Tesla is always controversial.

On June 22, 2012, Tesla’s first model, Model S, entered the market. Subsequently, Model X/3 joined, and a luxury brand comparable to BBA was established from scratch. Tesla has comprehensively surpassed same-level luxury brands in car owner satisfaction, employee satisfaction, and shareholder satisfaction over the past six years. Calculated according to the IPO price of $17 per share 8 years ago, Tesla’s stock price has risen by 2000%.

However, since July 1, 2017, after the entire company worked hard and the management team collectively supervised the factory for a year, Tesla still has a backlog of 420,000 Model 3 orders.

What’s more serious is that this tension is not limited to users. In the past two years, Tesla’s relationship with some shareholders, suppliers, employees, competitors, and even short-sellers has been highly tense.

Tesla is experiencing a comprehensive war.

Under the leadership of Elon Musk, Tesla has made various anomalies into norms. Since July 2003, Tesla has only been briefly profitable in two quarters of the past 60 quarters. Since 2016, 40 VP-level executives have left Tesla; when production capacity was at a standstill, the board of directors passed a CEO stock option incentive plan for 10 years, with a total value of $78 billion.

As the de facto leader of the intelligent electric vehicle industry, understanding and clarifying Tesla’s operating logic is essential for automotive industry practitioners, investors, or ordinary consumers.

One step ahead, six years ahead: Tesla is an integrated hardware and software company.

A fundamental premise for Tesla to achieve today’s achievements is the integration of Internet technology and traditional automotive engineering and manufacturing technology as the leader of the industry.

On June 22, 2012, Tesla began delivering Model S. This was a milestone in automotive industry history: Model S was the world’s first smart car. In November that year, Tesla sent a firmware update to all global owners (in fact, only 2,650) adding anti-theft alarms, voice commands, and automatic door handles.”Automatic extended door handles” means that the Model S, which was discontinued in mid-2012, fully integrated the central control system with the car control underlying CAN bus and electronic/electrical architecture. Simply put, this is evidence that Model S has deeply integrated internet and traditional car technology, and possesses intelligent car attributes.

In September 2014, Tesla completed a higher-level challenge: the production of models equipped with Autopilot 1.0. Prior to Tesla, luxury car brands equipped with ADAS systems had become commonplace, with Mercedes-Benz and Volvo being typical examples. However, because the software system and the vehicle’s execution control mechanism were integrated, Tesla was able to continuously improve its ADAS system through whole-car OTA iteration.

Lei Jun once personally visited the Tesla Fremont factory to experience the Model S, and concluded that “Tesla’s design thinking and functional service implementation level compared to other cars is an outstanding performance of the difference between mobile Internet applications and standalone local computing.”

We see many CEOs of car companies talking about concepts such as wheeled robots and smart cars today. In 2014, Elon Musk introduced the AP 1.0 model and said, “We really designed the Model S to be a very sophisticated computer on wheels. Tesla is a software company as much as it is a hardware company.” Cars are no longer just hardware but are becoming electronic devices.

On May 31, 2018, Li Tianshu, the owner of the first NIO ES8 vehicle and NOMI’s product manager, received the keys to his ES8. NIO thus became the world’s second truly intelligent car brand that supports whole-vehicle OTA. From this perspective, Tesla has been ahead of the industry in exploring intelligence for nearly six years.

Why haven’t world-class car manufacturers like Volkswagen, Toyota, and General Motors launched smart cars yet?

Accelerate the world’s transition to sustainable energy and seize three blue ocean markets with a closed-loop energy product strategy.

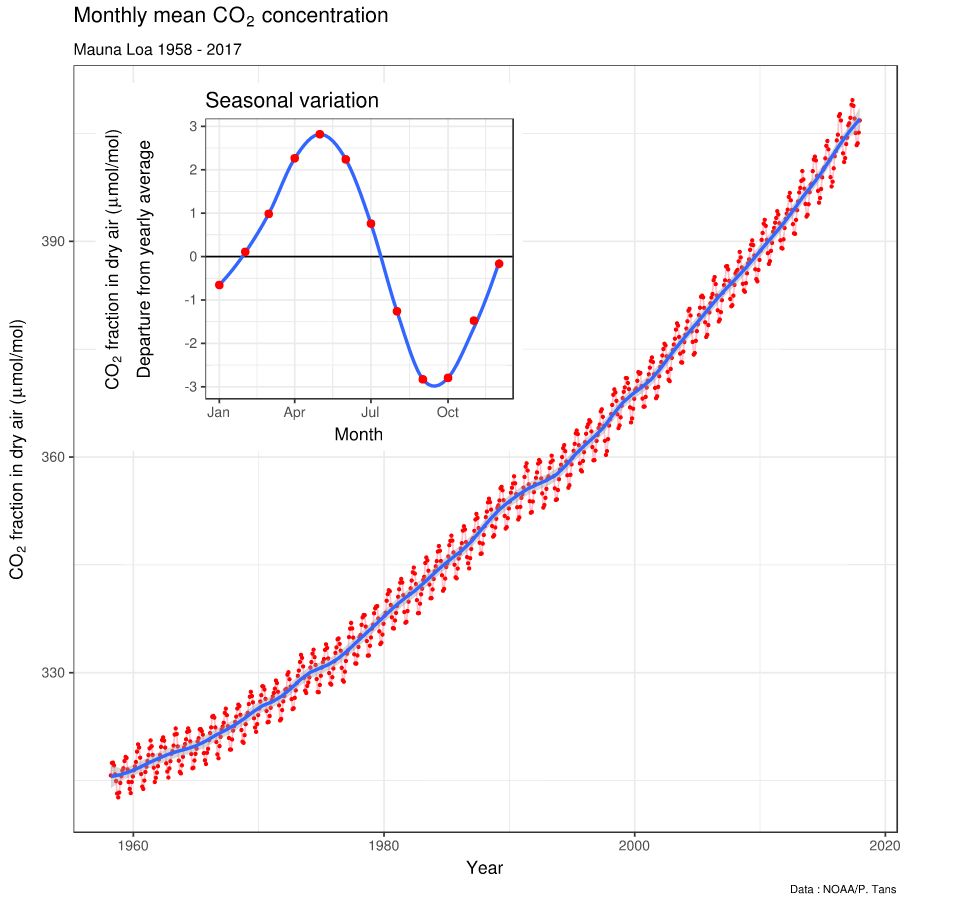

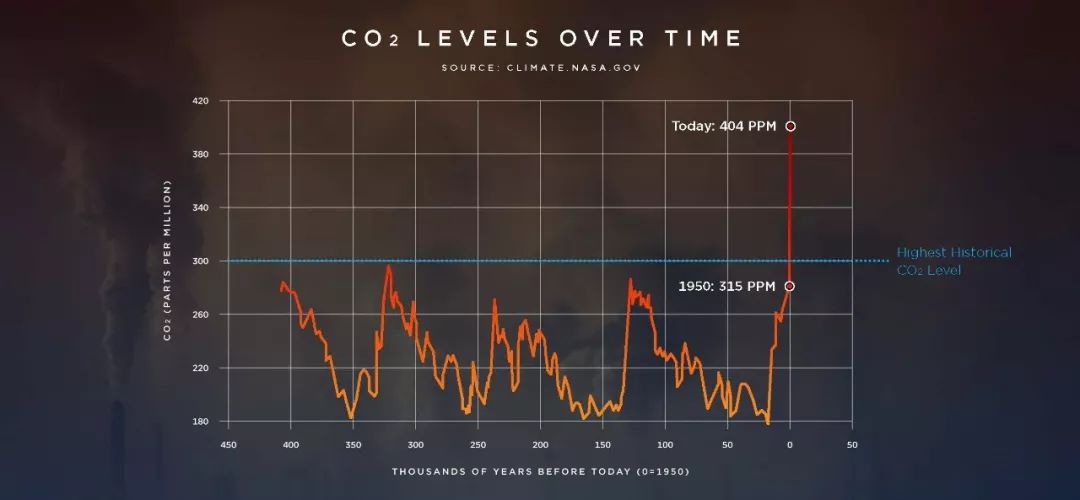

Open the Tesla website: accelerating the world’s transition to sustainable energy. This is the mission that Elon Musk emphasizes at every Tesla product launch. At the same time, the Kellingley Curve graph always appears on the PPT behind him.

Since investing in Solarcity in 2006 to become its largest shareholder, pushing Tesla to develop energy storage devices Powerwall and Powerpack in 2012, establishing the Tesla Energy business unit in August 2015, and acquiring Solarcity in August 2016, Elon Musk has been leading the way in a one-stop closed-loop sustainable energy solution.

Through solar power generation and energy storage products, Tesla aims to address the original sin of “decentralized emissions from electric vehicles becoming centralized emissions from power plants” and accelerate the world’s transition to sustainable energy. This is the reason why Tesla’s product line covers the entire life cycle of energy production, storage, and use.

During the SolarRoof launch event in 2016, Elon Musk expressed concerns about the permanent exceedance of the 400 ppm warning line for carbon dioxide concentration. Many climate scientists believe that this concentration will have catastrophic effects on the environment.

However, these are ultimately macro and idealistic reasons.

As electric vehicles become more prevalent, we will gradually realize that solar panels, energy storage products, and charging networks have identical attributes and are all part of the electric vehicle industry chain, belonging to a huge blue ocean market.

In a public speech in 2015, Tesla CTO J.B. Straubel explained from a micro perspective why widespread adoption of electric vehicles is inseparable from solar power and energy storage products.

About 100 million new cars are sold worldwide every year, and there are approximately two billion cars on the road. We expect the number of electric vehicles to reach one million by 2020 (in fact, global sales of pure electric vehicles reached 1.224 million in 2017, three years ahead of Straubel’s prediction). One full charge of these vehicles, calculated based on an average of 70 kWh per battery pack, requires a whopping 70 GWh of energy.

Meanwhile, as social productivity continues to develop globally, the demand for electricity in other areas is also growing, and the global energy network will see an increasingly severe power shortage.Following Straubel’s thinking, by 2021-2022, fast charging with 200 kW – 350 kW will become popular, and the electric vehicle ownership will reach 13 million vehicles (according to the International Energy Agency’s forecast). As a result, global energy networks will experience more severe supply-demand imbalances.

Equipping charging stations with energy storage products solves the intermittent supply and high volatility issues of solar power. From the perspective of the national power grid, energy storage products greatly reduce the pressure of instantaneous peak load on power consumption, shaving peaks and filling valleys. At the same time, they provide power support during major natural disasters that cause power grid failures. Behind all of this is the huge comprehensive efficiency improvement of the entire national energy system.

Today’s Tesla Energy has a series of product combinations, including the Powerwall for home energy storage, Powerpack for commercial and utility energy storage, SolarRoof for home solar power and renewable microgrids for commercial and utility solar power.

For Tesla, energy and automotive businesses are two equally important businesses; Straubel publicly states that the energy business is the absolute core to achieving Tesla’s mission. After completing the acquisition of SolarCity, Tesla announced the introduction of Panasonic’s investment, and the large-scale expansion of SolarCity’s factory in Buffalo, New York, renaming it Gigafactory 2.

In fact, traditional electric car manufacturers such as Nissan, BMW, and General Motors are also expanding into the energy storage business. The difference is that traditional car manufacturers choose to collaborate with other companies, while Tesla eventually chooses to independently develop solar panels, energy storage batteries, and an entire energy management system, which is the most difficult and heaviest development model.

Later, we will discuss how this model is coupled with Tesla’s other development strategies to produce extremely strong comprehensive competitiveness.

Continuous Mistake-Making, Continuous Correction, Continuous Evolution

Today, Tesla appears to be extraordinarily fast, accurate, and ruthless, despite being surrounded by negative news. The sales performance and super product power demonstrate that Tesla has the potential to become the “Apple” of the smart car industry.

However, in reality, Tesla has made many mistakes in its history. What has really driven Tesla’s success today is the management, the organization’s superb ability to correct mistakes and evolve, all led by Elon Musk.

In February 2008, 13 months before the release of the Model S, then-Tesla CEO Ze’ev Drori announced that the “WhiteStar” (internal product code for the Model S) would have two versions: a pure electric version and a plug-in hybrid version.Elon Musk explained that the extended range version of the Model S had a pure electric range of up to 60-80 km (side note: how could the 2017 Mercedes-Benz S 500eL, priced at 1.758 million yuan, have the audacity to offer only 32 km of pure electric range a decade later?), but in order to address range anxiety among some users, Tesla had to introduce the extended range version.

Six months later, Elon Musk announced that the extended range project had been terminated. In addition to the more complex engineering challenges, the bigger problem was that the pure electric version and the extended range version required different battery cycle times. Advancing both models at the same time would have caused Tesla’s research and development team to be too distracted and unable to focus on improving the user experience of electric vehicles.

The background here is that in 2010, just two years later, Tesla had only 899 employees, and the consequences of such a stretched research and development effort were unimaginable. In fact, Tesla’s management’s gamble-like research and development strategy made the team’s goals clear, with all efforts focused on breakthroughs in the engineering challenges of pure electric vehicles.

The end result was that Model S’s excellent product power received full praise from consumers, industry insiders, and even regulatory agencies, including breaking Consumer Reports’ rating category with a score of 103 and a record-breaking 99 consumer satisfaction rating.

By leading the world’s transportation industry electrification process, Tesla aims to build the most competitive car company of the 21st century.

This sentence was included in Tesla’s public BP homepage in late August 2011. In the 27-page BP, not a single page mentioned “smart.” At the time, Tesla categorized the core competitiveness of Model S as technology, design, and performance.

Standing in 2018, we can clearly see that more and more car companies are launching high-performance pure electric vehicles. Why hasn’t a Tesla-style blockbuster appeared? Now, the Model S/X/3 and even the not-yet-released Model Y have benchmark competitors in the market. But only Model S accumulated 15,000 orders in six months after its launch; Model X accumulated 30,000 pre-delivery orders; and Model 3 accumulated 455,000 pre- delivery orders.

The answer is simple and clear: pure electric is the prerequisite for achieving intelligence, and intelligence is the core of the future competition in the automotive industry.Translate the following Markdown text from Chinese to English, in a professional way, retaining the HTML tags inside the Markdown, and only output the result.

We all know about the subsequent corrections: Tesla, who was proud of “electric”, at the end of August 2011, stopped mentioning what technology, design, and performance (all of which are the basis for implementing intelligence) three years later, iterating Model S as “a very complex and tightly integrated computer on wheels“.

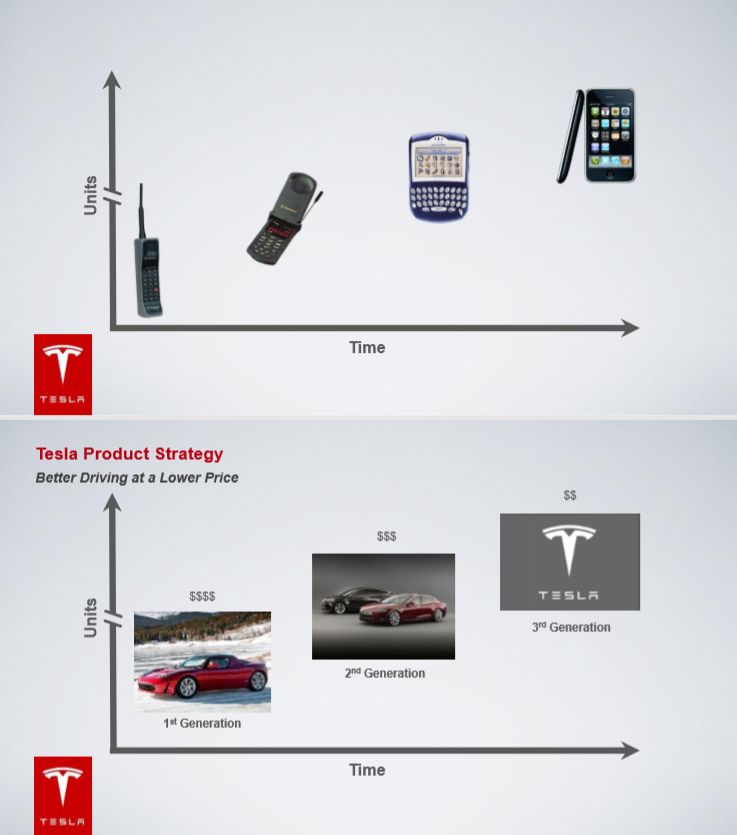

In fact, Tesla’s evolution was earlier than we imagined: in the Tesla investor PPT in January 2014, it was already explicitly stated that Tesla will lead the automotive industry from functional products to intelligent products, just like Apple launched the revolution in the mobile phone industry.

First Principle: The Inevitable Road to Greatness

Elon Musk’s admiration for first principles is astonishing. Due to the powerful potential of the first principle, all companies supported by him, including Space X, The Boring Company, Neuralink, and OpenAI, are without exception the most innovative in their respective fields.

Below is a brief summary of the first principles. Then, we will sort out how terrible Tesla’s competitive advantage is due to the comprehensive application of the first principle in the development process, combined with other values of Tesla.

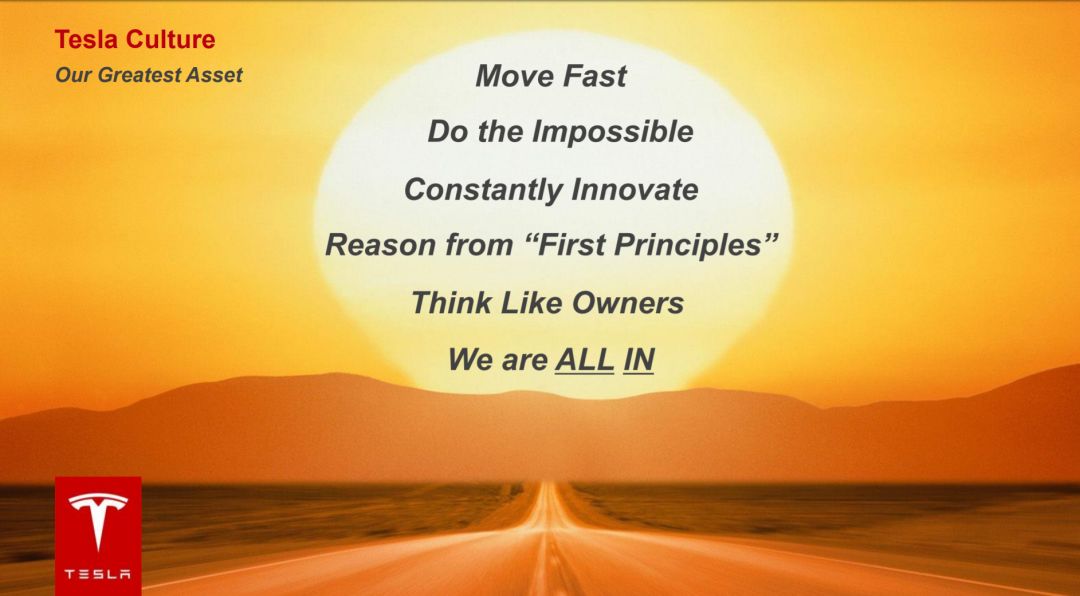

Rapid action, pushing limits, continuous innovation, thinking from first principles, focusing on users, and going all out.

The so-called first principle is to simplify things into the most basic parts, which are also the foundation of the entire system.

Anything has its own first principles, which are the most basic propositions or assumptions that cannot be simplified or removed or overturned.

Elon Musk has shared the case of Space X and Tesla, applying the first principles to think:

What is the rocket made of? Aerospace-grade aluminum, plus some titanium, copper, and carbon fibers. The cost of these raw materials is only 2% of the price of one rocket. Why don’t we make rockets ourselves?

What materials are batteries made of? Carbon, nickel, aluminum, and some polymers. If we buy these raw materials from the London Metal Exchange and make them into batteries, you will find that even with the manufacturing cost added, the battery cost is only $80/kWh.To think about the automobile industry from the first principles, it should be expressed as follows: “The raw materials used in automobile manufacturing are the main factors affecting product costs. For all car companies, everything in the manufacturing process is fair competition. Tesla can completely challenge the limits of physics from the perspective of improving efficiency and reinvent the entire process.”

Why didn’t traditional automakers launch high-end luxury pure electric vehicles like the Model S before Tesla?

Dieter Zetsche, the former Global Chairman of Daimler who owned 9% of Tesla shares (now divested), once said that Tesla gave electric cars passion and positive elements, breaking the image of electric cars being impractical and becoming a symbol of performance and fashion. Thanks to Tesla opening the market, Daimler paved the way.

In short, electric cars were seen as impractical and had a bleak future because the industry chain of batteries, motors, and controllers was immature, costs were high, and product performance was poor. The user experience of electric cars was far behind that of traditional fuel cars.

What did Tesla do to improve the user experience of electric cars?

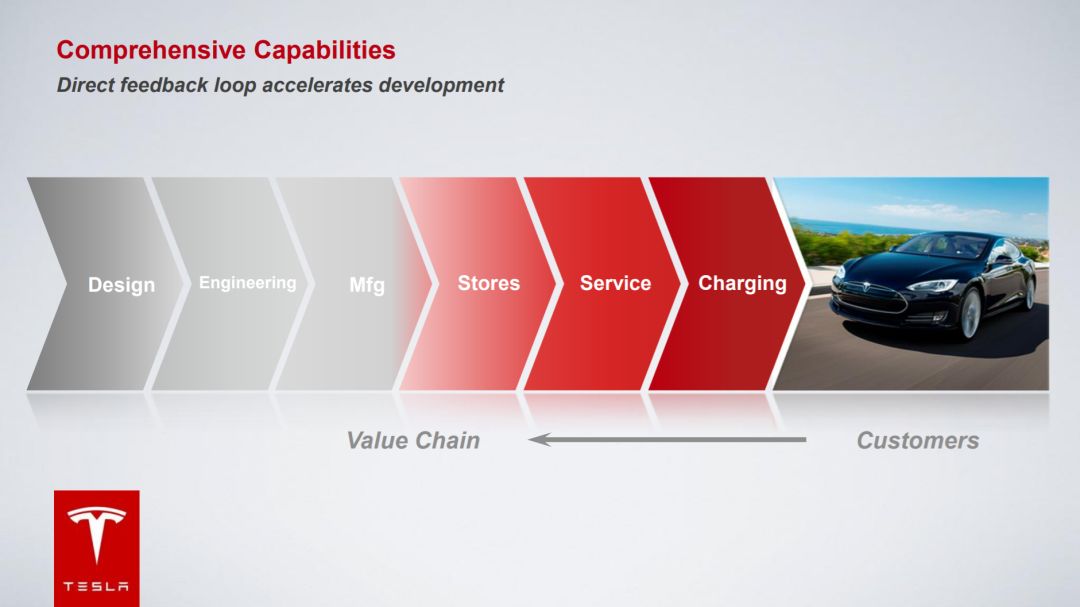

By thinking about the six major links of design, engineering, manufacturing, store (direct sales), service, and charging from the first principles, Tesla has formed a positive feedback loop for accelerated development, improving the user experience of pure electric cars.

- Design

On the basis of ensuring the elegant shape, comprehensively introduce the ultra-low aerodynamic drag design to reduce energy consumption and improve cruising range. Specific details include eliminating air intake grilles, a sleek fastback design from the front to the rear of the car, hidden door handles integrated into the surface of the doors, and a flat vehicle bottom.

Robert Palin, Tesla’s chief aerodynamics engineer, said that balancing low aerodynamic drag and design aesthetics is extremely challenging. Tesla’s design, aerodynamics, and chassis engineering teams worked closely together and ultimately achieved a drag coefficient of only 0.24Cd, 0.25Cd, and 0.23Cd for Model S/X/3, respectively, setting the lowest record among mass-produced cars of the same level.

- Engineering

Vehicle engineering: At the beginning of product definition, insisting on using all-aluminum bodies, successful lightweighting efforts have kept the weight of the world’s fastest accelerating, longest-range production sedan, the Model S P100D, under 2,100 kg; pioneering engineering design that lays the battery pack flat on the chassis, Model S/X/3 are all double five-star safety vehicles of IIHS, NHTSA and Europe E-NCAP.Powertrain Engineering: Since its launch, Model S has won the Green Engine of the Year award, Best Electric Motor of the Year, and the newly created Best Pure Electric Powertrain of the Year award at the International Engine Awards for five consecutive years.

There is one thing worth debating: Tesla battery and drive units are covered by an 8-year, unlimited mileage warranty, while BYD offers a lifetime warranty for their battery cells. Does this mean that Tesla falls short of BYD? Elon Musk proclaimed as early as 2015 that the drive unit for Tesla could sustain a cumulative driving mileage of up to one million miles with “virtually no” wear and tear. Regarding the battery, according to the Tesla Forum statistic, the battery for Model S will deteriorate to 95% of the factory-original capacity after a cumulative driving distance of 100,000 kilometers, and will deteriorate to 90% of the factory-original capacity after a cumulative driving distance of 200,000 miles (about 320,000 kilometers).

Software Engineering: As mentioned at the beginning of the article, vehicle over-the-air (OTA) has made Tesla the first intelligent car manufacturer, so there is no need to repeat it. With excellent software engineering capability, Tesla is currently able to identify 90% of vehicle faults through remote diagnosis and all software failures can be resolved through OTA.

At the organizational level, Tesla is the automobile company that pays the most attention to using information technology to improve its operational efficiency. In 2012, Tesla developed the first version of the enterprise operation IT system. Jay Vijayan, the then CIO of Tesla, said:

Elon’s vision was to establish a “vertically integrated” organization, in which information can “flow seamlessly across departments,” while we have a closed feedback loop to our customers. By doing this, we can provide the best products and services to our customers in the fastest way possible, while also efficiently operating a business at the same time.

To achieve this vision, we must have a “central business operation system” that is “simple, and can connect all departments and make the flow of information between departments seamless.”

In February 2017, Elon Musk hired Gary Clark as the new CIO of Tesla, reporting directly to Tesla’s CTO J.B. Straubel. His main task is to “develop a next-generation enterprise-shared IT system for Tesla and Space X.”

In fact, Elon Musk is not the only person working for both Tesla and Space X at the same time. Jinnah Hosein formerly served as Vice President of Software at Space X and Tesla, while Charles Kuehmann’s title is VP of Materials Engineering at both Space X and Tesla. At the urging of Elon Musk, the cooperation between the two companies is becoming increasingly close. The most typical example is that the two sides jointly established a material engineering database, from which Tesla has benefited.### Model S P100D

Model S P100D can complete the zero-to-100 acceleration in 2.4 seconds, and the instantaneous output current of the battery pack will soar to 1600 A. This is mainly due to the use of special nickel alloys for the main battery pack contactors instead of steel. This nickel alloy is a kind of alloy suitable for high-temperature environments in space structure and has been widely used in Space X’s Super Draco engine.

Coupling Reaction between Tesla and Space X

What kind of coupling reaction will Tesla and Space X generate after the launch of the new generation of enterprise shared IT systems?

Manufacturing

Why does Tesla need to build a super factory? By thinking from first principles and starting with procurement of raw materials, it can build the largest global battery factory by making the most of economies of scale through vertical integration, and thereby consistently obtain cost and performance advantages leading the industry.

In August 2013, Elon Musk publicly announced his plan to invest $5 billion in building a super factory with an area of 1.9 million square feet. It was expected that the battery capacity would reach 35 GWh by 2020, surpassing the total global battery capacity in 2013.

In May 2016, when the construction progress of the super factory was less than 30%, Elon Musk announced an expansion plan again, bringing forward the 35 GWh production capacity goal of the super factory to 2018, and it is expected that the battery capacity will reach an unprecedented 150 GWh by 2020.

Why launch a more aggressive battery production plan?

First, consider this question: Why did Tesla’s stock price suffer widespread doubts and shorts after the Model 3 launch event?

Model 3 was released in April 2016, and the base Model 3 with a range of 354 kilometers should have been priced far above $35,000 according to the battery cost at that time.

In fact, the starting price of Model 3 was based on the marginal cost after mass production of batteries in 2017. According to Tesla’s pre-research, for battery packs with the same specifications, the cost of the 2170 batteries will be 35% lower than that of the 18650 batteries used in Model S/X; At the same time, the cost of 18650 battery used in Model S/X is also much lower than the industry average.

How low is it?Tesla sold 101,405 Model S/X cars in 2017 with an average single-car battery pack size of 85 kWh. Calculated this way, Tesla consumed 8,619,425 kWh in 2017, equivalent to approximately 8.7 GWh of batteries composed of 18650 cells having identical voltage, capacity, internal resistance, cycle count, and self-discharge rate.

In other words, the battery strategy of Model S/X itself is to maximize economies of scale and continuously obtain cost advantages, which leads Tesla to an industry-leading position.

Coupled with the breakthrough in electrochemistry of the 2170 battery, the cost of the Model 3 can be controlled to $35,000 and still ensure a 25% long-term gross margin.

However, in Q4 of 2017, the first quarter of Model 3 deliveries, the gross margin of Tesla’s automotive business fell below 15% for the first time, rebounding to 19.7% in Q1 of 2018, still a significant gap from 25%.

Apart from the early investment in the Model 3 production line, the high cost of 2170 batteries before ramping up is also a major factor.

Therefore, what Tesla needs to do now is to quickly increase the production capacity of 2170 batteries, and once again use economies of scale to significantly lower battery costs.

As I mentioned earlier, the heavy model of building factories to produce batteries and solar panels will be coupled with Tesla’s other development strategies to generate extremely strong comprehensive competitiveness.

Last year, Elon Musk talked about several big orders for energy products on Twitter, and in fact, the second generation of Powerwall and Powerpack all switched to 2170 batteries. After accumulating more than 1 GWh of energy storage batteries delivered, Elon Musk said that the second 1 GWh will be achieved faster according to current orders.

If we consider the Semi Trunk, which uses several times more 2170 batteries per vehicle than Model 3, and is due to begin production in 2019, it is only natural to admire Tesla’s ultimate application of vertical integration, first principles, and economies of scale.

Based on this logic, it won’t be long before Model S/X is also equipped with 2170 batteries.

- Reshaping Sales

There is not much to say about this. Tesla adopts a direct sales model, where Tesla product specialists deal directly with customers, providing a uniform high-quality purchasing experience, while simplifying the purchasing process. Of course, the most important thing is to eradicate the profits eaten up by layers of dealers, making vehicle pricing more transparent.

-

Reshaping ServicesIn the service (maintenance and repair) sector, Tesla is able to complete these services at a lower price due to its self-operated model, as “not being cheated” is also a part of the excellent driving experience. Tesla’s guiding principle in the service sector is Best Service is No Service, which is worth expanding upon and will be discussed below.

-

Supercharger Station

In September 2012, the first 8 Supercharger stations began trial operation along the Boston-Washington and San Francisco-Los Angeles highways. As of today, Tesla has deployed 1308 Supercharger stations and 10622 Supercharger connectors worldwide, making it the largest global fast-charging network to date.

In the early days, Tesla’s strategy for energy supplementation was both battery swapping and fast-charging. In March 2009, Michael Donoughe, then head of Tesla’s vehicle engineering team, announced that the Model S battery pack would support both fast-charging and quick swapping (less than 5 minutes). Battery swapping was mainly designed to provide a convenient experience for the first batch of Model S users with a battery pack capacity of only 40 kWh.

In June 2013, Elon Musk personally demonstrated a 90-second battery swapping technology. In June 2015, Tesla announced that its focus would be on the construction of the fast-charging network, but that battery swapping technology would be retained. To this day, the entire Model S/X series supports cross-specifications swapping, such as upgrading a Model S 85D to a 90D or 100D through swapping.

Efficiency comes first

Traditional car manufacturers find it difficult to understand Tesla’s pursuit of efficiency at all costs, and yes, to some extent, Tesla goes all-out for efficiency.

In 2015, due to the excessive pursuit of “smoothness on the back,” Tesla’s seat supplier Futuris was unable to deliver on time, so Tesla decided to produce the Model X seats itself.

At the time, this strategy caused great controversy. Seat manufacturing is a low-profit, labor-intensive industry, so “the cost of seats is difficult to bear, why make them yourself” is completely untenable.

Subsequently, Tesla built its own seat factory, which now manufactures seats for the Model 3. Elon Musk himself participated in seat design and assembled an engineering team to develop fully automated seat production lines.

Can Tesla be more specialized than globally top suppliers such as ZF and Continental?

Obviously not. In October 2017, Tesla announced a recall of Model X vehicles produced between October 28, 2016 and August 16, 2017, because “the second-row seat cable needed to be adjusted.” In other words, all of the previously produced seats from Futuris had no safety hazards. This recall served as evidence that Tesla was an outsider in seat manufacturing.Developing a fully automatic seat production line, while also bearing the risks of decreased seat reliability and comfort, resulted in “meeting the seat demand for the entire year of 2018 (in Elon Musk’s words).” This is a typical case of Tesla pursuing efficiency.

The core of the problem is that Tesla’s self-developed products go beyond just seats. Elon Musk’s ultimate goal is to “open a factory in the mine (that is, the source of raw materials), and then drive out a car”.

In order to pursue efficiency, Tesla may give up more important things, such as employee satisfaction.

Most companies have a critical moment when they sprint to achieve their goals within a certain time period.

But how was the production plan for Model 3 executed over the past year? Production capacity increased from 2,000 vehicles per week to 5,000, 7,500, and finally 10,000 vehicles per week according to an overly aggressive timeline for a long period of time, and the entire management team, led by CEO, moved to the factory to work around the clock. This long-term high-pressure culture makes it difficult for employees to work at maximum efficiency.

Doug Field, Tesla’s only SVP and Model 3 engineering leader, left earlier, causing much regret. Elon Musk himself once praised him as the most talented engineering executive in the world. Doug Field leaving may not be a big deal, but the real worry is that 40 VP-level high-level executives have left Tesla in the past two years, as mentioned earlier.

In order to achieve the ultimate efficiency, Tesla can even accept a decrease in user experience.

Do you remember the saying “Best Service is No Service”? Elon Musk’s idea is that the production of Model 3 means that Tesla needs to deliver 3-4 times more vehicles, but Tesla does not need to open stores that match the scale, as it can solve the problem by improving the efficiency of single-store transactions.

Therefore, Tesla requires reservation owners to watch Model 3 instructional videos and user manuals in advance, and immediately begin signing documents upon arrival at the delivery center, then confirm the vehicle and drive away within 5 minutes.

A 5-minute/vehicle process may set a record for the automotive industry’s delivery efficiency, but it is difficult to say whether the user’s car pick-up experience is pleasant or not.

All of Tesla’s seemingly irrational measures are to better control the product development rhythm and maximize efficiency.

Tesla ChinaThe Model 3 launch helped Tesla’s market value stabilize at $50 billion. On July 10th, 2018, a heavyweight announcement was made that is no less important than the release of the Model 3, which is expected to drive Tesla’s market value into the “trillion-dollar club”: Tesla will establish a wholly-owned Gigafactory 3 in Shanghai Lingang area, combining research and development, manufacturing and sales in one super factory.

Elon Musk’s long-cherished wish since his first visit to China in 2014 has finally come true: “China” is a very important market, the most important market in the world, and “Tesla will definitely establish a factory in China” in our long-term plan.

Gigafactory 3 is Tesla’s first overseas super factory in history and the largest foreign-funded manufacturing project in Shanghai’s history. The planned annual capacity of Tesla’s China factory is 500,000, which exceeds the planned capacity of any new car company.

Tesla’s demands are very clear: to establish a factory in China, reduce product prices, localize operations to improve efficiency, and use pure product competitiveness to compete in the Chinese market after eliminating tariffs.

In terms of organization, after experiencing Tesla’s early weak sales in China, and continuous management changes, the third-generation Tesla China management team led by Ren Yuxiang and Zhu Xiaotong has brought China’s sales from “surprisingly bad” to the scale of “surpassing $2 billion in sales in 2017, the largest market for Tesla outside the United States”.

Ren Yuxiang joined Tesla in May 2015 as the Vice President of Tesla Global and President of Asia Pacific. In fact, since March 2015, he has participated in meetings between Tesla and the Chinese government as Elon Musk’s personal assistant.

In February of this year, Ren Yuxiang was promoted to Global Vice President of Sales and Service, and led the Global SDS (Sales Delivery Service), which includes the three items (store, service, and charging) in the six core competencies mentioned earlier, including those in the United States.

Today, Ren Yuxiang is the most powerful Chinese executive in Tesla’s history, and his knowledge of the Chinese market has made him the head negotiator for the Chinese factory. Just as Tesla launched its revolution from California back then, building factories in China will significantly increase the intensity of competition in the Chinese automobile market, and promote China’s automotive industry to enter the era of smart cars faster.

Conclusion

Tesla has many unique features, which is Elon Musk’s philosophy for survival:

Tesla must maintain a hardworking style, not for the sake of hardship, but because we are working towards a great cause, hitting those entrenched competitors who only want to maintain the status quo and with huge sizes. The list of big companies that want to kill Tesla is already long. The only way for a small company to beat these large companies is to work faster, more efficiently, and work harder.

With the release of Model 3 production capacity and the construction of the Chinese factory, Tesla is approaching a market capitalization of 100 billion dollars. If Tesla’s major business segments are split independently, the rationality of a 100 billion market value will be more convincing.

Tesla SuperCharger: The world’s largest and highest-power supercharging network.

Tesla Gigafactory 1/2/3: The world’s largest and fastest iterative electric car and energy product manufacturing factory with the highest level of automation.

Tesla Autopilot: The largest road test collection fleet in the world, with the most potential for automated driving research institutions.

Tesla Energy: A product portfolio covering two ends of the B and C markets, with huge potential for energy research, manufacturing, and sales organizations.

Tesla Vehicle Team: The smartest car research organization with the fastest iteration speed and advanced product development capabilities in the world.

Tesla Brand: A high-end luxury car brand that covers the global market comparable to BBA.

Elon Musk combined the above assets into the Tesla Empire and regarded the willingness to risk everything for the sake of evolutionary ability as the most fundamental philosophy for survival.

Some time ago, Elon Musk had a dispute with Buffett about the moat, insisting that “the moat is a very stupid concept.” In fact, Tesla only abandoned the traditional commercial stability and solid concept of the moat, and continuously evolving ability is Tesla’s moat.

As Ray Dalio, the author of “Principles,” said:

Evolution is the most powerful force in the universe, the only eternal thing, and the driving force of everything!

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.