After half a year of twists and turns, the cooperation between Toyota and Uber has finally landed.

This news was first exposed by the fastest-running Reuters journalist. Insiders said that Toyota will invest $500 million in Uber to jointly develop self-driving cars in order to catch up with competitors in the fiercely competitive field of autonomous driving. Several hours later, both the Uber official website and the Toyota North America official website confirmed in a statement that Uber and Toyota will deepen their cooperation on autonomous driving technology.

Unexpected Benefits

The reason behind Uber and Toyota’s deepening cooperation is quite dramatic. On February 21, 2018, Dara Khosrowshahi made his first trip to Asia since becoming Uber’s CEO.

During his visit to Japan, Dara learned an embarrassing fact: Uber’s market share in Japan’s transportation market is less than 1%. Dara admitted: “Our strategy in Japan has not been successful in the past, we need to be more open and discuss opportunities for cooperation with local companies.”

One day later, based on the lack of progress on cooperation on ride-hailing services, Dara unexpectedly gained benefits. On February 22, Dara posted this photo on Twitter, showing him and two executives from Toyota, Akio Toyoda and Shigeki Tomoyama, discussing “how to expand cooperation around self-driving technology and gain a deeper understanding of how to build excellent corporate culture.”

There is no need to say much about Akio Toyoda, the fourth generation of the Toyota family in Japan and the current Toyota President. Shigeki Tomoyama is a Toyota Group director, executive vice president and chief internet officer. Therefore, it can be understood that this was the first contact between the top management of the two companies on autonomous driving cooperation.

During a subsequent event, Dara told investors: Uber has established a preliminary partnership with Toyota, and Uber must ensure it has access to leading self-driving technology and commercialize it in a timely manner, which means Uber needs to cooperate with other companies, such as Toyota.

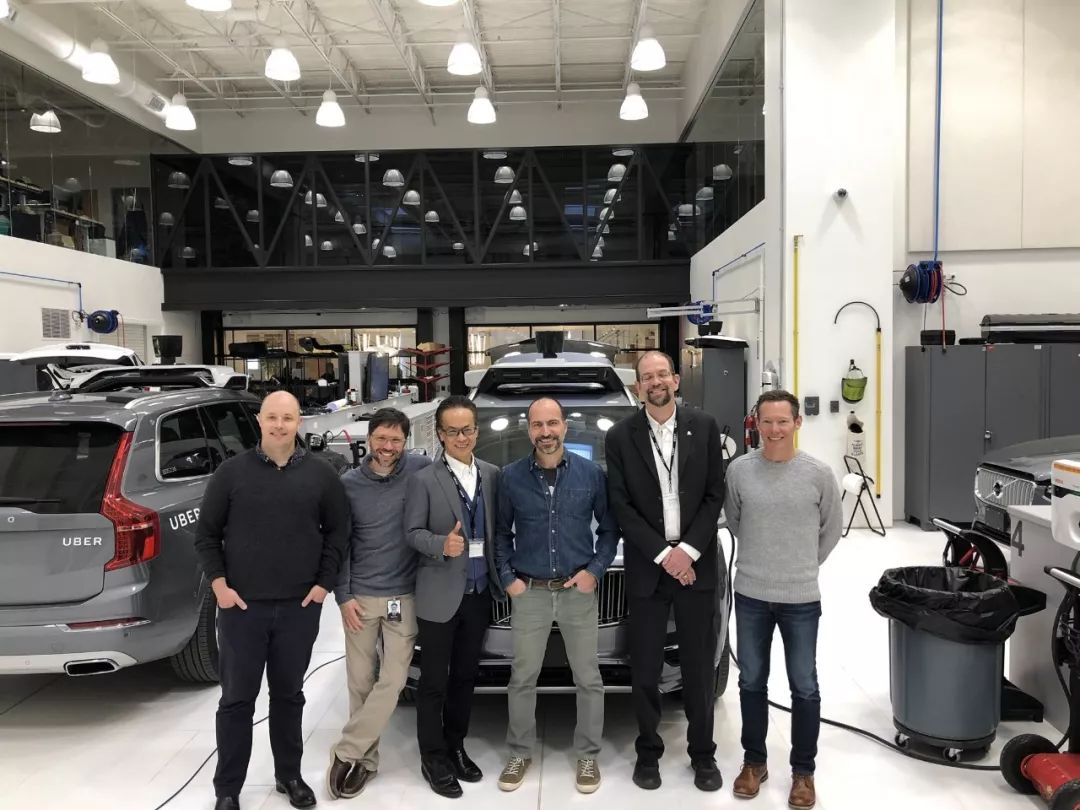

Twenty days later, on March 14, the management of both companies met again, this time at Uber’s self-driving car modification workshop. In addition to Dara and Shigeki Tomoyama, Dr. Gill Pratt, CEO of Toyota’s Research Institute, and Eric Meyhofer, VP of Uber’s Advanced Technologies Group, responsible for autonomous driving car research and development, also joined the discussion.

Eric Meyhofer joined Uber in 2015 and became the head of Uber’s autonomous driving business in May 2017, reporting directly to Dara. The Toyota Research Institute (TRI) is focused on developing autonomous cars, and in April 2018, Toyota announced the formation of a new company called Toyota Research Institute-Advanced Development (TRI-AD) with a team of 1,000 people, headed by Dr. Gill Pratt as the chairman.

Unfortunately, just two days after the meeting, Uber’s autonomous vehicle was involved in a fatal accident.

Toyota was also affected by the incident and was one of the first car companies to announce the suspension of autonomous vehicle testing and increased evaluation after the fatal accident.

However, both parties confirmed their plans to deepen their cooperation, with Dara and Shigeki Tomoyama present.

Collaboration details

Let’s take a look at the announcements from both companies and compare them.

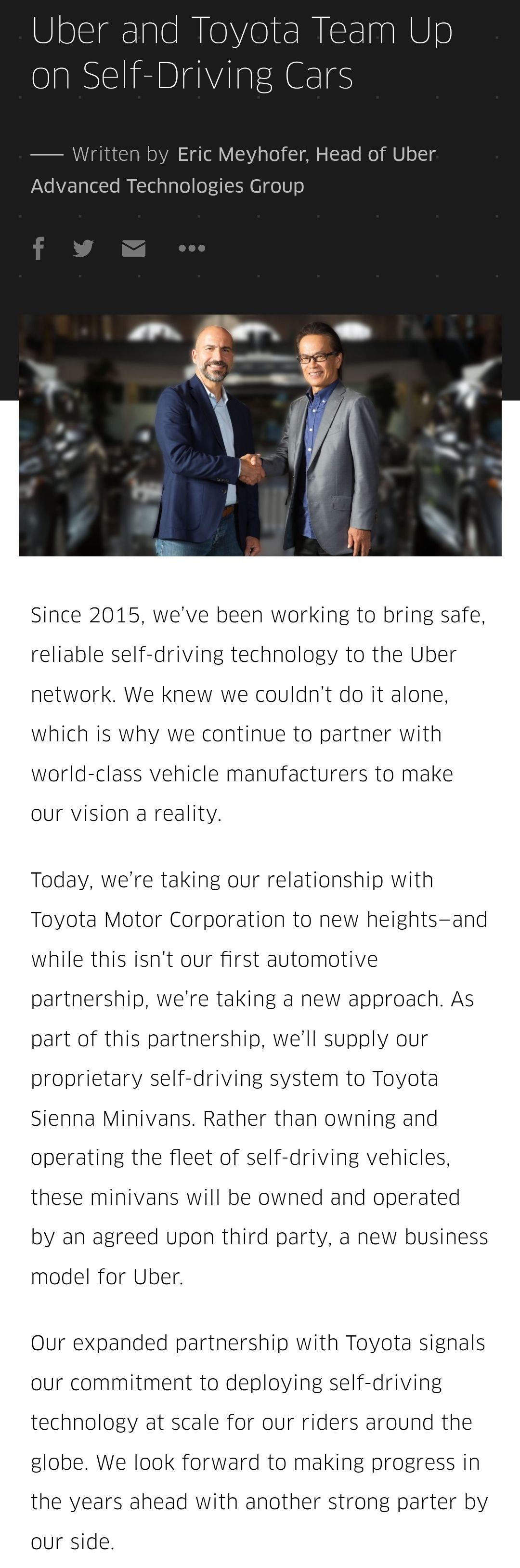

Uber’s announcement is simple and was personally written by Eric Meyhofer, while Toyota’s is lengthy, with a significant portion dedicated to the speeches from the leaders. This highlights the differences in PR approaches between internet companies that value efficiency and traditional automakers that prioritize following regulations and procedures.

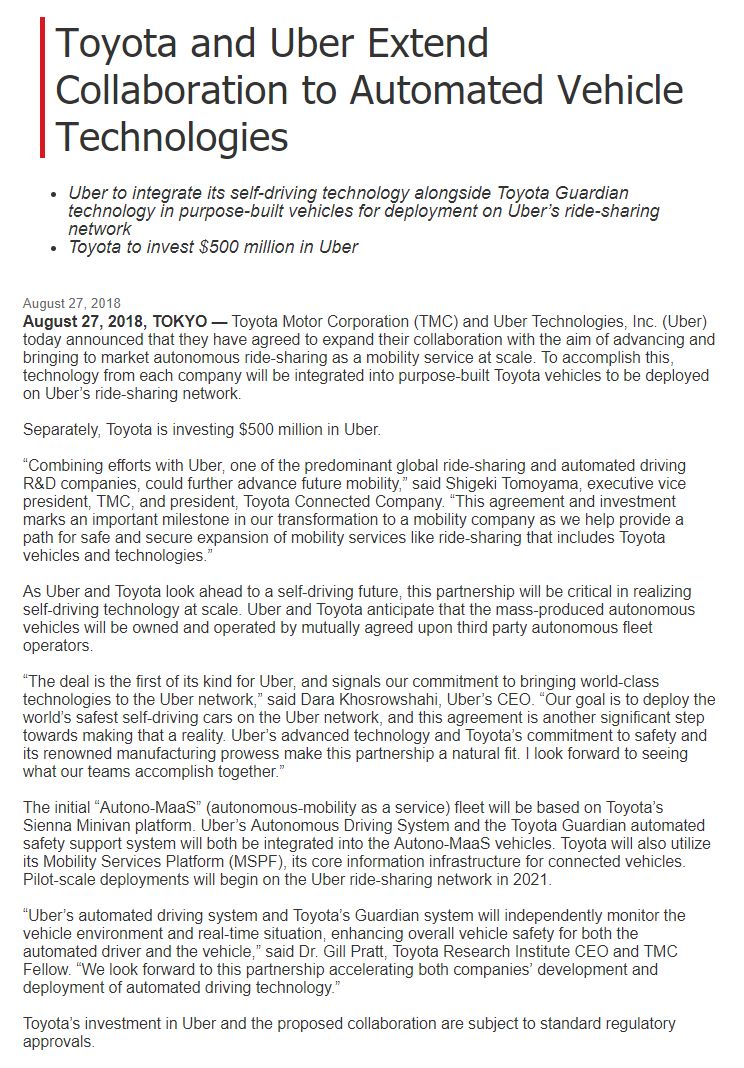

However, Toyota’s announcement does provide more details, which can be summarized as follows:

-

As an important milestone in Toyota’s transition process, Toyota will invest $500 million in Uber.

-

The fleet carrying Uber’s autonomous driving system will be developed based on the Toyota Sienna platform.

-

The fleet will also integrate Toyota’s TRI-researched Guardian (Advanced Driving Assistance) system.

-

The two systems will independently monitor and collect the vehicle’s operation and real-time road conditions.

-

The fleet will be deployed on the Uber ride platform as early as 2021.

How to view

Here are two interesting points worth highlighting. First, this may be the first fleet in the industry to integrate two independent systems. In my opinion, Toyota’s anxiety in the field of autonomous driving is evident in its adherence to joint development of autonomous driving cars with Uber, even after the latter’s car accident.

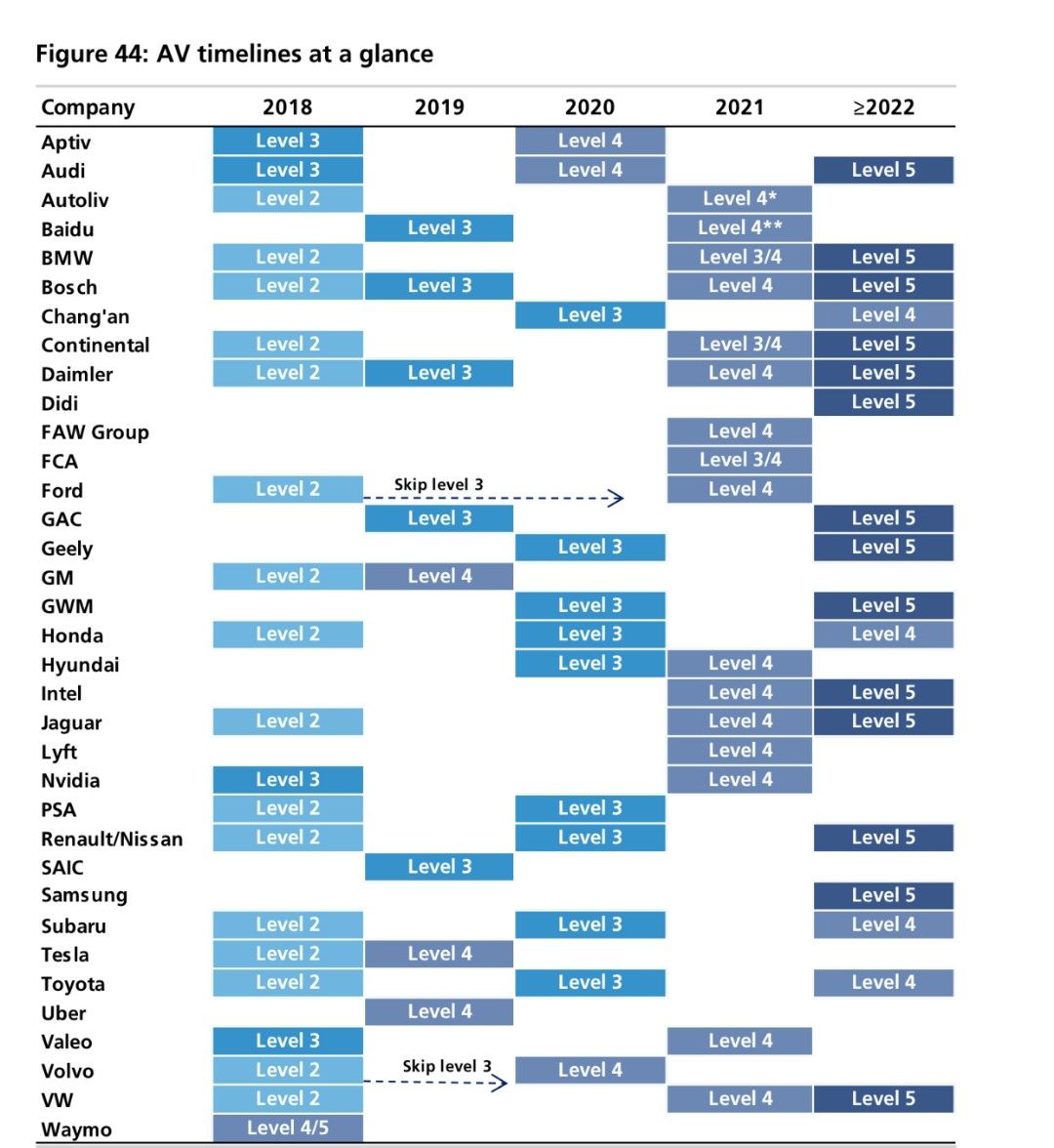

Why do I say that? Toyota’s TRI team is simultaneously developing two systems, one is the advanced driving assistance system Guardian, and the other is the fully autonomous driving system Chauffeur. The former can be simply understood as an SAE L2/3 self-driving system, while the latter is a true L4/5 autonomous driving system.

Why is Toyota so concerned about integrating Uber’s L4 autonomous driving system and its own L2/3 level system in the same fleet? My understanding is that the Toyota TRI team may have realized through technical analysis that it cannot independently commercialize the L4 autonomous driving system by 2021.

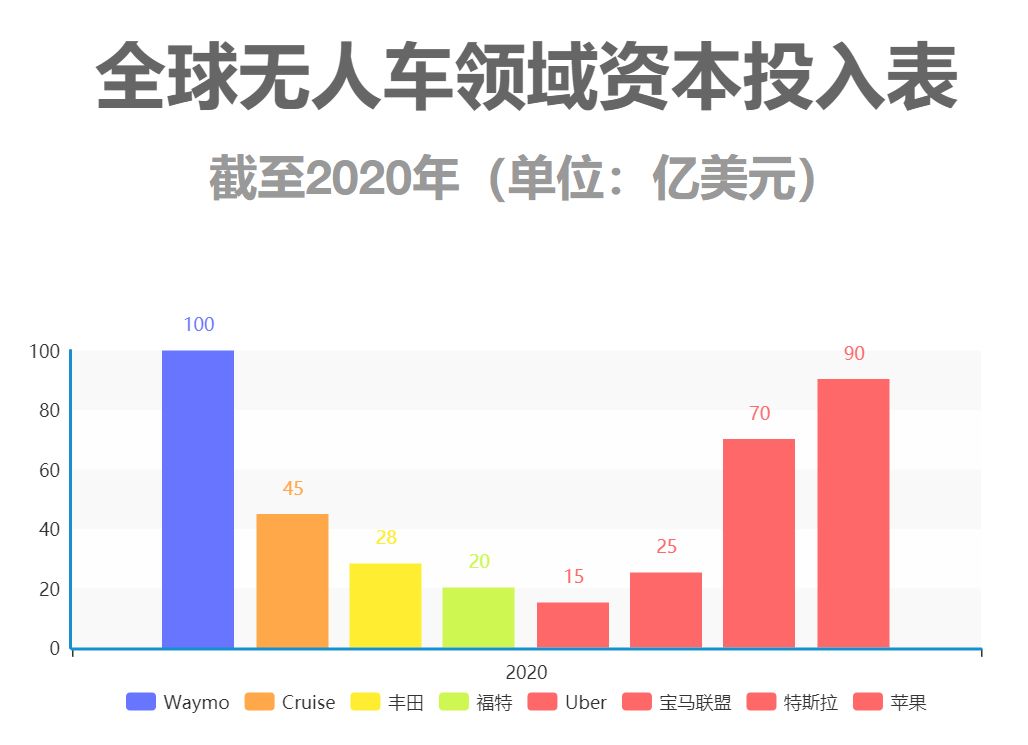

But even if we don’t mention the radicals such as Waymo, Cruise, or Tesla, 2021 is the year of commercialization of L4 self-driving cars. Prior to this, Toyota was one of the few automakers to choose to land L4 after 2022. Of course, after today’s cooperation, the chart below needs to be updated.

I mentioned in my article “The Endgame of Self-Driving Industry in 2018” that Toyota is one of the few car companies in the world that is temporarily lagging behind in the autonomous driving industry, but has the potential to catch up.

I mentioned in my article “The Endgame of Self-Driving Industry in 2018” that Toyota is one of the few car companies in the world that is temporarily lagging behind in the autonomous driving industry, but has the potential to catch up.

Toyota plans to invest JPY 300 billion (approximately USD 2.8 billion) in the next few years to accelerate the development of autonomous driving technology. However, in 2017, Toyota’s revenue reached USD 254.7 billion with a net profit of USD 16.9 billion, making it the double champion of the automotive industry in terms of revenue and profit.

Therefore, with Toyota’s financial status, if USD 500 million can buy L4 commercialization one year in advance, this investment does not need too much discussion.

Of course, whether Uber ATG is worth USD 500 million, especially with a valuation as high as USD 72 billion, is questionable.

Uber’s self-driving business can be described as “early bird catches the worm”. In 2015, Uber founder Travis Kalanick served as CEO, and with very efficient execution, he built a large-scale team to promote the development of self-driving technology for more than a year.

Until today, after experiencing two fatal incidents and layoffs of 400 people, Uber ATG still operates a team of over 1,000 people and a fleet of 300 vehicles, with a cumulative road test mileage of 5 million miles. These indicators should be included in the top five in the autonomous driving industry worldwide.But it’s still the same team. Because of the overly aggressive testing strategy, Uber caused the first ever autonomous vehicle-related fatality. In other words, Uber burned a lot of money and built a large-scale R&D team, but due to factors such as R&D strategy, executive turnover in the past two years, and the Waymo lawsuit, the final technological progress was not considered ahead.

Maintaining such a large team is very expensive. Previously, foreign media The Information reported that the ATG team burned about $125-200 million in every quarter over the past six quarters. Therefore, shareholders with listing cash out demands propose to sell the autonomous driving business, and CEO Dara is unlikely to oppose it.

Since Dara became Uber’s CEO, he has successively sold Uber’s Southeast Asian business, vigorously developed food delivery and freight platforms, and acquired/launched electric bike-sharing, with the company’s strategy completely different from that in the time of Travis Kalanick, which focused on travel platform subsidies, waging wars around the world, and advancing autonomous driving R&D. The former aims to reduce losses, improve financial performance, sprint for listing, and the latter is willing to tolerate burning money, continuous expansion, and winning in the future.

So from Dara’s perspective, accepting a $500 million investment and a very powerful car manufacturer partner, he should be pleased with it.

Finally, let’s summarize: Can Toyota win the next decade by investing $500 million in Uber and obtaining its ticket to autonomous driving? Well, it’s safe to say that this combination holds capital and talent that make them part of the top tier. The next step is to see if they have efficient and sustainable execution capabilities.

Looking at the Endgame of Autonomous Driving Industry in 2018

* NIO, XPeng, and their progress in autonomous driving

* NIO, XPeng, and their progress in autonomous driving

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.