On July 24th, Pacific Time, Tesla released its 2019 Q2 financial report. During the following conference call, Tesla CEO Elon Musk and CFO Zachary Kirkhorn answered analysts’ questions together. Tesla co-founder and CTO JB Straubel also attended the earnings conference call, which was his last.

Do you still remember what happened at the Tesla Q1 earnings call on May 3, 2018? Elon suddenly left after repeatedly refusing to answer analysts’ questions, leaving other executives and analysts bewildered. It was one of the few public relations disasters in which Tesla and Wall Street did not split.

At today’s earnings call, the Tesla management team maintained friendly communication with analysts throughout the call. However, the difference between Tesla’s insistence on long-term thinking and Wall Street’s focus on short-term financial statements was never reconciled, and the sharp drop in stock prices after the earnings report was released was the public manifestation of this difference.

From 350,000 to 500,000 Vehicles per Year

Tesla announced in the earnings report that, with the help of the ramping up of production at Gigafactory 3, global production is expected to increase from the current 350,000 vehicles per year to 500,000 vehicles per year by the end of Q2 2020, a year-over-year increase of 42.8%.

Gigafactory 3, Tesla’s first overseas factory, is a top priority for Tesla in the coming year. As of the end of June, the second-generation Model 3 production line had begun operations at Gigafactory 3. The design of the second-generation production line is more streamlined and cost-effective, with a production capacity of 150,000 vehicles per year, which is completely consistent with the aforementioned production capacity increase of 150,000 vehicles per year.

The key here is the second-generation production line’s ultra-low unit cost. Tesla disclosed in the earnings report that as of now, it has only received a construction loan of $510 million from a local Shanghai bank. Tesla mentioned that this loan is sufficient to support the first stage of construction investment.

Why has there been such a significant reduction in construction costs? There are two clues below.In November 2016, Tesla acquired Grohmann Engineering, a German engineering automation company. Elon stated after the acquisition that “automation is of paramount importance to Tesla’s future. Our goal is to manufacture machines that manufacture machines as automation production lines are more important than the machines themselves with the increase of production capacity.”

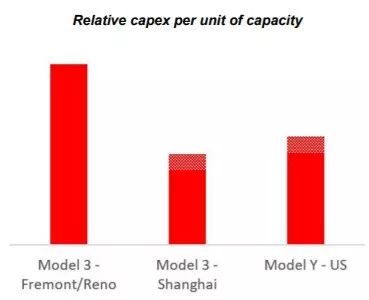

Tesla spent three years developing the Model 3 platform and its matching production line, which supports cross-regional and cross-model rapid and efficient replication. In the Q1 2019 financial report, Tesla mentioned that the Model 3 production line (cross-regional) and the Model Y production line (cross-model) at Giga 3 will benefit for the first time from this platform investment project.

In the Q1 conference call, Elon emphasized that the unit cost expenditure of the second-generation production line will be reduced by more than 50% compared to the first-generation production lines of Fremont and Giga 1. And internally at Tesla, their expectation is for the expenses of the first-generation production line to be between 25% to 50%. Considering that in 2018, Tesla spent over $2 billion on its first-generation production line (350,000 vehicles per year), compared to the design target of the second-generation production line (150,000 vehicles per year, $500 million), this platform investment project’s design target has basically been achieved.

But making cars is only part of the challenge that Tesla faces. Elon insists that with the Model 3’s superior product, demand isn’t the issue, the problem lies with potential customers’ cash reserves and payment capacity. Consumers do not lack demand for the Model 3; demand is suppressed due to their inability to afford it.

In other words, “the issue isn’t that it’s too expensive, it’s Tesla’s problem.” How can this problem be solved? “Local production and upgrading existing factories are crucial to regional market cost competitiveness.” After considering the price decline brought about by localisation and the pull of demand, Elon predicts that the long-term market demand for Model 3 in the Greater China region will reach 5,000 vehicles per week. On a global scale, this number is 15,000 vehicles per week.

At the end of 2018, Giga 1 produced 3.5 million 2170 battery cells per day with an annual production capacity of 23 GWh. During the Q2 financial report conference call, Tesla’s new CTO, Drew Baglino, revealed that Giga 1’s production capacity has reached 28 GWh per year.

“`markdown

“`markdown

CEO, CTO, New CTO

In response to the question “What is the expected battery cost when production capacity increases?”, Elon said: “You may need to research or reset how you view the overall planning of Giga 3 batteries (cost). You need to look at this issue on a much larger scale, such as what will happen with 100 28 GWh/year? “

We really need to think about what will happen with 2 TWh of annual production capacity? In order to achieve fundamental changes in world energy and truly accelerate the future of sustainable energy, we must think about the problem on this scale and in this way, because this is what we have to do.

If the problem is not considered from a TWh scale, it will not fundamentally change the energy revolution.

What is TWh? Tera Watt hours, trillion kilowatt hours. 2 TWh = 2000 GWh.

Another super big pie?

At the annual shareholder meeting on June 22, Elon and CTO JB Straubel recalled the story of preparing for Giga 1.

In early 2013, Model S production capacity had just started to ramp up. Elon and Straubel did a very simple calculation. How many kWh batteries does a car need? How many GWh batteries are needed to sell 500,000 cars in one year in the future?

The simple mathematical formula on a napkin completely shocked Elon and Straubel. The demand scale of 35 GWh/year will exceed the sum of the battery market demand for all global mobile phones, laptops, and electric vehicles.

“No one can solve this problem unless we build a new facility ourselves.”

So Tesla chose to locate in Nevada and built Giga 1 from scratch in the face of a field of grass, rocks, and bushes. Today, the initial investment of 35 GWh/year at Giga 1 has been completed, and it is currently the largest battery factory in the world.

“5 PPTs, investor’s money, execution, and we built Giga 1.”

Today, Tesla is beginning to think about the scale of 2 TWh. Obviously, this is a new problem that includes the battery demand for the next ten years of both the automotive and energy businesses. Tesla is expanding its focus from the US domestic market to the global market to solve this new problem, and Giga 3 is the first step in solving it.

How to view Model 3

“`On March 31, 2016, Tesla unveiled the Model 3. How should we view this highly anticipated model? Tesla CFO Zachary Kirkhorn gave his comments.

Three years ago, Tesla unveiled the Model 3.

Two years ago, the Tesla Model 3 went into production.

One year ago, Tesla validated the Model 3’s ability to ramp up production.

As of 2019, Tesla has achieved faster global logistics and delivery speeds.

Most importantly, Tesla has proven that there is a substantial demand for the new product, as the majority of Q2 orders came from non-backlog customers.

In Q2, Tesla delivered 77,550 Model 3s, an increase of 320% year-over-year.

As of Q3, Tesla’s new orders have exceeded Q2 levels, meaning the backlog of orders continues to grow. Elon Musk stated in a conference call that Q3 demand will surpass Q2 demand and that the order growth rate has increased. As for long-term global demand, Elon expects it to stabilize at 15,000 vehicles per week.

“We promise that the Model 3 will be a revolutionary product for the industry and for Tesla’s development history.”

Given the impact that the Model 3 has had on the industry, with multinational car giants buying and reverse-engineering it for cost analysis, and on Tesla itself, the Model 3 has brought permanent change to the company.

In addition to the product itself, Tesla, a luxury automaker selling 70,000 vehicles per year, has grown into a brand selling 350,000 vehicles per year over the past three years. Since its production began in August 2017, Tesla has achieved a 500% increase in production, manufacturing, supply chain management, sales, operations, service, and financial management expansion.

As Tesla CFO Zachary Kirkhorn stated, “Tesla’s growth is so rapid that we need to redesign our processes and systems to maximize efficiency on this new scale.”

The mission of AutopilotSince the release of the Model 3 in 2016, with a targeted long-term gross margin of 25%, Elon publicly announced that Tesla has sold over 270,000 Model 3s by the end of Q2. However, the gross profit margin that once approached 25% has been moving further away from that target in recent quarters.

Regarding the persistent price reductions from Tesla despite the pressure on gross margins, Elon provided an in-depth explanation.

On the gross margin point, the full self-driving is an extremely important part of the margin calculation.And the features for full self-driving are only a portion of them have rolled out. So the revenue recognition on the full self-driving option is limited at first**.

But as those features roll out, I would expect the take rate for full self-driving to increase significantly.So,the gross margin over time will be really quite compelling when factoring in the full self-driving option which is yes,accounted to $7,000 in mid-August and that number will increase over time.

The full self-driving option is an extremely important part of the gross margin calculation. Currently, only a portion of the features for full self-driving have been released, which results in limited revenue recognition on the full self-driving option at first. However, as these features roll out, Elon expects the take rate for the full self-driving option to significantly improve over time. Therefore, when factoring in the full self-driving option, which was priced at $7,000 in mid-August and will increase over time, the gross margin over time will become quite compelling.In the past two months, Elon announced at the shareholder meeting that Tesla will achieve feature complete for full self-driving by the end of 2019. He also tweeted that the price of the FSD package will increase monthly and hinted that Autopilot will increase the value of vehicles. Those who have purchased the FSD package will see the value of their vehicles increase exponentially with the release of self-driving features.

However, all of this is based on Tesla’s ability to achieve full self-driving in a short period of time.

In October 2016, Tesla launched the Autopilot option. At the end of 2017, Elon publicly stated that Tesla would achieve commercialization of self-driving by the end of 2018. The long-term marketing and commitment, combined with the huge technical challenges in commercializing self-driving, has made users lose faith in the short-term commercialization of Tesla’s Autopilot.

When Elon set a commercialization schedule again, no one paid attention. But this time, it is obvious that Elon is serious. As mentioned in “Tesla Autopilot is Changing the World,” Tesla has actively lowered the gross profit margin of cars and given Autopilot a higher gross profit margin contribution mission, indicating a serious effort.

#

Let’s review this article.

In the first section, Wall Street is concerned about how Tesla views the Q2 demand decline in the Chinese market. The Tesla management team has provided a radical production capacity growth plan and the answer of a long-term demand of 5,000 vehicles per week.

In the second section, Wall Street is concerned about expectations for battery costs after production capacity growth. The Tesla management team has provided a method of thinking in terms of 2 TWh, which is 100 times the current production capacity.## Section 3

After experiencing significant growth in Q2, Wall Street is concerned about demand in Q3. Tesla’s management team has provided long-term expectations of exponential growth and a goal of 15,000 global units.

Section 4

Wall Street is concerned about Tesla’s continually declining gross margin. Tesla’s management team has stated that the Autopilot autonomous driving option, currently in development, has enormous potential.

Wall Street is wondering how Tesla will perform in the next quarter. Tesla’s answer focuses on their long-term vision, which may take years, if not decades, to come to fruition. The conversation between Tesla and Wall Street is becoming increasingly fractured as conflicting values are highlighted, which include short-term financial performance versus the long-term potential of scaling for cost efficiency.

“Fundamentally, I believe that when everyone is focused on execution, when we can truly be a long-term-oriented company that is not distracted by short-term considerations or concerned by price changes that we have absolutely no control over, that is when we can reach our best. And that, for Tesla, will be the right choice–a company with a long-term, forward-thinking vision.”

Elon Musk, August 7th, 2018, in a blog post entitled “Taking Tesla Private”. Two weeks later, the effort to take Tesla private failed.

For the foreseeable future, this conflict will continue. However, no matter how intense or damaging the stock prices may become, it cannot stop Tesla from moving forward.

- Tesla’s Autopilot is Changing the World* Dialogue with Tesla China: Our goal is to become the global leader

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.