Tesla Q3 Production and Delivery Report Released

Tesla’s Q3 announcement has finally brought a breath of fresh air after a series of recent privatization dramas and SEC pressure. Once again, the Tesla Automotive Team has delivered an excellent performance report.

Model 3: Expected Hardcore Growth

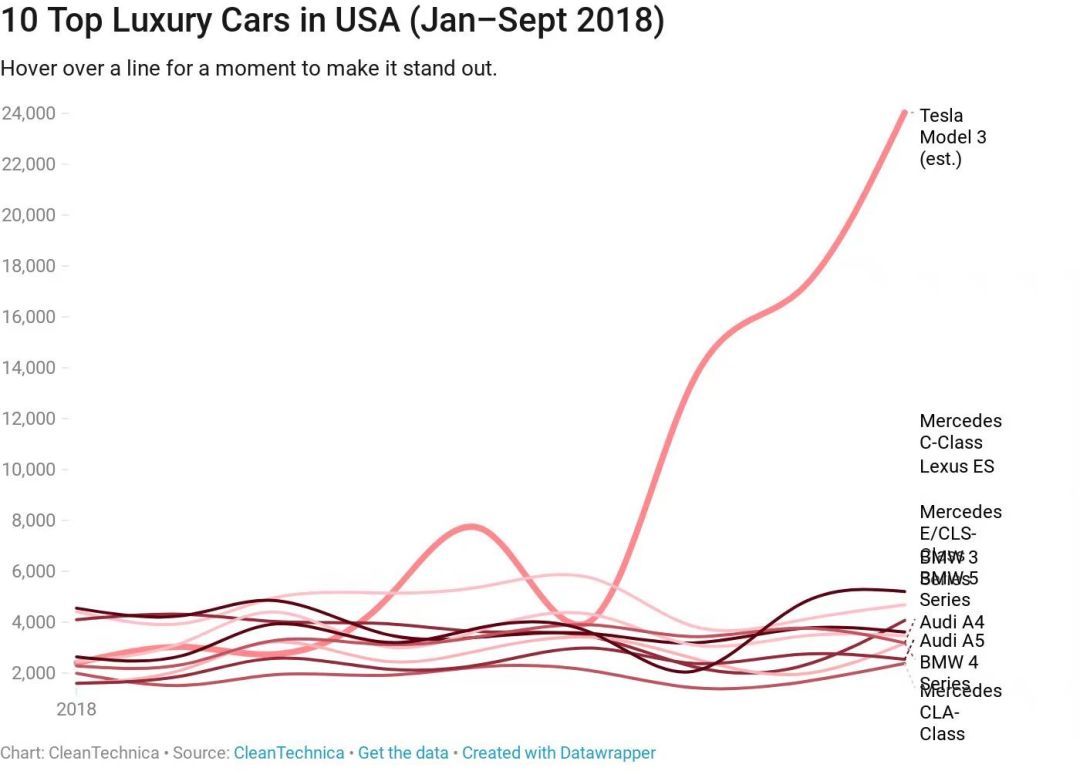

Model 3 remains the top priority of Tesla’s automotive business. In Q3, Tesla produced a total of 53,239 Model 3s and delivered 55,840. By September, the scale of delivery in the United States alone had reached 24,040. What does this mean? The Model 3 single model sales volume is more than the sum of Mercedes-Benz C-Class + CLA + CLS + E-Class + BMW 2 Series + 3 Series + 4 Series + 5 Series. If compared to itself, the 24,040 units mean an increase of 270% on a month-to-month basis and an increase of 19,000% on a year-to-year basis.

Why has there been such an abrupt doubling growth? In addition to the Model 3 project team’s effort to ramp up capacity, Tesla’s remarkable progress in delivery system cannot be ignored. At the end of Q2, Tesla had accumulated more than 15,000 vehicles “in transit”. Unlike traditional car companies with huge dealership systems, Tesla insists on a direct sales strategy which means it needs to establish a delivery system that matches Model 3 orders in a short period of time.

This is also why Elon Musk Tweeted that Tesla is transitioning from production hell to delivery logistics hell. Tesla also stated in the announcement that as capacity stabilizes, logistics and delivery of vehicles become the new challenge. In the past quarter, Tesla has made many improvements to its delivery processes and plans to further improve in Q4. This continuous improvement is necessary because as of the end of Q3, Tesla still has 11,824 vehicles “in transit”, including 8,048 Model 3s.

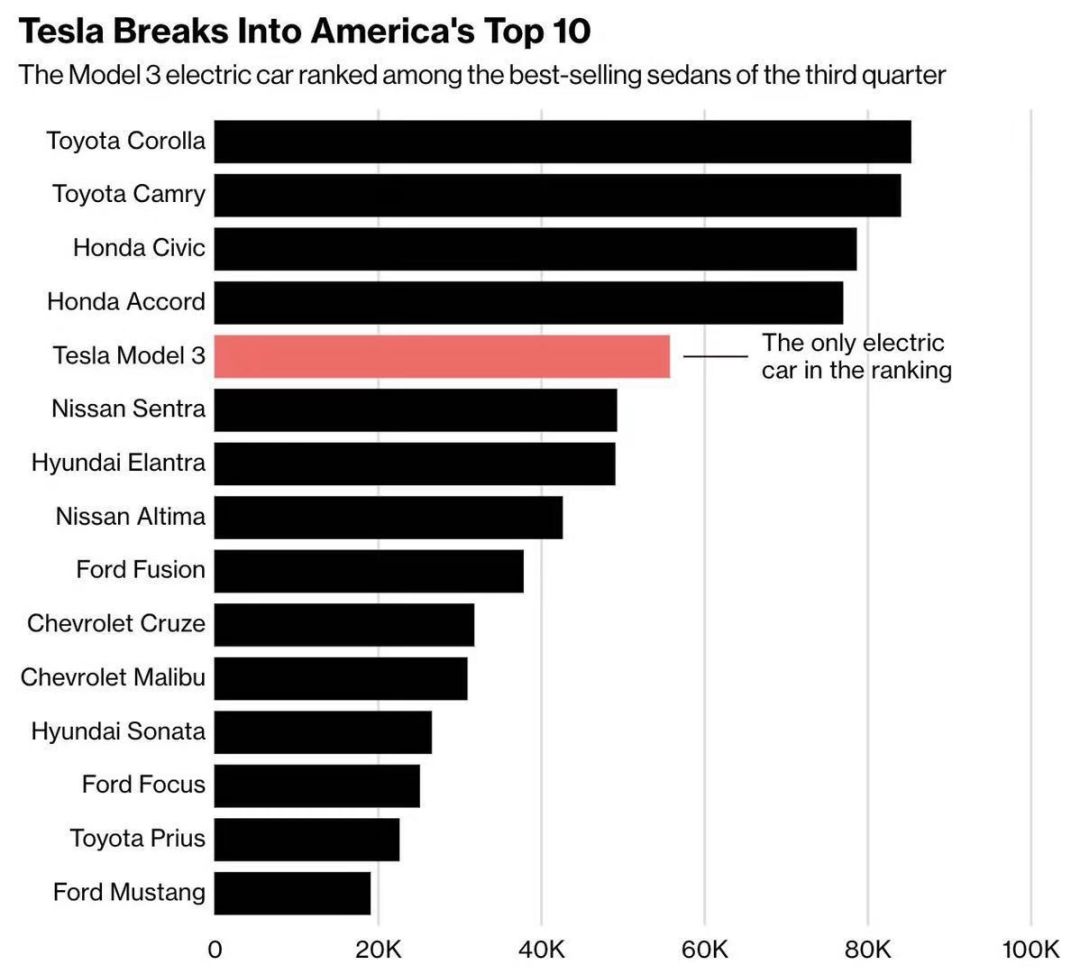

Even so, the Model 3 still made it into the top 10 best-selling sedans in the US, ranking fifth. The Model 3 stands out on this list, not only because it is the only pure electric vehicle, but also because other models on the list are affordable vehicles priced around $30,000. However, since the dual-motor high-end version was “discounted” in the past quarter, the Model 3, which was originally positioned at $35,000, increased its average price by 30% to reach $60,000.

With close to double the sales and a 30% increase in average price, the Model 3 is a strong performer.

Who bought the Model S/X?

Before Q3, the Model S/X had been struggling for two consecutive quarters. So when Tesla mentioned “our goal of delivering 100,000 Model S/Xs annually remains unchanged” in the Q2 earnings report, I was secretly waiting to see what would happen next. However, when the Q3 delivery announcement came out, Tesla once again included this statement…

In Q4 2017, Tesla sold as many as 28,320 Model S/Xs. But in 2018, Tesla has been hovering around 21,000 units for two consecutive quarters. In addition, there were other unfavorable factors in Q3, such as the largest developed and developing countries in the world starting a trade war, which raised tariffs on imported cars from 25% to 40%.

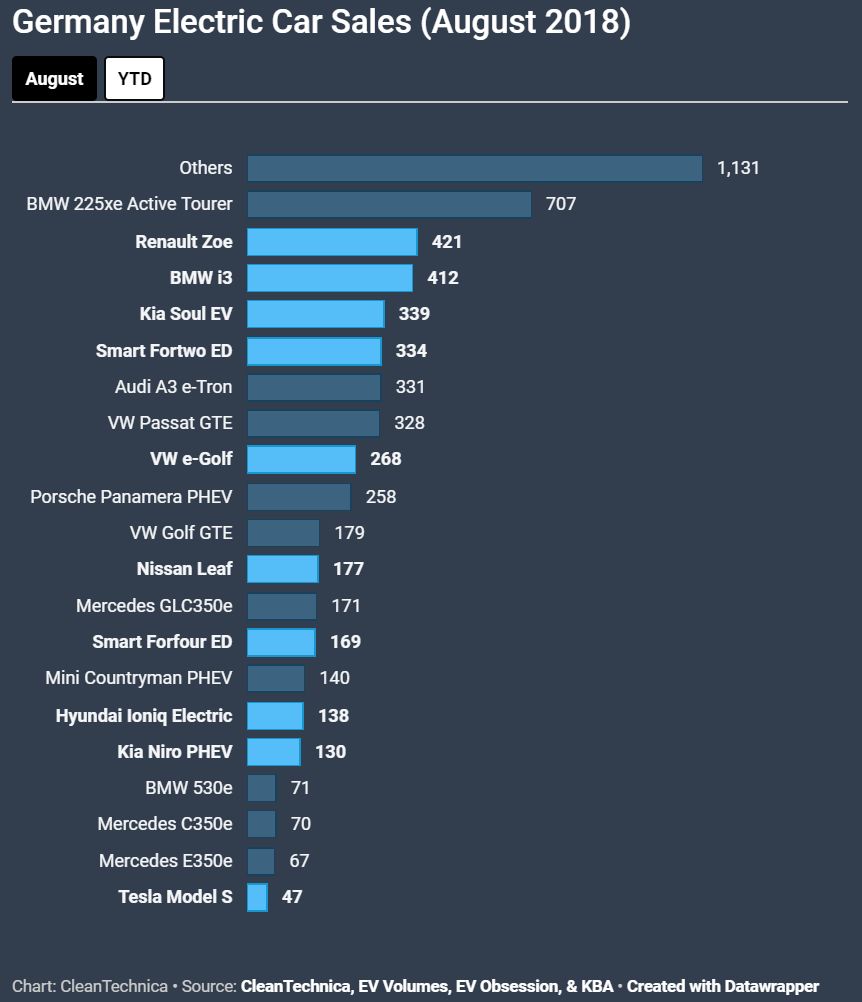

As traditional luxury brands launched their first pure electric vehicles, Tesla was somewhat affected. For example, in August, Germany only sold 47 Model Ss, and less than 1,000 units were sold in the entire year… Finally, Tesla’s official focus was on the Model 3, and there were no strong promotion policies for the Model S/X in Q3.

However, the production and delivery of Model S/X in Q3 reached 26,903 and 27,660 respectively, which is about five to six thousand more vehicles than Q1 and Q2. The announcement also explicitly stated that “demand for Model S/X is still high.” Despite facing some challenges in the second largest overseas market of China and the third largest market of Europe, the demand in the US domestic market has already been stabilizing. Who are the buyers of these cars?

However, the production and delivery of Model S/X in Q3 reached 26,903 and 27,660 respectively, which is about five to six thousand more vehicles than Q1 and Q2. The announcement also explicitly stated that “demand for Model S/X is still high.” Despite facing some challenges in the second largest overseas market of China and the third largest market of Europe, the demand in the US domestic market has already been stabilizing. Who are the buyers of these cars?

Thanks to the rebound of Model S/X, another set of data is worth noting: from a local perspective in the US, Tesla, Mercedes-Benz, and BMW sold 69,925, 66,524, and 71,679 vehicles respectively in Q3. This means Tesla’s sales of these three models are higher than the entire Mercedes-Benz passenger car series, and the gap between Tesla and BMW is less than 2,000 vehicles.

How did BMW successfully defend its lead? BMW’s best-selling model in the US is the mid-size SUV BMW X3, the same segment that Tesla’s next model, Model Y, aims to compete in.

Why traditional automakers should not ignore Tesla anymore? Today, BMW North America CEO Bernhard Kuhnt admitted that “Tesla is gaining momentum and putting pressure on the segmentation market,” which is the correct idea. According to the data released by Tesla in Q2, the top five models that Model 3 has replaced besides the BMW 3 Series are Toyota Prius, Honda Accord, Honda Civic, and Nissan Leaf. The average price of these models is between 25,000 and 35,000 US dollars.

This means that while Model 3’s competitiveness is putting pressure on competitors in the same level market, it will also facilitate “consumption upgrade” of the mass market. The more balanced distribution of consumer groups also means that the US domestic market capacity of 20,000 Model 3s per month is likely to be sustainable in the long run.

Such product cases are worth further study by BBA (BMW, Benz, Audi).

Who will be Tesla’s new chairman?

Q3’s performance once again proves that Elon has excellent leadership skills in leading the team to achieve performance. Nevertheless, the hasty decision to initiate/cancel privatization led to SEC’s intervention in Tesla. After the game between the two sides, the latest agreement reached between SEC and Tesla is as follows:

-

Tesla and Elon Musk each pay a $20 million fine;

-

Two new independent directors are appointed and an independent director committee is set up;

-

Elon Musk resigns as Tesla chairman within 45 days and cannot serve as chairman again in the next three years.The symbolism of the $20 million fine is greater than its actual significance, regardless of Tesla’s size or Elon’s personal wealth, and the appointment of independent directors was a routine operation last year. However, stepping down as chairman while maintaining CEO status is relatively more punitive in terms of touching the core clause.

Such a power structure is not unprecedented in Silicon Valley, such as Elon’s friend and Google founder Larry Page, who has been governing the company in this way for the past decade. Since 2001, Eric Schmidt has been the chairman of Google, Larry Page has been the CEO, and Sergey Brin, the co-founder of Google, has been the president. The tripartite structure has not only not affected Google’s prosperity, but has also successfully ensured that Google grows into one of the world’s most successful Internet companies.

Returning to Tesla, considering the high complexity of its business (such as energy and automotive businesses, although key components of the energy closed-loop, have a high degree of independence from a technical perspective), Tesla has not set up positions such as a COO or president in the traditional sense.

Jerome Guillen, President of Tesla’s Automotive Business, has extensive experience in the research and development, production, sales, and international expansion of smart electric vehicles, but has not been heavily involved in the operational management of the solar panel and distributed energy storage businesses. This has left Elon as the only management that is familiar with all aspects of the company and can provide guidance at any time.

Of course, the long-term high-pressure work rhythm and the fact-based and hands-on style have already made Elon exhausted, especially in the year when Model 3 production capacity climbed. Elon’s personal emotional management has become increasingly frequent and out of control, which leads both Elon and the board to agree that Tesla should find a COO to assist Elon in managing the company.

In fact, the SEC’s request for the appointment of a new chairman not only partially balances Elon and ensures shareholder interests but also has the meaning of assisting Elon in operating the company, with the new chairman playing the role of “Tesla’s Eric Schmidt”.

However, the SEC did not take into account the complexity of Tesla’s business. In fact, Tesla’s failure to find a COO for more than a year already speaks volumes. Serving as Tesla’s COO/chairman/president is probably one of the most challenging jobs. Considering that Elon is still Tesla’s largest shareholder and the pro-Elon faction of the board has multiple seats, the appointment of a chairman who does not involve business management will have a very limited role in improving Elon’s work rhythm and adjusting Tesla’s corporate culture.

Therefore, compared with Murdoch, who was impeached by shareholders because of the lack of “any experience in the automotive or engineering field”, Jerome Guillen, the current president of Tesla’s automotive business, is obviously a better choice as the new chairman.

Unless, the SEC and the board of directors approve the new chairman to be a puppet.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.