This article is from EVDog, a member of the 42 community and a practitioner in the automotive industry.

As of August 2019, China’s passenger car sales (CAAM data) reached 13.322 million units, a sharp year-on-year drop of 12.3% from January to August last year. Pure electric vehicles sold 63,000 units in August alone, a slight increase of 1.44% year-on-year. The cumulative sales from January to August reached 560,000 units, a year-on-year increase of 50.6%.

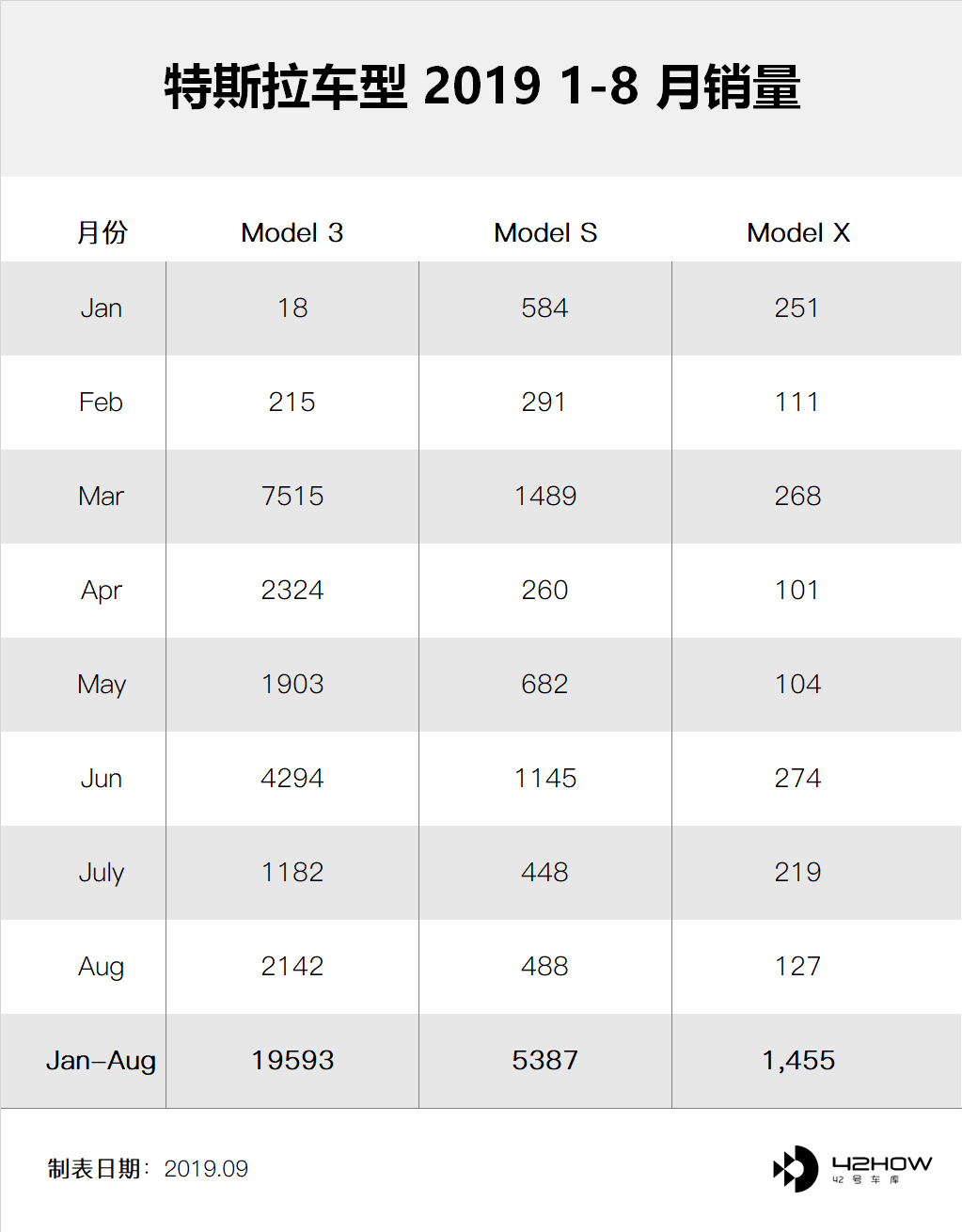

While many brands attribute the weakness of new energy vehicles in July and August to “economic downturn,” “centralized release of demand due to subsidy phase-down in June,” and “inventory sales promotions of vehicles meeting the National Emission Standard V (China V),” Tesla, which will soon be domestically produced, has pushed sales to alarming numbers:

Looking at the top 10 rankings of domestic pure electric vehicle sales from January to August this year:

Given the average customer unit price of most of the top selling models, if you visit the Tesla official website and build your own Model S or Model X, you will find that the first wave of airdrops has already captured a large share of total revenue of pure electric vehicles, while Chinese brands have mostly been criticized by the public as having “insufficient quality” with the exception of NIO, which has an average customer unit price of no less than RMB 448,000 and annual sales of 7,528 units, striving to defend the dignity of China’s smart manufacturing.

Whether it is overtaking or changing lanes, slogans that we have shouted for a long time and industry policies that we have implemented for many years seem to be challenged. There has always been skepticism about new energy policies in China. Coupled with the subsidy phase-down to be fully implemented after June 30, 2020, now there are new challenges from the launch of pure electric vehicles from Tesla and traditional luxury brands. The fate of China’s new energy industry seems to be unknown.

Why Will China’s New Energy Vehicles Win?

By “win,” we mean that China’s new energy vehicles will survive fierce market competition and do so well enough to achieve the ultimate goal of generating sufficient revenue to cover operating expenses solely from the new energy vehicle business, rather than simply by relying on traditional gasoline vehicle sales.

The core argument against domestic new energy vehicles is primarily focused on the following points:

- Huge technology gap with foreign brands

- Subsidized policies give rise to fraudulent vehicles

There is a common problem with these views: they only focus on the current situation or some historical cases, and magnify them as the truth. In short, they use a biased approach, rather than a development perspective. Why is this the case?# Markdown translation of Chinese text with HTML tags preserved

Domestic passenger cars, even the most eye-catching Geely, currently has a pricing limit of 216,800 yuan (Starry Energy). This price can only buy a mid-range B-class sedan or a low-to-mid-range mid-size SUV from ordinary joint venture brands. It is well known that there is a significant gap between domestic car engine and automatic transmission technology and international brands that cannot be bridged. This is one of the reasons why our country proposed the use of pure electric vehicles to take the lead.

Even in the field of pure electric vehicles, the monster corporation Tesla has launched three models, S, X, and 3, in a rhythm that even traditional powerhouses cannot match. The Model 3, in terms of performance, endurance, and advanced assisted driving level, far surpasses its peers. To put it bluntly, in fact, Tesla has no peers at present.

The huge gap is suffocating, but if we look at the scale of ten years, we will find that domestic cars have made amazing progress in the past few decades:

In the past, Chinese car manufacturers were dismantling and reversing light-duty trucks and vans like Isuzu, producing a large number of light-duty vehicles traveling on the fertile soil opened up by the reform and opening-up policies. With a large number of joint venture cars hitting the market, the shortcoming of low-priced and low-quality domestic cars was highlighted, and the label of low-end has been attached for two to three decades. Compared with the past and present of domestic cars, it is clear that we have made significant progress.

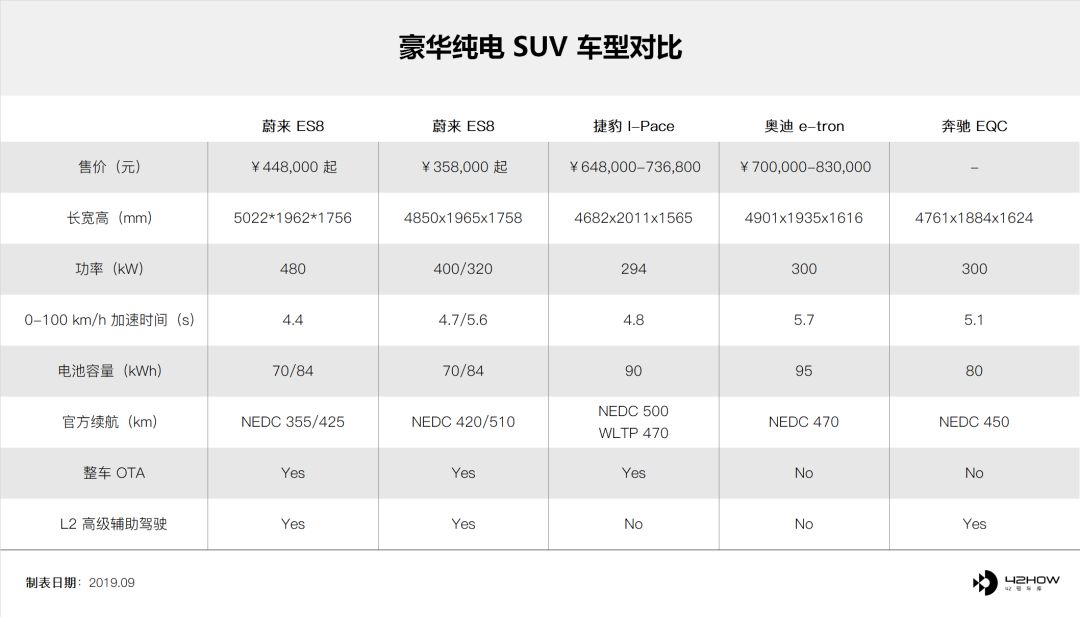

In the field of new energy vehicles, although there is still a significant gap with Tesla, the development of three-electric technology and advanced driving assistance features in domestic electric vehicles has at least caught up with the level of BBA:

In addition to high-end brands such as NIO, XPeng, WmAuto, and traditional domestic brands such as Geometry, Aion, BYD, and others are also continuously launching cost-effective new products. With battery cell manufacturers such as BYD and CATL constantly upgrading their products, battery modules with higher energy density are being applied by more and more car companies. The endurance of pure electric vehicles will be generally pushed to over 500 km in the next two years, which is already on par with many fuel-powered vehicles.

As a pearl on the crown of modern industry, the automobile is a capital-intensive and long-term industry. Being fixated on the relative differences with foreign competitors within the next three to five years and ignoring the progress of the entire industry in China over the past two decades, such a perspective is unlikely to yield scientific answers.

The criticism of subsidy policies mainly stems from early new energy commercial vehicles, and typical enterprises have also been punished by the state. As for passenger vehicles, checking the subsidy policy shows that the tens of thousands of yuan the government subsidizes to car enterprises are all subsidized to users by car enterprises in order to promote sales. Otherwise, there would be no such thing as “XX thousand yuan after subsidies” for buying new energy vehicles.The more important thing is that after users have installed the charging piles or completed the license plate registration, general car manufacturers will issue subsidies to the users, while some new forces directly reduce the car price. However, delays of one or two years in issuing subsidies by the state to companies are commonplace. Additionally, it should also be remembered that local subsidies have been cancelled after June 30th, 2019, and national subsidies will only last until June 30th, 2020.

Conclusion: Compared with the past, China’s automobile industry is now in an unprecedentedly strong era; the new energy policy has given birth to a group of eye-catching products. Chinese cars, especially new energy vehicles, are fully qualified to compete directly with international brands.

Why must China’s new energy vehicles fight a protracted battle?

When the pure electric cars launched by BBA were ridiculed round after round, a voice began to emerge: traditional brands have fallen behind, their new electric cars are not competitive, their software capabilities cannot keep up with the times, and their autonomous driving functions are not as grounded as domestic Chinese companies.

This argument actually makes the same mistake as the “inevitability of China’s new energy failure”: looking at the problem in a one-sided manner.

Traditional brands, especially overseas brands, have not only profound technical accumulation, but also have built up brand dividends over several decades or even centuries:

MINI Cooper SE, which reaches 0 to 100 km/h in 7.3 seconds and has a WLTP cruising range between 235 and 270 kilometers, has received over 45,000 orders;

Volkswagen ID.3, whose ST version with a WLTP cruising range of about 420 kilometers was initially available for booking, has received more than 10,000 orders within 24 hours, with an expected price of less than 40,000 euros;

…

Judging purely by parameters and price, if any domestic new force brand replaced the pure electric cars of traditional car companies, they would probably be laughed at and ignored globally. However, these traditional car companies have garnered plenty of orders, which means a stable revenue and cash flow for the foreseeable future – something that new forces in China are thirsting for. The brand itself is a protective moat that can protect traditional brands from suffering too heavy losses during the process of turning around, as long as the development of new products is completed before the brand is excessively consumed. New forces, on the other hand, only have one chance.

It is naive to rely on national policies for support or endless capital injections, and to play the slogan “China cannot let XX fall”. Without discussing how many Chinese enterprises in the car manufacturing field that were invested in during the 1980s and 1990s have already disappeared, and how many have been acquired by new forces as zombie qualifications, looking solely from the national strategic perspective, it is feared that even First Automotive Works (FAW) does not have the confidence to say that it will not lose the favor of national assets.

Any company that relies on external forces to stay afloat has no chance of long-term survival. Even businesses like Amazon, which have incurred huge losses for several consecutive years, can win investment favor only by showing healthy revenue growth and investment in the future every year.### Conclusion:

Weak brand Chinese new energy vehicle companies do not have the qualification to make mistakes. Only by stepping on the rhythm of every step and steadily developing L4 assisted driving models of the future, can they truly win the ticket to compete with traditional car giants for a long time. Undoubtedly, this will be a prolonged battle.

How can NIO fight a prolonged battle?

Chairman Mao explained what is a war of movement in “On Protracted War”:

“Our main force is fighting on a long and changeable front. To win victory, the Chinese army must wage a highly mobile war on a vast battlefield, advancing and retreating rapidly, concentrating and dispersing rapidly. This is a large-scale war of movement, not a positional war that relies solely on defense works such as deep ditches and high walls with layer upon layer of fortifications.”

To fight a good war of movement in an environment with limited resources and fierce competition, NIO needs to have a high degree of tactical flexibility. Let’s use the 4P theory to analyze whether NIO has flexibility in product, price, channel, and promotion.

Product strategy:

Five years is the traditional development cycle of the automotive industry, and it is also the reason why many car companies are unable to come up with convincing new products when they are going downhill. NIO, a company that lacks funds and has not formed a platform scale effect, cannot afford the strategy of having many sons to fight like General Motors and Volkswagen, and can only play some new tricks on the existing models.

On April 17, 2019, NIO opened up the option to upgrade the narrow side screen of the ES8.

In the past, we often saw car owners envying that an entry-level model now comes with better hardware, lamenting that their more expensive flagship products are still using outdated hardware. Although NIO’s option to upgrade may seem insignificant, it may have set a precedent for car manufacturers’ official after-sales hardware upgrades:

Users do not need to sift through various genuine parts and disassembled car parts on Taobao, worry about the quality assurance issues after modification, and can directly order on the official website. Of course, the implementation of this depends on NIO’s high investment in its direct sales system.

According to information leaked from some media channels, NIO will also offer upgrade options for the narrow instrument screen, the full-screen NOMI Mate, and the ultra-fine suede headliner (ES8) in the future. This series of retrofittings is included in an action plan called the “Refresh Plan.”

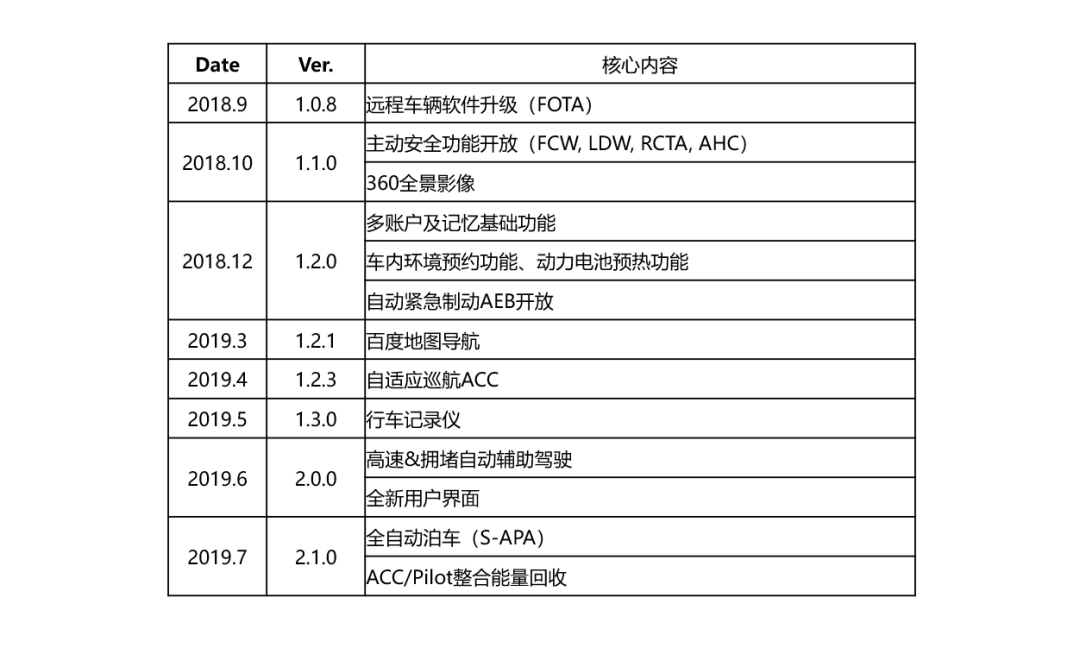

Compared to the hardware’s “fuss,” NIO’s software moves are much bigger. From the semi-finished state of ES8 delivery to the present, it has undergone multiple iterations:

Although NIO’s in-car system and NIO Pilot have received good reviews at present, they have not completely shaken off the shadow of semi-finished products from years ago. Public opinion tends to favor improvement of OTA content rather than creating something new. However, at least NIO has shown the possibility of iteration to the market, as well as the effort that has been put into it.

Although NIO’s in-car system and NIO Pilot have received good reviews at present, they have not completely shaken off the shadow of semi-finished products from years ago. Public opinion tends to favor improvement of OTA content rather than creating something new. However, at least NIO has shown the possibility of iteration to the market, as well as the effort that has been put into it.

Pricing strategy:

Compared with Tesla’s frequent price adjustments, NIO chose to stay within its current price range, believing that NIO’s decision to do so required enduring enormous pressure. As for the brand positioning, no more needs to be said. Only one thing needs to be emphasized: NIO is currently the only Chinese brand that has successfully entered the market above the RMB 350,000 range, which is not an easy feat.

Related product price ranges, among which the entry-level version of ES6 priced at RMB 358,000 has just started delivery, and the previous average price was above RMB 398,000.

Channel strategy:

During the August communication meeting with the media, Qin Lihong mentioned the NIO brand 2.0 plan. The focus of the plan’s channel strategy is NIO Space, which can be viewed as a minimalist version of NIO House: low cost, yet still able to perform the core display and sales tasks.

Currently, NIO Space has opened 15 stores (including pop-up stores).

Internet marketing has had a period of invincibility online, but the subsequent “back to offline” trend has allowed many businesses to break through their previous sales bottlenecks, such as Xiaomi, which was once underestimated by everyone. As a bulk consumer product, offline stores will still be the primary battlefield for sales in the foreseeable future.

Suspending the construction of high-cost NIO Houses and retreating from areas that are temporarily unsuitable for electric vehicle use (such as the Daxing’anling area, as we all know), NIO is expanding its network at low costs in high-potential areas, which is very important for NIO at present.

Promotion strategy:

NIO’s two products have been criticized for being overpriced. However, the relatively high prices have also brought considerable gross profit margins – although NIO’s latest semi-annual report shows that the gross profit margin remains negative, it also shows an improving trend:

Excluding battery recall costs, the gross profit margin for Q2 2019 was -10.9%.# NIO’s Business and Operation Strategies

NIO’s main business is not only selling cars but also providing NIO Power and NIO Service. These two businesses experienced rapid expansion with heavy investment before 2019. However, due to financial difficulties and two rounds of optimization of staff, investment in these two services has significantly slowed down. The impact on the cost of the main business will be reflected in the next quarter.

Early investment in NIO Power and NIO Service brought a large amount of sunk costs. With tight funding, how to maximize the use of these assets is testing NIO’s operational wisdom.

On August 24th, 2019, NIO announced that all first-time car owners will receive a lifetime free warranty and free battery swapping service.

Based on the after-sales service network and battery swapping stations already in place, only a small amount of operating costs were added to achieve lifetime double exemptions for all new and old car owners. This not only stimulated old car owners to actively go to the battery swapping station but also encouraged many onlookers to place orders.

In addition, NIO, which once insisted on order-based sales, has now started to provide a small amount of high-end models. For example, the ES6 model usually comes with all configurations except for the queen’s co-pilot, Nappa interior, and 21-inch rims, priced at 450,000 yuan or more. Users who buy these high-end models will receive a worry-free service package for the first year (valued at more than 12,800 yuan). Also, if the car owner cannot install the exclusive charging pile in the first year, they will receive a one-year worry-free energy package (valued at 11,760 yuan). Later, users can choose to give up the exclusive pile worth 7,800 yuan and get a one-year worry-free energy package instead. For Shanghai users without a fixed parking space to install charging piles, NIO will arrange for a local license plate for those who buy an energy package for more than six months. In other words, even without a fixed parking space to install a charging pile, you can get two years of free worry-free energy (includes 15 one-click charging services per month) plus a Shanghai license plate.

NIO maintains its original price and obtains enough gross profit margin to play various promotional measures.

The Road Ahead

China’s new energy vehicles will definitely survive, and China does indeed need a high-end new energy vehicle brand, but this entry ticket is not exclusively for any automaker.

To laugh last, one must live in the present and be prepared for a protracted war. This is especially true for NIO.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.