BMW, Mercedes Pivot From Competitors to Merger in New Auto Era

On December 20, 2018, Bloomberg published an article entitled “BMW, Mercedes Pivot From Enemies to Partners in New Auto Era.” However, I made some adjustments: Bloomberg referred to “from enemies to partners,” but I changed it to “from competitors to merger.”

Of course, this is an open topic for discussion. You could say that the probability is low, but I have reasons to believe it may happen.

Alliance of 1,200 Talents

On July 4, 2019, BMW’s official website released a press release, stating that BMW and Daimler had formed a long-term development partnership for autonomous driving. For BMW, the scene was somewhat embarrassing- the collaboration announcement between BMW and Mercedes-Benz for mobile travel alliance was still on BMW’s official website on February 22. It was unimaginable in the past that the most important competitor on this planet hung on BMW’s homepage for more than two quarters.

In summary, BMW and Mercedes-Benz signed a long-term strategic cooperation agreement, with the following key points:

- Both parties are committed to jointly developing the next generation of ADAS, including automatic driving and automatic parking under high-speed working conditions (finally aiming for SAE L4 level autonomous driving).

- Both parties plan to further negotiate the application of the autonomous driving system to suburbs and cities.

- The platform is a scalable autonomous driving platform that will be authorized to other OEMs and technology partners for the development of research results.

- The goal of the cooperation is to promote the rapid commercialization of autonomous driving technology. Both parties expect to achieve the commercialization of autonomous driving systems in private cars by 2024.

- The joint R&D team will consist of over 1,200 experts from BMW and Mercedes-Benz.

- The joint R&D team will perform tests at BMW’s Autonomous Driving Campus in Munich, Mercedes-Benz Technology Center (MTC) in Sindelfingen, and Daimler’s test and technology Center in Immendingen.

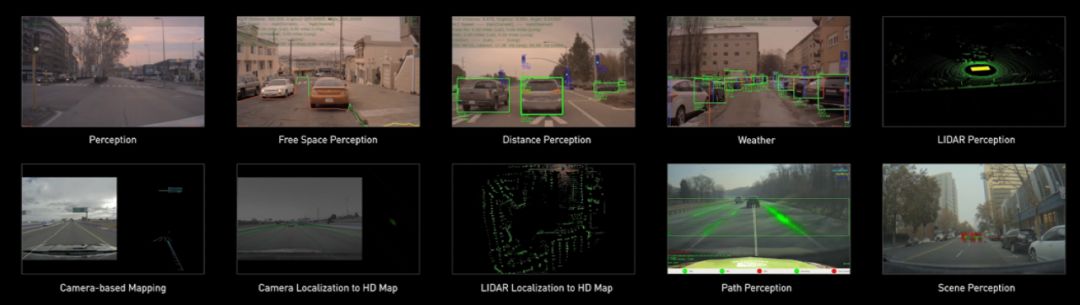

- The R&D content includes the development of scalable autonomous driving (including sensors) platform architecture and joint data centers for data storage, management, and processing, as well as software and function development.

The signal conveyed by this announcement is far greater than the content of the announcement itself. Frankly speaking, this may mean that BMW and Mercedes-Benz’s established autonomous driving strategy is about to fail, or at least, they have made significant adjustments respectively.Let’s review how BMW and Mercedes-Benz have come to their autonomous driving strategies today.

On July 1, 2016, BMW, Intel, and Mobileye held a joint press conference to announce their partnership to develop autonomous driving cars, with a production target of 2021. BMW is a leader in the automotive manufacturing and supply chain management industry; Intel is a leading company in chip design, manufacturing, and integration; Mobileye has an absolute technical advantage in the autonomous driving field of machine vision routes. So, in fact, at the beginning of the cooperation, this alliance was already very promising.

On May 16, 2017, Tier 1 supplier Delphi announced its inclusion into the alliance; on June 20, 2017, Tier 1 supplier Continental joined; and on August 16, 2017, the second car manufacturer, Fiat Chrysler Automobiles (FCA), joined.

Here, we will take stock of the resources in this alliance: Intel has a CPU + FPGA computing platform, an autonomous driving car data and storage center, and 5G low-latency communication protocols and chips; Mobileye has Eye Q series vehicle-grade ADAS solutions and the world’s largest crowdsourcing high-precision map solution REM; Continental and Delphi have extensive experience in sensors, redundant actuators, system integration, and other component supplies; BMW and FCA are both top vehicle integration and supply chain management experts.

With clear division of labor, responsibilities, and strong capabilities, this is a perfect autonomous driving alliance. In the initial cooperation announcement, BMW mentioned that the alliance is committed to developing “an autonomous driving platform architecture that can be adopted, customized and scalable by automakers worldwide.”

The reason why BMW has gathered the strongest resources in the industry is to play the role of an industry standard setter and export autonomous driving software and hardware solutions to the entire automotive manufacturing industry.

Mercedes-Benz’s story began a full ten months later than BMW.

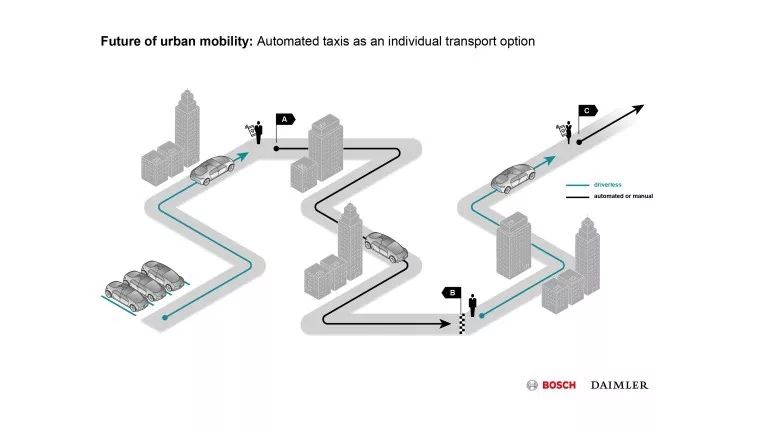

In April 2017, Daimler announced its partnership with Bosch on autonomous driving technology development, committed to commercializing SAE Level 4 and Level 5 autonomous driving cars by the beginning of the next decade. The project will integrate the global leading car manufacturer Daimler’s vehicle expertise and the world’s largest Tier 1 Bosch’s system and hardware expertise.

In July 2018, the Daimler-Bosch Alliance joined forces with top self-driving chipmaker NVIDIA. Within the union, NVIDIA will provide a car-grade autonomous driving computing platform, the DRIVE Pegasus chip with up to 320 Tops computing power, and autonomous driving software system. This software system uses machine learning to process and optimize the algorithms of Daimler and Bosch’s autonomous driving systems.

Danny Shapiro, senior director of NVIDIA’s automotive business, evaluated the alliance as follows: “This is not a routine transactional cooperation, this is a true strategic cooperation, and each company has its clear role within the cooperation framework.“

Although the members of the Mercedes Alliance are not divided as detailed as the BMW Alliance among vehicle manufacturers, Tier 1, software and computing platform suppliers, each one is a world-class player in its respective field. It can be said that the Mercedes Alliance is another top-notch self-driving alliance.

Breaking down the alliance, it is easy to see that BMW and Mercedes are direct competitors; Continental, Delphi and Bosch are direct competitors; and Intel-Mobileye and NVIDIA are direct competitors. This also means that as the alliance gradually takes shape, the two major alliances have become comprehensive and all-round competitors.

Standing on today’s date a year ago, it was a fantasy to discuss the possibility of cooperation between BMW and Mercedes in the field of autonomous driving. So today, one year later, how did the situation suddenly turn around, and how did BMW and Mercedes come together?

On January 25, 2019, German media Handelsblatt reported that Volkswagen, Mercedes and BMW were negotiating on cooperation in the field of self-driving vehicles. The subtitle of the article is “German carmakers and suppliers are exploring the cooperation of autonomous driving vehicles throughout the industry to amortize costs and compete with strong American competitors.”

According to reports, Volkswagen, Mercedes-Benz, BMW, Bosch, Continental, and ZF are all sitting at the negotiating table, discussing the key technologies and industry standards for autonomous driving. The article begins by stating that autonomous driving technology requires astonishing investment, which is not something that car companies are willing to accept.

According to reports, Volkswagen, Mercedes-Benz, BMW, Bosch, Continental, and ZF are all sitting at the negotiating table, discussing the key technologies and industry standards for autonomous driving. The article begins by stating that autonomous driving technology requires astonishing investment, which is not something that car companies are willing to accept.

Correspondingly, BMW has issued three profit warnings since 2018, while Daimler has issued four consecutive profit warnings. At BMW’s fiscal year 2018 conference on March 20th, the company announced its commitment to achieve more than 12 billion euros in cost optimization by the end of 2020. Daimler’s situation is even more severe: in the latest profit warning, it stated that the pre-tax loss in Q2 would reach 1.6 billion euros.

Contrary to popular belief, Mercedes-Benz and BMW, as the two wealthiest luxury car brands, do not have full confidence in autonomous driving, which shows not only in the technical level but also in the financing and personnel aspects.

Policy pressure has become the tipping point for the bankruptcy of the existing alliance between Mercedes-Benz and BMW, eventually leading to cooperation.

On July 8th, German Federal Minister for Economic Affairs and Energy, Peter Altmaier, warned that German car companies cannot fall behind in the future autonomous driving race.

“We cannot be complacent, hesitant, or sit idly by and wait for death. We must do our best.”

Behind Peter’s words, he had just tried Silicon Valley self-driving car company Zoox’s autonomous driving cars, which impressed him greatly.

This is definitely worth thinking about for German auto industry giants, considering that Zoox is not even leading in the fiercely competitive US autonomous driving industry.

If we look beyond autonomous driving and examine the bigger picture, we will find that BMW and Mercedes-Benz disarmed earlier in other peripheral business sectors.

On February 22nd, 2019, Daimler and BMW announced that they would invest 1 billion euros to form a joint venture to establish a mobility service alliance. Simply put, Mercedes-Benz and BMW have split all their mobility services ecological businesses, including charging, parking, ride-hailing, and car-sharing, into five companies, which are then merged and jointly held by Mercedes-Benz and BMW at 50% equity stakes.Reach Now: An online transportation service platform that provides various modes of transportation from A to B, including car-sharing, taxi services, and bike-sharing. It can be understood as the “BMW and Mercedes version of Didi.”

Charge Now: An electric vehicle charging platform with over 100,000 charging stations in 25 countries and regions across the world. It can be understood as the “BMW and Mercedes version of a supercharging network.”

Park Now: An online parking service platform that allows users to reserve parking spaces, manage parking times, and pay for parking without cash. It serves 30 million customers in 1,100 cities around the world.

Free Now: An online transportation service platform that provides taxi, private car-hailing, car rentals, and electric scooters, and is the largest transportation platform in Europe and Latin America, serving 21 million users and 250,000 drivers.

Share Now: A car-sharing platform that operates in 31 cities around the world, with 200 million vehicles and 4 million users.

We have already commented on this cooperation and its prospects in “Mercedes and BMW’s Strategic Partnership – Will it work?” We believe that Dieter Zetsche, the former CEO of Daimler, is right when he says that this alliance will be a global game-changer. However, based on the differences in funding size (11 billion vs 24.2 billion), user base (60 million total users vs 100 million monthly users), and order volume (less than 1 billion vs over 10 billion), we believe that this alliance still has a long way to go to catch up with the world’s largest transportation platform, Uber. And behind Uber, there are still Didi, Lyft, Ola, Grab…If we take a closer look, the integration of charging, parking, taxi, and car-sharing is actually a user-centric mobile travel ecosystem service created by Mercedes-Benz and BMW for the era of autonomous driving. The reasons for cooperation were discussed by BMW Chairman Harald Krüger and former Daimler CEO Dr. Dieter Zetsche in their conference, but only one reason is the truth.

As a listed company, shareholders cannot accept Mercedes-Benz and BMW’s long-term loss in emerging businesses. The high investment cost became the direct reason for the cooperation between the two sides.

Whether it is autonomous driving or travel ecosystem services, they do not involve the development and manufacturing of complete vehicles, and the latter is precisely the product foundation for Mercedes-Benz and BMW as the world’s top luxury brands. Don’t be in too much of a hurry, how do you know they haven’t thought of it?

On December 21, 2018, German media Handelsblatt reported that Mercedes-Benz and BMW were negotiating joint development of electric motors and battery packs. The two sides also discussed developing a common pure electric platform for compact models, based on this platform to research and develop edge models including BMW 1 Series, 2 Series and Mercedes-Benz A-Class. Through joint research and development, the total sales of the above-mentioned models are expected to catch up with more than ten models under the Volkswagen Golf platform.

With the fermentation of news, more information has been revealed. It is understood that the negotiations between the two sides have been going on for several months. Prior to this, Daimler had been in contact with CATL. It is well known that CATL will build a factory in Thuringia, Germany, and BMW will be one of the most important customers of the plant.

Both sides recognize that scale is the core of all competition. Through extensive and in-depth cooperation, the cost savings of Mercedes-Benz and BMW are expected to reach up to 7 billion euros.

In fact, German automakers have already begun to take action for the weak profitability of small models. BMW’s next-generation MINI has been handed over to Great Wall, and Mercedes-Benz’s next-generation Smart has been handed over to Geely, while Volkswagen’s Beetle has been announced to be permanently discontinued.

In this era of industry change, every car manufacturer is concentrating elite power, getting rid of baggage, and lightly equipped for the fight for survival. It is more important than anything else to stay alive.

At the end of the article, we hope to leave a question to Mercedes-Benz and BMW.Since 2019, Mercedes-Benz and BMW have been making headlines in the media so frequently that Michael Hafner, the head of autonomous driving at Daimler, jokingly said, “Collaboration is not merger, don’t worry, we won’t make a car that has both the BMW iconic double kidney grille and the Mercedes-Benz three-pointed star on the hood.”

Collaboration is not merger, but as an intelligent electric car, how much space is left for OEM to make differentiation and competitive advantage when the experience of platform, three-electricity, and intelligence (assistance/autonomous driving + mobile travel ecology) tends to be unified? Today, you are cutting the edge models, how will the fate of the E, S, 5, and 7 series be tomorrow?

We don’t want the differentiation between BMW and Mercedes-Benz to be only in styling and interior.

Can Mercedes-Benz and BMW’s partnership succeed?* BMW-Intel-Mobileye | A potential stock of autonomous driving in traditional companies

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.