After the release of NIO’s 2018 financial report, its stock price dropped significantly. For Wall Street, there are many negative factors impacting NIO. However, many financial media believe that the biggest negative factor is the termination of the Shanghai factory construction.

NIO Shanghai Factory Advances

On February 7th, 2018, the local media in Jiading District, Shanghai, the “Jiading News,” reported for the first time that NIO’s complete vehicle base would be located in Jiading Wai Gang Town with planned land of 800 mu. A NIO spokesperson responded: “Wai Gang will become NIO’s second factory following the Hefei base. More information is currently not convenient to disclose publicly.” This was the NIO Shanghai factory project’s first public appearance in the media.

Subsequent media reports revealed more information about this factory: The factory would start construction in mid-2018, located on the west side of the Wai Gang High-tech Industrial Park, and the position was a benchmark factory in line with the production qualification requirements for passenger cars.

Judging from the time frame, it took 13 months for NIO’s JAC factory from laying the first pile to running the complete production line. Based on this efficiency and NIO’s product release rhythm of one new car per year, the production of ES6 at the Shanghai plant is not impossible, but the timeline is already very tight.

On May 8th, 2018, JAC issued an announcement that NIO’s second model, ES6, will continue to be produced by JAC after preliminary negotiations between NIO and JAC.

In fact, until Q4 2018, NIO was still committed to Shanghai factory development plans.

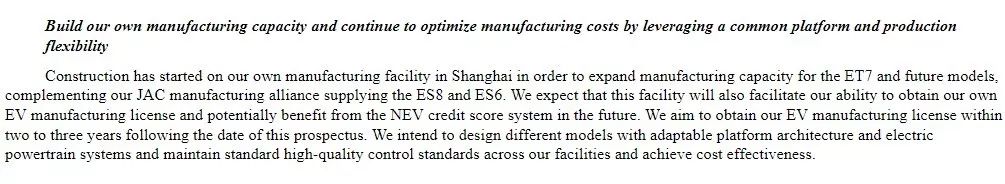

On September 12th, NIO had its IPO on NYSE, detailing in the IPO documents the company’s demands regarding the Shanghai factory.

More specifically, NIO’s JAC factory would take on the production function of ES8 and ES6, and NIO’s Shanghai factory would be a “supplement” to JAC factory, producing NIO’s first sedan, ET7, and subsequent models. NIO hopes to acquire production qualifications and new energy credits in the next two to three years. Additionally, NIO hopes to ensure excellent quality control standards and reduce manufacturing costs through the Shanghai plant.

In further documents, NIO further explained that the Shanghai factory had received preferential policies in funding, tax, factory construction, and land from the Shanghai municipal government.

Considering that the IPO document submitted in early August had clearly stated that the Shanghai plant was in the construction phase, the purpose of the subsequent additional investment was self-evident.

On October 27th, Shanghai held a ceremony for the signing of major foreign-funded projects. The official statement was “NIO Auto will increase its investment by CNY 16.66 billion in Jiading District to increase research and development investment in areas such as electrification, intelligence, interconnection, and lightweighting.”

William Li, Co-founder and Executive Vice Chairman of NIO (third from left in the front row).

This is the last public update NIO presented regarding the progress of their Shanghai factory.

Subsequently, the situation took a turn for the worse.

Did Tesla beat NIO?

Numerous media channels suggest that the pause in construction at the NIO factory is due to Tesla’s groundbreaking ceremony for their Shanghai Gigafactory, as stated in the “Management Regulations for Investment in the Auto Industry” by China’s National Development and Reform Commission.

On December 10, 2018, the National Development and Reform Commission issued “Management Regulations for Investment in the Auto Industry”, which came into effect on January 10, 2019.

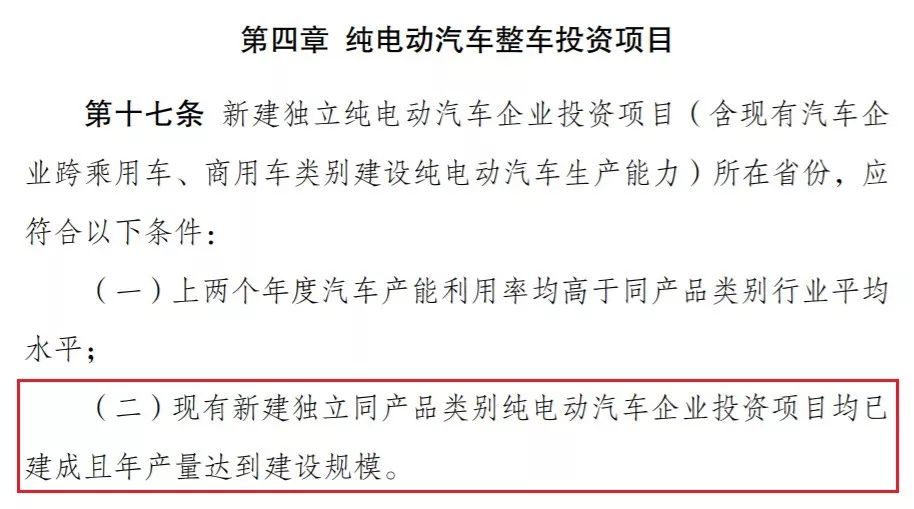

The regulations decentralize the approval process for pure electric car investment projects and production qualifications to local authorities. Furthermore, Article 17 of Chapter Four raised an extremely stringent requirement:

For a new independent pure electric vehicle enterprise project (including existing automobile enterprise cross-use and commercial vehicle categories that build pure electric vehicle production capacity) in the province, the following conditions must be met:

The vehicle production capacity utilization rate in the past two years exceeds the industry average utilization rate for the same product category;

Existing new independent pure electric vehicle enterprise projects in the same product category have been constructed, and the annual output has reached the designed scale.

One can interpret it as follows: For the Shanghai factory, Tesla has been approved but not NIO; NIO has been approved but not Tesla.

Let us revisit the timeline, and one can find that before and after the issuance of these regulations, the situation has been very puzzling, which makes it easy for people to draw the wrong conclusion that “Tesla has beaten NIO”.

On June 6, 2018, Jerry Guo, Tesla’s Government Negotiation Liaison in China and Vice President of Global Sales and Service, attended the Tesla 2018 Shareholder Meeting, signaling Tesla’s plan to build a factory in China in progress. Elon’s statement also confirms our judgment: Tesla is in final talks with all levels of government regarding the details of building a factory, and specific plans will be announced in July at the latest.On August 14, 2018, NIO submitted its IPO prospectus, disclosing that the construction of its Shanghai factory was already underway.

On October 17, 2018, Tesla signed a “land transfer contract” with the Shanghai Planning and Land Resources Administration, obtaining approval for over 1,200 mu (approx. 200 acres) and more than 860,000 square meters of land.

On October 27, 2018, NIO increased its investment by RMB 16.66 billion in the Shanghai factory project.

Note that to date, both companies continue to advance their factory investment projects in the same city.

On December 10, 2018, the “Regulations” stating that “one city cannot accommodate two factories” were introduced.

On January 7, 2019, Tesla held the ceremony for the groundbreaking of its Shanghai Gigafactory. Tesla CEO Elon Musk, Vice Secretary of the Shanghai Municipal Committee and Mayor Ying Yong, and leaders from the municipal government, the Ministry of Industry and Information Technology, and the National Development and Reform Commission all attended the ceremony.

The conclusion becomes clear: Tesla, as a world-renowned leader in intelligent electric vehicles, has been valued and introduced by the authorities, while the first-mover in the new car companies, NIO, is forced to make concessions and has been squeezed out of Shanghai. Is this what really happened?

NIO’s adjustments

Let’s look back to the disclosure of NIO’s factory construction time: in February 2018, shortly after NIO Day, orders for the ES8 poured in, and NIO services had not yet been put into operation. NIO was then in a promising and well-funded stage.

Throughout 2018, although NIO maintained its previous level of service quality (for the sake of user experience, a certain redundancy of team configuration was needed), it incurred significant losses, but NIO was the only Chinese luxury car brand with sales exceeding 10,000 units and an average price of over RMB 400,000. More importantly, the Q4 financial report data showed that NIO’s gross margin was positive.

This means that if NIO wants to become a company with a long-term vision, committed to building a closed-loop premium user experience, the foreseeable losses are no longer worth discussing, and the positive Q4 gross margin validates NIO’s business capabilities.

However, by January 2019, the situation had changed. We know that at NIO Day in December 2018, NIO launched the ES6.After the release of Tesla Model 3, Elon Musk personally wrote an article introducing the differences between Model S and Model 3 in terms of product positioning, functional parameters, and space. Meanwhile, Tesla has successively stopped the production of Model S 60/75D and other models to further clarify the differentiation of its product line.

NIO is facing the same dilemma. After the release of ES6, it will divert some ES8 pre-order users who have less strong car buying needs. If we take into account some significant improvements on ES6, this diversion effect will be more pronounced.

In addition to factors such as the Spring Festival and New Year holidays mentioned by NIO management and subsidy policies, NIO’s sales volume in January and February, as NIO’s CFO Xie Dongying said, showed “higher-than-expected month-on-month decline” in delivery volume.

NIO’s cash flow is starting to come under pressure.

After delivering 1,805 vehicles in January, NIO issued $650 million convertible bonds on February 4 with an interest rate of 4.50% per year and maturity in 2024.

NIO needs to reconsider its investment project for the Shanghai factory.

On the other hand, NIO-JAC factory is designed with a capacity of 100,000 vehicles per year, which is scalable and can be increased to 150,000 vehicles per year. If NIO’s cooperation with JAC is based on consideration of China’s capacity surplus in the automobile factory, what is the rationality of preparing for the Shanghai factory when JAC factory is producing over 10,000 ES8 at the moment? Especially when cash flow is tight, it is more logical to continue to have the ET7 produced by JAC.

According to Li Bin, NIO and JAC have already confirmed that the third car ET7 will still be manufactured by JAC.

In addition, the policy shift completely “blocked” the Shanghai factory project.

As mentioned earlier, according to the IPO document, NIO’s demands for the Shanghai factory project are as follows:

-

Obtain production qualifications

-

Obtain new energy credits

-

Ensure excellent quality control standards and achieve manufacturing cost reduction

At the financial report conference, Li Bin explained the factory project as follows:

In November of last year, China’s Ministry of Industry and Information Technology issued a very important policy, which clearly pointed out for the first time that car R&D enterprises and existing manufacturing enterprises can be allowed for cooperative manufacturing. The cooperation mode between NIO and JAC is a model that China encourages for innovative cooperation in general.

For NIO, the benefit is that in the future, subsidies and emission credits do not need to be transferred to us through JAC, but can be applied directly to the government department. On the other hand, we can manage the products as an independent automotive company, which is strategically significant for the company in the long run.

This means that NIO’s two major demands from last year are no longer valid today.Considering that the Shanghai factory investment project has been in progress for some time, it is reasonable for NIO to make some adjustments. However, in general, delaying the second factory and implementing cost-saving measures through open sourcing to improve efficiency is a more reasonable choice.

As NIO’s CFO, Dongning Wang, said, terminating the Shanghai factory project “will indeed have some impact on capital expenditure in the short term, but in the long run, this strategic adjustment will bring us higher asset return.”

ES6 debut in NIO, Let the bullets fly for a while | 42HOW Live

11 days and 10 nights, 3000 kilometers, exploring the gene of making cars of NIO | 42Group

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.