On August 7th, Tesla China’s official WeChat account released a progress map of the Shanghai Gigafactory 3 construction, stating that “Tesla Shanghai Gigafactory is progressing smoothly. It has only been 7 months since the groundbreaking and is expected to be officially put into operation by the end of 2019.” Barring any unforeseen circumstances, the domestically produced Model 3 will go offline within 5 months.

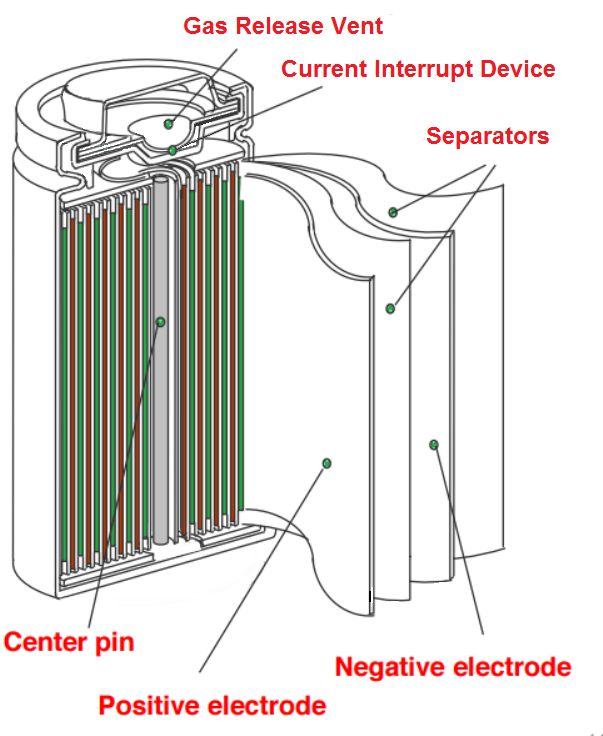

It is well known that “the 2170 battery pack used in Tesla Model 3 has the world’s most advanced comprehensive performance in terms of energy density, charge and discharge capacity, cycle life, cost and so on.” So, whose battery will be used for the domestic Model 3?

LG Chem’s Tesla Dream

Since the release of Tesla Model 3 in April 2016, LG Chem has been enthusiastic about this big fish. However, according to both cost and technology perspective, Panasonic’s advantage in the cylindrical battery field is very obvious. LG Chem has not been able to get into Tesla supply chain.

However, LG Chem demonstrated enough patience. Here are some key commercialization milestones for LG Chem’s 2170 battery:

-

On October 4th, 2016, LG Chem announced a 2170 battery supply agreement with Faraday Future.

-

On December 19th, 2016, LG Chem announced a strategic partnership with Lucid Motors on 2170 cylindrical battery supply.

-

In July 2017, LG Chem completed the adjustment of cylindrical battery production lines, and the second-generation 2170 battery was able to be put into mass production.

-

In December 2018, LG Chem delivered 2925 kWh of 2170 batteries to Rivian for the latter’s development testing.

Why mention FF, Lucid Motors and Rivian? Although these three are all startups, they are all players in the 2170 cylindrical battery camp. With the supply agreements with the aforementioned companies, coupled with the production line debugging and electrochemical formula improvement in July 2017, it can be seen that LG Chem has not given up on the 2170 battery.

LG Chem partners with Rivian to test batteries

As the countdown to production of the domestic Model 3 continues, 42HOW has learned that LG Chem, a supplier that has been providing testing samples to Tesla for the past three years, finally has the opportunity to penetrate Tesla’s domestic supply chain.

If the news is true, LG Chem China will definitely prepare supplies in advance to coordinate with the production and capacity ramp-up of the Model 3.

In fact, considering Tesla’s unique NCA (nickel-cobalt-aluminum) + cylindrical technology route, it is not difficult to discover some clues. Why is this? Before Tesla’s domestic production, the NCM (nickel-cobalt-manganese) technology route dominated the power battery field in China.

Compared with NCM, the technical barriers of Tesla’s main NCA route are much higher. First of all, production equipment, the preparation and calcination process of NCA battery precursors have more stringent requirements for production equipment; secondly, production environment, the higher alkalinity of the NCA high-nickel route requires a harsh environment of pure oxygen and humidity below 10%; finally, cost, the equipment and environmental conditions have raised the input cost, and thus the entry barrier.

After the three aspects are influenced, the maturity of the NCA battery industry chain in China is far inferior to NCM.

From a market perspective, before Tesla began domestic production, the popularity of NCA batteries was much lower than that of NCM. This is due to the technical barriers from the cell to the pack level, not all automakers can easily manage thousands of cylindrical batteries.

Academician Chen Li-quan, a leader in solid-state battery technology and member of the Chinese Academy of Engineering, once said: “A more critical reason is that Chinese car companies may want to use (NCA cylinders), but may not be able to control them. Tesla’s vehicle design and battery system control capabilities cannot be imitated and surpassed by most Chinese car companies in the short term.“

This means that if there is any major action by LG Chem China in the NCA + Cylindrical field in the past year, the credibility of the news of entering Tesla’s Chinese supply chain will be higher.On July 18, 2018, LG Chem announced an additional investment of $2 billion in its factory in Nanjing, China, with the goal of achieving an annual production capacity of 32 GWh by the end of 2023. What is the significance of 32 GWh per year? The first phase of Tesla’s Gigafactory 1 in Nevada, USA was designed with a production capacity of 35 GWh per year.

An LG spokesperson stated, “The additional investment is to proactively respond to the growing demand for electric vehicles, and the Nanjing plant aims to begin operation in October next year (2019).”

So far, the information we have is that LG Chem has increased its investment in its Chinese plant and the production time is similar to that of Tesla China. However, is this related to NCA + cylindrical batteries? Keep reading. “In the past year, LG China has also intensively laid out the NCA battery raw materials and industrial chain upstream.”

In April 2018, LG Chem announced a collaboration with China’s leading cobalt industry giant, Huayou Cobalt, to jointly invest more than RMB 4 billion in two joint ventures, Huajin New Energy and Leyou New Energy. Among them, Huajin, which produces lithium-ion three-element precursor, is majority owned by Huayou Cobalt, holding 51% of the shares, while Leyou, which produces three-element cathode material, is majority owned by LG Chem with 51%, achieving a cross-balance.

“In February 2019, Leyou’s Wuxi plant officially started construction, and the project is planned to be completed and put into trial production in December 2019.”

Following the trail of Huayou Cobalt, it can be found that on April 20th, 2019, Huayou Cobalt launched a significant premium acquisition of Tianjin Bamo Technology.

Why acquire Bamo Technology? In the acquisition plan, Huayou Cobalt explained that Bamo Technology’s products cover the most essential raw material varieties for the production of lithium-ion battery positive materials, such as cobalt trioxide and three-element precursor.

Bamo Technology’s major customers include leading power battery suppliers, such as CATL and BYD. “Interestingly, however, Lishen Battery and LG Chem are also core customers of Bamo Technology, and these two companies are among the few players in China’s NCA high-nickel 811 camp.” Prior to being acquired by Huayou, Bamo’s NCA product had achieved commercialization and matched with domestic power battery companies. However, the production capacity was limited, at around 300 tons per year.So, how can we prove that LG Chem intends to deploy cylindrical battery production lines in China? According to LG Chem themselves:

On January 10, 2019, LG Chem announced that it would add KRW 1.2 trillion (USD 1.07 billion) to its Nanjing factory, and according to the investment agreement, KRW 600 billion will be used for the production of cylindrical batteries.

According to Elon Musk, the cell supply for the Shanghai plant “will be localized from several suppliers, including Panasonic.” This means that LG Chem will not be the exclusive supplier, but it is very likely to be one of several suppliers.

How to view LG Chem?

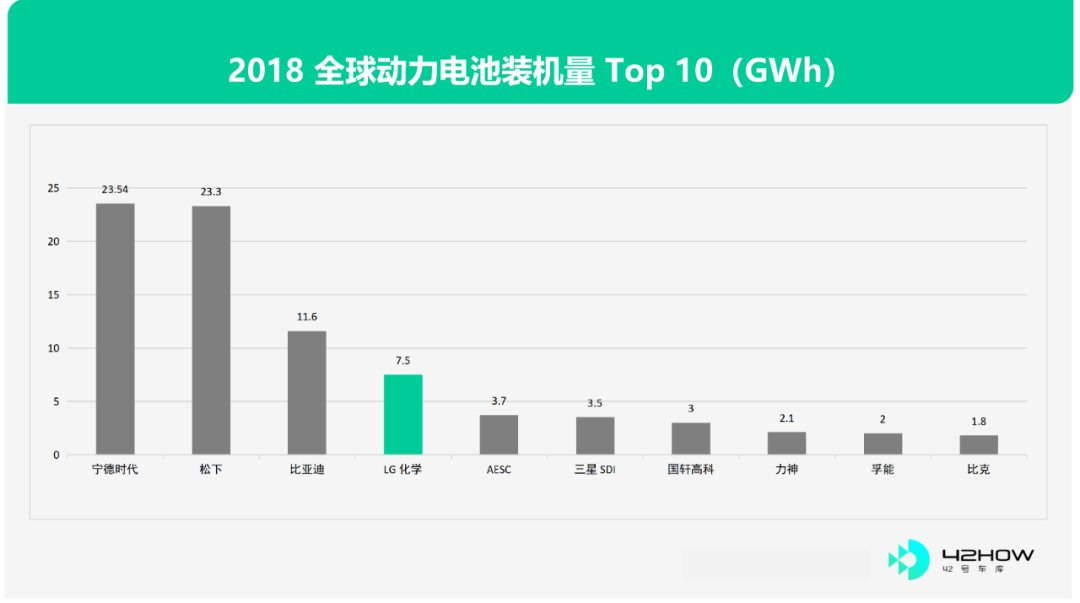

If we only look at the above text, it seems that LG Chem’s automotive OEMs are highly concentrated in the start-up company camp. In fact, Hyundai Kia, General Motors, Renault, Ford, Nissan, Volvo and Geely are all LG Chem customers. If this “name-dropping” form is not convincing enough, there is a more intuitive explanation below.

As of now, LG Chem’s power batteries have been used in pure electric vehicles from large car companies such as Chevrolet Bolt, Nissan Leaf Plus, Mercedes-Benz EQC, Audi e-tron, Jaguar I-PACE and the upcoming Porsche Taycan… In short, the North American power battery market is mainly dominated by Tesla and Panasonic, while the most of the orders of European power battery market are taken by LG Chem beyond BYD and CATL.

In fact, the joint venture with Huayou Cobalt is just the tip of the iceberg for LG Chem’s global efforts. The battery department’s revenue accounted for only 23% of the total revenue in 2018, which is far from satisfactory for LG Chem’s management. LG’s board of directors plans that by 2024, the revenue of the battery department will increase from the current KRW 6.5 trillion to KRW 31 trillion, an annual growth rate of 79%.

In addition to strong deployments in China, LG Chem has signed contracts with Canadian lithium mining company Nemaska Lithium, Jiangxi Ganfeng Lithium, South Korean battery anode manufacturer GS E & C, South Korean nickel sulfate company Chemco, and cobalt company Cobalt Blue in the past year. These are large-scale and intensive deployments of the battery raw material supply chain.

Returning to LG Chem and Tesla, what was previously mentioned about entering Tesla’s supply chain is not entirely accurate. In fact, LG Chem is actually returning to Tesla’s supply chain.During Tesla’s Q2 2018 earnings call, CEO Elon Musk revealed that due to the production hell on the 2170 battery, the LG Chem battery is being used for the Tesla Powerwall.

In addition to energy products, LG Chem and Tesla have deeper roots based on power batteries.

In December 2014, Tesla launched version 3.0 of its Roadster, which upgraded the car’s battery pack from 53 kWh at the factory to 80 kWh, increasing its range from 400 km to 640 km. The 80 kWh large battery mentioned here comes from LG Chem’s 18650 battery cell.

From 18650 to 2170 and beyond, LG Chem has a highly-structured research, development, testing and commercialization plan for the battery industry.

In May 2018, LG Chem executive Chung Ho-Young revealed LG Chem’s technical roadmap in an interview with the media. For LG Chem’s expertise in the soft-pack line, the company will switch from NCM 622 to 712 (with nickel-cobalt-manganese ratio of 7:1:2) and NCM 712 will be produced on a large scale in the next two to three years.

Regarding the cylindrical cell technology, LG Chem has already achieved mass production of NCM 811 battery cell. As for the NCA 2170 battery, LG Chem is conducting final product testing.

In 2020, LG Chem will mix aluminum oxide into nickel-cobalt-manganese batteries (NCMA quaternary batteries), which will increase nickel content to nearly 90% while further reducing cobalt content, and achieve a multidimensional balance between improving battery energy density, reducing costs, and improving charging and discharging performance.

From raw materials, ternary precursors, positive electrode materials to power batteries, LG Chem’s approach is very clear.In addition to the extensive layout on the industrial chain end, LG Chem plans to add KRW 13 trillion for the R&D of cutting-edge technology, increasing the size of its R&D team from 5,500 to 6,200 personnel. “We will re-examine each business to establish capabilities by selling underperforming business departments, joint ventures and acquisitions, and become a true global participant in the power battery industry,” said LG Chem CEO Shin Hak-cheol.

Global participation cannot circumvent China, and Shin Hak-cheol has a very positive attitude towards the Chinese market: “We have heard that China’s subsidy issue (policy resource tilt towards local power battery enterprises) will be resolved next year, and the Chinese market will perform better than it does now.” The locally produced Model 3 from Tesla might be LG Chem’s first step to return to China.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.