacity increase in the future, there will be great potential for further price cuts according to Tesla’s philosophy of “Buy early, enjoy early; buy late, get a discount“.② GM and LG Chem plan to establish a battery factory with an annual capacity of 30 GWh in Ohio

In December 2019, General Motors (GM) announced a joint venture with LG Chem to build a battery plant in Ohio with an annual capacity of 30 GWh. According to Electrek’s interview with Tim Grewe, Director of Battery Engineering and Electrification Strategy at GM, in February 2020, the company aims to “further reduce battery costs and make battery prices as low as possible” through this factory. LG Chem has its own super factories in South Korea, China, the United States, and Poland, and external estimates suggest that LG Chem’s total production capacity in 2020 will reach 97 GWh.

(Image source: Electrek)

Comments: To give you a reference for the capacity of 30 GWh, Tesla’s Gigafactory in Nevada, which is a collaboration with Panasonic, has an annual capacity of about 35 GWh in 2019. If we look at the 50 kWh battery pack, the capacity of 30 GWh is sufficient to produce 600,000 battery packs.

GM and LG Chem’s cooperation demonstrates General Motors’ strong determination to enter the electric vehicle market. In fact, LG Chem has been a long-term partner of General Motors for the past decade. As early as 2009, LG Chem provided power batteries for GM’s Chevrolet. Today, LG Chem is still GM’s largest battery supplier.

③ NIO announces another financing of $100 million after last week’s funding

On the afternoon of the 14th, NIO announced that it had again completed a $100 million financing. Similar to the announcement on February 6th, the two Asian investment funds that invested this time were “non-affiliated” and purely financial investors.

According to the agreement, NIO will issue and sell convertible bonds with a total principal amount of $100 million to the buyer in a non-public offering. Both transactions are subject to customary closing conditions and are expected to be completed no later than February 19, 2020. As of February 14th, NIO has announced a cumulative convertible bond financing of $200 million in 2020.

(Image source: NIO official website)

Quick comment: From NIO’s Q3 2019 financial report released in late December, the net loss for Q3 was RMB 2.5217 billion. As of the end of September 2019, NIO’s cash, cash equivalents, restricted cash, and short-term investments totaled RMB 1.9067 billion, plus the convertible bonds issued by NIO on September 5, 2019 (“Li Bin’s USD 95 million”, about RMB 700 million) have not yet been accounted for. All of these add up to RMB 2.6 billion, which is enough for NIO to sustain itself until Q1 2020.

Facing the Chinese New Year in January 2020 and the sudden outbreak of the epidemic, the convertible bond financing project of USD 200 million (about RMB 1.4 billion) has replenished NIO’s cash flow, and this money can help NIO get through the “cold winter” of the first two months of 2020.

Currently, NIO has several other financing projects underway. Meanwhile, NIO has stated that it is “fully confident” in achieving positive gross profit for the full year 2020. We hope that the epidemic will pass soon and China’s spring will come as soon as possible.

④ IDEAL ONE Starts Monthly OTA Updates in Spring

This week, IDEAL ONE announced its OTA upgrade plan since entering Spring, with upgrades to take place at the end of February, March, and April, respectively.

From the upgrades announced this week, a total of 12 major items will be involved, including new energy mode, new special road condition mode, optimization of display interface of instrument screen information, new WeChat in-vehicle support, optimization of time display mode, optimization of power on/off logic of whole vehicle, optimization of Bluetooth connection logic and opening up the function of auxiliary driver seat Bluetooth earphones, optimization of charging function, optimization of driving assistance system, improvement in car control APP connection speed and opening up new functions, optimization of seat function, and optimization of driving recorder.

Detailed optimization points can be viewed in the “IDEAL App”.

(Image source: IDEAL website)Quick Review: The pandemic has had a significant impact on the automotive industry. Major companies have put their best foot forward to launch online promotions and even online car sales. Ideal Auto’s OTA upgrade plan will help enhance product competitiveness.

Here are a few key points from the highly praised update list: Simplified naming of power modes, reduced learning cost for users with “Pure Electric Priority” and “Fuel Priority“.

In addition, the highly anticipated “Off-road Mode” has been added, making it easier for vehicles to handle some simple crossovers. Some of the new features include a car-mounted WeChat function that allows users to send and receive WeChat messages through voice commands. “And finally, the Bluetooth headset function for the co-driver is about to be available“. The Bluetooth adapter will be mailed out soon to users who have already taken delivery.

Are you satisfied with the Ideal ONE’s Spring Update list?

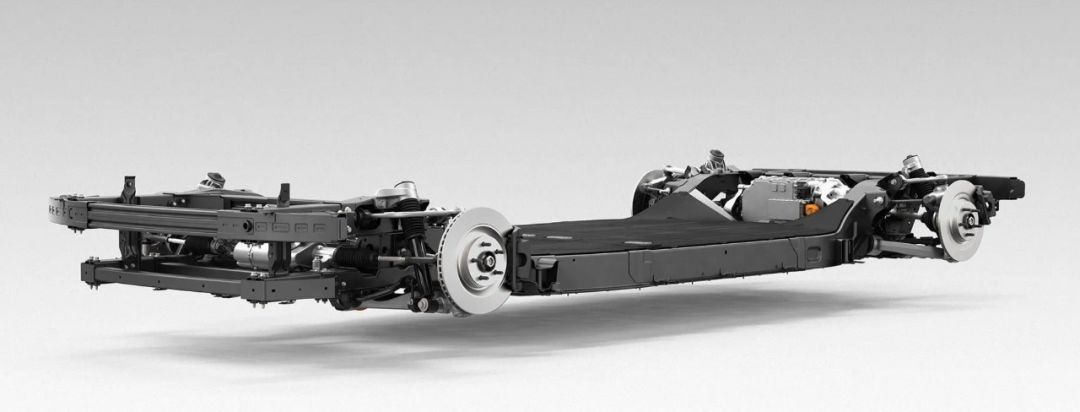

⑤ Hyundai Motor announced plans to invest 87 billion US dollars in the development of electric vehicles.

Hyundai will start investing in electric vehicles in stages beginning in 2020. Hyundai is expected to launch 11 new dedicated electric vehicles by 2025. The plan includes collaborating with an electric vehicle start-up, Canoo, to jointly develop compact and ultra-compact electric vehicles.

Hyundai believes that using Canoo’s pure electric platform can simplify the development process of electric vehicles and reduce costs. Canoo’s pure electric platform architecture, battery pack, and transmission system can be placed on this chassis, which can accommodate a wide range of body designs.

(image source: Electrek)

Quick Review: According to Hyundai’s 2019 financial report, net profit reached 3.28 trillion KRW, about 2.774 billion USD last year. Therefore investing 87 billion USD in stages in the field of electric vehicles is indeed a lot of money for Hyundai.

To shorten the development time and cost of new models, many automakers now directly choose mature electric vehicle platforms. For example, this collaboration between Hyundai and Canoo is similar to Ford and Rivian’s idea. It is indeed more suitable for traditional car companies with a late start to simply design the car shell on a “skateboard-style” chassis architecture.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.