Tesla Shanghai Factory Resumes Production, Stock Prices Rise Sharply

Tesla Shanghai factory resumed production officially on February 10, 2020, and Tesla’s stock prices soared by nearly 10\% after the opening bell in the evening.

The recent fluctuation of Tesla’s stock prices due to the battle between the bulls and the bears does not fully reflect the company’s value. Therefore, let us talk about something more substantial aside from stock prices.

How many cars can Tesla sell in 2020?

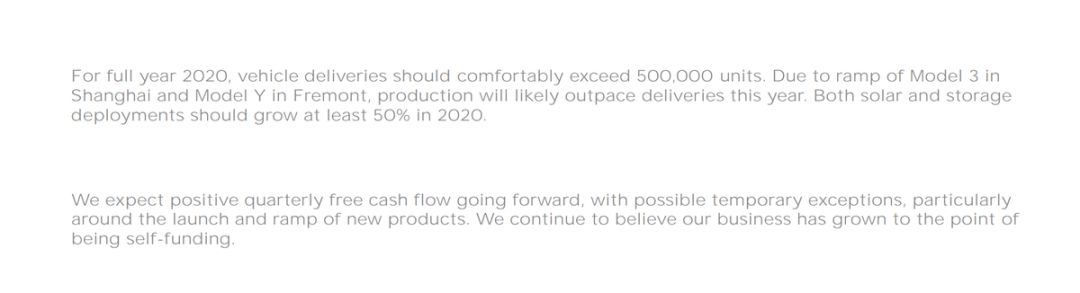

In the Q4 2019 earnings report, Tesla’s sales guidance was 500,000 vehicles, which is a 36\% increase from the 367,500 vehicles sold in 2019. For traditional automakers, this increase is clearly unrealistic. However, for Tesla, we believe that 500,000 vehicles is a achievable goal.

How can Tesla achieve 500,000 vehicle sales in 2020? We can look at it from two angles, “production capacity” and “demand“.

How many cars can Tesla produce in 2020?

Based on the Q4 2019 earnings report, we can see several data points:

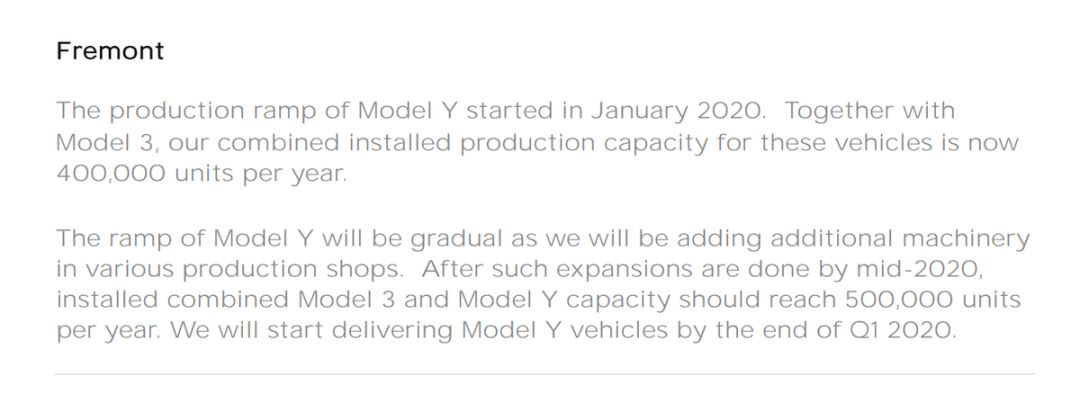

- Model Y has already started production at the Fremont factory in January 2020;

- The combined production capacity of Model Y and Model 3 is 400,000 vehicles per year;

- The production capacity of Model S&X is 90,000 vehicles;

- The total production capacity of Tesla’s Fremont factory is currently 490,000 vehicles per year;

- The production line for Model Y at the Fremont factory will be expanded gradually, and the production capacity of Model 3&Y will reach 500,000 vehicles per year after the expansion is completed in mid-2020.

We can simply calculate that the peak production of Model 3&Y in the first half of 2020 was 200,000 vehicles, before the expansion of Model Y production line. After the expansion was completed in the middle of 2020, the peak capacity for the second half of the year was 250,000 vehicles. This means that the total production of Model 3&Y at Fremont factory in 2020 was approximately 450,000 vehicles, in addition to 90,000 Model S&X vehicles. Therefore, the total annual output of Fremont factory in 2020 was about 540,000 vehicles.

We can simply calculate that the peak production of Model 3&Y in the first half of 2020 was 200,000 vehicles, before the expansion of Model Y production line. After the expansion was completed in the middle of 2020, the peak capacity for the second half of the year was 250,000 vehicles. This means that the total production of Model 3&Y at Fremont factory in 2020 was approximately 450,000 vehicles, in addition to 90,000 Model S&X vehicles. Therefore, the total annual output of Fremont factory in 2020 was about 540,000 vehicles.

Market demand determines product sales, and the production capacity sets the limit on sales. Recently, the highly demanded “medical surgical masks” have vividly demonstrated this principle to us.

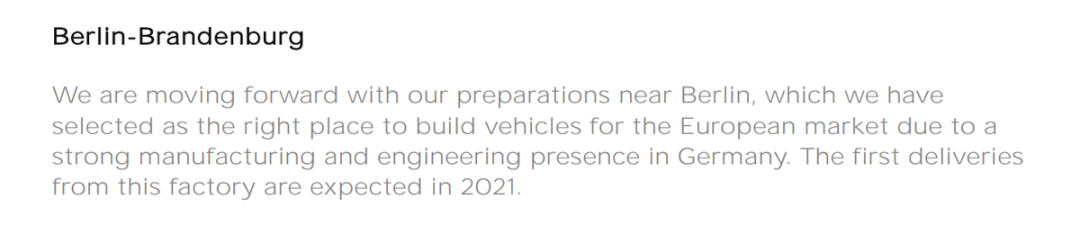

Tesla, which once won more than 500,000 orders, also knows this principle well. In order to break through this limit, Tesla established Gigafactory 3 in Shanghai, China and Gigafactory 4 in Berlin, Germany in 2019.

Gigafactory 3, which was completed first at the end of 2019, will also contribute to production capacity starting in 2020. On January 3rd, 2019, Tesla announced its 2019 Q4 production and delivery data, indicating that the capacity of Shanghai factory had reached 3,000 vehicles per week, and the capacity for 2020 was expected to be 150,000 vehicles per year, as shown in the 2019 Q4 financial report.

Therefore, the total annual output of two Tesla factories in 2020 can reach 640,000 vehicles.

It should be noted that production at Tesla factories resumed on February 10th. If we calculate based on the half month shutdown, the annual output of Tesla Shanghai factory can still reach 144,000 vehicles. Even if the subsequent impact lasts until May or June, Tesla’s current production capacity can still meet the annual demand of 500,000 vehicles without too much difficulty.

However, to continue breaking through the production capacity limit, more factories will be necessary. Currently, Gigafactory 3 phase two and the Gigafactory 4 in Germany are under construction.## Gigafactory 3 Phase 2 plan to produce Model Y in 2021 with a production capacity no less than that of Model 3. Similarly, Gigafactory 4 aims to achieve mass production in 2021, and according to documents submitted by Tesla to the German Federal Environment Agency, the factory will begin production in July 2021, with an initial weekly production capacity of 3000 vehicles.

Therefore, with the known scope, Tesla will have a production capacity of 300,000 vehicles per year in 2021.

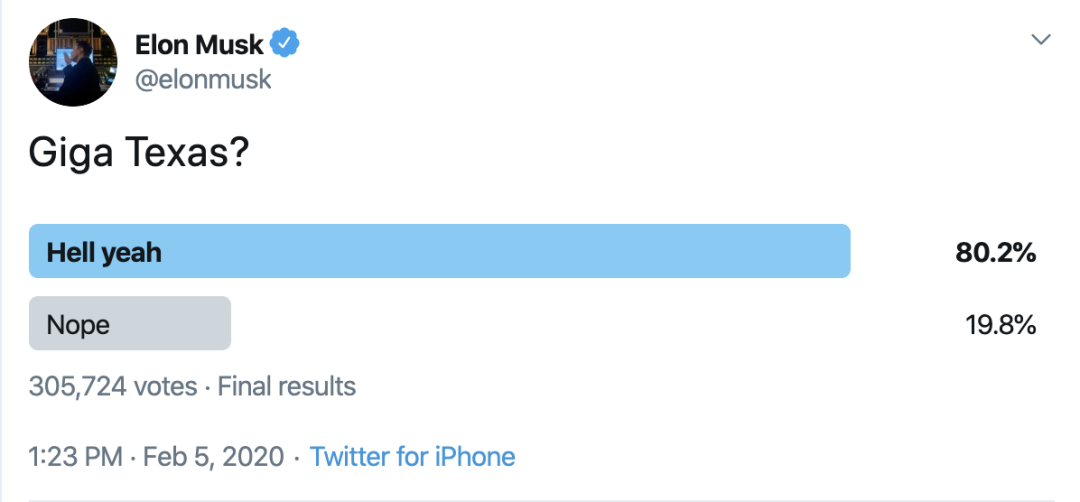

In addition to the four conventional models of S3XY, the Cybertruck electric pickup truck will also be put into production in 2021. Faced with over 200,000 orders of the Cybertruck, Elon’s hint on Twitter is Giga Texas.

After raising the production capacity ceiling time and time again, let’s now be concerned about the demand issue, how many cars can Tesla sell in 2020?

How Many Cars Can Tesla Sell in 2020?

Tesla’s goal is 500,000 vehicles.

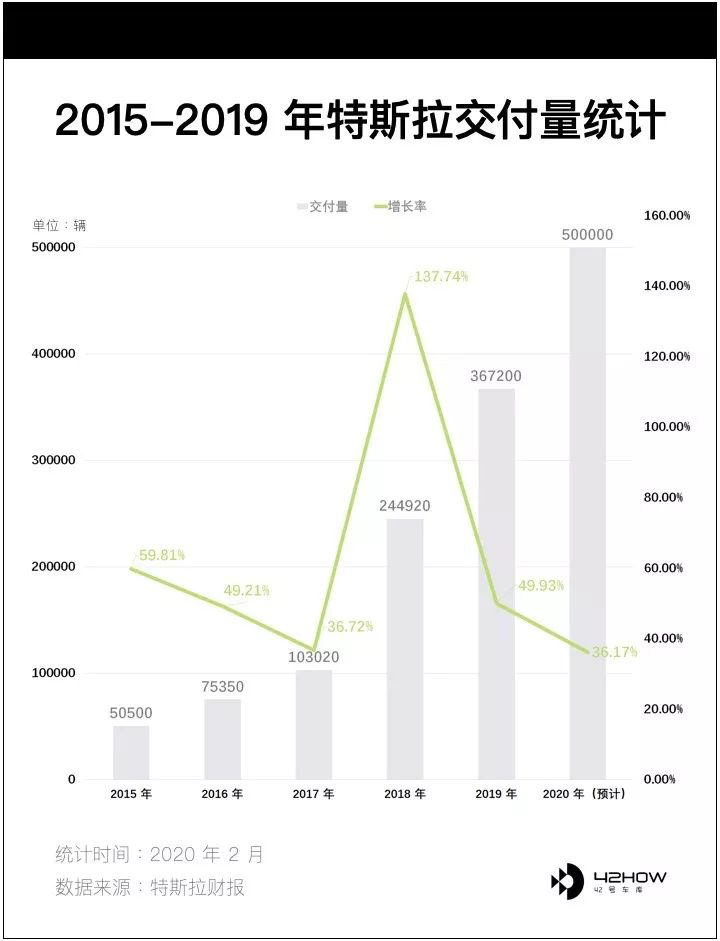

Let’s briefly review Tesla’s delivery volume and growth rate in previous years.

It can be seen from the chart that Tesla’s delivery volume in 2018 rose sharply by 137.7% compared to that of 2017.

The reason for the large increase in delivery volume is simple – Tesla’s fourth mass-produced vehicle, Model 3, began large-scale deliveries. In 2018, Tesla’s total sales volume was 245,000 vehicles, of which Model 3 accounted for 145,800 vehicles, accounting for a staggering 59.5%.

In 2019, although the growth rate of delivery volume slowed down compared to that of 2018, the increase was still close to 50%.

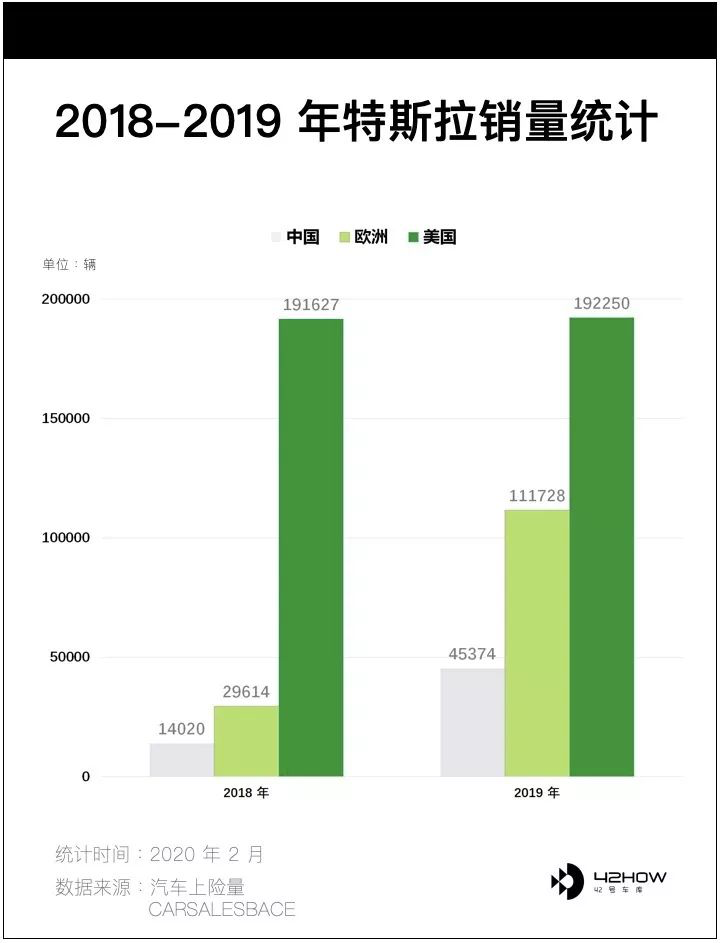

In 2018, Tesla’s sales were mainly concentrated in the US market, reaching 190,000 vehicles, accounting for 76% of total sales.

In 2019, Tesla began delivering Model 3 to the global market, in addition to Model S & X. With 110,000 vehicles delivered to Europe and 45,000 vehicles delivered to China, the majority of deliveries were still in the US market and the delivery volume in 2019 was basically flat compared to that of 2018.From the data, the 44% growth in 2019 came mainly from opening up new markets. However, from another perspective, the US market had already digested all of its backlogged orders in 2018. This means that the 190,000 units sold in 2019 were purely incremental, indicating that there is a sustained demand in the market for smart electric vehicles.

Following this trend, in 2019 Tesla had already digested its backlogged orders globally. In 2020, the global market situation may be similar to that of the US market in 2019, maintaining a level of around 360,000 units. So, where will the 140,000-unit increase in 2020 come from? Is a 36% growth possible?

We believe that this is completely achievable, and even somewhat conservative.

There are two reasons: “new products that can bring incremental growth” and “a growing market environment.”

Products

In 2020, Tesla will start delivering its fifth mass-produced vehicle: the Model Y. At the same time, the domestically manufactured Model 3 has already begun large-scale deliveries.

Let’s first take a look at the Model Y.

The Model Y is a mid-size SUV with the same design for its appearance and interior as the Model 3. In other words, the Model Y is an SUV version of the Model 3.

In 2018, Tesla achieved a growth rate of 137% with the Model 3. Compared to the Model 3, the Model Y has greater advantages in terms of product strength and the era in which it exists.

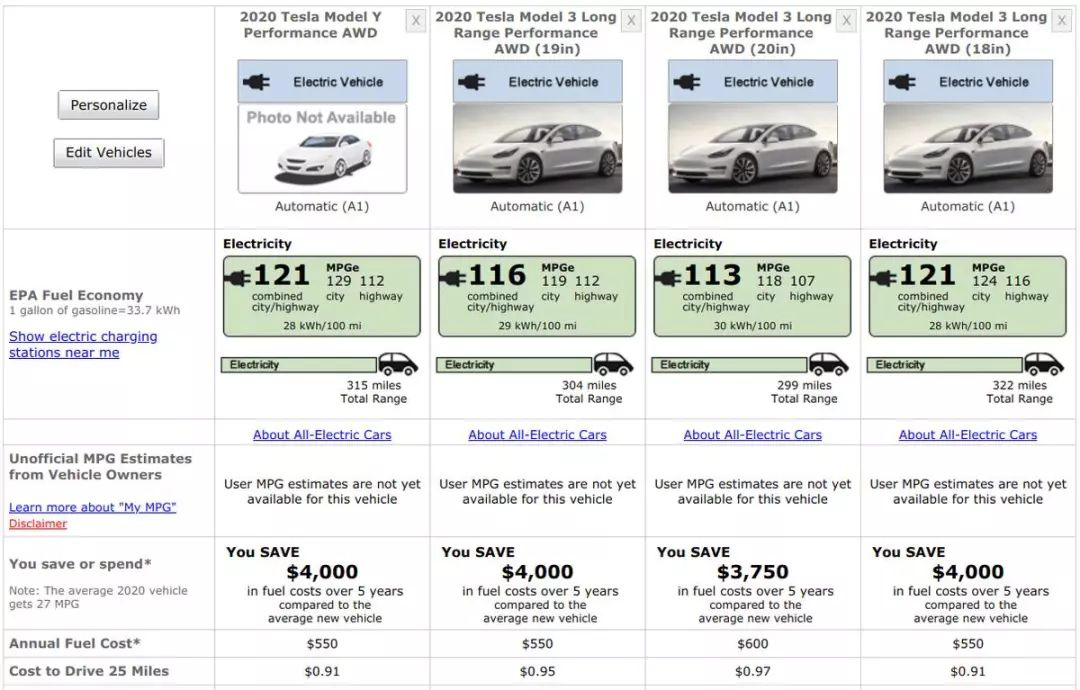

On February 6, 2020, the US Environmental Protection Agency announced the range of the performance version of the Model Y: 315 miles (507 kilometers). This not only sets a record for the range of pure electric SUVs but also surpasses the smaller and lighter Model 3.

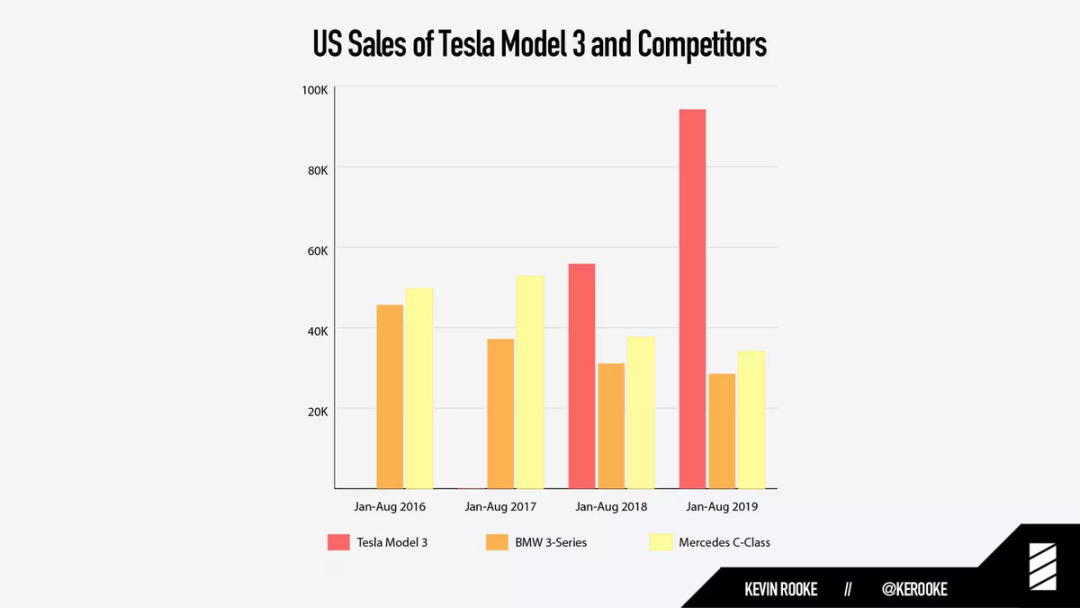

According to data compiled by Twitter user Kevin Rooke, from 2017 to 2019, Model 3 has caused a significant impact on the gasoline car market of the same level, with the sales of Mercedes-Benz C-Class in the U.S. falling by 31%, and BMW 3 Series dropping by 37%.

According to data compiled by Twitter user Kevin Rooke, from 2017 to 2019, Model 3 has caused a significant impact on the gasoline car market of the same level, with the sales of Mercedes-Benz C-Class in the U.S. falling by 31%, and BMW 3 Series dropping by 37%.

Image source: KEVIN ROOKE

The shortcoming of Model Y’s mileage and supplementing energy is gradually disappearing with the improvement of electric efficiency and the large deployment of Tesla’s supercharging stations and chargers. The intelligent longboard of Model Y’s electronic and electrical architecture and Autopilot assisted driving is pulling ahead of its peers at a steady growth rate. Compared with traditional gasoline cars, Model Y’s advantages are increasingly prominent.

In the U.S. market, the best-selling model of BMW is X3, that of Mercedes-Benz is GLC, and that of Lexus is RX. As for Audi, its best-selling model in the U.S. is Q5. All four brands’ best-selling models have a common feature, which is mid-size luxury SUV. That is to say, in this circle of the BBA brands, consumers’ demand for SUV is higher than that for sedans. So, it is reasonable to believe that the Model Y, with a more powerful product force, will replicate this history in the SUV market, which is larger than the one in which Model 3 operates. As for the upper limit of Model Y’s sales in 2020, it depends more on production capacity than on demand.

Now let’s take a look at the domestic Model 3.

Tesla delivered only 33,900 Model 3s in China in 2019, which didn’t turn out to be a hit as it was in the U.S. And the reason for this is simple: it’s too expensive! Although China accounted for half of the world’s total electric vehicle sales, the cars that sold well were those priced below CNY 100,000.

Here is another piece of data.

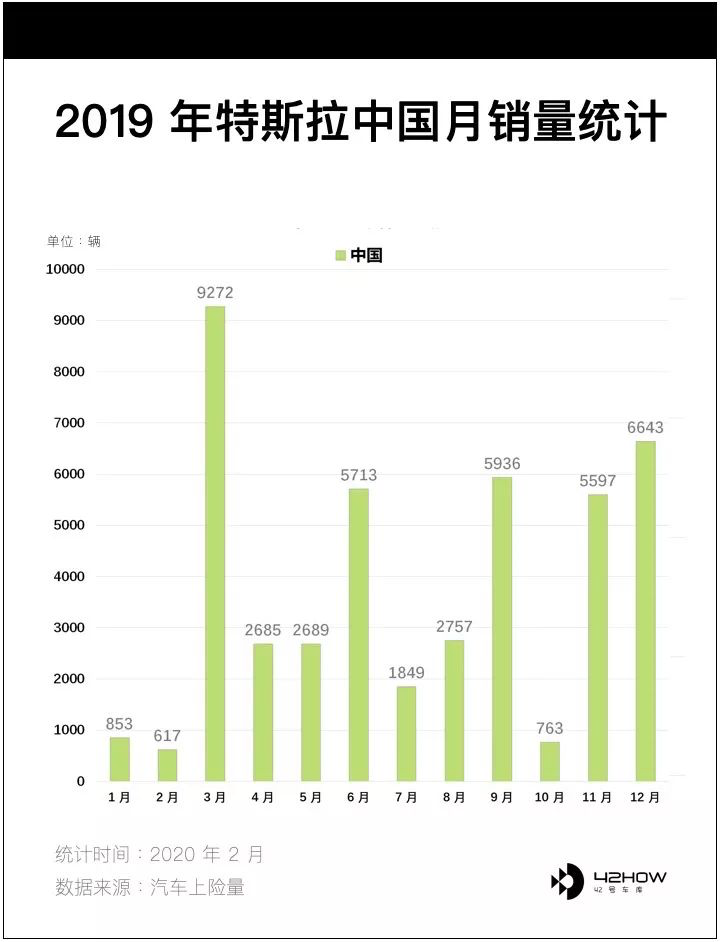

This is the monthly delivery volume of Tesla in the Chinese market in 2019. It can be found that the sales will surge significantly in the last month of each quarter because Tesla will launch some promotional policies to boost sales in that month to meet its quarterly sales target. Therefore, to increase Tesla’s sales in China, it is simple – to lower the price.

In order to have greater room for price reduction, Tesla has opened a factory in China.There are three good news for Tesla in the Chinese market in 2020.

Firstly, at the 2020 Electric Vehicle Hundred People Forum, Miao Wei, Minister of Industry and Information Technology, announced that the subsidy for new energy vehicles, originally scheduled to be reduced in 2020, will be extended for another year, so domestic Tesla can continue to enjoy a subsidy of RMB 27,500.

Secondly, according to the announcement issued by CATL on February 5th, domestic Tesla will start using CATL’s lithium-ion battery from July 1st. According to the information we get from the supply chain, CATL will provide Tesla with CTP batteries whose positive electrode material is lithium iron phosphate, which will be used for the production of standard range upgrade version Model 3.

Although the energy density of a single lithium iron phosphate battery cell is low, after using the CTP technology, the energy density of the pack can be effectively improved. Moreover, the battery capacity of the standard range upgrade version Model 3 is only 53kWh. Compared with the long-range version, there is more space in the battery compartment, so it is completely feasible to change to lithium iron phosphate batteries while maintaining the original battery capacity.

At the Electric Vehicle Hundred People Forum, Ouyang Minggao, an academician of the Chinese Academy of Sciences, mentioned that the cost of power batteries is between 0.6-1.0 yuan/Wh, with 0.6 yuan/Wh for lithium iron phosphate batteries which are relatively cheaper, and 1 yuan/Wh for ternary lithium batteries.

Therefore, after changing to lithium iron phosphate batteries, Tesla can further reduce the cost of the vehicle. In addition, with the improvement of localization rate of domestic Model 3 parts, there is still room for cost reduction, so price reduction is inevitable.

Thirdly, according to reliable sources, Tesla will produce a domestic long-range version Model 3 in Q2 and Q3 of 2020. If the selling price can be reduced to within RMB 400,000, it will bring more sales increment for Tesla.

To sum up, Model Y will be the key model to drive Tesla’s sales growth in 2020, and domestic Model 3 will become the key model to drive sales growth in the Chinese market.

Growing market

Having talked about Tesla’s two key products in 2020, let’s take a look at the global electric vehicle market.Bloomberg predicts that electric vehicle sales will account for 3% of global vehicle sales in 2020, and will increase to 11% by 2025.

From a policy perspective, the EU has set new targets for the average carbon dioxide emissions of new passenger cars:

-

In 2020, 95% of new cars will meet a target of 95 g/km or approximately 4.1 L/100 km.

-

In 2021, all new cars must meet the target of 95 g/km.

-

By 2025, emissions must be reduced by 15% from 2021 levels to 80.75 g/km.

-

By 2030, emissions must be reduced by 37.5% from 2021 levels to 59.375 g/km.

For most traditional automakers, failure to introduce new energy vehicles to reduce carbon emissions will result in hefty fines in the billions of euros. Therefore, starting in 2020, more and more traditional automakers are introducing pure electric vehicle models, and have announced 10-year plans for electrification.

In the “Development Plan for the New Energy Vehicle Industry (2021-2035)” (draft for comments) released by the Ministry of Industry and Information Technology at the end of 2019 in China, it was clearly stated that by 2025, the proportion of new energy vehicle sales will be around 25%.

Think about the Super Bowl on February 3, where traditional carmakers Porsche, Audi, and General Motors all aired ads for their electric vehicle models. Seeing traditional carmakers willing to spend millions of dollars advertising electric cars during prime time, it’s clear that their attitude towards electrification is gradually changing.

The entry of traditional automakers will attract more attention to electric vehicles, which is good for the whole market. However, the products currently rushed to market do not pose a significant threat to Tesla, but rather shatter the illusions of many people who thought that traditional automakers would easily defeat Tesla. It also made many consumers who are interested in electric vehicles more aware that Tesla’s electric powertrain technology is still the leader in the industry.

This is not only good news for the electric vehicle market, but also for Tesla. Along with electrification comes the arrival of intelligent systems.The Ministry of Industry and Information Technology stated in the “Development Plan for New Energy Vehicles Industry (2021-2035) (Draft for Comments)” that the proportion of sales of new intelligent connected vehicles will reach 30% by 2025. Ignoring electrification, Tesla is far ahead of its competitors in the field of intelligence.

After experiencing Tesla deeply, I have a feeling that Model 3 is a product that leads the times significantly, which is reflected in two aspects: electronic and electrical architecture and Autopilot assisted driving technology.

The advanced electronic and electrical architecture brings OTA upgrade functions, and the driving experience brought by Tesla’s steadfast self-researched assisted driving is something that traditional cars have never had.

For most people, if they haven’t experienced Model 3, it’s hard to deeply understand the subversion that “intelligence” brings to cars through words and videos. They don’t reject Tesla, they just don’t know that cars can be so intelligent now.

I have driven to Shanghai to pick up my friends multiple times with Model 3. After a brief experience, they asked me a question: Why should they buy ordinary gasoline cars?

The attributes of cars are changing from a means of transportation to an electronic product.

In this era of product transformation, more people are needed to educate this market. The increasingly large group of car owners is a huge advantage for Tesla.

Tesla now has over 600,000 car owners.

Last but not least, let’s go back to this chart. According to Tesla’s delivery guidelines, this year’s goal delivery growth rate is only 36.17%, which is the lowest since Tesla’s founding in 2015.

And this year is the year of the launch and delivery of Model Y and made-in-China Model 3, and it is also a year when the market environment is more favorable to electric cars, and the year in which the Tesla user group is the largest.

We can hardly believe that this year’s goal is only 500,000 vehicles.

Let’s take a look at the financial report’s description of 500,000 vehicles:> For full year 2020, vehicle deliveries should comfortably exceed 500,000 units.

In Tesla’s growing maturity and confidence, it is evidently lowering people’s expectations. Here is a simple forecast: on the basis of 360,000 units delivered in 2019, Model Y will have a production capacity of 150,000 units in 2020, Tesla’s target production and sales volume in China this year is 100,000 units. Overall, it is expected that Tesla’s sales in 2020 will be at least around 600,000 units.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.