“2019 was a turning point for Tesla,” as stated in the Tesla financial report just released today for Q4 and full year 2019.

After the financial report was released, Tesla’s stock went up 11 points in after-hours trading, nearly reaching the $650 mark, setting a new high.

Elon was again seen happily “dancing” on Twitter after the conference call ended.

As stated earlier, Tesla’s Model 3 was the key model that helped Tesla achieve this turning point in 2019. Model 3 broke the sales record for electric vehicles and also Tesla’s own sales record, bringing profitability for Tesla. This was a significant milestone for the entire new energy vehicle industry. The success of Model 3 has also made Tesla confident that electrification and intelligence can become the choice for more customers.

In 2019, Tesla’s fourth Gigafactory, located in Berlin, Germany, grew from the ground up, while the Chinese Gigafactory, producing cars in China, officially began production.

To meet the needs of more consumers, Tesla released the mid-sized SUV Model Y and pure electric pickup truck Cybertruck in early 2019.

Tesla’s stock price hit a low of $176.99 in 2019. But with the increase in production, factory expansion, and new product releases, Tesla’s stock price continued to rise to nearly $600.

Tesla’s market value has now surpassed $104.7 billion, making it the second-highest valued car company, ahead of Volkswagen Group.

Through Tesla’s efforts in 2019, more and more consumers have recognized the company’s value.Now let’s turn our attention to the released financial report and the content of the conference call, to see what the highly anticipated car manufacturer has in store for 2020.

What does the financial report say?

- Financial data:

– In Q4 2019, Tesla’s cash and cash equivalents increased by $930 million, reaching $6.3 billion. Free cash flow was $1.01 billion, up 173% from the previous quarter, exceeding market expectations of $429.5 million.

– GAAP operating revenue for Q4 was $359 million ($261 million for Q3) and operating profit margin was 4.9% (4.1% for Q3).

– Tesla’s overall gross profit for Q4 2019 was $1.39 billion, up 17% from the previous quarter but down 4% YoY. The gross profit margin per vehicle was 22.5% (22.8% for Q3), and net income was $105 million under GAAP rules.

– GAAP EPS for Q4 was $0.81, exceeding market expectations of $0.78.

– Tesla’s total revenue for 2019 was $24.578 billion, surpassing market expectations of $24.47 billion. The company incurred a net loss of $862 million for the full year, slightly higher than the market expectation of $810 million, but lower than the net loss of $976 million for the same period last year.

- About Model Y:

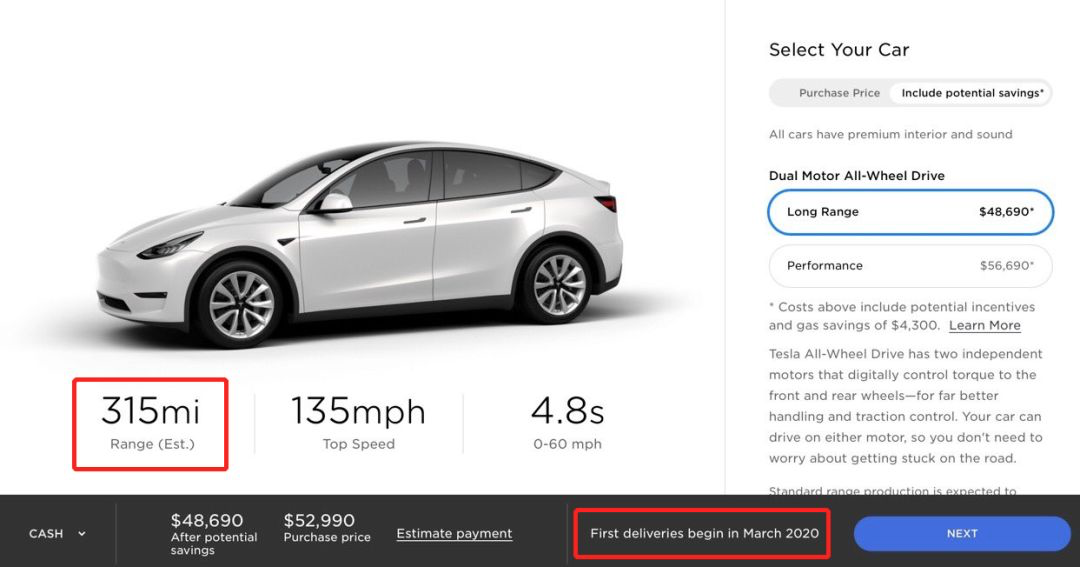

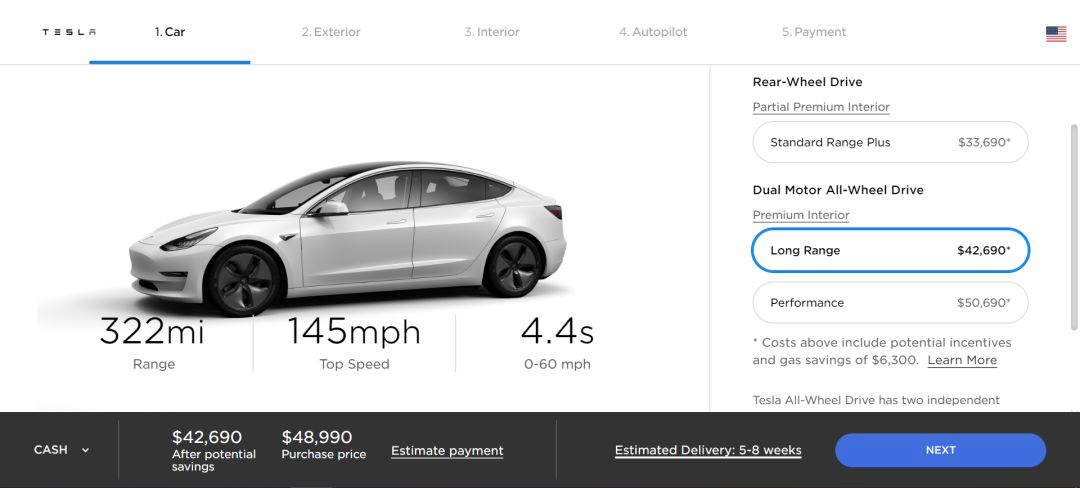

– The mass production of Model Y has been pushed forward to January 2020, and the expected delivery time on the US official website is March 2020, much earlier than the fall 2020 release that was announced during the Model Y launch event.

– The EPA range of the all-wheel drive long-range version of Model Y has increased significantly from 280 miles to 315 miles, which is even more than the 322 miles range of the AWD Model 3. Tesla’s drive efficiency is truly frightening.

- About delivery volume and production capacity:

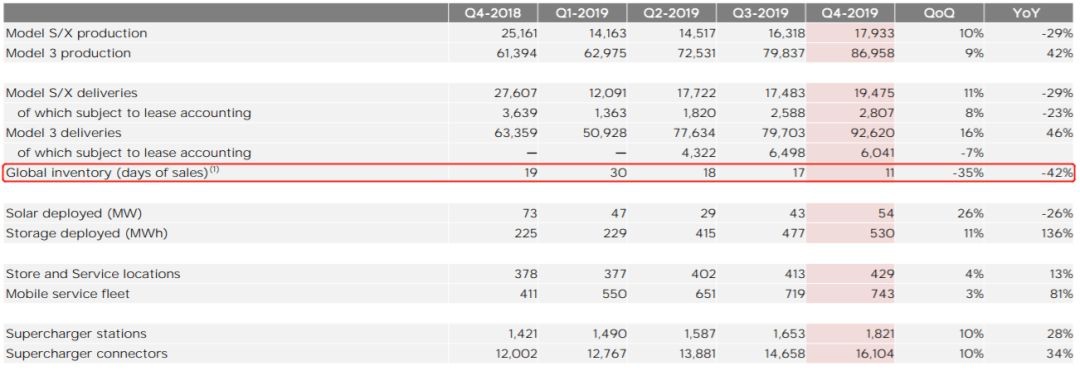

– Tesla delivered 112,095 vehicles in Q4 2019 and a total of 367,500 vehicles for the full year, surpassing the sales target guidance set at the beginning of 2019.

– The average inventory time for vehicles in Q4 was only 11 days (17 days in Q3), significantly lower than the industry average.

-

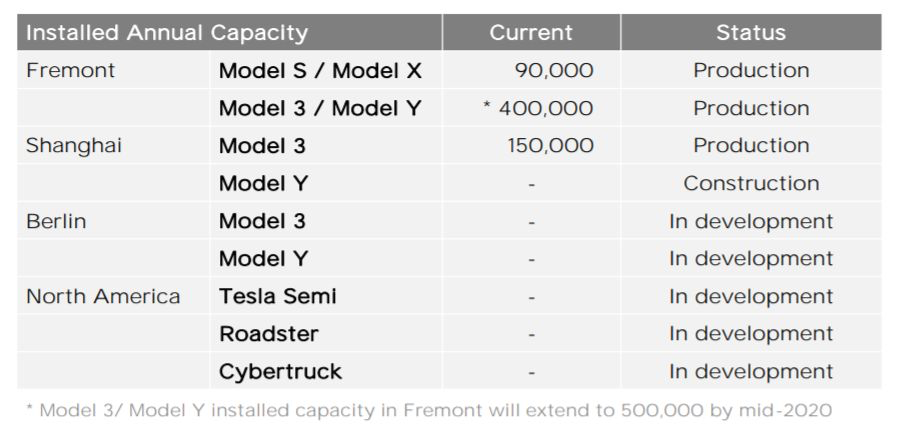

Currently, the production capacity of Model 3/Y at Fremont factory is 400,000 units per year. With the gradual increase in Model Y production capacity, the production capacity of Fremont factory is expected to increase to 500,000 units per year in mid-2020.

-

Model Y has started production at the Fremont factory, and the second phase of the Shanghai factory is expected to start production of Model Y in 2021. Considering the popularity of SUV models, the production capacity of Model Y should be at least the same as that of Model 3.

-

Tesla will begin limited production of Semi in 2020.

-

In 2020, Tesla aims to sell 500,000 vehicles.

-

About Energy Business:

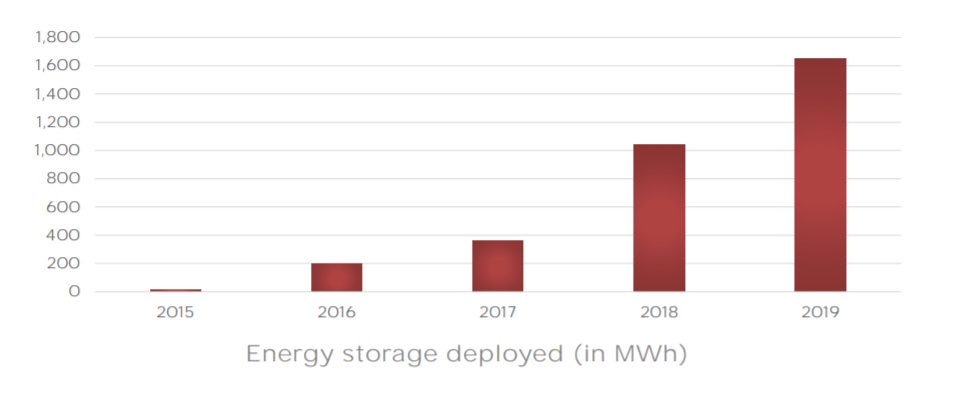

In Q4 2019, the deployment of energy storage reached a historical high of 530 MWh, including the first deployment of Megapack. Since the launch of this product, the interest and order levels of global project developers and utility companies have exceeded expectations.

In 2019, Tesla deployed a total of 1.65 GWh of energy storage, more than the sum of all previous years. 54 MW of solar energy was deployed in Q4, an increase of 26% compared to Q3.

In 2020, Tesla’s deployment of solar and storage equipment will increase by at least 50\%.

Surprise from Model Y

If Tesla’s key model in 2019 was the Model 3, then the Model Y will definitely continue Tesla’s glory in 2020.

In today’s earnings report, Tesla revealed two details about the Model Y:

-

The start of mass production of Model Y is advanced to January 2020.

-

The EPA range of the AWD Long Range version of Model Y has been significantly increased from the previously announced 280 miles to 315 miles.

Since last year, information about the early production of Model Y has been continuously reported. Today, Tesla officially announced the mass production time of Model Y, which is significantly earlier than the time announced at the 2019 conference.

Throughout the development history of Tesla, from Model X to Model 3, and then to Semi and Roadster 2, Tesla CEO Elon Musk usually releases the news first, and then motivates the team to achieve this goal. In addition, Tesla often challenges itself in manufacturing, such as the falcon-wing doors of Model X and the highly automated production line of Model 3.

Therefore, a word that always accompanies Tesla is “delay“, and Tesla’s fans are used to these “delays” and jokingly call it Elon Time.

However, starting with Model Y, the “delay” hat has been thrown into the 2019 trash bin by Tesla.

The ability to greatly advance the mass production time by half a year benefited largely from the development and manufacturing experience of Model 3. Starting from the more streamlined white body of Model Y and optimizing the production line, Tesla believes that not only has Model Y achieved early mass production, but the ramp-up time for production capacity in the later stage will also be greatly reduced.

At the same time, the delivery time of Model Y on the Tesla official website has also been updated to March of this year.

Another surprise can also be seen in the figure above. The EPA range of the all-wheel-drive Model Y has increased significantly from 280 miles (450 km) to 315 miles (507 km). If you have no concept of this number, let’s take a look at the all-wheel-drive Model 3 with the same 75 kWh battery pack.

Despite being larger, heavier, and having higher wind resistance than Model 3, Model Y has only 7 miles less range.

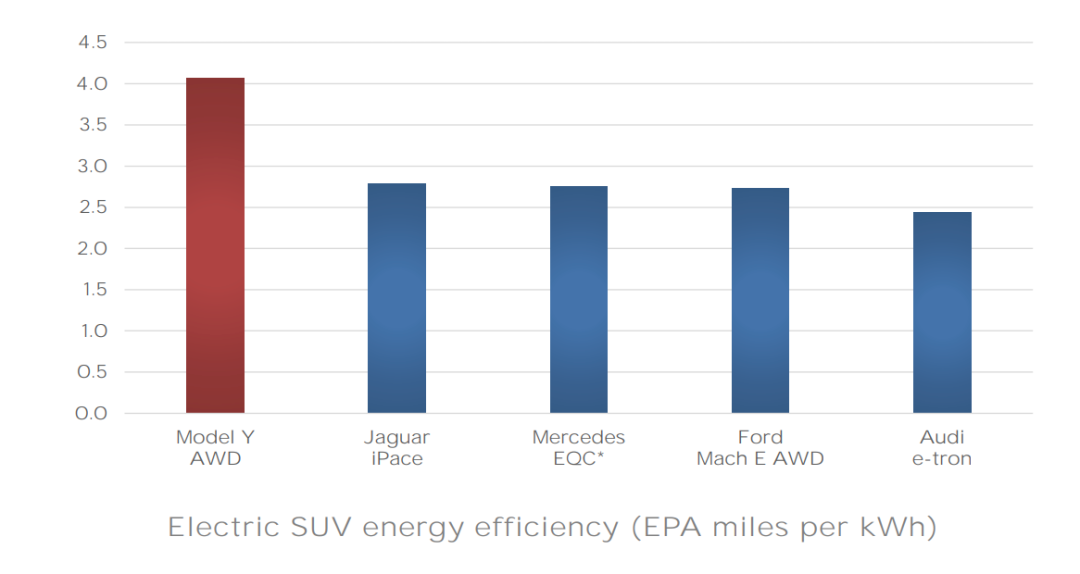

Although Tesla hasn’t explicitly confirmed whether the hardware of Model Y and Model 3 is completely identical, what we can confirm is that while Model 3 has achieved industry-leading energy efficiency, Model Y has once again broken the record and is currently the most efficient pure electric vehicle.

And Model Y’s even stronger product power is also the confidence that Tesla set a new sales record in 2020.

And Model Y’s even stronger product power is also the confidence that Tesla set a new sales record in 2020.

Conservative 500,000 annual sales target

With the early arrival of Model Y, it was originally thought that Tesla’s sales guidance for this year would be very impressive, but the result was unexpectedly conservative, with an annual sales guidance of only 500,000 vehicles. Although this still represents a nearly 40\% increase over 367,500 vehicle sales in 2019, it is still too conservative.

Why?

Currently, the Fremont factory’s Model 3/Y production capacity has reached 400,000 vehicles per year, and Model S/X has a production capacity of 90,000 vehicles per year.

In addition, with the annual production capacity of 150,000 Model 3s at the Shanghai Super Factory, Tesla’s total production capacity has reached 640,000 vehicles per year. And Tesla officially expects that by mid-2020, the production capacity of Model 3/Y at the Fremont factory will increase from 400,000 vehicles per year to 500,000 vehicles per year.

Of course, the above production capacity planning may all be under ideal conditions.

Tesla CFO Zach Kirkhorn said during the earnings call that to prevent the spread of the new crown virus, the Chinese government has temporarily closed the Shanghai Super Factory. Currently, the increase in production of Model 3 at the Shanghai factory is expected to be delayed by one to one and a half weeks due to the government’s request to close the factory.

In addition, as Tesla will release the new generation of Model S Plaid this year, it means that the existing Model S production line will undergo renovation and upgrades, and will also be affected by capacity ramp-up.

However, even if we take into account the impact of the above two factors, Tesla’s production this year should still easily reach about 600,000 vehicles.

Let’s review a sentence from the financial report:

None of this would be possible without strong demand for our products. For most of 2019, nearly all orders came from new buyers that did not hold a prior reservation, demonstrating significant reach beyond those who showed early interest.> Amazingly, this was accomplished without any spending on advertising. As more people drive our cars and as the industry rapidly validates electrification, interest in our products will continue to grow.

Without strong demand for our products, none of this would have been possible. Throughout most of 2019, almost all orders came from new buyers who did not pre-order, indicating that their influence extended far beyond those who showed early interest.

Surprisingly, this was achieved without any ad spending. As more people drive our cars and as the industry rapidly validates electrification, interest in our products will continue to grow.

Additionally, in an interview after the delivery ceremony for the Chinese-made Model 3 for the first batch of employees on December 30, Tesla China’s general manager Wang Hao was asked about the sales target for the China market in 2020, to which he replied, “We will sell as many units as we produce.“

Obviously, demand is already a non-issue for Tesla and, with production capacity steadily increasing, Tesla’s sales guidance for 2020 can be considered very modest.

Details from the Conference Call

- On FSD:

Tesla originally planned to achieve Full Self-Driving before 2020, but it is obvious that they have fallen behind schedule.

Elon stated during the conference call that “we are several months away from achieving full self-driving capabilities. Tesla’s Autopilot and AI teams are great and have made significant progress, although we may not seem to have made much progress in the eyes of consumers. In terms of software, however, we have made substantial progress.”

Another fundamental task is training through automatic labeling using a large number of videos and cameras filming simultaneously. We are striving to improve the efficiency of automatic labeling, which is basic work.

For those interested, please refer to our previous articles:– Analysis of Autopilot with Automatic Labeling, Tesla Trains Human Driving Behavior

- About Model S/X:

During today’s conference call, an analyst asked about the lackluster sales of the Model S/X in the fourth quarter of 2019, largely due to the use of the 2170 battery. When will the Model S/X switch to the 2170 battery cells? Elon’s answer was cautious and only stated that the switch from 18650 to 2170 was merely a change in battery form. In the past, the efficiency of the chemical reaction inside the 18650 battery has been optimized many times. The range of the Model S is already approaching 400 miles, and the actual range of the current Model S/X is stronger than the official range listed on the website. It is just that the EPA-related data has not been updated yet.

- About the factory:

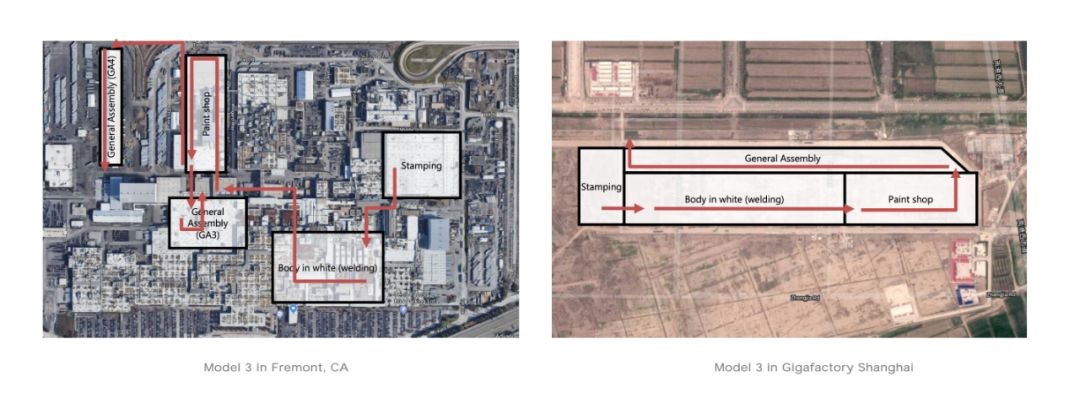

Thanks to the localization of the supply chain, lower material costs, reduced logistics costs, reduced import and export taxes and fees, and more efficient factory layout, the operating efficiency of Tesla’s Shanghai factory will be higher and the cost of vehicle manufacturing will be lower.

Closing Remarks:

Recalling more than half a year ago, with a lack of demand and a low stock price, bankruptcy was circulating around Tesla.

However, with the Q3 2019 financial report turning a loss into a profit, the delivery of the Shanghai factory, and impressive data from the Q4 2019 financial report, Tesla’s stock price skyrocketed, joining the hundred-billion-dollar market value club and surpassing Volkswagen to become the current second-largest car company by market value.

More importantly, Tesla has proven that the demand for smart electric cars is real and showed its ability to achieve sustainable profitability.

As a new era automotive giant, Tesla has become more mature, whether from the early production of the Model Y, the sales guidance of 500,000 units, or the outlook for FSD. From its previously unbeatable aggressiveness to its current modesty, Tesla is now ready to become a mature leader in 2020.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.