Header Image

On the evening of February 5th, Tesla’s stock fell 17%, ending a four-day surge.

After searching for all the information related to Tesla, I couldn’t find any recent positive news related to the stock price increase. So today I want to put aside the stock price and talk about something rational.

How many cars can Tesla sell in 2020?

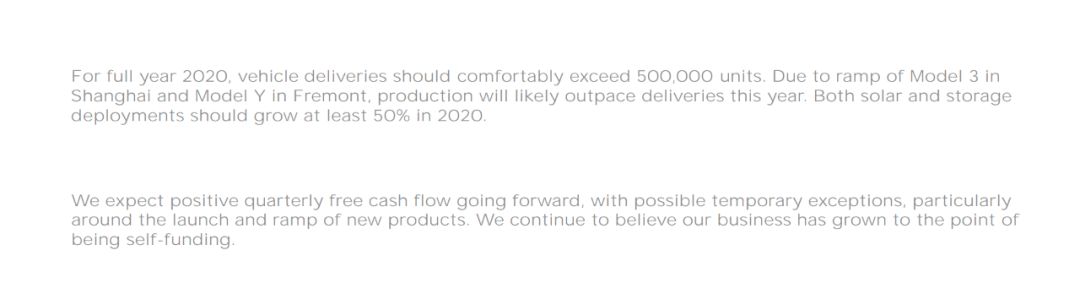

In Q4 2019 financial report, Tesla gave a sales guidance of 500,000 vehicles. Compared with the delivery volume of 367,000 vehicles in 2019, this represents an increase of 36%. This increase is obviously unrealistic for traditional car companies, but for Tesla, we believe that 500,000 vehicles is a completely achievable goal.

How many cars can Tesla produce in 2020?

According to the data released in the Q4 2019 financial report, Model Y has started production at the Fremont factory in January 2020, and the combined production capacity with Model 3 is 400,000 vehicles per year. Taking into account the 90,000 vehicles of Model S&X, the total production capacity of the Fremont factory is 490,000 vehicles.

The financial report also mentioned that the production line of Model Y at the Fremont factory will be gradually expanded. After the expansion is completed in mid-2020, the production capacity of Model 3&Y will reach 500,000 vehicles per year.

Let’s do a simple calculation: the peak production of Model 3&Y in the first half of 2020 is 200,000 vehicles, and the peak production capacity in the second half of the year after the expansion is completed is 250,000 vehicles, which means that the total production volume of Model 3&Y at the Fremont factory in 2020 is about 450,000 vehicles. Plus 90,000 vehicles of Model S&X, the total annual production volume of the Fremont factory in 2020 will be approximately 540,000 vehicles.

The quantity of sales depends on market demand, and the ceiling of sales is determined by production capacity. The recently popular “medical surgical masks” vividly illustrates this point.Tesla, which once won more than 500,000 orders, also understands this truth. In order to break through this ceiling, Tesla built Gigafactory 3 and Gigafactory 4 in Shanghai, China and Berlin, Germany, respectively, in 2019.

Gigafactory 3, which was completed at the end of 2019, will also contribute to the production officially starting in 2020. According to the production and delivery data announced by Tesla on January 3, 2019, the production capacity of Tesla’s Shanghai factory has reached 3,000 vehicles per week, and the capacity for 2020 is 150,000 vehicles according to Tesla’s Q4 financial report.

Therefore, the total production capacity of Tesla’s two factories in 2020 can reach 640,000 vehicles per year. It is worth mentioning that according to the latest news from the Shanghai Municipal Information Office, Tesla’s Shanghai factory will resume production on February 10th. For the difficulties in resumption of work for key production enterprises in Shanghai, the municipal government will coordinate efforts to help companies resume production as soon as possible.

Even if the shutdown lasts for half a month, the annual output of Tesla’s Shanghai factory can still reach 144,000 vehicles. Tesla’s current production capacity can meet the demand of 500,000 vehicles per year without much problem even if the subsequent impact lasts until May or June.

However, in order to continue to break through the ceiling of production capacity, more factories are necessary. Currently under construction are Gigafactory 3 phase 2 and Gigafactory 4 in Germany. The plan for Gigafactory 3 phase 2 is to produce Model Y in 2021, and the production capacity will at least meet the level of Model 3 now. Gigafactory 4 will also target mass production in 2021. Based on the documents submitted by Tesla to the German environmental authorities, the factory will start production in July 2021, and the initial weekly production capacity will also be 3,000 vehicles.

Therefore, within the currently known range, Tesla will gain an additional production capacity of 300,000 vehicles per year in 2021.Apart from the four regular models of S3XY, Cybertruck electric pickup will also be put into production in 2021. Facing the 20W+ orders of Cybertruck, Elon hinted on Twitter that Giga Texas will take care of it.

After the ceiling of production capacity has been raised time and time again, let’s focus on the demand issue. How many cars can Tesla sell in 2020?

Tesla’s target is 500,000 vehicles.

Let’s briefly review Tesla’s delivery volume and growth rate over the years.

As can be seen from the chart, Tesla’s delivery volume in 2018 increased significantly by 137.7% compared to 2017.

The reason for the large increase in delivery volume is simple – Tesla’s fourth mass-produced car, Model 3, began to be delivered on a large scale. In 2018, Tesla’s total sales volume was 245,000 vehicles, of which 145,800 were Model 3, accounting for as much as 59.5%.

Although the growth rate of delivery volume in 2019 decreased compared to 2018, the increase was still close to 50%.

Let’s take a closer look.

In 2018, Tesla’s sales were mainly concentrated in the US market, reaching 190,000 vehicles, accounting for 76% of the total sales volume.

In 2019, Tesla began to deliver Model 3 to the global market, in addition to Model S&X. Tesla delivered 110,000 vehicles to the European market and 45,000 to the Chinese market. The majority of deliveries were still in the US market, and the delivery volume in 2019 remained basically the same as that of 2018.

From the data, we can see that the 44% growth in 2019 came mainly from opening up new markets. However, from a different perspective, the US market had already digested all the backlog orders in 2018. This means that the 190,000 vehicles delivered in 2019 were pure incremental, which means that the demand for smart electric vehicles continues to exist in the market.

If following the pattern, Tesla has already digested the global backlog of orders in 2019. The global market in 2020 may maintain the level of around 360,000 vehicles, just like the US market in 2019. So where does the incremental 140,000 come from in 2020? Is a 36% growth rate possible?

If following the pattern, Tesla has already digested the global backlog of orders in 2019. The global market in 2020 may maintain the level of around 360,000 vehicles, just like the US market in 2019. So where does the incremental 140,000 come from in 2020? Is a 36% growth rate possible?

We believe that this can be achieved, with even a hint of conservatism.

Two reasons: “new products that can bring incremental growth” and “a growing market environment.”

Product

In 2020, Tesla will begin deliveries of the brand’s 5th mass-produced car: Model Y, and the locally produced Model 3 has already begun mass production and deliveries.

Let’s start with Model Y.

Model Y is a mid-size SUV with the same design as Model 3 in appearance and interior. In other words, Model Y is the SUV version of Model 3 in a simpler and more understandable way.

In 2018, Tesla achieved a growth rate of 137% relying on Model 3, and compared with Model 3, Model Y has a greater advantage in product strength and the era it is in.

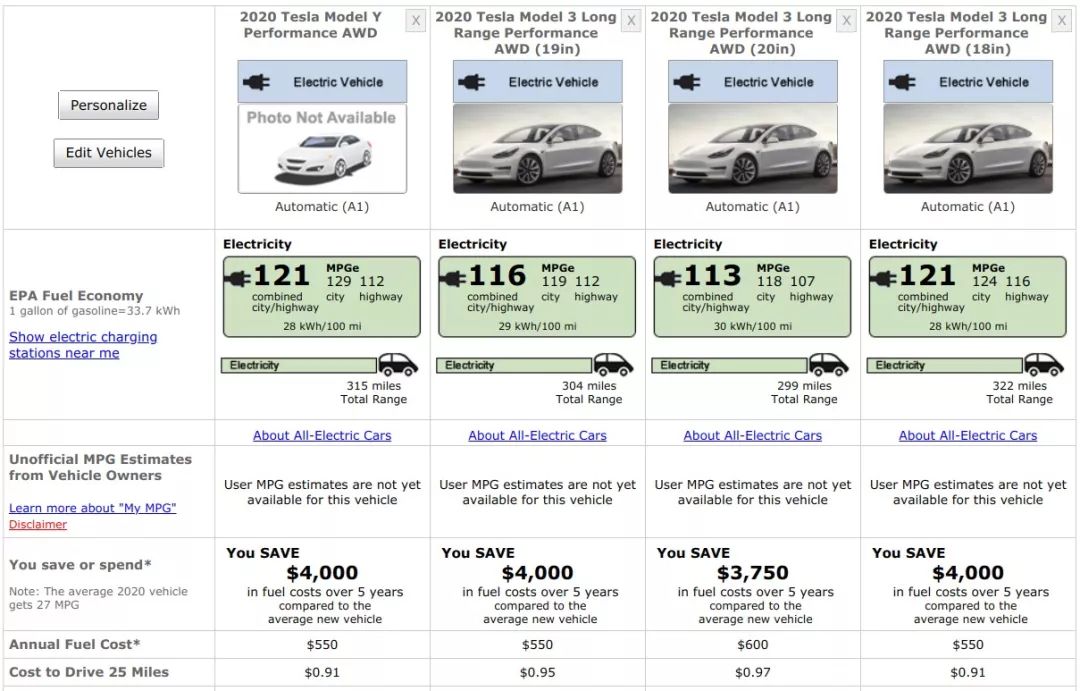

On February 6, 2020, the US Environmental Protection Agency announced the EPA range of the Model Y performance version: 315 miles (507 kilometers). Not only does it set a record for the range of pure electric SUVs, but it also surpasses the smaller and lighter Model 3.

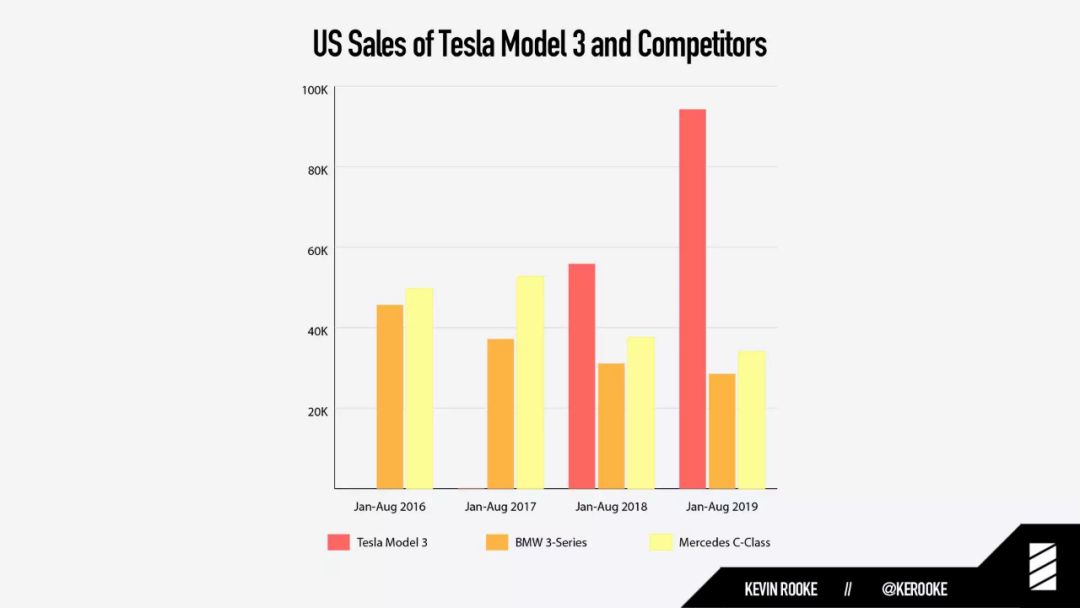

According to data compiled by Twitter user Kevin Rooke, from 2017 to 2019, since Model 3 was introduced, Mercedes-Benz C-Class sales in the United States decreased by 31%, while BMW 3 Series sales fell by 37%. This is the impact of the product strength of Tesla Model 3 on the same-level fuel car market.

As an electric car, the Model Y’s weakness in range and replenishment is gradually disappearing with the improvement of electric efficiency and the deployment of Tesla supercharging stations and charging piles. Meanwhile, the Model Y’s intelligent electronic and electrical architecture and Autopilot assisted driving are steadily outpacing its competitors in the same class with a stable growth rate, making the advantages of the Model Y over traditional fuel cars even greater.

As an electric car, the Model Y’s weakness in range and replenishment is gradually disappearing with the improvement of electric efficiency and the deployment of Tesla supercharging stations and charging piles. Meanwhile, the Model Y’s intelligent electronic and electrical architecture and Autopilot assisted driving are steadily outpacing its competitors in the same class with a stable growth rate, making the advantages of the Model Y over traditional fuel cars even greater.

In 2019, the BMW X3 was the best-selling model in the US market, the Mercedes-Benz GLC was the best-selling model in the US market, the Lexus RX was the best-selling model in the US market, and the Audi Q5 was the best-selling model in the US market. The best-selling models of these four brands all have a common feature – they are all mid-size luxury SUVs, indicating that the demand for SUVs is higher than sedans in this circle such as BBA.

Therefore, we have reason to believe that the more powerful Model Y will replicate this history in the SUV market, which is even larger than the market Model 3 is in.

As for the upper limit of Model Y’s sales in 2020, it depends more on production capacity than demand.

Let’s take a look at the domestically produced Model 3.

In 2019, Tesla delivered only 33,900 Model 3s in China, and it did not become a hot model like it did in the US market.

There is only one reason for this: it’s expensive!

Although China’s electric vehicle sales account for half of the global total, the high-selling models are all commuter cars priced at 100,000 yuan or less.

Here is a piece of data.

Chart

This is Tesla’s monthly delivery volume in the Chinese market in 2019. We can see that sales will increase significantly every March, June, September, and December because Tesla will launch some promotional policies at the end of each quarter to boost sales.

Therefore, it’s easy to improve Tesla’s sales in China by lowering the price.

To have greater room for price adjustments, Tesla opened its factory in China.

For Tesla, there are three good news in the Chinese market in 2020.

Firstly, the new energy vehicle subsidy, originally scheduled to expire in 2020, will be extended for another year. Therefore, domestically produced Tesla can enjoy a subsidy of 27,500 yuan.

Secondly, according to an announcement by CATL on February 5th, domestically produced Tesla will start using CATL’s lithium-ion battery after July 1st. According to our sources, CATL will provide the CTP battery with iron phosphate as the positive material for Tesla to produce standard range upgrade version Model 3.

Here is an information point: the CTP battery of Standard Range Plus Model 3 with positive electrode material being Lithium Iron Phosphate (LFP) is available now.

Although the energy density of a single Lithium Iron Phosphate battery cell is relatively low, the energy density of the Pack can be effectively improved after adopting CTP technology. Moreover, the battery capacity of Standard Range Plus Model 3 is only 53 kWh, and there is more space in the battery compartment compared with the long-range version. Therefore, it is entirely possible to replace it with a Lithium Iron Phosphate battery while maintaining the original battery capacity.

At the EV100 Forum, academician Minggao Ouyang from the Chinese Academy of Sciences mentioned that the cost of power batteries is currently between 0.6-1.0 yuan/kWh. 0.6 yuan/kWh is for Lithium Iron Phosphate battery, which is relatively cheaper, and 1 yuan/kWh is for ternary lithium battery.

Therefore, after replacing the Lithium Iron Phosphate batteries, Tesla can further reduce the cost of the vehicle.

In addition, as the localization rate of Model 3 parts increases, there is also room for cost reduction, so it is just a matter of time before the price drops.

Third, it is reported that Tesla will produce the long-range version of Model 3 in the second and third quarters of 2020. If the selling price can be reduced to below ¥400,000, this will be another wave of growth for Tesla.

To sum up, Model Y will be a key new product for Tesla’s sales growth in 2020, while the domestic Model 3 in China will become a key new product for market growth.

In a growing market

After talking about Tesla’s two key products in 2020, let’s take a look at the global market environment for EVs.

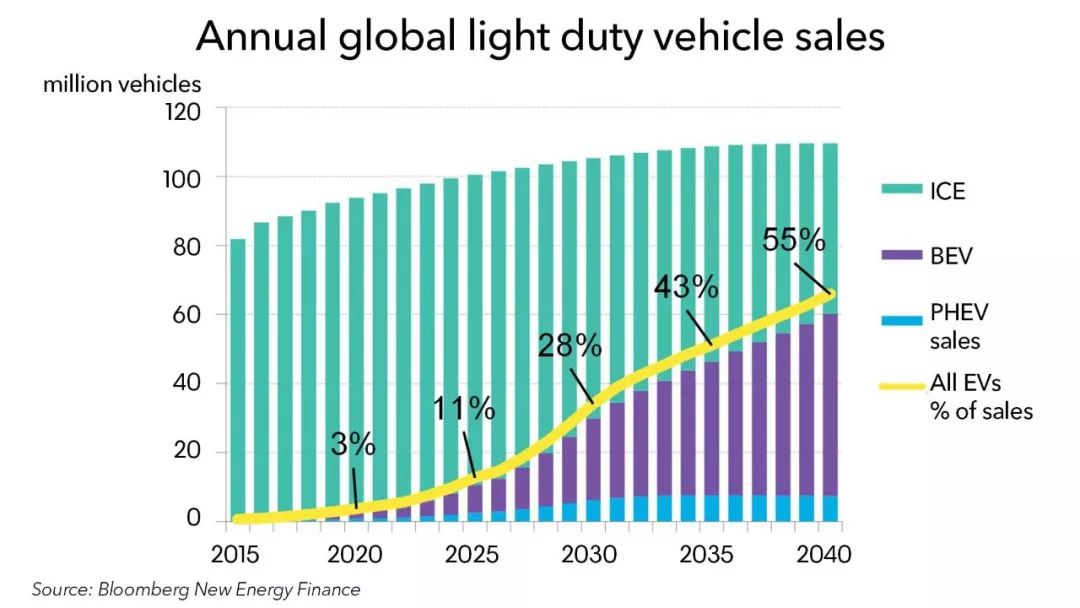

Bloomberg predicts that the sales of electric vehicles will account for 3% of global car sales in 2020, and will increase to 11% by 2025.

From a policy perspective, the European Union has set new targets for the average carbon dioxide emissions of new passenger cars:

In 2020, 95% of new cars will meet the target of 95 g/km (about 4.1 L/100 km).

In 2021, all new cars will meet the target of 95g/km.

By 2025, the target will be further reduced by 15% from 2021, to 80.75 g/km.

By 2030, the target will be further reduced by 37.5% from 2021, to 59.375 g/km.For most traditional automakers, if they don’t introduce new energy vehicles to reduce carbon emissions, they will face billions of euros in fines. So, starting from 2020, more and more traditional automakers have begun to introduce pure electric vehicle models and have released 10-year plans about electrification.

In the “New Energy Vehicle Industry Development Plan (2021-2035)” (solicitation draft) released by the Chinese Ministry of Industry and Information Technology at the end of 2019, it is also clear that by 2025, the proportion of new energy vehicle sales will reach about 25%.

Just think about the advertisements for electric vehicles from traditional automakers such as Porsche, Audi, and General Motors during the Super Bowl on February 3. Seeing that traditional automakers are willing to spend millions of dollars during prime time to promote electric vehicles, it is undeniable that their attitude towards electrification is changing imperceptibly.

The entry of traditional automakers will bring more users’ attention to electric vehicles, which is a boon for the entire market. However, currently rushed products have not posed too much of a threat to Tesla. On the contrary, it has shattered the fantasy in many people’s minds that “traditional automakers can easily beat Tesla in a minute,” and has also made many consumers who are concerned about electric vehicles more recognized that Tesla’s three-core technology is the leader in this industry.

This is a boost for the pure electric vehicle market, but also for Tesla.

With electrification comes intelligence.

As mentioned above, the Ministry of Industry and Information Technology clearly states in the “New Energy Vehicle Industry Development Plan (2021-2035)” (solicitation draft) that by 2025, the proportion of new intelligent connected vehicles will reach 30%.

Leaving electrification aside, Tesla is far ahead of its competitors in the intelligent field.

After deeply experiencing Tesla, I have a feeling that the Model 3 is a product that significantly leads the times, and its advantage lies in the electronic and electrical architecture and Autopilot assisted driving technology.

The OTA upgrade function brought by advanced electronic architecture and the driving experience improvement brought by Tesla’s persistent self-developed auxiliary driving are unprecedented in traditional cars.

The OTA upgrade function brought by advanced electronic architecture and the driving experience improvement brought by Tesla’s persistent self-developed auxiliary driving are unprecedented in traditional cars.

For most people, without experiencing Model 3 themselves, it’s hard to understand the disruptive impact of “intelligent” technology on cars through just words or videos. They don’t reject Tesla because they don’t like it, but because they don’t even know that cars can be so smart now.

I have driven Model 3 several times to meet my friends in Shanghai, and after a brief experience, they asked me a question: why bother buying ordinary gasoline cars?

The attributes of cars are changing from a means of transportation to an electronic product.

So in this era of product transformation, there is a need for more people to educate this market, and the increasingly large user base is a huge benefit for Tesla.

And now Tesla has over 600,000 users.

In conclusion

A more favorable environment for electric cars and a larger user base can bring stable customers to Tesla, and the production of Model Y and domestic Model 3 will bring new growth to Tesla.

Making a simple prediction, the sales volume base in 2020 is 360,000 vehicles, the production capacity of Model Y in 2020 is 150,000 vehicles, Tesla’s target in China this year is 100,000 vehicles, minus last year’s 45,000, and an increase of about 55,000 vehicles is expected this year.

Adding everything up, 360,000 + 150,000 + 55,000 = 565,000, so overall, Tesla’s sales volume in 2020 is likely to be around 550,000 vehicles.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.