Entering 2018, the autonomous driving field has once again become a hot topic, starting with Waymo’s order of 20,000 Jaguar I-PACEs. In this article, I will share some of my recent observations in the autonomous driving field. If you have different views, please feel free to comment and exchange at the end of the article.

There has never been a bubble in the autonomous driving field

Considering the complexity of the technology and the uncertainty of commercialization, autonomous driving has been considered a capital-intensive industry from the beginning. However, at the end of 2016, many industry insiders and research institutions believed that the field had seen a bubble. Three typical acquisitions are as follows:

- General Motors’ $1 billion cash and options acquisition of Cruise Automation;

- Uber’s $680 million acquisition of Otto, plus a $300 million cooperation with Volvo;

- Ford’s $1 billion cash and options acquisition of Argo.ai.

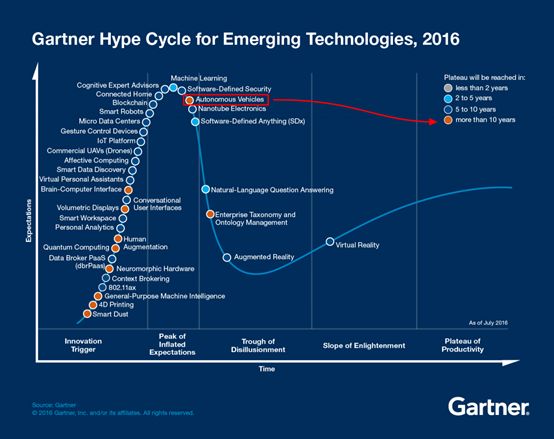

The background here is that the startup companies successfully acquired at a valuation of $1 billion or more had team sizes of less than 50 people. Therefore, in August 2016, the Hype Cycle for Autonomous Vehicles in Gartner’s technology maturity curve peaked at the Peak of Inflated Expectations.

Gartner believes that in 2016, autonomous vehicles were overly hyped by the mainstream media, resulting in unrealistic and excessively high expectations for this technology. Autonomous vehicles still require at least 10 years to mature and become popular.

Gartner’s technology maturity curve has a considerable influence on the industry, and many enterprises use it as a judgment basis for evaluating emerging technologies and making significant investment decisions.

So it’s obvious that there was a bubble in the autonomous driving field?

I think it is the scarcity of talent and the capital-intensive nature of the industry that led to miscalculations by research institutions and investors.

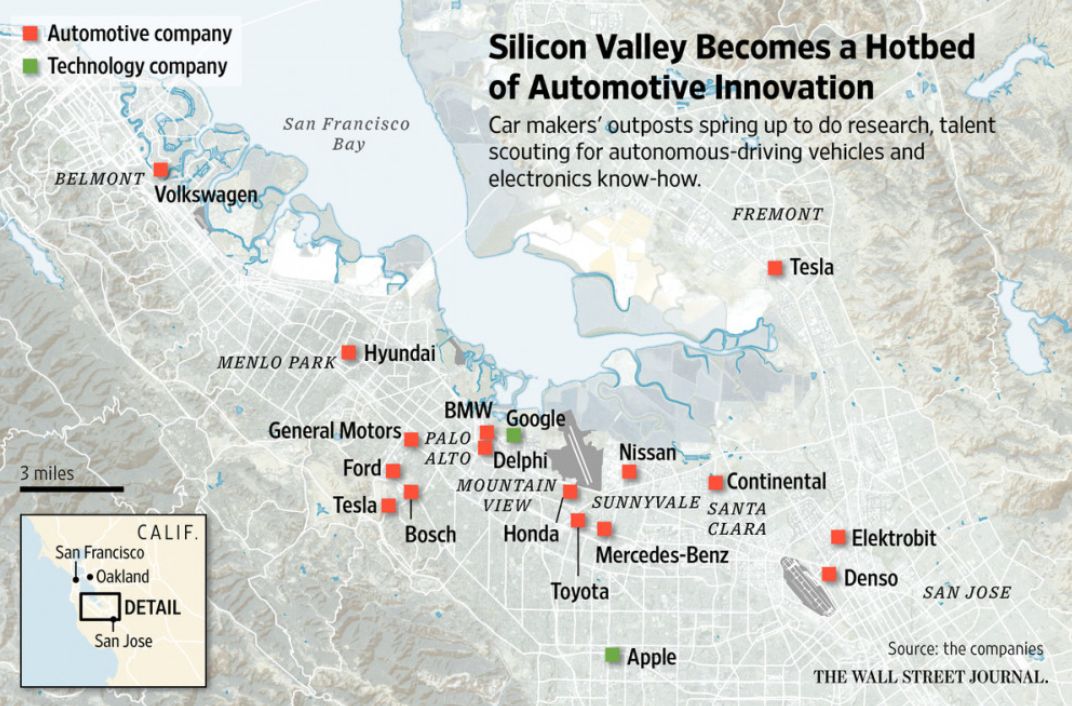

In fact, there are 55 autonomous driving research and development companies approved for autonomous driving licenses by the California Department of Motor Vehicles (DMV) today. If you include unapproved companies, this number far exceeds 100. This further highlights the scarcity of talent.

There are at least 20 startup companies whose core research and development teams come from the four major autonomous driving talent training camps: Waymo, Uber, Baidu USA and Tesla, indicating high frequency of talent flow in the autonomous driving industry.

There are at least 20 startup companies whose core research and development teams come from the four major autonomous driving talent training camps: Waymo, Uber, Baidu USA and Tesla, indicating high frequency of talent flow in the autonomous driving industry.

The second characteristic is capital intensive.

By 2018, General Motors’ Cruise fleet had about 180 vehicles, with a team size of over 800 people; Uber’s fleet reached 300 vehicles, with test mileage of 5 million miles; and the smallest Ford Argo.ai team had a team size of 350, and their fleet’s test mileage is unknown.

The following are arithmetic problems:

-

Establish a team of more than 300 autonomous driving engineers with an average salary of 300,000 USD per year;

-

Establish a test fleet of at least 100 autonomous vehicles, with a cost of 350,000 USD per vehicle for transformation;

-

Establish a safety testing team that matches the fleet size;

-

The cost of operation and energy consumption for the test fleet of 100 vehicles running for two years.

10 billion USD is a fair and logical price.

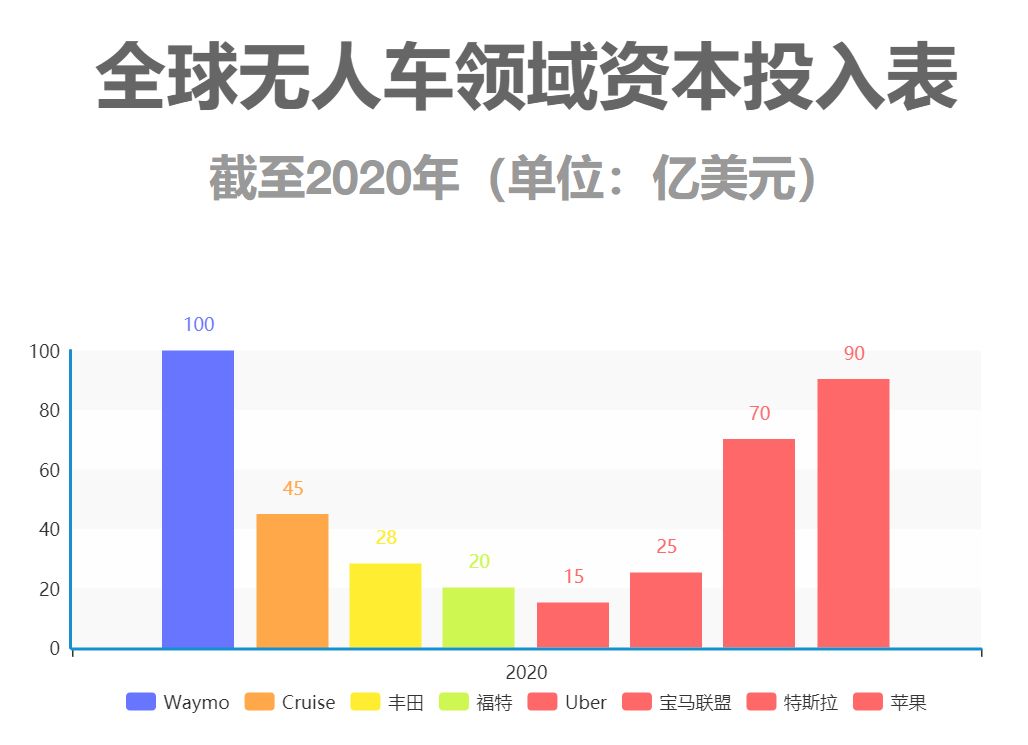

And if you need more convincing, take a look at how much money the giants spent on technology commercialization:

Waymo: A fleet of 62,000 Chrysler Pacific test vehicles + 20,000 Jaguar I-PACE test vehicles + corresponding operation and maintenance costs, even with cost savings from scale, Waymo’s investment is well over billions of US dollars.

General Motors Cruise: acquisition of $1 billion + GM’s additional $1.1 billion + Softbank’s $2.25 billion + factory renovation by GM, conservatively estimated at $4.5 billion.

Toyota: “Investing 300 billion yen (approximately $2.8 billion) over the next few years to develop a team of 1,000 employees.” Let’s assume that “the next few years” is before 2020.

Ford: Invest $4 billion by 2023 (including $1 billion for Argo.ai acquisition) to develop autonomous driving technology, estimated to have invested $2 billion by 2020.

(The red columns of Uber and others are estimated based on objective conditions and may differ greatly from the actual situation.)

Uber: First, a wave of executive departures, followed by a fatal self-driving car crash; then professional managers became CEO, changing the focus from development to market listing; estimated to have invested a total of $1.5 billion by 2020.

BMW Alliance: The powerful alliance consists of BMW, Chrysler, Intel, Mobileye, Delphi, and Continental; the drawback is the conservative commercial plan with an estimated cost of 2.5 billion dollars.

BMW Alliance: The powerful alliance consists of BMW, Chrysler, Intel, Mobileye, Delphi, and Continental; the drawback is the conservative commercial plan with an estimated cost of 2.5 billion dollars.

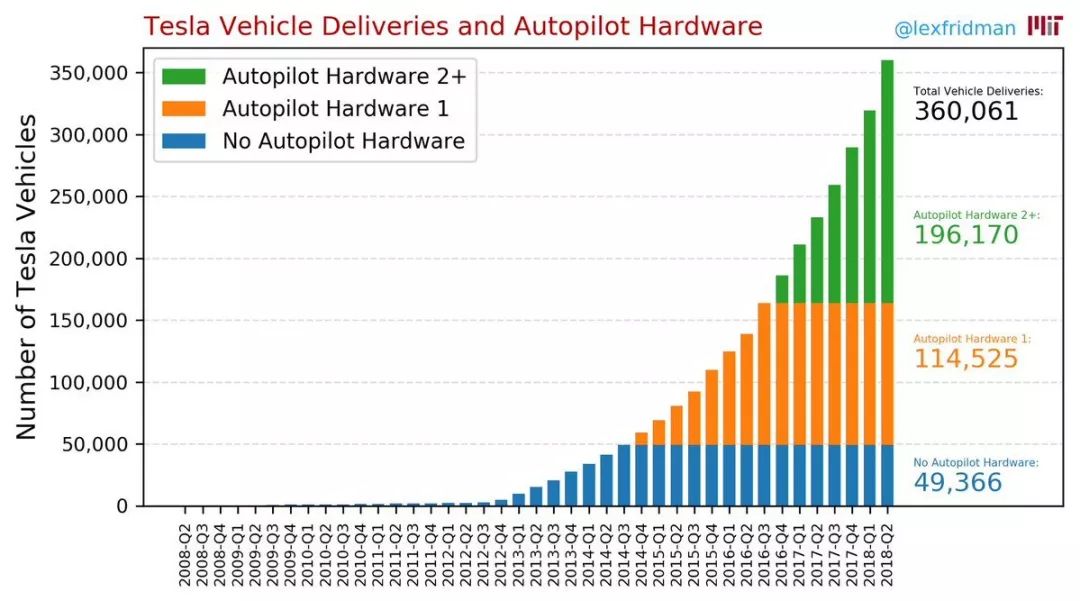

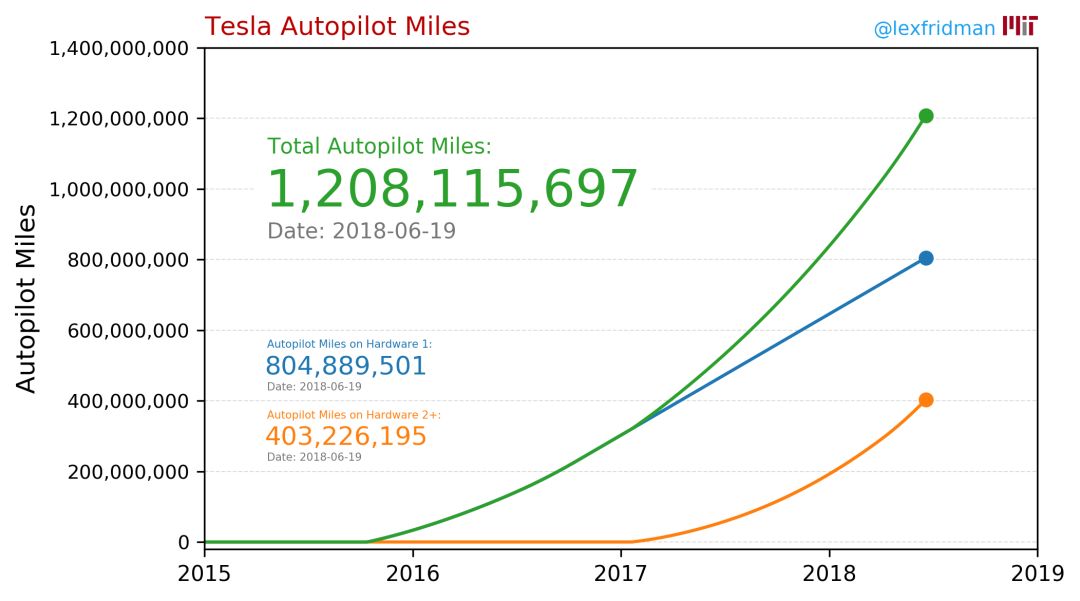

Tesla: One of the biggest variables in the autonomous driving industry. As of August 2018, the number of Autopilot 2.0 cars reached 200,000 with over 400 million miles of collected road test data. The road test fleet is expected to reach 600,000-900,000 by 2020. The AP 3.0 car model, equipped with an autonomous driving AI chip, is set for mass production in Q1 2019. The expected cost of comparable investment in autonomous driving technology is 7 billion dollars by 2020.

Apple: One of the biggest variables in the autonomous driving industry. According to my sources, Apple has already achieved a very leading level of technology capability. Currently, the order of ranking between Apple, Waymo, and General Motors cannot be confirmed, with an estimated cost of 9 billion dollars.

Waymo has the strongest technology capability among the aforementioned leaders. The trend of Waymo’s road test mileage is very close to an exponential growth model.

Waymo also has the fastest commercialization pace. Waymo previously announced four commercial applications:

-

Robo-taxi

-

Autonomous trucking

-

Technology licensing

-

Last-mile service (transporting passengers to bus/subway stations)

Waymo’s advanced technology capability and well-planned commercialization strategy have brought it excellent market returns: In a UBS report, Waymo is the only company in the industry to produce L4 level autonomous driving cars in 2018. In a Morgan Stanley report, Waymo’s latest valuation reached 175 billion dollars.

There has never been a bubble in the autonomous driving field, only heavy capital investment required to transform from demo to commercialization, which raised the competition threshold significantly. Perhaps it should be expressed in this way: From a capital perspective, the autonomous driving taxi (Robo-taxi) business is not suitable for independent startups.

What should traditional automotive giants do?Capital-intensive feature basically blocks the possibility of start-up companies to overthrow traditional automotive giants. In addition, the technology-intensive and the understanding of vehicle regulations, technology, and safety that traditional automotive giants have cultivated for hundreds of years, almost blocked the road for start-up companies attempting to rise independently.

Considering that the global automotive industry has not been Internet-based so far, there is no so-called zero-sum game. The rules of the Internet that top companies win and others become cannon fodder are not directly applicable to the autonomous driving industry. That is to say, even if Waymo, Apple, and GM take the lead for the time being, it does not mean that other giants have to surrender.

For technology-intensive giants such as Volkswagen and Mercedes-Benz, the practice of GM acquiring (strategic investment) start-up companies is worth learning. When Cruise was acquired, the team had less than 40 employees and only two test cars. Today’s leading position comes from GM’s management’s comprehensive support for autonomous driving business. Specifically, this includes:

-

Thoroughly solve financial problems and allow the team to focus on technology research and development

-

Maintain independence after the acquisition, allowing Cruise to sustain as a start-up company

-

Emphasize on management, promote the integration of vehicle engineering and chassis control teams with software algorithm teams

We have seen some similar combinations, such as Volkswagen + Aurora, GAC + Pony.ai, and so on.

Why is it not a good idea for traditional automotive giants to independently develop autonomous driving cars?

The most critical issue is corporate culture and execution. Although giants have rich experience in production, manufacturing, and vehicle control fields, the large company syndrome, slow decision-making, and low efficiency, combined with completely different operating mechanisms from the Internet industry, make giants’ competitiveness in the field of autonomous driving challenging. On the contrary, Waymo and Cruise, which have taken the lead now, are all small companies with efficient execution.

In addition, giants’ attractiveness to talents is often inferior to start-up companies, and the frequent flow of talents in Baidu Research America, Waymo, and others is typical proof.

In fact, the strategy of cooperating with start-up companies with strong algorithm teams invested/acquired by giants to jointly develop autonomous driving cars, is a comprehensive consideration of the characteristics of giants and start-up companies, maximizing each other’s advantages.

For large companies that are obviously lagging behind and have insufficient capital strength in the field of autonomous driving, there is also a worst-case scenario: “Technology authorization” proposed by Waymo.

Where are the opportunities for start-ups?

In the development of autonomous driving to this day, we have seen many start-up companies gradually running various solutions. The widely promising and relatively typical blue ocean markets are the following three scenarios: unmanned delivery vehicles, unmanned take-out vehicles, and unmanned freight… which are the combinations of the words low-speed, enclosed, and restricted area.The reasons for vertical market segmentation are obvious: as mentioned earlier, due to the capital-intensive, technology-intensive and long design industry chain of the autonomous driving field, the probability of start-ups operating autonomous robo-taxis from scratch to overturn traditional automobile giants is extremely low.

The above-mentioned segmented markets seem to be much more friendly to start-up companies’ commercialization, and are analyzed below one by one:

- Autonomous Freight Transportation

Here are two interesting perspectives: Tesla’s pure electric semi-trailer, Semi Trunk, comes with Autopilot 2.5 hardware as standard equipment, but at the launch event, the company** never mentioned autonomous driving**.

Tesla focused on three ADAS functions: automatic emergency braking, automatic lane keeping, and lane departure warning, as well as Track Platooning function (i.e., the first truck is driven by the driver, and the following trucks automatically follow without the need for a driver, transforming the truck fleet into a “train”).

Uber has two business layouts for the freight market: one is Uber Freight, which aims to match supply and demand on both ends of the freight market; the other is the self-driving truck business of Uber. Earlier this month, Uber announced two business adjustments: resumption of the self-driving car road test plan, which was suspended for only 4 months due to a fatal accident; and termination of the self-driving truck research and development plan.

Representatives of the two radical groups in the autonomous driving field have both stopped the development of self-driving trucks, which is worth our deep consideration.

The common reasons why the autonomous freight transportation market is more easily commercialized are as follows: the high-speed/port scenes corresponding to the freight market are relatively simple; the requirements for algorithm control accuracy for goods (relative to people) are lower; there is a large talent gap in the freight driver industry, etc.

Let’s first talk about the high-speed/intercity highway scenes.

We consider the problem from the perspective of a logistics company: the first item in the total cost of operating the freight industry is the driver’s salary cost, which accounts for 40% of the total cost, followed by the energy consumption cost, which accounts for 26% of the total cost.

Can installing a set of self-driving driving systems developed by a start-up company on a semi-trailer significantly reduce costs?

The answer is no.

Because the current technology capabilities of start-up companies have not yet reached the level to cancel the tester (even in relatively simple scenes such as high-speed/intercity highways). This means that when the vehicle is in autonomous driving mode, the tester must sit in the driver’s seat to take over unexpected situations at any time.

Let’s briefly explain the logistics company’s thinking logic: TCO is the first law of freight and travel.

(Total Cost of Ownership: that is, the total ownership cost, including the cost of purchasing products to the cost of using and maintaining them in the later period. This is a widely used technical evaluation standard.)

For logistics companies, TCO includes vehicle purchase cost, vehicle insurance, energy consumption cost, maintenance cost, labor cost, accident cost, etc. After-market self-driving systems have greatly reduced accident costs and slightly reduced energy consumption costs, but cannot cover the cost increase of the self-driving system itself.

The commercialization of any segmented market must be based on forming a business closed-loop. If the balance of profits and losses cannot be established, it means that the commercialization node has not yet arrived.

Below is the port scenario.

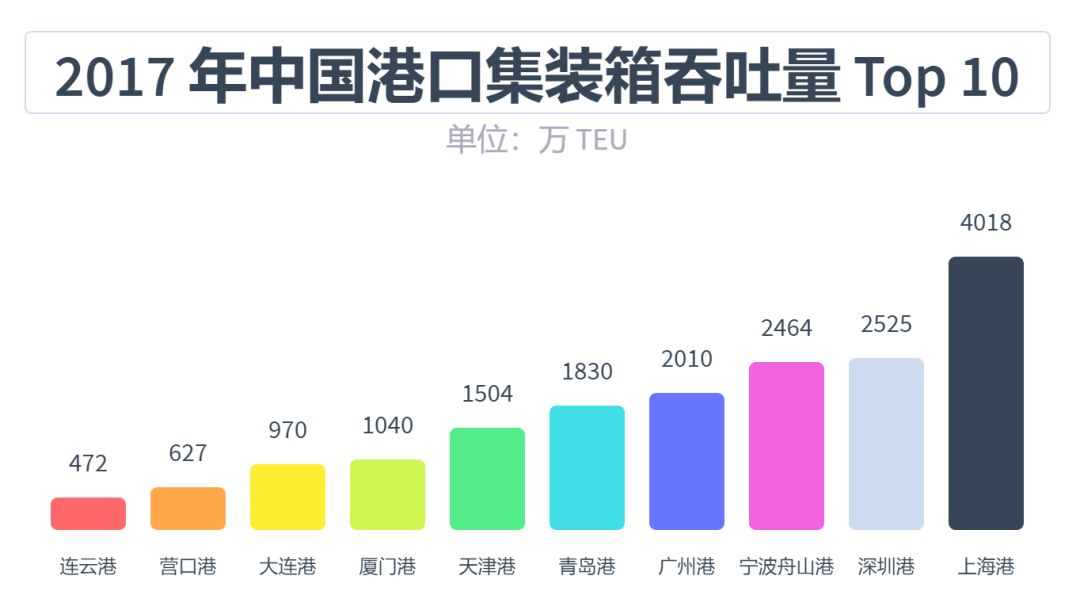

In 2017, 7 of the top 10 ports in the world were in China. The top-ranked Shanghai port had a container throughput of 40.18 million, and the annual growth rate of container throughput of China’s top 10 ports was all above 100%.

The biggest advantage of ports over high-speed/intercity highways is that this scenario is relatively closed, so it is less restricted by policies.

But what closes in can also close out: many ports will choose the AGV (Automated Guided Vehicle) scheme.

AGV refers to the container automatic loading and unloading based on AGV on the critical path of the cargo circulation in the port after installing magnets and building electromagnetic tracks. This is a very mature and highly standardized modern logistics automation equipment.

That is to say, a start-up company’s self-driving system needs to compete with existing mature automation equipment and defeat it in order to have commercialization conditions.

(One more thing: what is the rigid demand of freight and even the entire commercial vehicle field? It is ADAS + convoy driving. This may be a startup opportunity to greatly improve safety and reduce TCO with a low-cost solution.)

- Unmanned logistics and express delivery vehicles

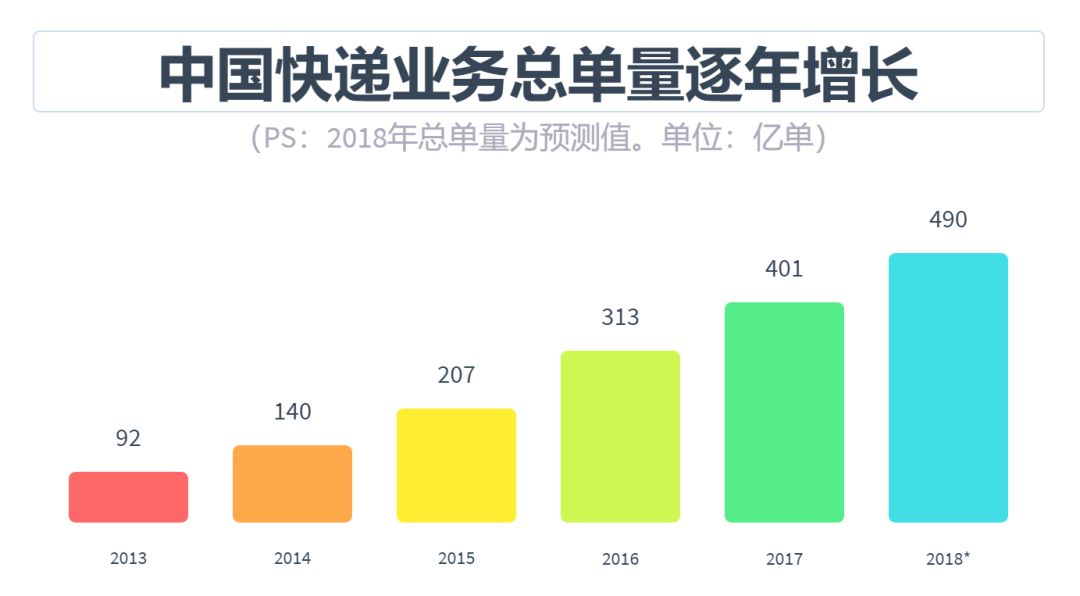

In 2014, China’s express delivery volume exceeded 10 billion pieces, and it is increasing at a rate of 10 billion pieces per year. It is expected to reach 49 billion pieces this year.

On May 19, 2018, the largest domestic takeaway platform announced that the daily orders exceeded 20 million. According to the current growth rate, China’s takeaway market is very likely to exceed 100 million orders/day in the next few years.

In addition, China’s labor costs have increased five times in the decade since 2005. The insufficient transportation capacity during peak periods of takeout/delivery is becoming increasingly prominent.

This is a very good application scenario for self-driving technology.

When breaking down the analysis, we can see that the commercialization of autonomous delivery vehicles for takeout services will be faster than for express delivery services. Here is the specific analysis:

When comparing the cost structure of express delivery and takeout, we can find that the cost of express delivery can be divided into intercity and last mile delivery, while takeout mostly only has the concept of “last mile” delivery. There are very few takeout orders with a distance of more than 30 kilometers. However, for express delivery, the major cost is intercity logistics cost, which brings us back to the discussion of freight mentioned earlier.

Although express delivery in China has become faster and faster, it is still far behind takeout in terms of timeliness. The centralized delivery of transfer stations means that a courier can deliver 100-200 packages per day. But takeout’s timeliness determines that a deliveryman can only handle about 30 orders per day.

A package for express delivery could be a refrigerator or a document. The uncertainty of package size is not friendly to unmanned delivery vehicles. For takeout, its food box size is fixed, which means that the operating efficiency of each takeout delivery vehicle is stable.

Therefore, the unit logistics cost of the last mile category (the scenario covered by autonomous vehicles) for takeout is much higher than for express delivery.

Of course, what we have seen is that Alibaba, JD, SF, Ele.me, and Meituan’s robots have not been widely deployed, mainly because the TCO of current unmanned express delivery/takeout vehicles is still higher than labor costs and the business model is not feasible.

However, considering that sensor costs are rapidly decreasing and China’s express delivery/takeout market has already become an oligopoly, the commercialization of unmanned delivery vehicles will still be faster than that of passenger and commercial vehicles.

Developing autonomous driving technology with Chinese characteristics

In addition to capital and technology, regulation is also an important factor for the commercialization of autonomous driving vehicles.

From a global perspective, the enterprises that have reached the technological and commercialization threshold and begun large-scale investment are widely concentrated in the United States. The United States not only leads rising China in the autonomous driving field, but also surpasses traditional automobile powers such as Germany and Japan. This may be one of the reasons for the cooperation between China and Germany/Japan on standard-setting and data sharing.

Recently, the Shanghai Economic and Information Commission went to the United States to experience Waymo’s autonomous driving vehicles and affirmed Waymo’s “smooth and fluent riding experience,” which strengthens our determination to accelerate the development of autonomous unmanned vehicles.

First-class policies and scenarios, second-class capital and technology, China will develop an autonomous driving ecosystem with characteristics different from Silicon Valley.

This is a unique opportunity for Chinese companies in the autonomous driving industry chain (sensors, algorithms, chips, high-precision maps, platforms).

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.