Check out the recent Weibo post from He XPeng, the CEO of XPeng Motors, and you’ll find two major events: firstly, former head of autonomous driving development at Qualcomm, Wu Xinzhou, has joined XPeng Motors as Vice President of Autonomous Driving; secondly, XPeng Motors’ first pure electric sports coupe, codenamed E28, will be unveiled at the Shanghai Auto Show.

At Garage 42, we will follow up with E28 at the Shanghai Auto Show. Today, we’d like to share XPeng’s strategy and thinking in autonomous driving.

XPilot outperforms the competition

About half a year ago, we listed the top three domestic automakers that value autonomous driving development: NIO, Chehejia, and XPeng. In September 2017, Gu Junli, former head of machine learning at Tesla, resigned and joined XPeng Motors as Vice President of Autonomous Driving.

In XPeng’s official Weibo post announcing Wu Xinzhou’s appointment, XPeng mentioned that Wu will be responsible for “overall technical planning, business and team management for XPeng Motors’ autonomous driving in the U.S. and China.” XPeng has made some personnel adjustments. Wu Xinzhou will be the person in charge of XPilot, responsible for both the technical and business aspects.

To date, XPeng’s autonomous driving team has grown to 190 people, ranking in the top three in terms of team size among new automakers’ autonomous driving teams. According to Wu Xinzhou, XPeng hopes to expand the team to between 250 and 300 people by the end of this year. With the autonomous driving research and development team located directly in Silicon Valley, and the team constantly expanding within a controllable range, XPeng’s emphasis on XPilot can be clearly seen.##XPilot, the killer feature of XPeng G3

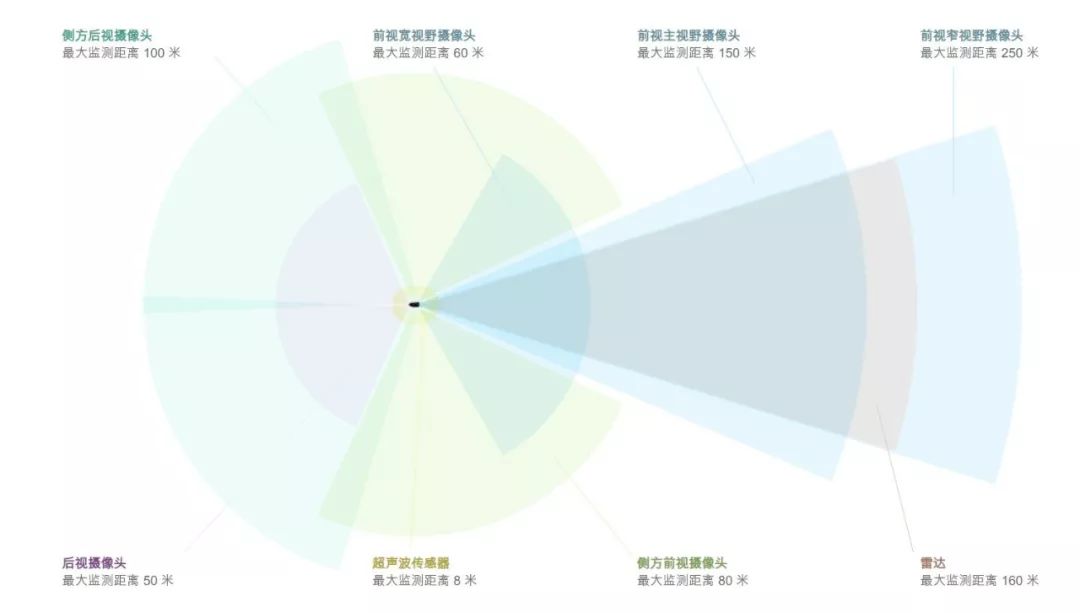

I want to talk about XPilot from a hardware perspective. He XPeng said that intelligence, including human-vehicle interaction and automatic driving, would be the most lethal feature of a product. This point is evident in XPilot. Let’s take a look at XPeng G3’s XPilot. It has 5 cameras, 3 millimeter-wave radars, and 12 ultrasonic sensors. It is identical to the NIO ES8.

Here, “identity” doesn’t mean that the camera’s selection, parameters, and performance are the same. Rather, it means that both companies use more diverse types and quantities of sensors to enhance the perception of the vehicle’s surroundings in terms of strategy.

The impact of hardware perception is global. After collecting such rich sensory data, there must be enough computing power to handle the data for decision-making and control. The result is that XPilot’s software and hardware solutions, as well as its software investment, are all very significant, even on par with NIO’s NIO Pilot.

However, the problem is that the NIO ES8 is a luxury SUV with an average price above 400,000 yuan, while XPeng G3’s top model costs only over 200,000 yuan. In other words, XPeng G3 has achieved a leapfrog benchmark in XPilot’s advanced driving assistance system, assuming that both NIO and XPeng can deliver on their promise to implement the features promised in the conference PPT through OTA upgrades.

By the way, I also found a bug on XPeng’s official website. Look at the actual arrangement of the sensor shown in the figure above. Combined with the fact that XPeng G3 could not identify the front car but successfully identified the rear car, it seems that the sensor is arranged as follows:

- 12 ultrasonic radars (omitted)

- 5 cameras: one front-facing camera, two sets of ultra-wide-angle fisheye lenses on the left and right

- 3 mm radar: one rear-facing, one on the left, and one on the right

Have you found the problem? If this is the case, XPeng G3 has no front radar and no rear camera. This is a very obvious bug. Without a front radar, even AEB cannot be enabled. Without a rear camera, even the reversing image cannot be displayed.After all, since it’s a concept image from the official website, it’s recommended that XPeng use the correct one. Here is an example:

Overall, XPeng is one of the few new car companies that views automatic assisted driving as a core competitiveness. As mentioned earlier, if we consider the positioning of XPeng G3, this is even more impressive.

The Future of XPilot

In our interview with Jamie Caelson, Vice President of Autonomous Driving at NIO, we mentioned that the ES8 has shifted from Bosch’s early solution to independent research and development and that the resulting independent research and development has led to delayed functional deliveries.

For XPeng, this challenge also exists. According to Wu Xinzhou, XPeng’s team has been involved in autonomous driving since the second half of 2014, and has developed the underlying line control of XPeng G3 independently, as well as the path planning and control parts, including XPeng He’s self-parking PR multiple times in public.

Wu Xinzhou stated that XPeng has accumulated about three to four years of time and has independently developed automatic parking functions for China’s various complex parking lots. The success rate of XPeng G3’s automatic parking function is much better than that of Tesla Model X. XPeng has taken advantage of this differentiated advantage in such a high-frequency demand function, which is a little bit of sweetness XPeng has tasted in independent research and development.

However, on the other hand, XPilot of XPeng G3 did not take a completely independent research and development route. The sensor perception technology of this system is provided by suppliers.

Wu Xinzhou said that adopting the supplier’s solution for perception has taught XPeng a lesson, because if perception is not self-developed, XPeng will face many challenges when implementing many functions.

Many things have become industry problems or problems that cannot be solved because if perception cannot be detected, what can you do?>

Wu Xinzhou mentioned that starting from the next generation model E28, XPilot will change its perception technology from supplier solutions to in-house research and development. He gave several reasons for this decision:

First, the expansion of the XPeng US autonomous driving team, which has a wealth of knowledge reserves and experience working with big data.

Second, XPeng has already independently researched and developed the planning and control technologies of the three major autonomous driving technologies, so replacing the supplier’s product with self-developed technology for perception is relatively less risky.

Third, XPeng will focus on localized research and development tailored for China’s road conditions, which will become a differentiated advantage. Regarding XPilot 3.0, which will be self-developed, Wu Xinzhou has provided a very aggressive timetable. Today, the fully autonomous parking and ACC under G3’s full scene is categorized as L1. When E28 reaches SOP, the XPeng team will complete the release of its fully self-developed L2 autonomous driving technology.

Within the following 9-12 months, XPeng will push for L3 autonomous driving through 3-4 OTAs, including high-speed lane changing, which allows drivers to complete driving from point A to B; parking memory, which allows the vehicle to take over once it reaches the parking lot, finds a parking space, and parks itself.

Tesla switched from supplier solutions (Mobileye EyeQ3 on Autopilot 1.0) to in-house development (Tesla Vision on Autopilot 2.0) for its perception technology in October 2016. Tesla spent about 18 months, with the help of its VP of computer vision and software engineering, to achieve this switch, letting the experience of AP 2.0 catch up to AP 1.0.

XPeng will embed a complete L3 level autonomous driving solution before the release of the E28, which is a huge challenge for Wu Xinzhou. If successfully implemented, XPilot will become XPeng’s core competitiveness as planned.

Before Tesla, the mainstream approach for L1 and L2 autonomous driving functions was to adopt supplier solutions. The supplier would organize a professional team to conduct a large amount of testing to ensure the safety and reliability of the system, but the drawback is that the product loses its ability to be improved after delivery.

After Tesla, China’s new car companies are trying to imitate Tesla’s autonomous driving technology development, which essentially means taking back this technology capability from suppliers. For new car companies, this is a very difficult technical challenge.

Therefore, regardless of the outcome, XPilot is worth paying attention to.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.