*42HOW Note: This article is translated from XinIMa. The author, Lee Xingyu, is the Vice President of Market Expansion and Strategic Planning at Horizon Robotics, an expert in the field of autonomous driving, and a former senior marketing manager for automotive application processors at Freescale Semiconductor and a security technology expert at Silan Microelectronics with 16 years of experience in the semiconductor industry. This article mainly discusses how the intelligent automotive electronic architecture can be transformed in the wave of smartization. It is authorized to be released.

In the wave of digital transformation, a profound change in the automotive electronic and electrical (E/E) architecture is brewing, and the automotive industry is on the road to intelligentization, following the path of the PC and mobile phone industries. What kind of technological challenges, industry changes, and response measures will this reflect?

Only by looking at this intelligent automotive electronic architecture transformation in the context of the grand narrative of the robot age can we see its full significance to this era. It is easy to see the trend, but it is difficult to undergo self-revolution. Whoever can more resolutely embrace this trend will win the competition in the automotive industry’s hundred-year transformation.

Here are several key conclusions of this article:

-

Intelligent cars will become a mobile supercomputer and data center, and they will be the most complex single product in IT history, giving birth to a new Wintel.

-

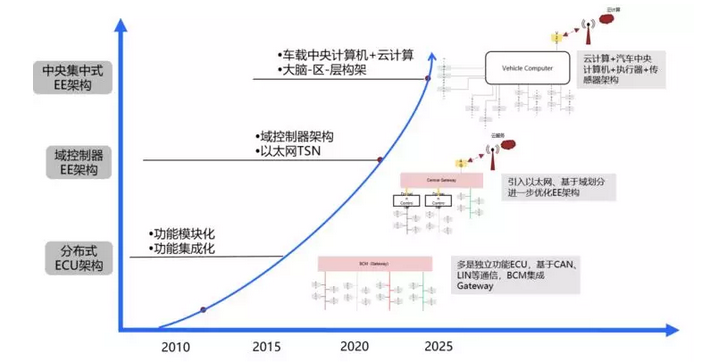

The commercialization of the new E/E architecture will be around 2025.

-

Organizational change is the biggest challenge faced by OEMs in this technology revolution.

-

As the first form of mobile autonomous machines, intelligent cars will leverage a commercial value much larger than their own market.

-

The E/E architecture transformation has four major trends: centralized computation, software and hardware decoupling, platform standardization, and functional customization.

-

The new E/E architecture will be built based on the concept of a central computer-layer-zone and reflect the concept of service-oriented architecture (SOA).

-

The new E/E architecture will enable OEMs to regain the initiative in the game with leading Tier1s.

-

AI edge computing chips are the technological high ground and need to cross the critical point of cost, power consumption, and performance.

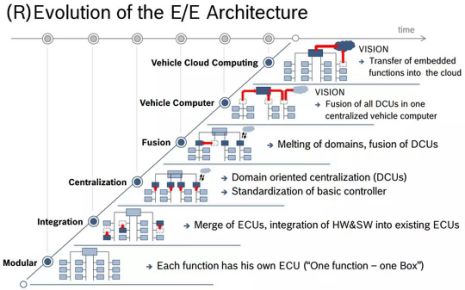

Major trend: From distributed to centralized

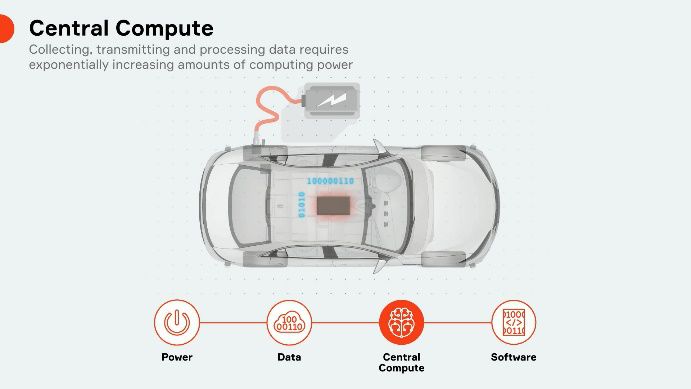

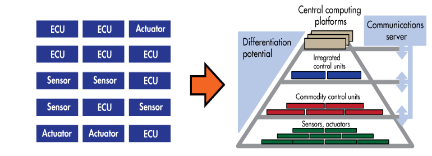

Today, E/E architecture design faces four major challenges: functional safety, real-time performance, bandwidth bottlenecks, and computational black holes. Therefore, the intelligent automotive E/E architecture is moving from a distributed system to a centralized system. Its ultimate form will be a super-central computer, which will involve four key trends: centralized computation, software and hardware decoupling, platform standardization, and functional customization.

1. Centralization of Computing: Service-oriented system architecture (SOA) will become mainstream, providing software with high-performance real-time computing platforms. Under this concept, a true “brain” for cars will emerge: a super central computer. This will work in synergy with Multi-Access Edge Computing (MEC) and cloud computing to form a collaborative solution, avoiding endless increases in computing demand for vehicles.

1. Centralization of Computing: Service-oriented system architecture (SOA) will become mainstream, providing software with high-performance real-time computing platforms. Under this concept, a true “brain” for cars will emerge: a super central computer. This will work in synergy with Multi-Access Edge Computing (MEC) and cloud computing to form a collaborative solution, avoiding endless increases in computing demand for vehicles.

With the centralization of computing comes a new concept: Zone Control, which is fundamentally different from the current popular concept of Domain Controllers. To use a military analogy, the domain concept is like dividing the Army, Navy, and Air Force based on their respective functions (power domain, chassis domain, entertainment domain, safety domain), each with independent combat capabilities, but unable to share resources with each other. In contrast, the zone concept is organized by war zone, forming a joint operations command center with the central computer, resulting in a qualitative leap in collaboration and execution efficiency.

2. Decoupling of Software and Hardware: The SOA architecture will also bring about the concept of Hardware Abstraction Layer (HAL), where hardware will no longer be exclusively dedicated to a certain function. For example, a front-facing camera could previously only be used by the AEB/ACC system, but now, any vehicle function can call upon this camera. This means that an independent perceptual layer will emerge, with it becoming a shared resource.

Today, functional safety is one of the biggest challenges faced by intelligent vehicles. If a distributed architecture is used, adding independent safety-redundant hardware to every function would be a cost disaster. However, the new design architecture can link all hardware resources with applications, giving more choices for safety routing and opening up a new pathway for economically viable functional safety.

In terms of supply chain management, because there are many independent suppliers for each resource, OEMs will have more choices, rather than having to purchase packaged domain controller suppliers, allowing OEMs to regain the upper hand in the game with leading Tier 1s.

3. Platform Standardization: In the future, an OEM may only develop one electric vehicle platform, covering low-end, mid-range, and high-end models. The automaker will build its own hardware platform, satisfying three principles: universality, standardization, and interoperability, making the collaborative evolution of the intelligent vehicle industry more efficient.

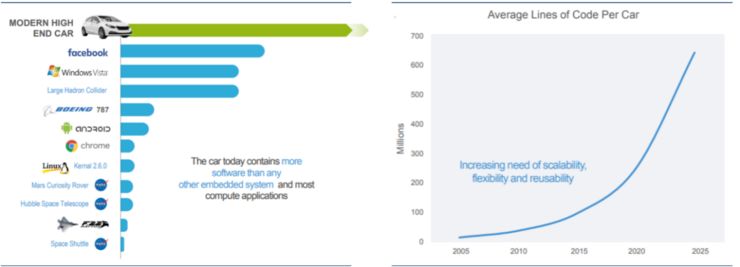

The more important reason comes from a business perspective – money! Developing such an intelligent platform may require writing more than 300 million lines of code, a level higher than the Windows operating system. Developing and maintaining multiple platforms is economically infeasible.

Volkswagen and Ford have already shared the MEB platform in the electric vehicle field to reduce development costs. Recently, Daimler and BMW announced their partnership to jointly develop autonomous driving technology, lowering development costs and establishing autonomous driving standards.As this trend deepens, it is likely that a Wintel platform similar to the PC industry will emerge, forming an ecosystem for intelligent vehicles. This common platform will be adopted by most OEMs, just as we have seen in the PC and mobile phone industries.

4. Customized Functionality: Intelligence is the core element of future brand differentiation, mainly achieved by increasing software functionality. In the future, the cars delivered by OEMs will not be a product with fixed functions, but rather a continuously evolving robot. Tesla’s recent OTA updates of “Sentry Mode” and “Dog Mode” vividly demonstrate this point.

It is almost certain that intelligent cars are the largest single product in terms of software and hardware development in the history of IT, leading the IT industry into an era of billions of lines of code and thousands of teraflops of computing power.

Challenges of Intelligent Remodeling

For OEMs, this is a thorough subversion, bringing about huge changes in four areas: organization, talent, supply chain and core technology.

Organizational change is the most challenging, integrating all functional domains of the car will have an unprecedented impact on the organizational structure. It will fundamentally reshape the organizational structure of the host factory, shifting from a functional organization to a platform-based development organization.

Redefining the core technology of the intelligent age: computing platforms, operating systems, and application software. Tesla’s core technology layout is chips and software, hitting the nail on the head.

From a technical perspective, the biggest challenge comes from AI edge computing.

In the past few years, we have seen that as the level of automatic driving increases, the AI computing power needs to be upgraded by about an order of magnitude. To achieve full autonomous driving, we need a scale of 1000 TOPS computing power, which has already reached the level of human brain computing power.

This level of computing power requires AI chips to break through the bottleneck of cost, power consumption, and performance. There must be innovation in the processor architecture combined with algorithms and toolchains, designed through software-hardware synergy. It is not practically meaningful to purely talk about the absolute computing power of chips without considering algorithms and toolchains.There is a big misconception in the industry that absolute computing power is the main indicator of AI chips, but what we really need is effective computing power, which needs to be measured from four dimensions: the effective utilization of computing power, the effective computing power per watt, the effective computing power per dollar, and the efficiency of computing power converted into AI results (e.g., target quantity, frame rate, etc.).

Such an overall solution determines the efficiency and quality of data transformed into decisions/services, and is the hard technology that the era truly calls for. Google, as a practitioner of this philosophy, has proven this point with the success of TPU. In China, Horizon Robotics, a start-up based on this philosophy, has launched an extremely efficient journey AI chip and will soon launch the second-generation journey chip.

It can be said that the future of intelligent cars is a mobile supercomputer and data center, and the edge AI processor is the main battlefield for intelligent car competition, and also the technological high ground.

Measures and Industry Practice

The best way to predict the future is to create it, and Tesla, Ampere, GM, and BMW are pioneers of this revolution.

According to Ampere’s plan, this transformation will be phased. A hybrid architecture will be introduced in 2022 to integrate the PDC (power data center) into the traditional vehicle-mounted E/E architecture. By 2025, an open central computer architecture will be implemented.

Tesla, the most radical carmaker, replaced the concept of domain controllers with area controllers in the Model 3’s E/E architecture, and the entire architecture consists of only three major modules.

Bosch’s evolutionary route starts with the centralization of domains, with the ultimate goal of vehicle-mounted central computers.

BMW’s changes in E/E architecture clearly reflect the trend of computing centralization.

ConclusionFrom a technical point of view, the concept of the central computer-layer-zone will establish a new framework for intelligent vehicles. The zone is a local control, perception, and execution unit, the layer is a resource pool divided by function, and the central computer is the true decision-making brain that calls various layer resources for application/services, executes high-level decisions, and controls unit operations or completes situational awareness tasks.

For the vehicle E/E architecture, the concept of the central computer is new, but for the PC and mobile phone industries, it is already a very mature concept. As the wave of intelligentization extends from the IT industry to the automotive industry, we see the same story unfolding, and the genes of the automotive industry are undergoing changes.

In this sense, whether it is Apple, Intel, Qualcomm, Samsung, or Huawei, their logic of entering the automotive industry is not simply a copy but a new editing of their own IT genes and the inherent automotive genes to evolve new species, and to lead the computing industry from the TOPS era of mobile phones to the POPS (1000TOPS) era, in which they have innate genetic advantages.

The goal is often clear, but the path to the goal is vastly different. Whether it is an IT newcomer or an old soldier in the automotive industry, everyone accumulates based on their own advantages and climbs the same mountain from different slopes. In this process, everyone has different product roadmaps, performance, safety, and cost considerations, and it is difficult to say which road is better, so whether it is Continental and Bosch’s gradual domain fusion path or Tesla and Nvidia’s more radical practice, they are all explorations for the future and deserve respect.

From PCs to mobile phones to robots, every generation of intelligent devices grows ten times the size compared to the previous generation. As the first form of mobile autonomous machines, intelligent vehicles are undoubtedly the killer application of the robot era and the flagship of technology, which will create countless types of mobile robots. Just as the steam engine opened the era of the industrial revolution and the mobile phone industry led the entire mobile device era, intelligent vehicles will ultimately leverage commercial value that is much larger than their own market.

* How strong is Tesla’s battery life?

* How strong is Tesla’s battery life?

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.