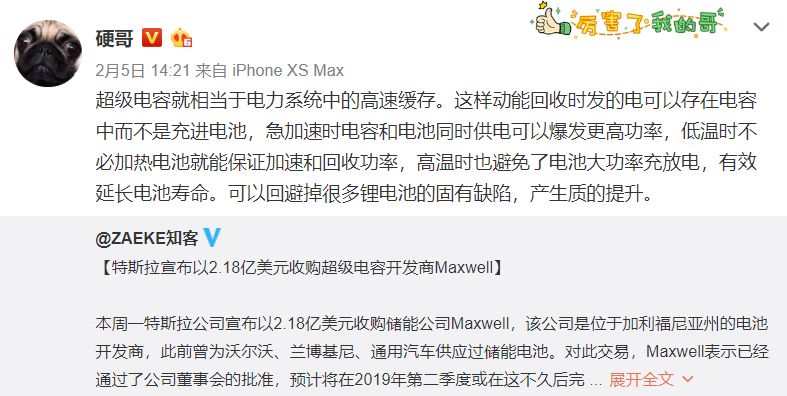

On February 5th, 2019, Tesla announced its acquisition of Maxwell at a premium of 55%, for a total of $218 million.

This acquisition marks Tesla’s first major move in the field of electrochemistry, which is very significant.

Strategic Change

With the trend of electrification in the automotive industry, more and more companies are trying to lay out next-generation battery technologies such as solid-state, lithium-air, and fuel cells, to achieve “overtaking in corners”. For example, Bosch, Toyota, Volkswagen, etc. are all conducting pre-research and commercialization of solid-state batteries.

As the leader in the electric vehicle industry, how can Tesla avoid being left behind by large companies with more funds, talent, and resources that will discover groundbreaking battery technology first? In Tesla’s second quarter 2017 earnings call, Tesla CEO Elon Musk and CTO JB Staubel together responded to this question from analysts.

Elon: Okay, here’s my opinion of the week’s battery breakthrough. When someone has a great cause and says they’ve got this breakthrough battery technology, you know what? Send us a sample. Or, if you don’t trust us, send it to an independent lab so they can test the parameters. Otherwise, STF (as in shut the fuck up). Yeah. Everything works on PowerPoint.

JB Staubel added that Tesla is now the world’s largest lithium-ion battery consumer, which puts Tesla in a unique position when it comes to contacting teams working to commercialize cutting-edge battery technologies. Tesla regularly receives different battery samples and has tested a large number of battery samples, and continues to track hundreds of cutting-edge battery research projects, but Tesla’s battery strategy will not change for the time being.The acquisition of Maxwell signifies a shift in Tesla’s battery strategy towards absorbing external technology teams to lay out future battery technology strategies. For Tesla, Maxwell’s technology will effectively supplement the shortcomings of performance in Tesla’s existing product line.

Who is Maxwell?

In response to this acquisition, a Tesla spokesperson said that they have been searching for meaningful potential acquisitions to support Tesla’s mission to “accelerate the world’s transition to sustainable energy”. However, no details were provided regarding the cooperation between the two sides. So, what kind of company is Maxwell?

It should be noted that Maxwell is not an electrochemical start-up team like QuantumScape, Seeo, or Sakti3. On the contrary, even if not acquired by Tesla, Maxwell is a commercially stable and technically profound electrochemical company.

Specifically, Maxwell’s core technology is divided into two parts: dry battery electrode technology and energy storage business driven by supercapacitors.

First, let’s talk about the dry battery electrode technology. According to Maxwell executives, the company’s “dry electrode” technology has been developed and patented, which can significantly increase the range of electric vehicles and reduce battery costs.

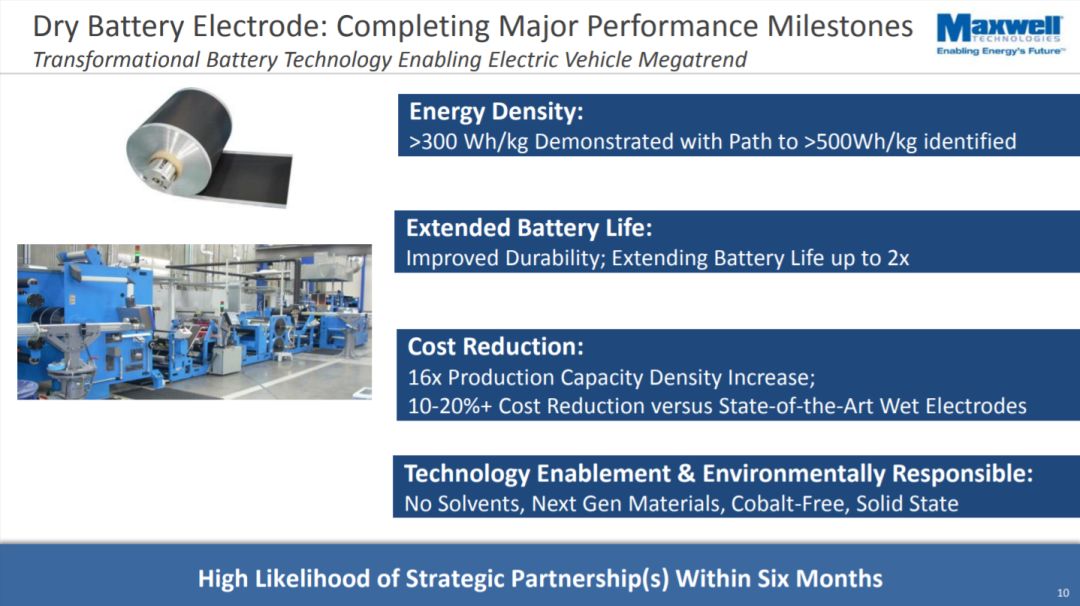

On January 16, 2019, Maxwell issued a report on the company’s business. One page of the PPT introduced the dry battery electrode technology as follows:

Dry battery electrode: Achieve major performance milestones, revolutionize battery technology and make electric vehicles a trend.

Dry battery electrodes have the following four advantages:

- Energy density: >300 Wh/kg has been validated, and there is a path to achieve 500 Wh/kg.

- Extended battery life: Improved durability, doubling the battery life.

- Cost reduction: Production capacity density increased 16 times, and the cost is reduced by 10%-20% compared to wet electrodes of existing technology.

- Technical support and environmental responsibility: Solvent-free, next-generation materials, cobalt-free, solid-state.

This page of the battery technology PPT looks similar to any power battery start-up team’s BP technology page. The difference with other companies is that, as mentioned earlier, Tesla has tested a large number of battery samples and continues to track hundreds of cutting-edge battery research projects, but only Maxwell made Tesla willing to spend $218 million to acquire it.If we take into consideration that Tesla’s convertible debt of approximately $920 million will be due on March 1st; that Model S/X prices decreased by $2,000 and Model 3 prices decreased cumulatively by $3,100, which puts further pressure on gross margins; and that Elon Musk had to cut the workforce by 11% to reduce costs, then Tesla’s acquisition of Maxwell for $218 million can only be explained by the synergies created by Maxwell’s technology and Tesla’s market appeal. Oppenheimer analyst Colin Rusch, who has been following Maxwell’s progress for a long time, noted in his report that Maxwell’s battery component manufacturing process is significantly more efficient than the industry standard process. Even when compared to the most efficient battery manufacturing process on the market, Maxwell’s process can significantly reduce the production costs of electric vehicles.

To put it simply, if Tesla successfully achieves its planned cost reduction of batteries and the production of the standard version of Model 3 in the next 6 months, then it is highly likely that the standard version of Model 3 will have the added benefit of Maxwell’s technology.

Note at the bottom of the PPT slide: High Likelihood of Strategic Partnership(s) Within Six Months.

This report was issued 20 days prior to Tesla’s announcement of its acquisition of Maxwell. So, who could be the potential strategic partner?

Another technology is called supercapacitors.

Elon Musk himself has some history with supercapacitors. On May 21st, 2013, he revealed himself as a fan of supercapacitors on Twitter and even planned to pursue a doctorate in supercapacitor technology at Stanford University.

In fact, the improvement of performance of current electric cars through supercapacitors is not complicated. Mr. Yi from the electric vehicle industry and a Model X/3 owner explained the characteristics of supercapacitors.

# Super Capacitors and the Future of Electric Vehicles

# Super Capacitors and the Future of Electric Vehicles

Super capacitors are like the high-speed cache in a power system. They store the electricity generated during kinetic energy recovery, which can be used later to power the vehicle during acceleration. This allows for a surge of higher power during acceleration by both the capacitor and the battery, without the need to heat the battery in cold temperatures, and without the high power of charging or discharging the battery in high temperatures. This technology can avoid many of the inherent shortcomings of lithium batteries and significantly improve performance.

Dr. Shen Fei, Vice President of Power Management at NIO, has proposed a similar approach to Tesla and Maxwell’s: parallel connection of super capacitors and batteries. The super capacitor can be used for fast acceleration and deceleration, while the battery provides average power. This can be described as a new hybrid technology for electric vehicles.

It can be understood that the theoretical advantages of combining super capacitors with existing electric vehicle technologies are multi-dimensional. However, only Tesla and Maxwell’s teams know the engineering challenges in this approach.

Tesla has a history of aggressively intervening in its acquired companies to promote rapid integration and development. Therefore, with the acquisition of Maxwell’s technology, it is reasonable to be optimistic about the short-term productization of this technology.

Tesla’s previous acquisitions include Riviera Tool, which was directly taken over and renamed Tesla Tool & Die in 2015. SolarCity was acquired in 2016, and its sales organization was significantly reduced, and the CEO and CTO quickly resigned. However, the acquisition resulted in a significant decrease in SolarCity’s losses. In 2017, Tesla acquired Grohmann Engineering and CTO JB Straubel took over the team, establishing a highly automated factory in Germany, and terminated cooperation with major automotive companies. Tesla’s priority is the manufacturing of the Model 3.

Today, Maxwell, considering the acquisition has received the approval of Maxwell's board, should terminate its cooperation with Geely, Volvo, GM and Lamborghini, its former partners in the automotive industry, within the next two quarters.

## For the Next Decade

In Tesla's product line, the new Roadster's 0-60 mph acceleration has been achieved in 1.9 seconds, even the Model S P100D, released three years ago, can accelerate 0-60 mph in 2.5 seconds. Furthermore, by increasing the battery pack's size and capacity, Tesla has successfully reduced the cycle count of the 18650 battery, thus virtually avoiding the problem of battery lifespan decay.

Considering the stronger high-power charging and discharging characteristics and up to 1200 cycles of 2170 batteries, Tesla can be said to have solved the problems of high-power charging and discharging and battery life for pure electric passenger cars. So what is the significance of acquiring Maxwell?

First, in Maxwell's forward-looking technology roadmap, it proposes a path to achieve up to 500 Wh/kg, which is the future of the pure electric vehicle industry in the next decade. **Doubling energy density and battery pack flat design on the chassis has the opportunity to significantly reduce the curb weight of future pure electric cars compared to same-level fuel-powered models while significantly improving safety.** Furthermore, the lower curb weight is the foundation for achieving lower energy consumption and longer range.

Second, in Tesla's other product lines, such as the upcoming pure electric pickup truck and semi-trailer, there are higher requirements for instantaneous charging and discharging power. Moreover, the semi-trailer fleet in the freight logistics scenario also requires longer range and battery life.

In Tesla's energy product line, the commercial and utility energy product combination composed of the energy storage device PowerPack and the solar panel also have high requirements for instantaneous high-power charging and discharging.

Finally, **Elon said that his dream is to promote the electrification of all transportation.** Today, in the passenger car market, luxury cars have been able to beat same-level fuel cars, but this is just the first step. In the next ten years, Tesla will launch many niche market products to change the game.

Acquiring Maxwell accelerates the world's transition to sustainable energy.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.