**Between BYD and Greatness: The Turning Point of a Culture**

What kind of company can be called great?

When it comes to the automotive industry, the answer may not escape those few, such as the former Ford, the long-standing Toyota, and the future Tesla - enterprises that have created breakthroughs from 0 to 1 in specific fields, and brought huge changes to the development of the industry and social progress.

We look forward to seeing the name of a Chinese enterprise appear in this list one day.

If we have to choose a car brand as a representative of the Chinese automotive industry, BYD should be on the list - an independent private enterprise with unique technical genes, who has stumbled forward in difficult times, persevered with an unprivileged background and not very wealthy family, and has great prospects.

Worldwide, BYD is often used as a reference when it comes to understanding Chinese cars.

BYD has created many Chinese-style miracles. It took them 8 years to independently develop batteries and become the leader in the domestic battery industry. In just 5 years, they went from a vehicle manufacturer with zero experience, to becoming the top seller of their self-owned brand. And in just 3 years, they have become the best-selling new energy vehicle in the world... Despite all these amazing achievements, it is still difficult to say outright that they are great.

The reason could be very subtle, and I am also looking for an answer.

I accidentally saw an interview with Mercedes-Benz CEO Li Shufu, who believes that **the future competitiveness of an enterprise lies in its culture.**

Perhaps BYD's answer lies here.

## BYD: Sales Fluctuations Like a Roller Coaster, Profit Volatility Like Heartbeats

To discuss whether a company is great or not is in itself an accolade. As a tech company in the independent brand field, BYD has been developing for 25 years with its blood, sweat and tears, leading to the situation today, and absolutely deserves respect.

In 2003, BYD became the largest enterprise in the domestic battery industry, and announced that it was entering the vehicle manufacturing industry that same year, setting an extremely forward-looking development path for new energy vehicles.

**Why 2003? Not only because they made money from selling batteries, but also because it was the starting point of China's high period of automotive development.**

In 2001, China joined the World Trade Organization and faced fierce competition from international peers. The young and inexperienced Chinese auto industry was worried, but in 2002, the Chinese auto market experienced explosive growth with over three million units sold, a growth rate of nearly 40%, ushering in a new era of family car consumption.

In 2003, the market was further stimulated as dozens of home appliance companies announced they were entering the auto manufacturing industry. Companies like AUX, Chunlan, and Midea were at the forefront of the trend and enthusiastically bought qualifications, factories, and boasted various exaggerations.

However, years later, these home appliance companies finally understood that car manufacturing was not easy and much harder than home appliances. They all eventually retreated in defeat.

However, BYD managed to increase its annual sales from 4,500 to 450,000 in just five years between 2004 and 2009, eventually becoming the first domestically produced auto brand in terms of sales.

After reaching the pinnacle, came the decline. BYD then experienced a difficult and painful transition period between 2010 and 2012.

Both external factors, such as the impact of the global economic crisis, and internal problems due to BYD’s lack of control and strategic balance were responsible. In 2010, BYD set a sales target of 800,000 for the year, a 100% increase from the year before, an extremely overconfident expectation. In that year, BYD crazy increased its channels and expanded its staff, but the sales target wasn’t achieved. BYD had entered a transformation period.

After 2014, with the implementation of China’s new energy vehicle development strategy, BYD, which got into this field early, entered another period of rapid development. In 2017, BYD’s new energy vehicle sales ranked first globally, reaching 114,000 units, more than five times the sales volume in 2014.

However, BYD did not make money in 2017. Its annual report showed a net profit of 4.1 billion, down nearly 20% from the previous year, and 2018’s first-quarter report was also unimpressive. Profit decreased by 500 million, down 84% compared to the same period last year.

However, the domestic and international investment markets are still optimistic about BYD. Bloomberg published a report titled “Buffett-Backed China Carmaker Gets More Love Than Tesla,” analysts are still enthusiastic about this company in which Buffett holds shares, despite BYD’s stock price falling by 14%. The main reason is BYD’s technology accumulation in the new energy field and the Chinese government’s clear policy guidance. They expect BYD to receive more subsidies in the second half of the year.

Actually, if you look at BYD’s financial reports over the years, you will find that BYD’s profits have always fluctuated dramatically, dropping by as much as 90% (such as in the darkest moment of 2012) and then skyrocketing by five to six times (such as in 2013 and 2015, both with growth rates of more than five times).

Bloomberg compiled data shows that the market is very optimistic about BYD’s performance in 2018, with expected earnings per share growth of 32%, higher than the average of 29% for Chinese auto manufacturers listed on both Hong Kong and the mainland. It is expected that its sales will grow by 24%, higher than the expected growth rate of about 17% for the group.

The fact that BYD has such strong market confidence proves that the company has enough vitality – what exactly is the reason? Is it their strategy, technology, or management culture?

It cannot be management culture. The recent advertising gate scandal is a precise interpretation of BYD’s poor management. Most people may recognize that BYD’s technology is leading in China, but upon analysis, its technological strength has not been able to support its grand strategic blueprint – this is to some extent also due to problems in the company’s corporate culture.

It is important to understand why everyone says that BYD excels in strategy.

First-rate strategy: Entering the game through energy and focusing on batteries and core technologies.

As a company that entered the automotive and new energy vehicle industries from the battery industry, BYD’s strategic vision is inherently more far-sighted and sharp than its competitors. From the beginning of car manufacturing, Wang Chuanfu had planned to focus on new energy vehicles, but first accumulated experience in building fuel vehicles, waiting for the new energy vehicle market to gradually grow before entering at the right time.

In terms of new energy layout, BYD has a similar mindset to Tesla.

BYD has four dreams – photovoltaics, energy storage, electric vehicles, and rail transport. These four dreams support BYD’s drive to transform human society towards clean energy.

Just like Elon Musk’s Solar City, Tesla, Boring Company, and SpaceX aviation business, two energy companies have similar business layouts in electric vehicles and future transport.

However, BYD is more focused on electrification, while Tesla combines electrification with intelligence.

Starting with batteries, BYD has a complete industrial chain system of photovoltaics, energy storage, and battery recycling, and is one of the few battery production companies that has also established a layout in upstream materials.

The Most Important Raw Material for Power Batteries is Lithium

The price of raw materials directly affects the price of batteries and thus affects production costs. BYD has been laying out lithium mine resources since early years, in addition to establishing Qinghai Salt Lake BYD Resource Development Co., Ltd. in conjunction with Salt Lake Share, the founder and main shareholder of BYD, Wang Chuanfu’s cousin Lu Xiangyang, is the major shareholder of Rongjie Co., Ltd., which has the right to exploit the largest lithium mine in Asia.

Therefore, BYD has accumulated potential cost advantages in the field of battery raw materials. In 2018, after BYD’s batteries began to be supplied to external markets, this cost advantage is believed to become more prominent.

Recently, the most popular topic about batteries is the market value comparison between BYD and CATL. CATL was listed in June 2018, and its market value climbed all the way to nearly 180 billion. The market value of BYD, which has been working for more than ten years, is only about 120 billion. CATL snatched the first place, and BYD was a little uneasy. After more than a year of preparation, battery outsourcing finally started to take shape. Recently, BYD signed a joint venture agreement with Changan to establish a power battery company.

This move symbolizes that BYD is finally compromising, opening up, and embracing change.

In addition to external sales, this move also includes changes in the route of passenger car batteries from iron phosphate to ternary lithium. China’s battery technology has gone through the development process of lithium manganese oxide, lithium iron phosphate, and ternary lithium. BYD has deep accumulation in lithium iron phosphate battery technology, but is thus slow to respond and difficult to meet the rapidly changing market. It was not until 2017 that BYD stated that its passenger vehicles would switch to ternary lithium batteries. However, in BYD’s electric buses, which have always been proud of, it still insists on using safer lithium iron phosphate batteries.

In addition to the long-term strategic layout of the battery field, BYD is also a pioneer in the layout of new energy vehicle products. Just as in 2014, it proposed a “542” high-performance automobile product strategy, which is aimed at developing a new generation of automobile products that can break the 100-kilometer mark in 5 seconds, with full-time four-wheel drive and a fuel consumption lower than 2L per 100 kilometers-think about the price of BYD products, this goal is indeed amazing. This is the later launched BYD Dynasty series.

After entering a new era of new energy vehicles, BYD’s product strategy has become 33111, which is the latest e-platform strategy released at the Beijing Auto Show in 2018. The two 3s respectively represent the highly integrated three-in-one system of the drive system’s motor, electronic control, and transmission, and the high-voltage system’s DC-DC, charger, and distribution box. The three 1’s respectively represent a PCB board that integrates control modules such as instrument, air conditioning, audio, and smart keys, a smart automatic rotating big screen with “DiLink Smart Ecosystem,” and a long-range and stable battery.

It can be said that BYD has basically gathered all the current technical trends in the new energy vehicle industry: integrating efficient electric drive systems, convenient charging facilities, integrated control systems and interaction interfaces, as well as safe and efficient batteries. Electric vehicles with these traits are simply Dream Cars in the field of new energy vehicles.

Second-rate technology: Pursuit without persistence

Many people may feel unhappy when it comes to saying that BYD’s technology is second-rate.

However, BYD’s technology level has indeed limited its strategic space for development. BYD’s technological shortcomings lie not in achieving breakthroughs from 0 to 1, but in persisting from 1 to 10,000.

Among Chinese auto companies, BYD’s technological pursuit is definitely considered first-rate.

When facing some foreign advanced technology blockades, BYD has been able to successfully break through through its own efforts and strategic layout, and independently develop China’s own technology. For example, as I mentioned in a past article, BYD developed China’s own plug-in hybrid system by its own efforts – the F3 is the world’s first mass-produced plug-in hybrid model.

In addition, BYD is one of the few companies in China that makes its own IGBTs (Insulated Gate Bipolar Transistors). IGBTs are core elements of motor drive chips, and China relies on imports for 90% of these chips. Even Tesla, a super independent company, has to seek help from others. The recent chip dispute made everyone aware of the low-level reality of China’s semiconductor industry development. BYD’s early layout in electronic power devices has laid a good foundation for its later efforts in the field of new energy vehicles – surveys show that IGBT costs account for about 10% of the overall vehicle cost.Additionally, IGBT chips are closely related to high-power fast charging, which is also one of the core solutions to address range anxiety for electric vehicles. In Europe and America, major manufacturers such as Volkswagen and Ford began jointly building 350 kW high-power charging stations as early as the beginning of 2017. Thanks to its IGBT technology, BYD also has ample space for development once it enters the field of fast charging.

BYD’s IGBT Module for Vehicles

Another noteworthy technology BYD possesses is V2G technology, namely the bidirectional inversion charging and discharging technology, which combines the functions of driving motors, on-board chargers, and DC charging stations into one. It can not only convert AC current from the power grid into DC current to recharge, but also invert DC current from the battery into AC current for discharging. Therefore, the car can become a giant mobile power bank.

At the 2017 China New Energy 100-person Forum, Professor Ouyang Minggao pointed out that V2G technology is an important trend in the new energy field, and named BYD as having already made certain achievements in this area.

The importance of V2G technology lies in its ability to achieve intelligent movement of electric current. After the popularization of electric vehicles, a vehicle becomes a mobile charging station with great imagination space.

BYD has a lot of core technologies in independent control.

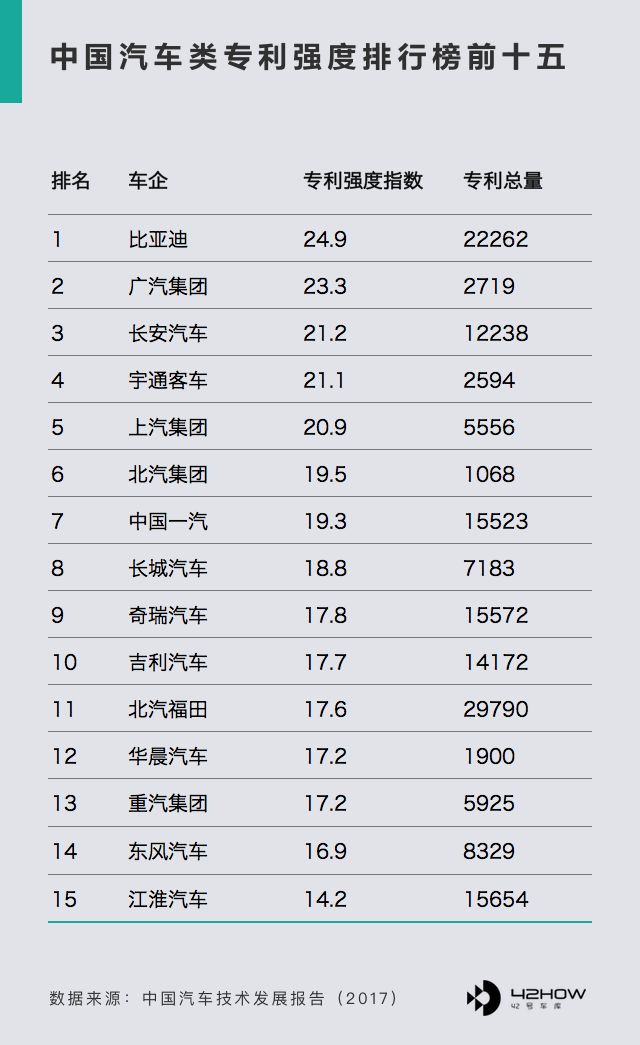

According to the 2017 China Automotive Technology Development Report jointly compiled by the China Society of Automotive Engineers and Toyota, BYD ranked first in terms of patent quantity and intensity among domestic automakers.

BYD has a cumulative total of 22,262 publicly disclosed patents in the automotive field in China (as of 2016), with a patent intensity index of 24.9, both ranking first.

In terms of technological pursuit, BYD might concede to no one domestically, however, there is a lack of impact from its technological advancements. While BYD has pioneered many firsts in China, no technology has currently become world-class top-tier – the overly vertical value chain layout and the lack of power for continuous evolution have limited BYD’s technological influence.

BYD’s pursuit of technology lacks the ultimate focus of Toyota and the subversion of Tesla. Everything is about solving the “have or have-not” problem. After going from 0 to 1, BYD seems to struggle to get from 1 to 10,000.

Translated Markdown text:

By insisting on the lithium iron phosphate technology route and entering the mainstream ternary lithium battery market relatively late, BYD missed out on the dominant position in China’s power battery industry due to its closed supply chain.

On the other hand, as a host manufacturer that relies on batteries and electronics, BYD has not made many breakthroughs in the field of smart cars, which is also puzzling. So far, besides remote driving function, there is almost nothing noteworthy of BYD’s technological achievements in the field of autonomous driving. Comparing BYD with Tesla, BYD is far behind Tesla in terms of autonomous driving or intelligence. BYD is an electronic product manufacturer, but it hardly involves real smart systems.

For example, V2G technology has a bright prospect, but BYD has not continued to apply it deeply. In the past, BYD’s criticized problems with body quality and battery attenuation were caused by negligence in quality control during the innovation process.

This brings us to the soft power of corporate culture and management.

Third-rate culture and management: neglecting people

First-rate strategic vision and second-rate technical pursuit, combined with third-rate or substandard management, are like having a treasure and a sword in martial arts stories, but not knowing how to read.

As a technology-oriented company, BYD’s culture is to some extent characterized by the arrogance of technology fanatics, with a lack of humanistic care for the general public. Although BYD claims that its corporate culture is centered on people, in reality, BYD’s culture lacks attention to people.

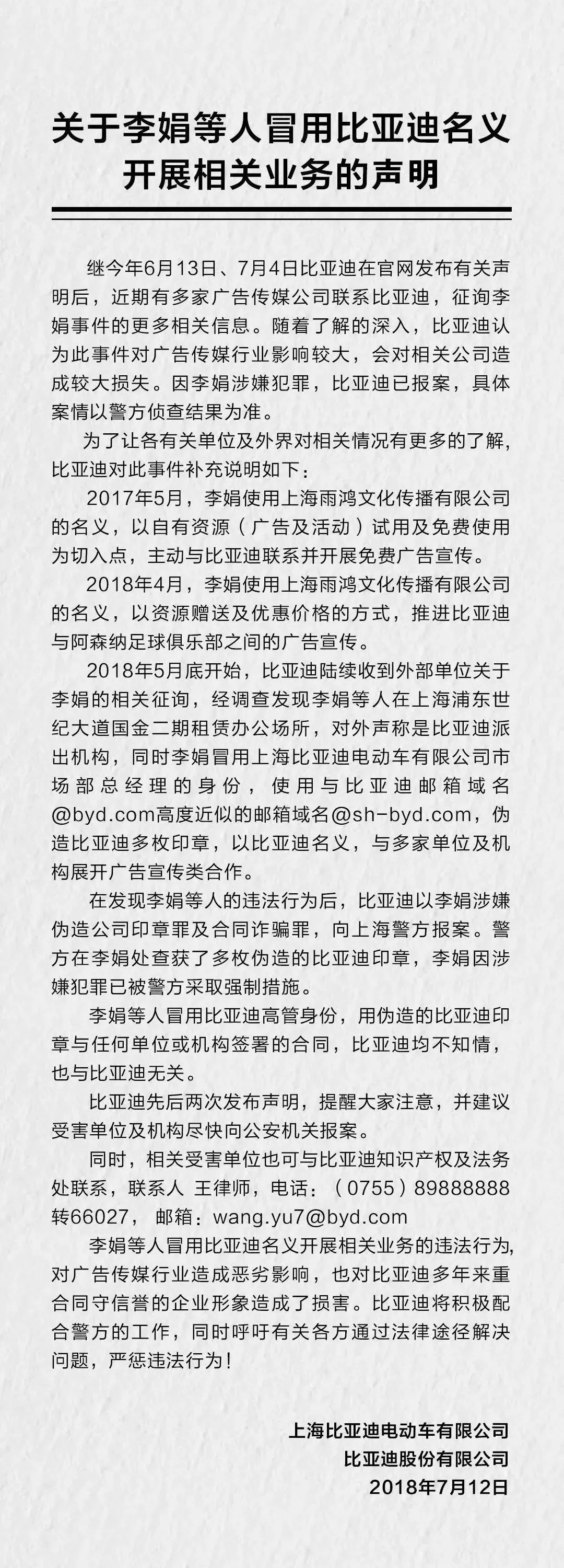

Recently, the advertising fraud incident reflects BYD’s poor internal management. As the “reality” gradually emerged, the source of the matter still lies within the company. A large-scale automobile manufacturer with an annual production value of more than 100 billion and a sales volume of nearly 400,000 units per year has exposed its disorderly management behind its closed talent pool and management system.

The trigger of the advertising fraud incident was a statement issued by BYD’s public relations team, claiming that these Yin and Yang contracts were not related to them, and they were completely unaware of them. This declaration revealed that BYD’s team is too far away from its real consumers, so much so that they lack the patience to seriously consider public opinion, or that BYD’s internal communication process is too chaotic. Are they not neglecting people by committing such a low-level mistake?

—One of BYD’s famous jokes in the early years was “800 RMB for room and board designer”, mocking the low salary of BYD designers and the poor aesthetics of BYD car models and logos. Despite years of consumer complaints, BYD persisted in its ways. This stubbornness encouraged BYD to persist in independent R&D during international technology blockades and to remain “deaf to outside matters” when faced with market criticism. This dual existence is the real BYD.

Fortunately, under market pressure, BYD has finally begun to open up. In 2016, they hired a former Audi designer as the brand’s design director. The new Tang series immediately increased the brand’s popularity.

Hopefully, this will bring some reflection to BYD – after all, consumers will treat you according to how you treat them.

On Zhihu, there is a question about what it’s like to work at BYD. After looking at the answers, they’re not very positive and reflect some issues. Most BYD executives are promoted from within, from recent graduates to leadership positions, and few outsiders are brought on board. This kind of isolation is obviously not conducive to the healthy development of a corporate management system.

The biggest gap between BYD and becoming a great company lies in their greater emphasis on applicational culture rather than evolutionary culture. Applicational culture typically requires instant usefulness, while evolutionary culture gives individuals and companies the organic vitality for sustainable development.

BYD’s recent openness may be a good signal.

* BYD, is it really the Chinese version of Tesla? (Part 1)

* BYD, is it really the Chinese version of Tesla? (Part 1)

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.