Structural Changes in the Supply Chain: The challenge for EV Manufacturers

As the automotive industry moves towards electrification, all automotive manufacturers are facing a new challenge: structural changes in the supply chain. There has never been a component that has captured one-quarter of Electric Vehicle’s (EV) Bills of Materials (BOMs) like high-voltage power batteries do.

For the most critical component, companies are implementing either one of two strategies: collaborating with suppliers to define and develop components, ensuring a high level of supply chain stability through exclusive supply agreements; or completely independent design, development, and manufacturing, controlling supply stability at a higher level.

Regarding the power battery, the lifeline of EVs, Great Wall Motors’ choice is independent research and development, and vertical integration.

In 2012, Great Wall Motors established a battery project team. In 2019, Honeycomb Energy (formerly the Great Wall Motors Power Battery Business Unit) announced a five-year development plan, which includes the release of quaternary batteries, cobalt-free batteries, and goals that stretch as far as 2025.

What are Cobalt-free and Quaternary Batteries?

On July 9th, Honeycomb Energy held a press conference. Below, I will present Honeycomb Energy’s latest business developments primarily based on the information provided in the press conference, supplemented by the current status of the industry.

Let’s start with “new materials,” namely quaternary batteries and cobalt-free batteries, which have drawn the most attention recently.

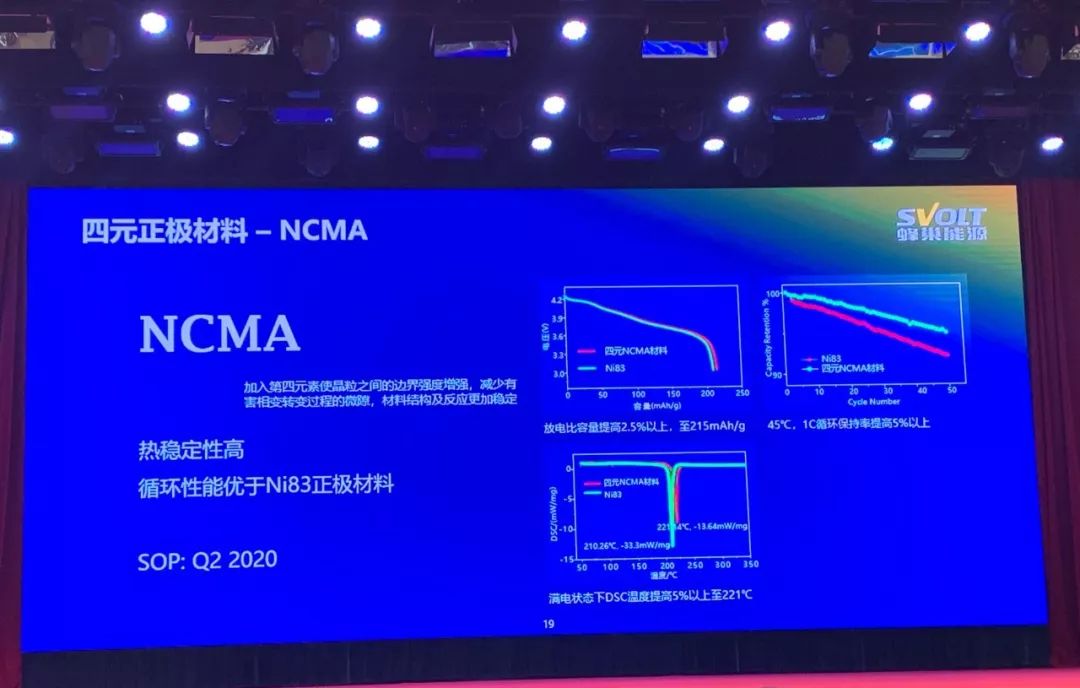

Quaternary batteries refer to improving the performance of EV’s power batteries by adding Mx as the fourth element in traditional NCM nickel-cobalt-manganese ternary lithium batteries.

The positive electrode material ratio of NCM batteries has gone from 111, 442, 532, 622 to today’s 811. As the nickel (Ni) element increases, the energy density of the battery increases continuously. However, on the other hand, the chemical activity of high-nickel batteries is stronger, and the stability of the materials is decreasing correspondingly, reducing the cycle life of the battery.

By incorporating the Mx element, Honeycomb Energy engineers have successfully increased the strength of the boundaries between the crystals, reduced the harmful micro-voids that cause phase change transformation, and made the material structure and reaction more stable.

Ultimately, the result is that the cycling performance of NCMA batteries is better than NCM 811, while heat resistance, gas generation, safety, and other indicators are superior to NCM 811. In simpler terms, the battery has a higher energy density, longer lifespan, and is safer.From an industry perspective, in May 2018, an industry insider of the power battery told etnews, a Korean media outlet, that when the proportion of nickel in NCA batteries exceeds 90%, manganese needs to be added to enhance stability, whereas aluminum needs to be added to improve discharge characteristics in NCM batteries. After 2023, the four-element positive electrode material will become one of the industry trends.

Sadly, two days ago, during the LG Chemical’s Q1 earnings conference call, Kang Chang-bum, General Manager of LG Chemical’s battery division, stated that LG Chemical’s NCMA four-element battery will achieve mass production in 2022.

What about CATL? CATL’s four-element material cell project was launched in September 2018, and it is expected to complete material development by the end of this year and achieve SOP for four-element material cells in Q4 2020. CATL’s project is far more intensive and radical than LG Chemical’s.

Now let’s talk about cobalt-free batteries. NMx batteries refer to positive electrode materials that are completely free of cobalt (Cu). CATL Energy’s specific implementation is as follows:

-

Doping specific elements without spin-orbit coupling reduces electronic superexchange, decreases Li/Ni mixing, and improves electrical performance.

-

Doping elements with high M-O bond energy slows the volume change of crystals during the charge and discharge process, stabilizes the structure, and improves cycle life and safety.

Let’s take a look at the results. First of all, completely getting rid of cobalt means that** the cost of positive electrode materials will be reduced by 10% – 15%**, and the overall BOM cost of the battery will be reduced by 5%. *Considering that the price of cobalt has been fluctuating severely, the importance of cobalt-free batteries lies in the stability of the power battery supply chain.*

From an industry perspective, the trend of going cobalt-free is more popular than going four-element.

Samsung SDI has now controlled the cobalt content of both NCA and NCM power battery routes to 5%, and officially announced that it is still improving the formula to completely remove cobalt without sacrificing performance, but** has not given a clear production schedule.**

The proportion of cobalt in the 2170 battery produced by Tesla-Panasonic at the Tesla Gigafactory 1 plant has now been reduced to 2.8% by weight of the whole battery, and the proportion of cobalt in the positive electrode material of the 2170 battery has also been reduced to about 5% through molar mass calculations. In Q1 2018 report, Tesla mentioned that the ratio of cobalt in Tesla’s NCA batteries was lower than that of competitors 811 batteries,** and the long-term goal is to reduce the cobalt content to zero.**

For cobalt-free batteries, the schedule of Hunan Senlong New Energy Technology Co., Ltd. (Senlong) is to complete material development by the end of this year; further optimize material system in March 2020; carry out material trial in April, finalize the system in August and realize SOP in Q3 2020. This is also a radical plan beyond the industry.

Of course, whether it is a ternary or cobalt-free battery, bringing new elements means an increase in uncertainty in electrochemical reactions while improving battery performance and reducing battery costs. Multiple elements also bring huge challenges to the consistency of battery cells and the complexity of production processes.

These are the problems that Senlong faces, and considering the harsh R&D-testing-mass production schedule, the challenges of Senlong are indeed significant.

R&D & Capacity Layout

In addition to products, Senlong has always had an ambitious plan in the battery industry chain. As you read on, you will have a deeper understanding of this sentence.

In terms of upstream industry layout, as early as September 2017, Great Wall Motors acquired a stake in Australian lithium mine supplier Pilbara Minerals; in October 2018, independent Senlong also invested in Guangxi Tianyuan New Energy Material Co., Ltd.

Together with research and development centers in Baoding, Shanghai, Korea and India that are already in use, as well as the Pack production line that has been put into production in Baoding, Senlong’s business gradually covers power battery materials, battery cells, modules, PACK, BMS, energy storage, solar energy R&D and manufacturing.

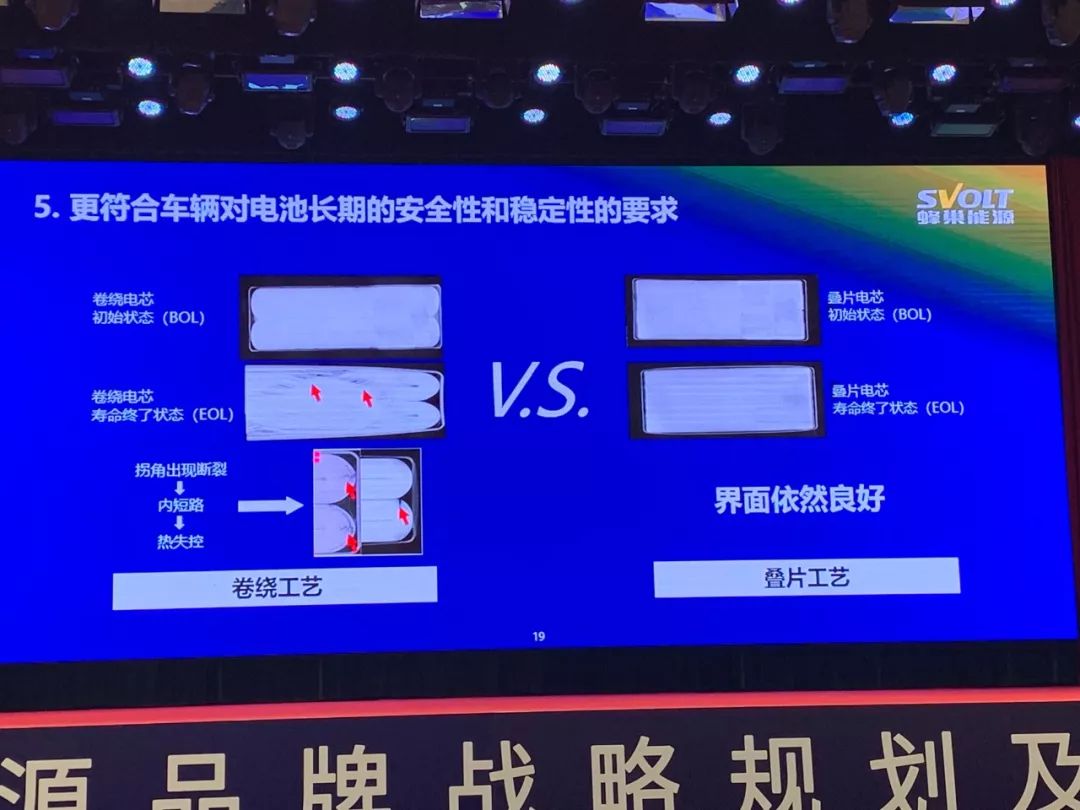

In terms of battery cell production process, Senlong adopts the stacking process – different from the traditional winding process, Senlong chooses the stacking process to produce square batteries, which is not common in the industry at present.

The improvement brought by the stacking process is obvious. Compared with the winding process, the number of tabs in the stacking process is doubled, internal resistance is reduced by 10%, and discharge performance far exceeds that of the winding process. In addition, the stacking process can increase the energy density by 5%, increase the cycle life of the battery by 10%, and reduce the cost by 5%.

In terms of battery cell specifications, the stacking process is no longer limited by the specifications for winding needles and can better meet the demand for large-format batteries in pure electric vehicle platforms.

In terms of battery cell specifications, the stacking process is no longer limited by the specifications for winding needles and can better meet the demand for large-format batteries in pure electric vehicle platforms.

Finally, in terms of safety, the stacking process avoids the risk of corners breaking and causing internal short circuits and subsequently causing thermal runaway, which greatly improves safety, unlike winding technology.

The advantages of the stacking process over winding technology are so obvious that many mainstream battery manufacturers, including Panasonic, CATL, Samsung SDI, LG Chem, and AESC, have developed plans to adopt stacking technology in production. However, the difference between them and SVOLT Energy is that the earliest implementation of stacking technology by those companies will not be until 2024.

This is because, at present, the stacking process has a fatal shortcoming compared to the winding process: low efficiency.

On this critical issue, SVOLT Energy has announced that it has already mass-produced the first generation 45-degree process with a production time of 0.6 s/pcs. The development and speed verification of the second-generation linear stacking process, which has a production time of 0.45 s/pcs for the anode, have also been completed. It is expected that the third-generation stacking process, which will catch up with the winding process with a production time of 0.25 s/pcs, will be developed by 2023, which will once again give SVOLT Energy an edge over its competitors.

The challenges that SVOLT Energy faces now include solving the issues of raw material supply chain, research and development, manufacturing, and finally, production capacity layout.

According to SVOLT Energy’s plan, by 2025, it will invest in and use seven major R&D centers in the United States, Beijing-Tianjin-Hebei, South Korea, Japan, Shanghai, Wuxi, and India, responsible for the research and development of advanced materials, processes, and BMS software.

In terms of manufacturing, SVOLT Energy has laid out a total of 76 GWh of production capacity in Beijing-Tianjin-Hebei, the Yangtze River Delta, and the western region of China. In addition, there are 20 GWh and 24 GWh production capacity layouts in North America and Eastern Europe, respectively, resulting in a huge production capacity of 120 GWh by 2025.

The first factory, with an investment of RMB 10 billion, is already under construction in Changzhou.

It must be said that, when looking at the power battery market in China and even globally, SVOLT Energy’s industrial plan is impressive.

SVOLT’s Challenges

Let us take a more rational view of the challenges facing SVOLT Energy.

As mentioned earlier, SVOLT’s advanced material technology and process development are in line with the industry leaders, making it a trendsetter. However, the big difference is that SVOLT is ahead of the competition in terms of commercializing all these advanced technologies.### How to define the “Strongest Competitor”?

In 2018, CATL’s installed capacity reached 23.4 GWh, while BYD’s was only 207.9 MWh, with an annualized installed capacity of less than 2.5G, even after a YoY growth of 1305%. What about in earlier years, such as 2017 or 2012?

Almost ten times the production capacity implies a lot of meanings. CATL’s supply chain management, cost control, R&D know-how accumulation, and most crucially, the human and financial resources invested in forward-looking technology pre-research, not only will not be weaker than BYD, but will also be several times stronger in many respects.

Other than CATL, there are also Panasonic, BYD, Samsung SDI, LG Chemical, and so on.

Frankly speaking, whether it’s NMC or LFP, or overlapped production technology efficiency benchmarking to winding, they are still just PPT. The task that lies ahead of BYD is to take advantage of the small to win big, overcome all the technological and reliability challenges on the road to commercialization, and gain a foothold in the global power battery market. So, what are BYD’s winning odds?

But on the other hand, Wei Jianjun’s investment in the BYD project is not weak at all. From February 2018 to date, the size of the BYD Energy team has reached 1,750 people, among whom there are 1,030 people in the R&D team alone, and 350 people are outside experts and foreign experts. From 2016 to 2020, the cumulative R&D investment will reach 2.93 billion yuan.

The road is difficult, but it’s also bright. With BYD Energy setting sail, will Wei Jianjun create another Great Wall?

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.