NIO has just released its third quarter report, which is also its first quarterly report since going public. Let’s take a look at the core information.

Production & Deliveries

Unlike traditional car companies, which focus more on revenue and profit margins, the most important thing for all new car companies, including Tesla, is whether they can deliver cars to customers before the patience of pre-ordering owners runs out. From this perspective, NIO has done quite well: In Q3, NIO produced a total of 4,206 ES8s and delivered 3,268 vehicles, with a MoM increase of 741% and 3,168%, respectively.

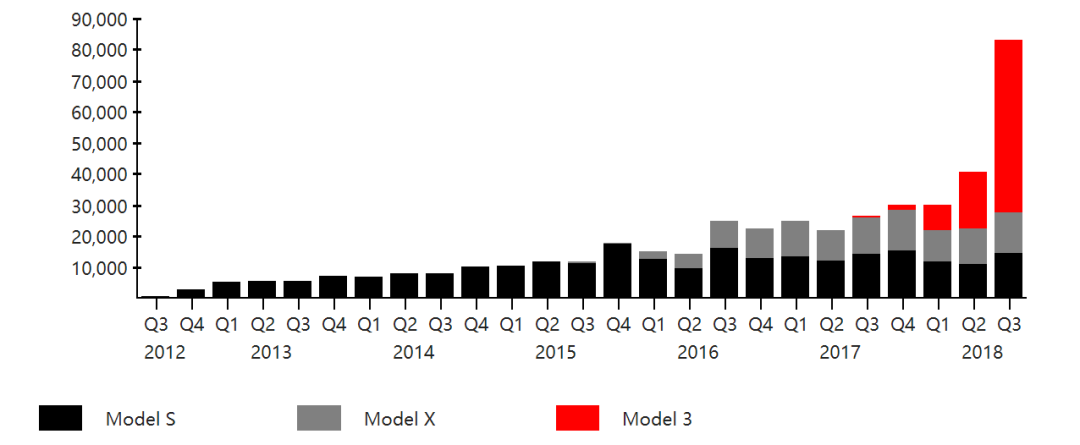

Of course, the increase is too exaggerated because it delivered very few vehicles in the second quarter, so its reference value is not that significant. Even so, NIO’s progress in ramping up production and deliveries is still quite good. Here are Tesla’s Model S delivery numbers starting from June 22, 2012. Tesla only delivered 250 Model S vehicles in Q3 2012, followed by 2,400 and 4,900 units in the next two quarters, respectively.

In contrast, NIO delivered 100 ES8s in Q2 and 3,268 in Q3, with delivery guidance for Q4 ranging from 6,700 to 7,000 vehicles. From this perspective, NIO’s performance is even better than Tesla’s.

Of course, this comparison is not entirely appropriate. In this new wave, Tesla was the first new car company in the world to reach delivery, while NIO was only the first new car company in China to reach delivery. During this period, the development of the intelligent electric vehicle industry chain took a full six years, and the technical and engineering challenges it faced are beyond comparison.

In October, NIO delivered 1,573 ES8s. Considering that NIO’s vehicle registration agency procedures were delayed during the National Day holiday and JAC-NIO’s factory was shut down for production line upgrades for the upcoming mass production of the ES6 at NIO Day at the end of the year, this performance is also impressive.

By the way, excluding October, NIO delivered a total of 3,368 ES8s. Based on the delivery guidance of 6,700 to 7,000 units in Q4, the full-year delivery milestone of 10,000 units seems to be within reach. Do you feel that something is not right here?The bet between Li Bin and He XPeng on “whether 10,000 ES8 will be delivered in 2018” was initially a joint PR effort to attract traffic. However, it has now become more interesting. Nevertheless, Xie Dongyin, NIO’s CFO, explicitly stated in the financial report that “ES8 order volume continues to grow, production capacity steadily improves, and we are confident to achieve the delivery target of 10,000 ES8s in 2018.”

Revenue & Profit

As a listed company, revenue, expenses, and profits, or in other words, input-output ratio, are key indicators. In Q3, NIO achieved revenue of RMB 1.4696 billion, with automotive sales accounting for RMB 1.4269 billion and other sales accounting for RMB 42.7 million. NIO specifically mentioned that the growth in other sales is mainly due to the increase in revenue from home charging piles installed in Q3.

NIO’s operating loss in Q3 was RMB 2.8099 billion, a year-on-year increase of 118.2% and a quarter-on-quarter increase of 49.9%. NIO pointed out in the financial report that one of the reasons for the significant increase in operating, sales, and management expenses is the increase in the number of employees in product, software development, user development, and service-related teams.

NIO’s team size has been growing rapidly. Li Bin previously revealed that NIO already has a team of over 7,000 globally. For comparison, at the end of 2012, after two quarters of deliveries, Tesla had only about 3,000 employees. Of course, NIO did use more people and accomplished more things. The NIO factory has already made adjustments for the co-production of the second models, ES6 and ES8, and is expected to begin delivery in mid-next year.

NIO’s gross margin in Q3 was negative 7.9%. In the previous quarter, it was negative 333.1%. The increase in gross margin naturally stems from the large-scale production and delivery of ES8.

Finally, NIO specifically mentioned in the financial report that the net loss attributable to ordinary shareholders in Q3 was RMB 9.7568 billion, a quarter-on-quarter increase of 59.7%. Among them, “the net loss attributable to ordinary shareholders caused by the increase in the redemption value of convertible redeemable preferred shares” reached RMB 6.923 billion, and this loss is a non-cash expenditure and will not recur after the company’s IPO. Except for equity incentive expenses, the increase in the redemption value of convertible redeemable preferred shares, and the increase in the redemption value of non-controlling interests, the adjusted net loss attributable to ordinary shareholders was RMB 2.3702 billion.To summarize, it is difficult to draw a clear conclusion on whether NIO’s operating performance has improved or worsened in comparison to the previous quarter, as the revenue, R&D, operation, sales, management, and gross margin were significantly impacted by the large-scale delivery of ES8 and the upcoming release of ES6 in the first quarter since NIO’s IPO.

NIO’s financial results conference call will be held tonight at 9:00pm, and management including Li Bin and Xie Dongying will attend the meeting and answer questions from investors and analysts. Hopefully Li Bin will continue to uphold the fine tradition of new car-making companies and share more business progress information at the financial report meeting. 🙂

Last but not least, it seems there was a small bug in NIO’s financial report: deliveries were only made from June 28 to June 30 in the second quarter.

Wait a minute, didn’t they deliver 10 cars on May 31, with CEO Qin Lihong and employee #0001 Li Tianshu as owners? 🙂

- NIO, the user enterprise, listed with its suspense* Comparison of 33 Details between the NIO ES8 and the Model X: Expert Reviews from Dual Car Owners and Senior Geeks

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.