Through long-term promotion by global media, governments, and car companies, pure electrification in the automotive industry has gradually become deeply ingrained in people’s minds. However, compared to other energy sources such as mild and full hybrids, range extender EVs, and even hydrogen fuel cell vehicles, consumer enthusiasm remains limited.

This is due to the simple and easy-to-understand logic of the three electric powertrains of pure EVs, where we tend to have a preconceived judgment that “new technologies with a simple structure and clear logic will defeat old technologies with complex structures and abstract logic“, and that new technologies will always be more efficient and reliable.

However, industrial development, supply chain maturity, commercial viability, and user experience are often not influenced by a single judgment. This is also the reason why the pure electric vehicle was invented as early as 1828 by Hungarian Ányos Jedlik, but it was not until today that the global automotive industry has begun to reconsider the prospects of pure electric vehicles.

Based on a comprehensive consideration of the above factors, when Aiways was established in February 2017, its engineering and technical team researched, tested, and evaluated all energy sources except for fossil fuels (gasoline/diesel) to bet on the next decade of new energy vehicles.

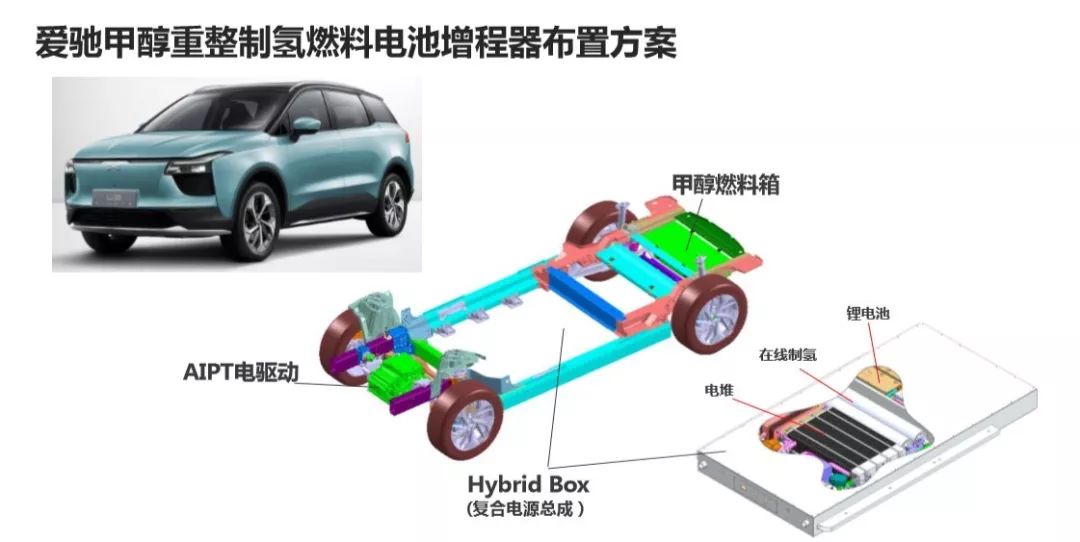

After extensive exploration, testing, and verification, Aiways has made its final two choices: pure electric vehicles, with the specific three electric powertrains already installed in the Aiways U5, and “range-extending electric vehicles”. However, this “range-extending” is not the traditional one. Aiways’ range extender is called the “Methanol Reformation Hydrogen Fuel Cell Stack Reformer“.

“What? Methanol… reformer?” The name is indeed too long, but as Aiways’ president, Fu Qiang, said, “Every word is useful and not redundant”. To have a fundamental understanding of this powertrain, one must first fully understand the name: “Methanol Reformation Hydrogen Fuel Cell Stack Reformer“.

Let’s start with pure electric vehicles.

Today, the two basic issues with the user experience of pure EVs are “range anxiety” and “inconvenient charging”. These two issues severely limit the functionality of cars as travel tools that expand production and life radii. Technically, this is because the energy density of lithium batteries is far lower than that of gasoline/diesel.

This is also why, although mainstream car companies are all following the pure electrification route, for true multinational giants, multi-line betting and parallel incubation are the more core strategies. For example, Toyota in Japan, GM in the United States, and Hyundai in South Korea have all devoted a lot of effort to the commercialization of hydrogen fuel cell vehicles (FCEVs) in addition to pure electric vehicles.

Both Toyota Mirai and Hyundai NEXO are FCEVs that are relatively mature and competitive with pure electric vehicles. However, for a new type of drive to be popularized, not only does the product need to be mature, but FCEVs face the same, or even more severe, problem as pure electric vehicles: a shortage of hydrogen refueling facilities and high construction costs.

Since there are some commercial challenges in the preparation and transportation of hydrogen, there are only two options left for Aiways: one is to abandon the FCEV route and return to the path of pure electric vehicles; the other is to follow the Ideal Car’s approach and see if there is a way to produce hydrogen online.

The “Methanol-Reforming Hydrogen High-Temperature Fuel Cell Stack Reformer” from Aiways, which has a rather long name, is a new energy powertrain that completes energy conversion by adding methanol, producing hydrogen online, and using a hydrogen fuel cell to drive the motor.

Why is methanol fuel cell hybrid the way to go?

Obviously, this is a high-complexity powertrain. However, Fu Qiang, in an interview, said that around 2017, when Aiways planned the MAS platform and Aiways U5, it considered various powertrain routes, and eventually the “methanol fuel cell hybrid” stood out in terms of commercial feasibility and user experience after numerous screening.

What are the advantages of a methanol fuel cell hybrid?

After years of negative publicity about ethanol gasoline, many people undoubtedly have a major aversion to “methanol.”

Why not go directly to hydrogen fuel cell cars instead of using methanol to produce hydrogen?

This question needs to be answered from two perspectives. First, just like the difference between pure electric vehicles and range-extended electric vehicles is only distributed charging versus online power generation, the difference between hydrogen fuel cell vehicles and methanol fuel cell hybrid vehicles lies only in distributed refueling versus online hydrogen production, and there is no essential difference.Of course, online hydrogen production through range extenders significantly increases the complexity of powertrain, which is inevitable. But why can’t Aiways make Toyota-style hydrogen fuel cell vehicles?

As we all know, hydrogen fuel cell vehicles face challenges in the high cost of building refueling stations and difficult promotion. Even for Toyota, a state-owned enterprise in Japan, the effects of promoting hydrogen fuel cell vehicles are extremely limited. Not to mention Aiways, a startup company.

Combining China, the world’s largest automobile market with a total of over 250 million vehicles, with the “formation of a nationwide network based on the level of petroleum fuel, which I think is impossible to achieve in less than twenty or thirty years,” in the words of Fu Qiang.

Secondly, there is a significant gap between China and foreign countries in terms of both patent reserves and commercialization technology eligible for vehicle standards in high-pressure hydrogen storage.

Therefore, methanol-based fuel cell vehicles are a better direction. Of course, this raises a question: why methanol and not “proven” gasoline/diesel?

Aiways Executive Vice President Wu Wei mentioned China’s strategic position in the methanol market. In fact, China has the right to set the price of methanol. The global methanol production capacity is approximately 160 million tons/year, of which over 85 million tons are in China, accounting for over 50%. Accordingly, China has the pricing power for methanol, and the market trends for methanol are to a large extent determined in China.

This is significantly different from the upstream resource of petroleum for gasoline and diesel. China’s dependence on fossil fuels for energy has risen to more than 70% from over 50% a few years ago. Considering China’s “plentiful coal, insufficient oil, and scarce gas” energy characteristics, it is unwise to continue to bet on gasoline and diesel in the automobile industry from the perspective of national energy security.

Fu Qiang specifically mentioned the advantages of “plentiful coal”: “Now in China’s mining, to a certain extent, the quality of a lot of coal is changing; coal seams are becoming deeper and the quality of coal is getting worse, which affects the application of coal in other aspects. But for the production of methanol, it is not picky about coal. Any quality of coal can be used to produce methanol.”

In other words, Aiways’ choice of methanol-based hydrogen production and range extended electric vehicles is based on both national conditions and technological considerations. By using methanol as a carrier for hydrogen, it aims to promote the commercialization of fuel cell electric vehicles.

Some may ask, why not just make pure electric vehicles without making things so complicated?Let’s go back to the discussion on pure electric vehicles in the previous section. Firstly, it is quite difficult to significantly increase the energy density of batteries in the short term, given the need to ensure the safety, lifespan, and cost of lithium batteries. With the entry of global automotive giants, the competition for battery resources will become more intense, making it increasingly challenging for startup companies to maintain their competitiveness in battery technology.

Once falling behind in battery technology, the challenges of providing satisfactory key user experiences such as acceleration and cruising range directly affect the performance of electric vehicles.

These are the real challenges that every new car manufacturer will face, and Aiways is simply preparing ahead of time.

Aiways’ Commercial Layout

A critical question is: as the most complex product in the civil industry, how can we safeguard the reliability of the supply chain for methanol fuel cell extended-range electric vehicles? And where will consumers go to add ethanol after receiving their cars?

In an interview, Fu Qiang discussed Aiways’ position: the automotive industry is an integrated industry, and many people do not understand that they want to do everything themselves such as developing batteries, electric cores, and autonomous driving… The real intellectual property lies in how to integrate these components, and in reality, these are the roles played by an automotive OEM in the industry chain.

Wu Wei stated that from methanol fuel tanks to high-temperature fuel cell stacks, lithium batteries, electric motors… methanol fuel cell extended-range electric vehicles do not require many new parts developed from scratch. In fact, this technology has already accumulated more than 50,000 kilometers of operation on Aiways’ top supercar, Gumpert Nathalie, without any problems.

Secondly, whether it is a pure electric vehicle or a high-pressure hydrogen fuel cell car, the biggest problem is that whenever a new driving form is introduced, a new refueling station, charging station, or hydrogen station must also be promoted to support it.

The biggest advantage of methanol is that it can directly utilize the refueling network of energy giants such as Sinopec, PetroChina, CNOOC, and ChemChina. As the number of fuel car ownership declines, the previous oil storage tanks can be cleaned and then coated with a layer of plastic film to be used as methanol storage, paving the way for the spread of a methanol refueling network.The transformation cost is estimated to be around 700,000 to 1.5 million yuan, far lower than the funding and physical space costs required for charging stations or hydrogen refueling stations.

In terms of the industrial chain, in February 2019, Aiways completed an investment in Blue World Technologies, a Danish methanol fuel cell system developer. In September, Blue World Technologies’ methanol fuel cell factory broke ground at the port of Aalborg, Denmark, and is expected to be put into production in 2020. According to Wu Wei, Blue World Technologies has strong technological reserves in the field of methanol reforming fuel cells: “Globally speaking, in the field of methanol reforming fuel cells, Blue World Technologies should be at least in the top three.“

As the world’s largest fuel cell production base, after the construction of the Blue World factory, it will provide Aiways with methanol reforming online hydrogen production fuel cells, which will be mass-produced for Aiways models.

On November 7, Aiways and the People’s Government of Gaoping City, Shanxi Province held a project cooperation signing ceremony.

Shanxi Province is a comprehensive energy revolution reform pilot in China. The reason why Aiways chose Gaoping is very pure: firstly, Gaoping is a pilot city for methanol vehicle applications, providing excellent conditions for the development of methanol hydrogen fuel cell technology in the local area. Secondly, backed by the 3 million tons of methanol production capacity in Jincheng, Gaoping has dual advantages of policy and resource promotion of methanol hydrogen fuel cell electric vehicles.

Back to the present, Aiways’ methanol reforming fuel cell electric vehicle is like Tesla’s pure electric vehicle in 2003. Just like Fu Qiang said: “There are two possibilities for being a pioneer. One is to become a martyr, and the other is to become a pioneer. We take advantage of the small company’s flexibility and fast decision-making, our sensitivity to technological insights, and then start to bet on this field.“

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.

*

*